A Journey Towards Professional Excellence – 70 years of State Bank

After independence in 1947, Pakistan was inherited with a weak financial system architecture lacking a proper banking network and a central bank. Mr. Zahid Husain, one of the senior most Muslim officers of the Indian Audit and Accounts Service who was serving in Delhi as Pakistan’s High Commission to India was summoned in April 1948 and assigned the charge of a Special Division for the creation of a central bank named State Bank of Pakistan.

The promulgation of May 12, 1948 State Bank of Pakistan Order as well as the Order for the amendment of the Pakistan (Monetary System & Reserve Bank) Order, 1947 required the Reserve Bank of India to relinquish its role in Pakistan on June 30, 1948. |

|

On 1st July 1948, Quaid-e-Azam, Muhammad Ali Jinnah inaugurated the State Bank of Pakistan, housed in Victoria Museum Building rented from Karachi Municipal Corporation. Travelling especially from Ziarat to Karachi against medical advice of his doctors indicated the importance that the Quaid had envisioned to this major milestone of the newly created country, and impact that it would imprint towards the successful journey of the new nation in the area of banking and finance. Incidentally, this ceremony was also the last public function attended by the Quaid. After 13 years, Central Directorate of SBP shifted to its current Main Building location at I.I. Chundrigar Road.

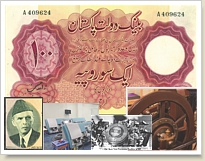

Initial Challenges: Issuing Currency Notes & Rehabilitation of the Banking System

Immediately after inception of the State Bank of Pakistan, the Government of Pakistan issued a series of bank notes on emergency basis on 1st October 1948 with the help of Thomas De La Rue & Company of Great Britain and later by the Pakistan Security Printing Corporation established in 1949.

For the banking system, out of 99 scheduled banks and 3497 branches, only 13 banks and 631 branches were located in Pakistan. While all the 12 Indian banks transferred their headquarters from Pakistan to India, the Muslim owned Australasia Bank (now Allied Bank) in Lahore remained. Despite extensive capital flight to India, two banks, namely Habib Bank and Muslim Commercial Bank shifted their head offices from Bombay to Karachi and Calcutta to Dhaka, respectively. |

|

From July 1, 1948, the Imperial Bank had been acting as an agent of State Bank for conducting business of Central and Provincial Governments; however, State Bank realizing the need for a commercial bank truly national in character and able to take over its agency function replaced it with National Bank of Pakistan. National Bank was created on November 9, 1949, under National Bank of Pakistan Ordinance, 1949 for the purpose.

Strengthening of Legislation to Discharge Duties

The promulgation of the State Bank of Pakistan Order of May 12, 1948 as well as the Order for the amendment of the Pakistan (Monetary System & Reserve Bank) Order, 1947 became the precursor for a more comprehensive legislation in the form of SBP Act 1956 enhancing the scope for Bank’s operations.

Between 1948 and 1962 banking business in Pakistan was regulated by scattered pieces of legislation. These enactments were largely adaptation of laws in force before the partition of sub-continent in 1947. Moreover, banking was characterized by surplus liquidity, exceptionally low interest rates on deposits and virtually no competition.

However, with the changing economic environment and the realization to consolidate various amendments in legislation governing operations of banks, the need for a comprehensive legislation was felt and as a result, the Banking Companies Ordinance, 1962 came into force. The law provided a consolidated basic legal framework for the banking business empowering State Bank for its regulation

Banking Reforms in 1972

During the 60s and 70s, the banking sector of Pakistan, though flourishing, was marred by various structural issues; the primary one being the ownership structure. These structural issues led to an inequitable sectoral and geographical distribution of credit in the economy and a resultant increase in concentration of credit.

In this backdrop, State Bank embarked upon a comprehensive agenda of Banking Reforms in 1972. The reforms aimed at improving the soundness and efficiency of the banking system and purging it of negative consequences. To cater to discrepancies related to credit allocation, bodies such as Agricultural Credit Advisory Committee and National Credit Consultative Council were created in 1972 and 1973 respectively, under the aegis of State Bank to devise an integrated credit plan for all sectors of the economy and setting targets for commercial banks for credit disbursement to these sectors. |

|

Nationalization of Banks

However, the above reforms could not achieve their desired goals as they were not given enough time to materialize. They were soon followed by nationalization of the banking system in 1974. With the promulgation of Banks Nationalization Act 1974, the Federal Government assumed exclusive right of ownership, management and control of all banks. A total of 14 banks that existed at that time were nationalized under the act.

A Banking Council was also set up to make policy recommendations to the Federal Government to direct banking activities; formulate policy guidelines; outline performance criteria and assessment; analyze and appraise financial statements and undertake reorganization of banks.

The Banking Council prepared the Bank Amalgamation Scheme 1974, whereby 13 nationalized banks were amalgamated into 5 banks, namely National Bank of Pakistan, Habib Bank Limited, United Bank Limited, Muslim Commercial Bank Limited and Allied Bank Limited.

|

|

However, these measures tended to take away the element of competition among banks. Since all the business policy decisions were taken by the Banking Council, the banks had no incentive to offer better products or services to customers. By the end of 1980s, it became quite clear that the national socio-economic objectives sought under the nationalization process, were not being met. Thus, as part of a larger economic reforms program, the process of privatization of banks started in the 90’s.

Financial Sector Liberalization

By the end of 1989, a financial sector liberalization program was initiated to instill competition and switch over to market-based and efficient monetary and credit mechanism. Financial liberalization aimed at restructuring of banks, rationalization of branch network and introduction of policy reforms to encourage participation of the private sector in banking business.

To strengthen its regulatory function and ensure that State Bank works with more diligence and authority, the legal framework consisting of SBP Act, 1956, Banking Companies Ordinance-1962 and other relevant laws were improved further. An important milestone was the abolition of Pakistan Banking Council to enable State Bank to function as a sole regulator of banks.

Besides strengthening banks and their regulator, liberalization of financial markets also took place. Interest rate structure was rationalized through removal of controls on lending and deposit rates. A major shift in monetary management came about in January 1995 with the introduction of open market operations, which contributed towards a well-functioning primary and secondary market for short-term government paper. |

|

Moreover, measures were taken to follow a market based foreign exchange market granting licenses to money changers in 1990 and allowing residents to open foreign currency accounts in 1991.The rupee was also made convertible on current international transactions in 1994.

State Bank Autonomy

State Bank enjoys greater autonomy today. State Bank’s autonomy was strengthened during 1990s with various changes in legal framework governing financial sector. As per amendments made in Banks (Nationalization) Act, 1974 in 1997, exclusive right of the government and its corporations to establish a bank were withdrawn. Whereas amendments in BCO-1962 facilitated consolidation of SBP’s supervisory role. More importantly, the SBP Act was amended in February 1994, giving full autonomy to the Board of Directors of the Bank in all matters relating to administration and conduct of business of the Bank within the provisions of SBP Act, 1956. This act was amended again in 1997 to further enhance SBP’s responsibilities.

The latest landmark in the journey of SBP autonomy is an independent monetary policy setting that is considered as key for effective monetary policy decisions. In 2015, an independent Monetary Policy Committee empowered to make monetary policy and its allied decisions was established.

Innovations in the New Millennia

Efforts were made during 1980s for starting Sharia based banking. However, a more focused but gradual approach for transformation of banking system into Shariah compliant banking was adopted at the start of this millennium wherein both Islamic and conventional banks were allowed to operate simultaneously in the country. This approach has proved to be a success as reflected by its significant growth.

The turn of the millennia witnessed strong technological changes leading to a sea change in the way financial transactions are carried out. Realizing their importance for Electronic Payment Systems and digital financial services, SBP transformed itself into a modern central bank by implementing world class Core Banking, Enterprise Resource Planning and data warehousing Systems followed by the implementation of a real time gross settlement system named as Pakistan Real-Time Interbank Settlement Mechanism in 2008, thus leading to the transformation of country’s payment systems.

To promote digital retail payments in the country in line with global practices, SBP issued comprehensive operational guidelines for credit card business of banks in 2009, followed by regulations for prepaid cards and payment card security. Bank customers can now use internet banking to pay their bills and transfer funds across bank accounts with ease and convenience. Addressing challenges of interoperability of payment systems and building trust on e-commerce, SBP in recent years has introduced a number of enabling regulations such as Regulations for the Security of Internet Banking in 2015 to mitigate the risks associated with Internet Banking.

Apart from mobile banking, which relies on information and communication technologies typically through point-of-sales terminals or mobile phones, Branchless Banking enables the delivery of financial services outside conventional bank branches, often using agents. To ensure that every citizen has access to basic financial services, SBP issued Branchless Banking Regulations in 2008 to promote financial services delivery using non-conventional channels. The first branchless banking provider started operations in late 2009. Since then, industry has been moving forward, expanding with persistent growth trends and spreading out across all areas of the country.

Recognizing the new wave of advancements in distributed ledger technologies, Artificial Intelligence, Big Data Analytics and Cloud Computing SBP is also working on enabling the introduction of latest banking and payment related entities including digital-only banks, Fintechs and Electronic Money Payment Institutions to foster innovation, promote digital financial services and facilitate better delivery of consumer products and services.

Financial inclusion is a powerful force for inclusive growth in countries which empowers people to access a well-functioning financial system. In Pakistan, financial inclusion remains low. The Access to Finance Survey 2015 revealed that access to formal financial services increased from 12% in 2008 to 23% in 2015 while the ratio of adult population with a bank account has increased from 11% in 2008 to 16% in 2015 only.

Recognizing the gaps leading to persistent financial exclusion, State Bank launched a comprehensive National Financial Inclusion Strategy (NFIS) in 2015 along with the government of Pakistan. The strategy sets clear targets of increasing adult population’s access to formal financial accounts from 16% to 50% by 2020

Despite innovations, SBP remained cognizant of the fact that conventional banking lending products are still largely limited to the corporate sector and many of the desired areas have limited access to finance. Expanding its facilities beyond export refinance, which was introduced in 1973, SBP now provides subsidized short term and long term refinance facilities to the development of priority sectors. Agriculture being backbone of Pakistan’s economy has been a top priority with agricultural credit disbursements expected to hit Rs. 1 trillion this year. Similarly, the Policy for SME Finance was launched by Prime Minister in December 2017 to enhance the share of SME finance to 17 percent of total private sector credit by 2020.

Going Forward: SBP Vision 2020

To achieve its statutory objectives, the state Bank developed its third Strategic Plan for 2016 to 2020 in 2015. Commonly known as SBP Vision 2020, the vision organizes activities around six strategic imperatives, including: Enhance the effectiveness of monetary policy; Strengthen the financial system stability regime; Improve the efficiency, effectiveness, and fairness of the banking system; Increase financial inclusion; Develop modern and robust payments systems; and Strengthen SBP’s organizational efficiency and effectiveness. These strategic goals will fill the existing gaps and pave way for preparing the bank and financial system as a whole for delivering next generation of services and foster economic growth of the country.