Equal opportunities for both men and women for accessing and pursuing all financial and professional endeavors are essential for sustainable and inclusive economic growth in any country. Recognizing the importance of women’s empowerment and foreseeing it as a tool for poverty alleviation, SBP has addressed the gender gap in Pakistan’s financial sector through a range of policy measures and direct interventions.

Strategy:

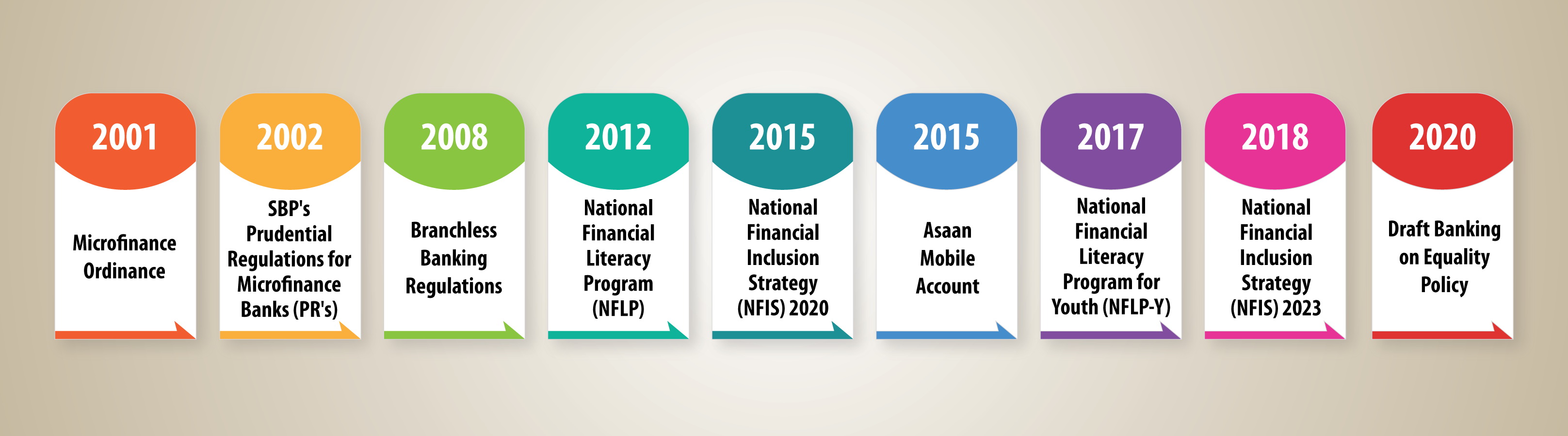

National Financial Inclusion Strategy (NFIS)

Under SBP’s National Financial Inclusion Strategy (NFIS) 2023, SBP is committed to improve usage in women’s accounts with a headline target of reaching 20 million active women accounts by 2023. Prior to this, under NFIS 2015, SBP achieved its headline target of improving adult women’s account ownership to 25% by 2020, well before the timeline, as the ratio stood at 27% by 2018.

Schemes:

SBP Refinance & Credit Guarantee Scheme for Women Entrepreneurs

To improve access to finance for the women entrepreneurs, SBP launched a refinance cum credit guarantee scheme for women borrowers across the country. Under the scheme, refinancing will be provided by SBP at 0% with 60% risk coverage to participating financial institutions for onward lending to women entrepreneurs across the country at a mark-up rate of up to 5% per annum. The key features of the scheme are as under:

Financing to women entrepreneurs across Pakistan at mark-up rate of up to 5 percent p.a.

Maximum financing amount is Rs. 5 million

Maximum tenor of the facility is 5 years including grace period of up to 6 months

Risk coverage of up to 60 percent is also available to the Participating Financial Institutions

Prime Minister's Kamyab Jawan Youth Entrepreneurship Scheme (YES)

The Government of Pakistan has designed a comprehensive program named “Prime Minister’s Kamyab Jawan Program” through which all Pakistani citizens aged between 21 and 45 years with entrepreneurial potential can avail financing under Youth Entrepreneurship Scheme (YES). Furthermore, a quota of 25% is reserved for women entrepreneurs. In this regard, key features of the scheme are as under:

Financing limit up to PKR 25 million, with 25% quota for women entrepreneurs

Markup rate of up to 5% per annum and up to 50% credit guarantee to Participating Financial Institutions

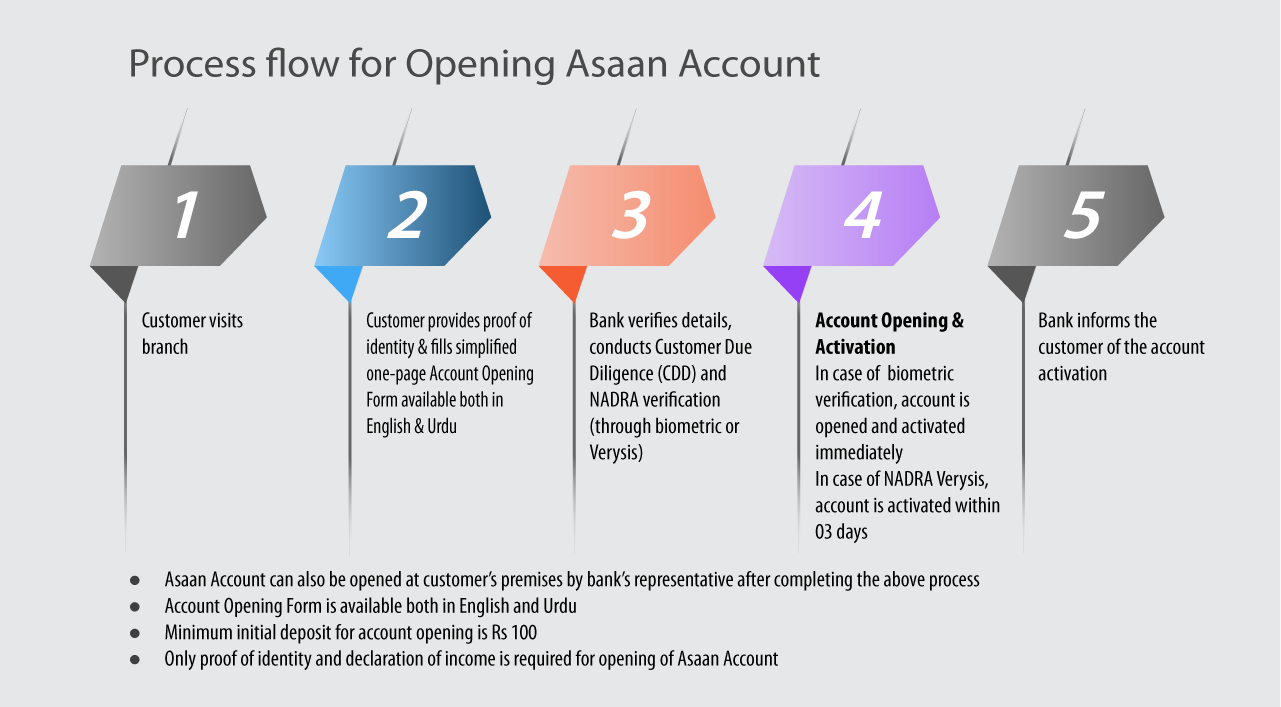

Asaan Account

The Asaan Account aims to facilitate unbanked or under-banked masses to open an account easily with less requirements. It is especially targeted towards women or housewives, skilled or unskilled work force, farmers, less educated or uneducated people, laborers or daily wagers, self-employed individuals, pensioners, young adult population etc.

Asaan Accounts are offered by all Commercial, Islamic and Microfinance banks and have the following features:

Financial Literacy:

Lack of financial literacy among masses is one of the major impediments in promotion of financial inclusion in Pakistan. As per Access to Finance Survey 2015, almost 40 percent of the financially excluded population of the country reported lack of understanding of financial products as the main reason for financial exclusion. In order to enhance the financial education and awareness among low-income segment, SBP has taken following initiatives:

National Financial Literacy Program (NFLP)

SBP launched the “National Financial Literacy Program (NFLP)” in 2017 to impart basic financial education to general public over a 5-years period targeting 1 million people with 50% female participation and 70% rural involvement. Since its inception in 2017 until May 2021, more than 886,000 participants have been imparted with basic financial education.

National Financial Literacy Program for Youth (NFLP-Y)

SBP, in collaboration with National Institute of Banking and Finance (NIBAF) launched National Financial Literacy Program for Youth (NFLP-Y) over a 5-years period in 2018. The program targeted 45 districts which aims to train 1.6 million children, adolescent and youth by March 2023.

As of May 2021, the program has reached 691,947 beneficiaries out of its target of one million beneficiaries through face to face sessions. Furthermore, more than 55,000 youth have been trained through E-Learning Portal and Online Game ‘Pompak’ till May 2021 out of its target of 0.6 million beneficiaries. Further, more than 20 million people were reached through the NFLP-Y official social media platforms (Facebook, LinkedIn, Twitter, and YouTube).