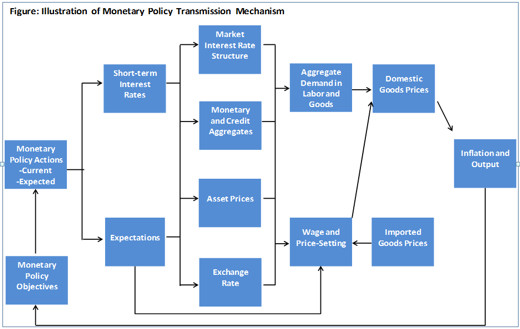

Transmission Mechanism of Monetary Policy

The process through which changes in the monetary policy stance affect the aggregate demand and inflation is termed as the transmission mechanism of monetary policy. The transmission mechanism generally involves uncertain time lags and it is, therefore, difficult to predict the precise effect of monetary policy changes on inflation. Broadly, the monetary policy transmission works through five channels; i.e. interest rate channel; balance sheet channel; exchange rate channel; assets price channel; and expectations channel.

The interest rate channel works through influencing the retail interest rates that banks charge on loans to businesses or offer on deposits to households. At the first stage, changes in the policy rate influence money market interest rates; such as repo and KIBOR (Karachi Interbank Offer Rates); which in turn impact the long-term interest rate. In particular, KIBOR is used as a benchmark rate for lending to consumers and businesses. The changes in KIBOR and thus the borrowing cost for consumers and businesses influence decisions of the public to consume, save, or invest. Generally, lower interest rates encourage people to save less and consume more, and vice versa. The demand for credit falls as it becomes expensive for investors and general public to borrow from commercial banks. As a result, economic activity slows down and results in a fall in the demand for and prices of goods and services.

The balance sheet channel generally refers to the mechanism by which monetary policy affects the credit portfolio of financial intermediaries as well as other economic agents. Specifically, changes in the monetary policy rate affect the availability of loanable funds with the financial institutions and financial position of other economic agents by altering their cash flows and net wealth. These changes in wealth and interest income have an effect on micro and aggregate expenditure, output, and prices in an economy. For instance, a contractionary monetary policy tends to reduce capacity of banks to extend credit, due to lesser availability of funds, and lower demand of businesses and consumers for credit, due to decline in their net wealth and cash flows. In this way, a tight monetary policy decreases the aggregate demand and thus prices of goods and services in the economy.

The exchange rate channel is the channel that links domestic economy with international economies. For instance, an increase in the domestic interest rates make the local currency financial assets, such as rupee denominated bonds, rupee deposits, etc, relatively more attractive than foreign currency denominated assets. It results into an increase the relative demand of local currency compared to foreign currency and may lead to either an appreciation of local currency or lower depreciation pressure on local currency. The relative increase in the value of domestic currency makes domestic goods more expensive than foreign goods, thereby causing a fall in the net exports and thus in aggregate demand. In addition, changes in interest rate may have a direct effect in inflation by influencing the prices of imported goods and services.

The asset price channel works through the prices of assets – real as well as financial. For instance, an increase in interest rates results in a rise in the returns on bank deposits as compared to returns on investing in other assets. As a consequence, investors and consumers prefer to deposit their cash rather than holding real estate, bonds and stock. It results in a reduction in demand for these assets, which eventually decreases their prices and the wealth of the holders of these assets. As their wealth falls, so do their expenditure, which decreases the demand of goods and services in the economy and eventually their prices as well.

The expectations channel deals with the expectations of general public and investors mainly about the future interest rates and inflation in the economy. As the longer-term interest rates depend in part on market expectations about the future course of short-term rates, the expectations of future official interest-rate changes affect the long-term interest rates and hence the aggregate demand in the economy. Similarly, monetary policy may influence market expectations about the future inflation; which generally play an important role in wage and price setting behavior of economic agent and determining actual inflation in an economy. For instance, a credible central bank with a history of success in curtailing inflationary pressure announces that inflation is high and may need tightening in the future. The announcement may be enough to trigger the market sentiments and may lead their stakeholders to adjust their expectation that inflation will come down in the near term.

|