The survey covered almost every aspect of the RDA ranging from account opening, investment avenues including returns and processes, remittances along with ease of sending, products and services like Roshan Apni Car and Roshan Apna Ghar, and service standards like complaint handling, banks’ response time, etc.

The survey received tremendous response from our valuable RDA holders as approximately ten thousand respondents from 116 different countries filled the survey. Summary of the survey findings is as follows:

It was gratifying that for 75% of the respondents, it was easy to find information regarding RDA. The emigration status of the respondents demonstrated that majority is on work visa followed by the permanent residents. Further, 88% of the respondents were 18 to 50 years old, out of which more than 50% belonged to 31-40 years age bracket.

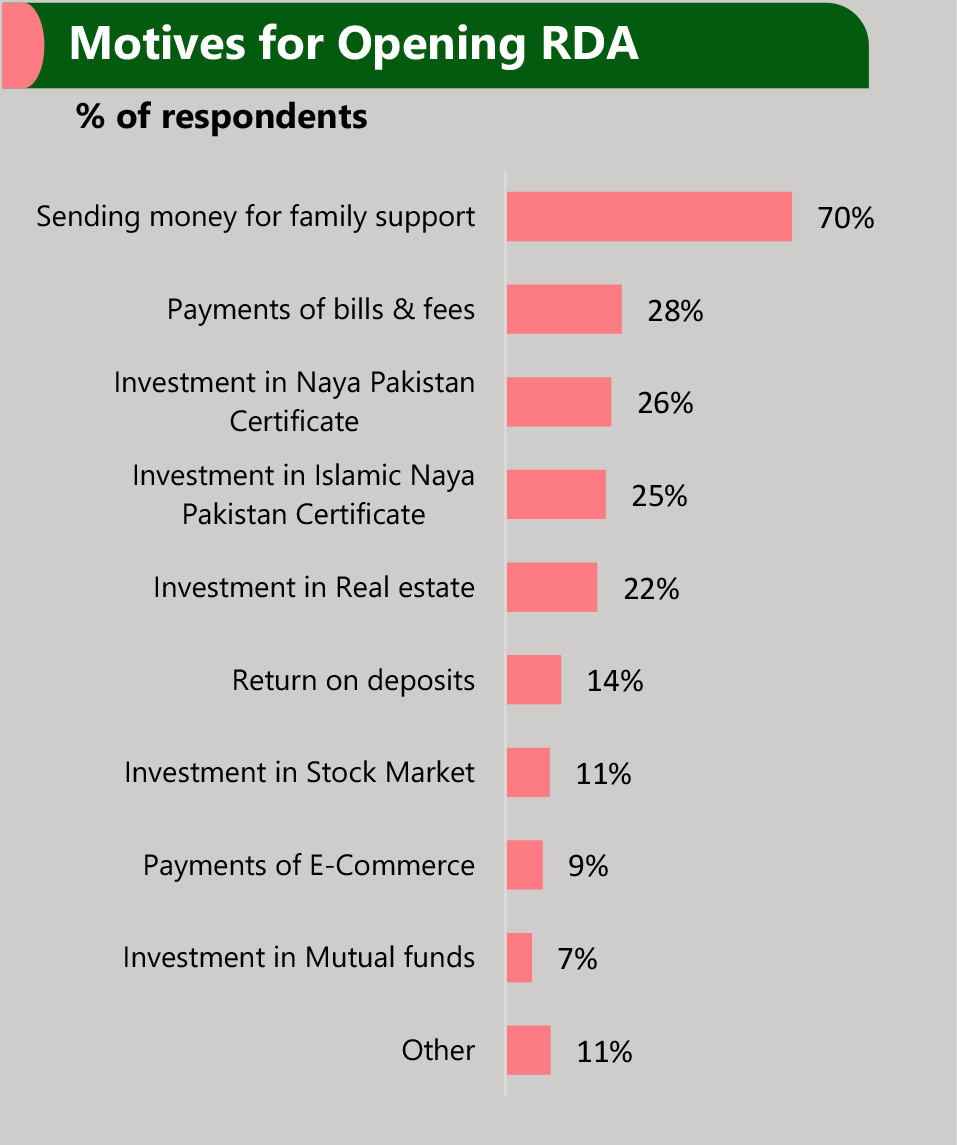

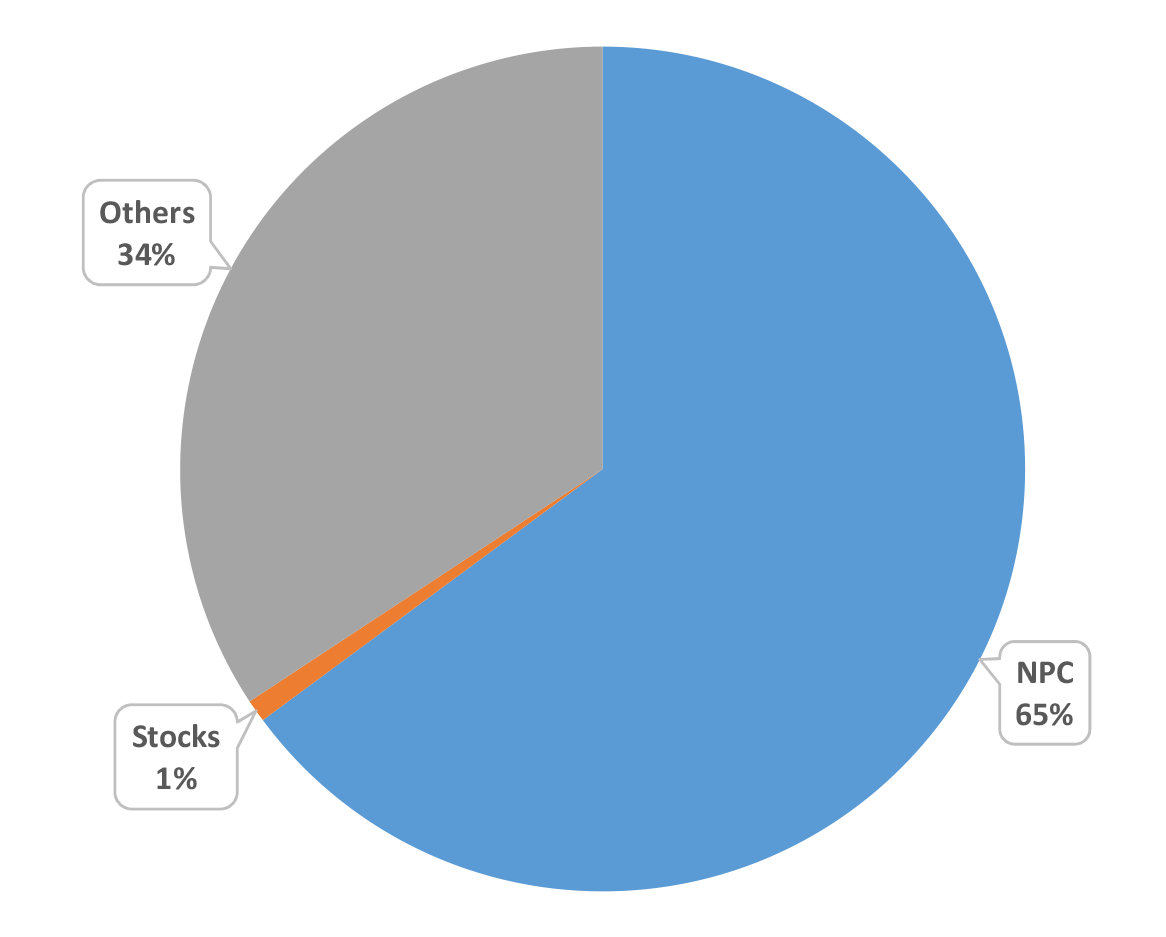

It was not surprising that the 70% of the respondents were from GCC countries followed by 10% from UK plus EU. For majority of the respondents, dominant purpose of opening the RDA was sending remittances for family support followed by bill payments and investment in NPCs.

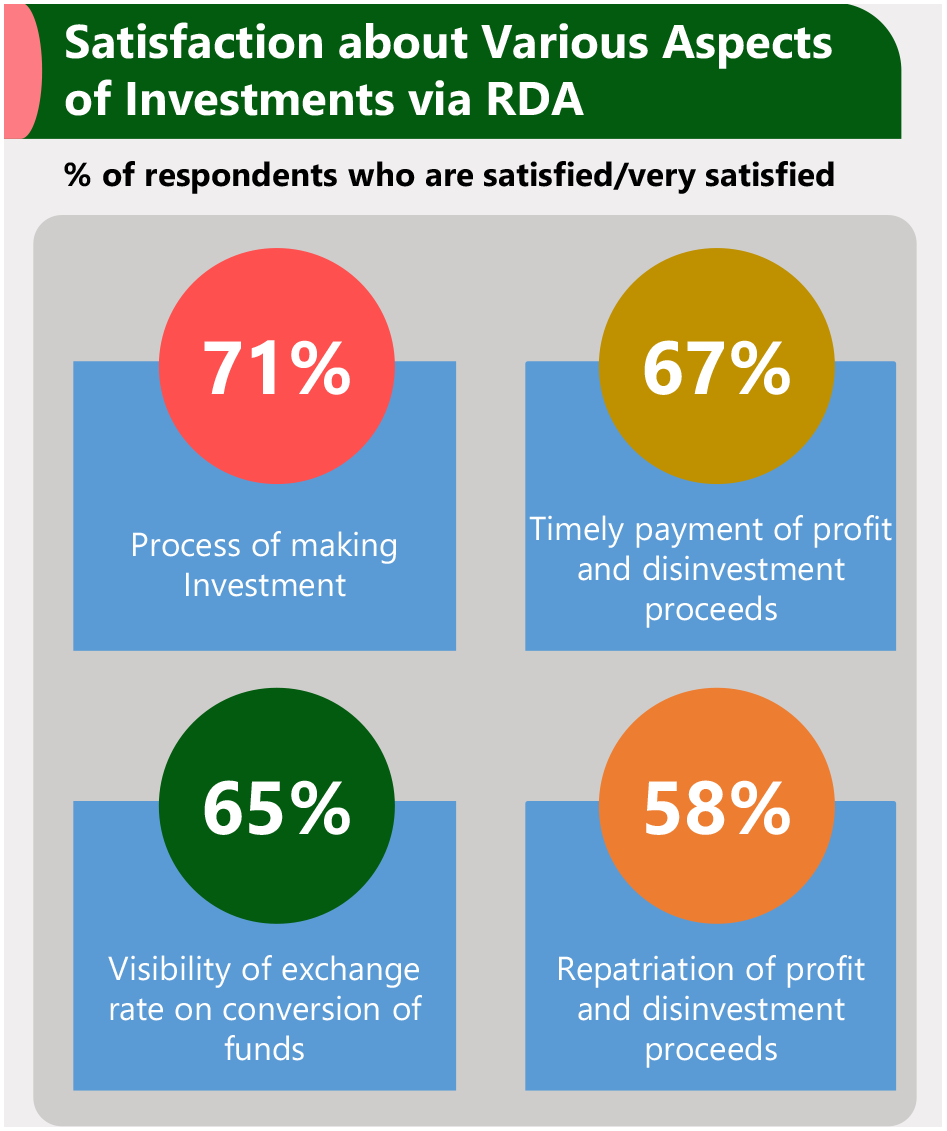

These results were also satisfactory in terms of the products and services offered under RDA. It was encouraging to see that 71% of the respondents were satisfied with the various aspects of making investment through RDA. One of the key features of RDA is repatriability from accounts without any approval from SBP. The survey respondents also provided us confidence that they are well aware of this feature which distinguishes it from other accounts.

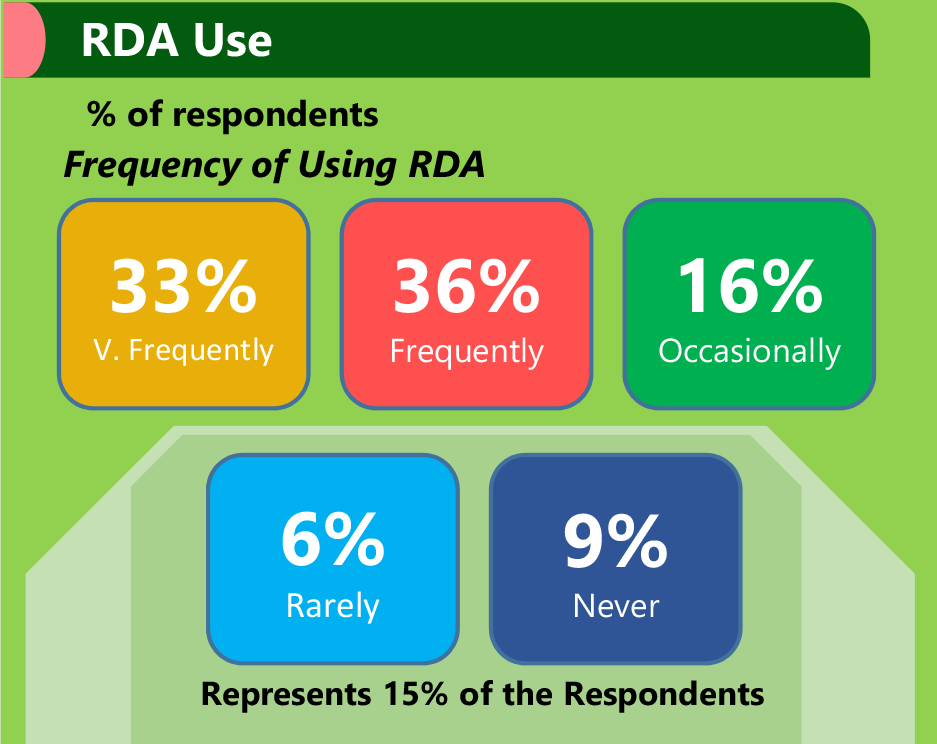

RDA was designed to enable our Pakistani diaspora to avail lifestyle-banking services within Pakistan, through the comfort of their homes. Around 70% of the respondents were both frequent users and satisfied with the various aspects of RDA and the products and services suite. Roshan Apna Ghar and Roshan Apni Car turned out to be the most popular products under the RDA banner.

It is significant achievement for all the stakeholders of the RDA that the 70% of the respondents were happy with RDA and its products and considerable majority of the RDA holders are frequent users of the products. Above all, 77% of the respondents are likely to recommend to others that the RDA facility is worthwhile.

Although journey of the majority of the respondents’ with RDA was seamless but a portion faced issues at some stage.

One of these areas, where the respondents were not satisfied was the complaint resolution process, due to the process being highly manual in nature. SBP being cognizant of this feedback immediately started the process of developing an automated complaint resolution platform (a dedicated portal as well as Mobile App), with the vision to enable the RDA holders to lodge and track complaints through an end-to-end digital process.

Currently, the complaint portal has been made live on the portal, whereas work on a Mobile app is in progress, which will be available soon for all of our customers.

Key Suggestions:

The respondents were asked for suggestions to improve the current processes and investment avenues along with any new products that users expect the banks to offer.

Like rest of the survey, the responses in suggestion section was also very encouraging. The responses received ranged from words of appreciation for RDA team and SBP to frictions in few of the processes. The respondents suggested various new propositions under RDA like issuance of credit cards by banks, availability of Raast platform for transactions, improving the process of mutual funds and stock exchange investments more user friendly, increase in products and services offered through mobile apps like account opening, direct investment options from account etc. The respondents also suggested that RDA holders may be given an opportunity to invest in National Saving Schemes as an alternative investment option.

Overall, the survey results were highly encouraging and provided us key insights to further improve the RDA proposition. SBP thanks our valuable NRPs for this heartening and overwhelming response that further pushes us to improve our service standards meeting their expectations.

|

|