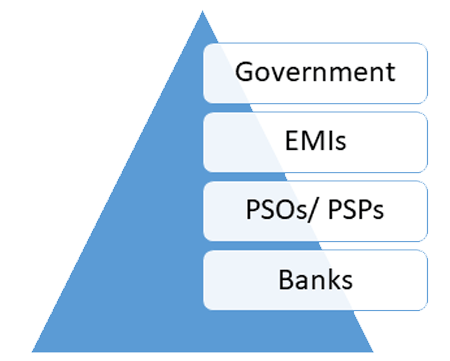

Digital Financial Services (DFS) in Pakistan are extended by Financial Institutions licensed under the following laws:

|

SBP Act 1956 |

|---|---|

|

|

|

|

|

Rules for Payment System Operator/ Payment Services Provider (PSO&PSP) 2014 |

|

There are in total 44 number of Banks of which there are with a network spanning 16,121 branches. These institutions are licensed to provide full range of financial services to Pakistanis.

Licensed under the Rules for Payment System Operator/ Payment Services Provider (PSO&PSP) 2014, these institutions are licensed to provide the following services to Pakistanis:

(i) An electronic platform for clearing, processing, routing and switching of electronic transactions.

(ii) It can make agreements with Banks, FIs and other PSOs and PSPs Merchants, e-commerce service providers and any other company for the provision of services mandated to the PSO and PSP under the said rules.

In the year 2019, State Bank of Pakistan, with the objective to promote digital payments, foster innovation in payments industry, increase financial inclusion in the country and provide Regulatory framework to non-banking entities in payments landscape, issued Regulations for Electronic Money Institutions (EMIs) under the powers conferred on it by Payment Systems and Electronic Fund Transfers Act, 2007.

The EMIs are entities that offer innovative, user-friendly and cost effective low value digital payment instruments like wallets, prepaid cards, and contactless payment instruments. E-money has played a crucial role in digitizing different types of payments in various countries. The EMIs in Pakistan are expected to offer interoperable and secure digital payment products and services to end users.

Under the Regulations, prospective EMI applicants are granted EMI license in three stages viz In-Principle approval, approval for Commencement of Pilot Operations and the Final Approval i.e. License.

Following list shows the details of EMIs licensed by SBP under the Regulations for EMIs.

Government Entities play a major role in extending Digital Financial Services to Pakistanis – RaastPay enables Dividend Payments, Salary Disbursements, and other Government to Person (G2P) transfers.