1- It is mainly through money and foreign exchange market that SBP implements its monetary policy stance. To implement its monetary policy, SBP operationally focuses on controlling short-term interbank interest rate – overnight money market repo rate – through the use of various monetary policy tools (OMOs, Interest Rate Corridor, Reserve Requirements, FX Swaps, etc.). The short-term rates translate in to other longer-term market interest rates, such as KIBOR, that are used as benchmark for lending to businesses and households. In the transmission mechanism, efficient financial markets increase the efficiency and effectiveness of monetary policy transmission by reducing various uncertainties and improving translation of short-term interest rates to pricing of longer-term loans.

Monetary Policy Tools

1- Open Market Operations

- Open Market Operation is a tool used by a Central Bank (or monetary authority) to inject or mop-up funds, based on the liquidity requirements, from the banking system via the purchase or sale of eligible securities.

- Operationally, in case of OMO (Injections), SBP lends funds to banks/PDs against eligible collateral to address liquidity shortage in the system. In OMO (Mop-up), SBP sells MTBs to banks against funds to remove surplus liquidity from the system.

-

SBP conducts four types of open market operations (OMOs) to manage system’s liquidity:

- Injection – Reverse Repo: (To tackle short market positions)

- Mop-up – Repo (To tackle long market positions)

- Outright Sale or Purchase (long-term liquidity mgt.)

- Bai-Muajjal (Islamic mode - Deferred Payment)

- Eligible Collateral: For OMO (Injections) marketable government securities (i.e. MTBs and PIBs) are eligible securities. For OMO (Mop-up), SBP sells MTBs (on repo or outright basis) to banks for removing excess liquidity from the system. In case of Bai-Muajjal, a Shariah compliant tool for managing liquidity in the Islamic banking system, GOP Ijara Sukuk are eligible securities.

- Eligible counterparties: Banks and PDs are eligible counterparties to OMO transactions. For Bai Muajjal transactions, Islamic banks and specialized Islamic windows of conventional banks are eligible counterparties.

-

Tenors: There is no restriction on SBP in terms of tenor of conventional OMOs. However, usually SBP conducts OMOs of shorter tenors (e.g. 7 to 14 days).

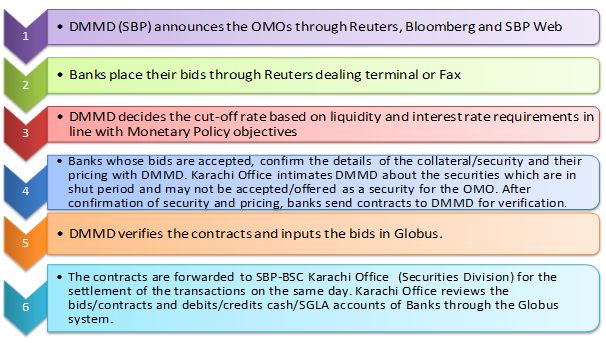

- OMO Process Flow

2- Islamic OMOs - Bai Muajjal

Background:

- SBP introduced OMOs for IBIs in October 2014. Under these OMOs, SBP can purchase GOP Ijara Sukuk (GIS) on deferred payment basis (Bai-Muajjal) for a tenor of up to 1 year and sell GIS on ready payment basis; using competitive bidding auction process. These OMOs provide SBP a tool to manage excess liquidity available with IBIs and improve effectiveness of monetary policy transmission in the absence of regular Sukuk issuances by the GOP.

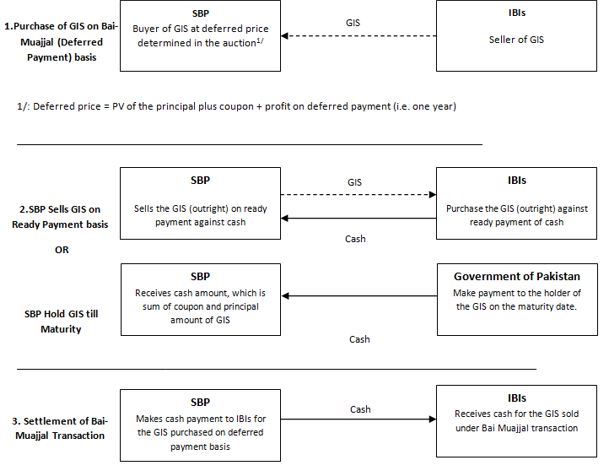

Mechanics of Bai-Muajjal Transactions:

- Under the Bai Muajjal transaction, SBP invites quotes from IBIs to sell their holding of GOP Ijara Sukuk on deferred payment basis to SBP.

- SBP evaluates and accepts the quotes of participants based on a cut-off price.

- Successful bidders transfer their GIS holding to SBP on the deal date (which is usually same as auction date). It is important to note that SBP does not pay any cash to the successful bidder at this stage. Rather, SBP only pays the deferred price to IBIs on settlement date (i.e. after one year)

Graphic Illustration of a typical Bai Muajjal Transaction:

3- Interest Rate Corridor

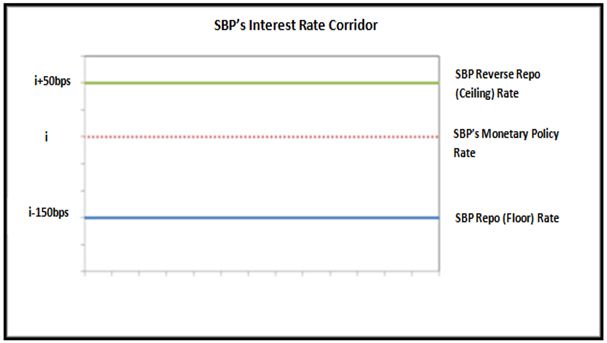

- SBP Target Policy rate: SBP Target policy rate is a single policy rate that unambiguously signals SBP’s stance of monetary policy to achieve macro‐economic objectives with price stability. The SBP Policy Rate is set between the SBP standing facilities - Floor and Ceiling of the interest rate corridor. SBP aims at keeping the money market weighted average overnight repo rate close to the SBP Target rate using liquidity management tools, mainly OMOs and outright sale/purchase of government securities.

- Standing facilities aim to provide and absorb overnight liquidity, signal the general monetary policy stance and bound overnight market interest rates within the acceptable levels. Two standing facilities are available to eligible counterparties on their own initiative. These include SBP Reverse repo (Ceiling) facility and SBP Repo (Floor) facility. At present, the width of the Interest rate corridor, that is, the difference between the ceiling and the floor rate is 200bps

- SBP Reverse repo (Ceiling) rate: At times of liquidity shortage, scheduled banks, PDs and DFIs can access SBP Reverse repo facility to borrow funds (against eligible collateral) from SBP on overnight basis to meet their liquidity requirement. At present, the Ceiling rate is 50bps above the SBP Target policy rate i.e. the key monetary policy rate.

- SBP Repo (Floor) rate: At times of excess liquidity, scheduled banks and PDs a can access SBP repo facility to place their surplus funds (against eligible collateral) with SBP on overnight basis. At present, the floor rate is 150bps below the SBP Target policy rate i.e. the key monetary policy rate.SBP established an “Interest Rate Corridor” (IRC) in August 2009 with SBP reverse repo rate, the policy rate, as ceiling and SBP repo rate as floor.

- Eligible Collateral: For SBP Reverse repo (Ceiling) facility, marketable government securities (i.e. MTBs and PIBs) are eligible securities. For SBP Repo (Floor) facility, SBP sells MTBs (under repo sale) to banks availing the facility to park excess liquidity with SBP.

- Eligible counterparties: Scheduled banks, PDs and DFIs are eligible counterparties to SBP Reverse repo (Ceiling) facility; however, only scheduled banks can access SBP Repo (Floor) facility.

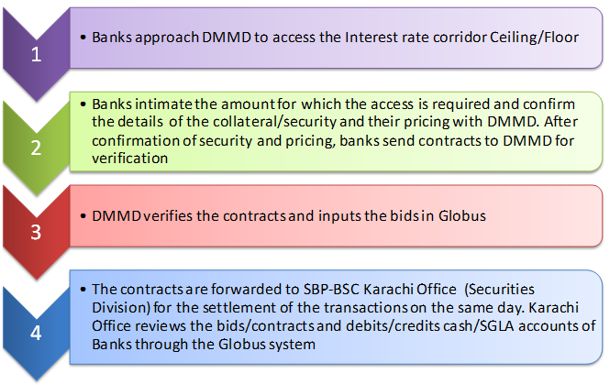

-Standing Facilities process flow:

- Historical Developments in Interest rate corridor:

- SBP introduced an interest rate corridor in August 2009 with the objective of introducing the corridor was to minimize volatility in the short term interest rates to achieve the ultimate goal of maintaining price stability.

- Since the adoption of “Interest Rate Corridor” (IRC), volatility in the overnight money market repo rate has reduced.

- The structure of SBP’s Interest Rate Corridor (IRC) was revised in May 2015 to:

- Strengthen Transmission of Monetary Policy

- Align SBP’s monetary policy operational framework with International best practices

- A new policy rate as “SBP Target Rate” for the money market overnight repo rate was introduced in addition to SBP Reverse Repo Rate (ceiling rate) and the SBP Repo Rate (floor rate) of the corridor. This O/N repo rate target is a single policy rate to unambiguously signal SBP’s stance of monetary policy.

- The adoption of SBP Target policy rate has aligned the operational target of overnight money market repo rate with the proposed Policy Rate (i.e., the SBP Target Rate). SBP aims at keeping the money market weighted average overnight repo rate close to the SBP Target rate to unambiguously target SBP’s monetary policy stance.

IV. Reserve Requirements

- Cash Reserve Requirement:

- Cash Reserve Requirement is a percentage of banks total liabilities or some subset thereof which banks are required to hold as reserves at the Central Bank.

- Under current regulations (Section 36 of SBP Act, 1956), all scheduled commercial banks, microfinance banks, Islamic banks and Islamic banking subsidiaries of the commercial banks are required to maintain a certain proportion of their liabilities in the form of cash with SBP.

- All banks (including Islamic Banks/Branches) have to maintain CRR at an average of 5.0% of total demand liabilities (including time deposits with tenor of less than 1 year) during the reserve maintenance period, however daily minimum requirement is 3.0%. Time liabilities (including time deposits with tenor of 1 year and above) are exempt from cash reserves.

- Bi-weekly average CRR for DFIs on their total DTL is 1%.

- Similarly, banks are required to maintain 5 percent as cash reserve and 15 percent as special cash reserves against foreign currency deposits.

- For the purpose of applicable DTL for CRR, Time and Demand Liabilities (TDL) as of close of business on Friday (first day of reserve maintenance period) is taken into account for determination of required CRR. If Friday is a holiday then TDL as of close of business on preceding working day is taken into account.

- It is also pertinent to mention that SBP does not remunerate required or excess reserves.