Keeping in view need to improve availability of adequate housing in the country and important role of construction sector in boosting economic activities in other countries, Government of Pakistan envisions to increase the number of housing units manifold in coming years and has taken several measures in this regard... Read more

Pakistan is a country of over 200 million people, with strong economic growth potential. Pakistan’s high population growth rate fuels urbanization and with it comes high demand for housing from almost every stratum of society. There is an estimated shortage of 12 million residential units in the country; most of it in low and middle income group.

As per Pakistan Economic Survey for FY21, construction sector contributed 2.5 percent in GDP. Further, 7.71 percent of the employed Pakistani labour force is engaged in construction sector.

Construction industry is considered as one of the engines of long-term economic growth in an economy. There are at least 40 other industries closely tied with construction industry and 70 percent of unskilled labor market is linked with housing & construction. In order to leverage the potential of this sector towards the long-term sustainable economic growth, SBP has taken a number of measures including:

Keeping in view the distinctive nature of housing finance, State Bank issued separate set of prudential regulations (PRs) for housing finance. These regulations are revised from time to time based on changing market dynamics.

Salient Features of PRs:

SBP has established a Steering Committee (SC) on Housing and Construction Finance under the Chairmanship of Governor, State Bank. The SC includes Chairman NAPHDA, two Deputy Governors of SBP, M/s Arif Habib and presidents of select banks (NBP, HBL, UBL, Standard Chartered, Meezan Bank, Faysal Bank, Bank Alfalah, Bank of Punjab and First Microfinance Bank). The SC has constituted sub-committees to work effectively in different areas including developer finance, end user housing finance, use of technology, capital market development, removal of legal and regulatory hurdles in housing finance and training and capacity building of banking industry to develop this sector. The SC convene meetings on regular basis.

Major Decisions of SC:

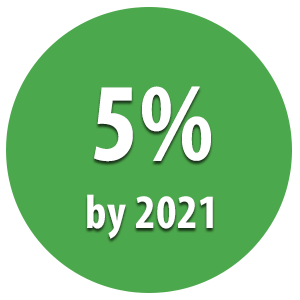

SBP has advised banks to allocate 5% of their private sector advances in housing and construction finance over a period of 18 months i.e. by December 2021. State Bank has completed one-on-one meetings with banks for finalization of their action plans for achievement of mandatory targets for housing and construction finance. Further, for the purpose of monitoring, these targets have been broken down to quarterly targets. It is expected that by December 31st, 2021, banks credit to housing and construction finance will reach to Rs. 384 billion.

Click here to read the circular.

Mandatory Targets under Mera Pakistan Mera Ghar (MPMG)

As a subset of housing and construction finance targets, SBP has also allocated targets under MPMG both in terms of number of housing units to be financed and amount to be financed. Monthly targets have been allocated to each bank based on its asset size. SBP monitors performance of each bank against these targets. In case of shortfall from target, SBP imposes penalty. The penalty charged on a bank can be reduced after review of bank’s efforts through an objective criteria. Various contributing factors of the criteria include logins of applications, approvals of housing finance, results of SBP’s latest mystery shopping surveys, involvement of bank’s management, evidence of BOD’s support, sale and marketing efforts, innovation in delivery channels, capacity building of staff and human resource (headcount) involved in MPMG.

Click here to read the circular

Inclusion of Investments in Achievement of Mandatory Targets for Housing and Construction Finance

In order to increase funding for housing and construction through capital markets and microfinance banks (MFBs), SBP has decided to allow counting of investments in REITs and PMRC bonds or sukuk, equity investment in RIETs and financing to MFBs for housing finance by banks or DFIs towards achievement of their housing and construction finance.

|

SBP has introduced a mechanism to incentivize and penalize banks with respect to meeting or failing to meet targets. Specifically, banks meeting quarterly targets, commencing December 2020, will be required to maintain CRR reduced by an amount equal to increase in housing and construction finance from 30th June 2020 for the forthcoming quarter. This incentive, however, will be subject to a ceiling of 1 percent of the total demand and time liabilities based on which CRR is calculated. Conversely, if the banks fail to meet the target, they will be penalized by requiring to maintain extra CRR by an amount equal to the shortfall in the target.

|

SBP issued guidelines to encourage banks/DFIs to extend housing finance to the housing units in under construction projects. These guidelines have been developed considering current market norms of buying or selling of housing units in under construction projects by addressing issues of legally enforceable rights and responsibilities. Under these guidelines, all payments to the builder or developer shall be routed through an escrow account maintained by the bank or lead bank of consortium. These guidelines will help spur economic development through promotion of activity in housing and construction sectors. Apart from providing an opportunity to the borrowers to avail housing finance under ‘Mera Pakistan Mera Ghar’ in under construction projects, this will also help builders to enhance stock of new apartments/flats across the country.

Click here to read the circular.

Steering Committee for housing and construction finance facilitated the process for development of standardized Risk Acceptance Criteria (RACs) for providing builders/developers finance. These RACs comprehensively cover builder/developer’s eligibility for formal financing, mechanism to assess credit reputation, track record assessment and financial capability to service the loan. These RACs, being standardized in nature, save banks from developing risk assessment criteria on individual basis.

|

SBP facilitated banks and Punjab Government for the development of checklist of property documents that are required by banks for authentication before disbursement of financing. The title documents requirements vary from one land record authority to other e.g. revenue department, development authority, housing society, etc. The provision of standardized checklist for different land record authorities enabled Punjab Government to develope an online portal for prescreening of title documents as per requirements of banks offering mortgage finance. Besides, SBP also collaborated with Punjab Government to carryout extensive capacity building sessions for the banks’ staff to sensitize the effectiveness and utilization of the portal. SBP will also facilitate the same process if other provinces introduce such mechanism.

|

Customer already owning a house but wishing to upgrade the living standard or change house due to change in family size have to bring in the cash as equity to avail mortgage. Therefore, buying and selling a house simultaneously is cumbersome process and the same may not happen at one point in time or otherwise customer has to liquidate his assets to bring in equity.

With the objective to facilitate housing finance to those who own liquid securities or other properties, banks have been allowed to count these collaterals against meeting prescribed 15% equity contribution of the borrower.

Click here to read the circular.

|

Banks have been facilitated to use alternative delivery channels for lead generation and quick disbursement of housing finance. Banks are engaging real estate agents, microfinance institutions, microfinance banks and branchless banking agents to originate customers for disbursement of housing finance. Encouraged by State Bank, banks have employed direct sales force for housing finance. |

A network of banks’ focal persons has been setup to facilitate builders/developers finance under NAPHDA negotiated procurement process. Performing the role of a one-window facilitation, these focal persons coordinate with builders/developers and NAPHDA for quick processing of project finance.