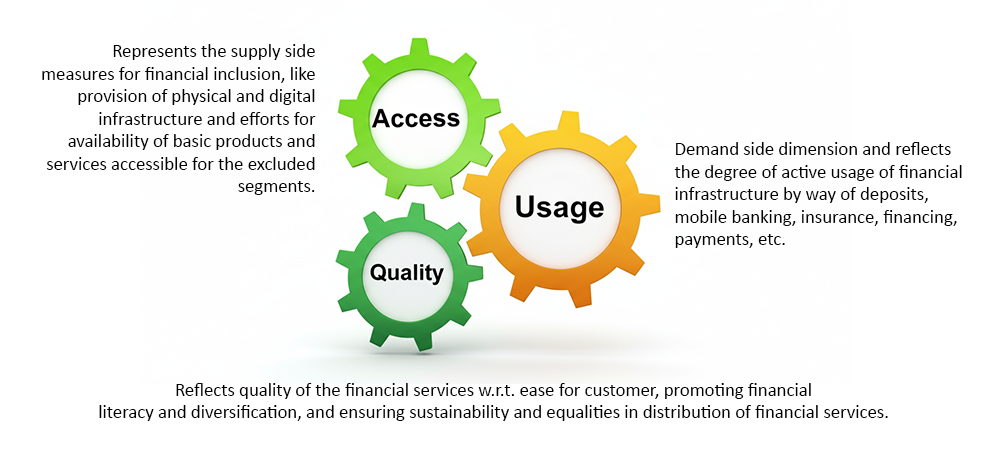

State Bank of Pakistan (SBP) has introduced a comprehensive tool to assess the state of financial inclusion in the country. The Pakistan Financial Inclusion Index (P-FII) assesses financial inclusion beyond account ownership, by measuring parameters under three key dimensions of financial inclusion, i.e. Access, Usage and Quality.

*All indices range from 0 to 100

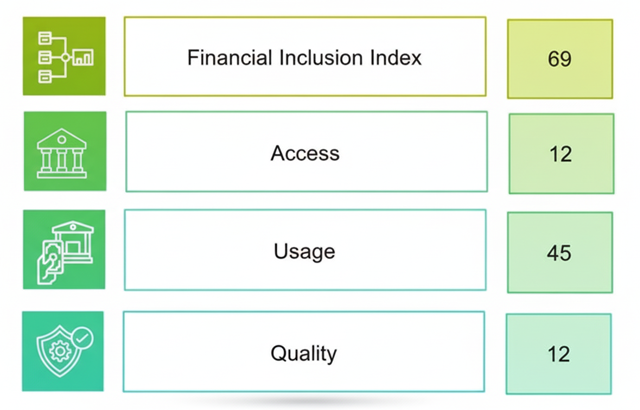

The index is a combination of sixty-nine indicators reflecting banking, non-banking and payment services provided by banks and financial institutions. The index is calculated by assigning non-parametric weightages and benchmarking each indicator against a defined target value, representing its projected outcome that SBP aims to achieve by 2030.

No of Inidicators

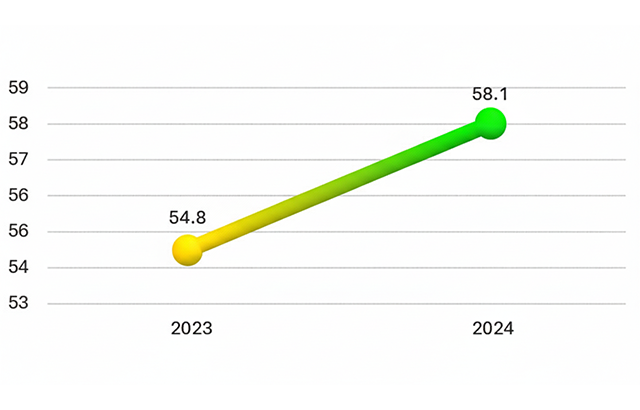

The result reflect in expanding financial infrastructure across the country through the collective efforts of all stakeholders. Overall, the P-FII shows a significant improvement from last year across all three dimensions.

The development of P-FII solidifies SBP’s commitment to ensure informed and evidence based policy making for building an inclusive, resilient and sustainable financial ecosystem that serves all segments of society. This is also aligned with SBP’s financial inclusion objective to improve usage and quality of financial services, while extending financial access to all.

Access the detail paper here.