|

ISO 20022 Messaging Standard

Built on latest global standards |

Advanced Liquidity Management

Built-in tools for monitoring and optimizing available funds. |

|

Advanced Queuing

Multi-queue system for optimal liquidity management and system-wide settlement efficiency |

Decoupled Architecture

Modules operate independently, enabling targeted resilience and flexible scaling |

| Better capacity and efficiency

Designed to process higher volumes with minimal delays. |

Latest Security Features

Up-to-date encryption and monitoring for secure operations. |

The system supports the following functionalities for efficient

transaction execution and monitoring

|

High-value interbank funds transfers with immediate settlement finality |

|---|---|

|

Scheduling of future-dated payments, allowing institutions to manage liquidity with precision |

|

Transaction queuing & prioritization, supporting time-critical payments |

|

Real-time monitoring of balances, payment queues, and settlement positions |

|

Automated billing and fee calculation, with downloadable invoices and billing logs |

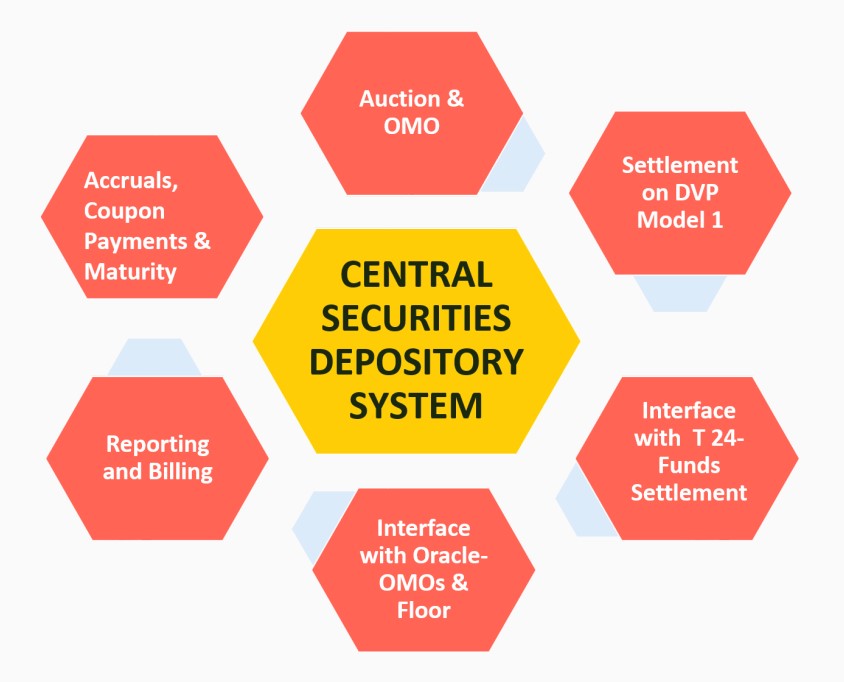

Central Securities Depository SystemThe new system also provides a Central Securities Depository (CSD) platform for money market operations such as auction of government securities, sale and purchase of securities in the secondary market, collateral management and open market operations. |

|