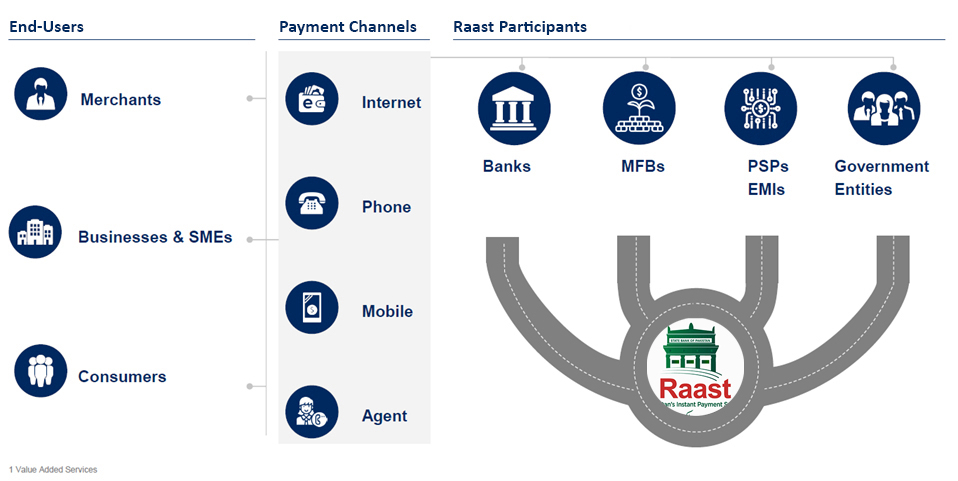

Raast is Pakistan’s first instant payment system that will enable end-to-end digital payments among individuals, businesses and government entities instantaneously. The state-of-the-art Pakistan’s Faster Payment System will be used to settle small-value retail payments in real time while at the same time provide a cheap and universal access to all players in the financial industry including commercial banks, microfinance banks, government entities and fintechs (EMIs & PSPs).

Pakistan has had low electronic transactions for a number of reasons including low banking penetration, lack of trust and awareness of digital payment methods, limited interoperability, difficult accessibility and high cost of transactions. The Real Time Gross Settlement System (RTGS) of Pakistan provides instant payment settlements for large value and corporate transactions only. Raast: Pakistan’s Instant Payment System will facilitate retail payment settlements with much great efficiency.

Raast aims to address some key industry challenges within the payment ecosystem:

|

Limited interoperability: Financial institutions (i.e. the providers of digital payment services) have difficulty connecting to each other due to a lack of necessary central infrastructure |

|---|---|

|

High cost of digital payments to the end user: End users are charged high fees for transferring money digitally, making digital payments inaccessible for a large portion of the population |

|

Poor user experience: End users must go through a complex process to make digital payments and there are no digital modes of payment that are widely accepted by merchants |

|

Lack of security: Currently available digital payment types and infrastructure do not offer sufficient/adequate data protection and authentication |

| Instantaneous payments: Near real-time digital payments across individuals, merchants, businesses, and government entities |

|---|---|

|

Low-to-no transaction costs for end users: Raast is designed to operate at a cost recovery model in order to make digital payments affordable to end users of all socio-economic backgrounds |

|

Full sector-wide interoperability: Raast will allow all financial institutions to seamlessly connect to each other via a single link to the central infrastructure, making digital payments accessible across any channel to customers of any financial institution |

|

Customer-centric innovative products/services: Raast will be built on cutting-edge technological standards, allowing financial institutions to develop innovative and user-friendly digital payment products and services (e.g. payment through phone number as RAAST ID). |

|

Reliability and enhanced security: RAAST uses more secure payment types, ensures that each transaction is authorized by the payer, and offer enhanced data protection and fraud detection services. |