Page 38 - Payment System Review -Q2 FY24

P. 38

C: A Short Guide to Using QR Code Payments

SBP has launched interoperable QR Code to facilitate digital payments where people can send funds to each other without typing long account numbers or IBANs. Further, this is also

envisioned to replace cash based transactions particularly at small merchants/micro sellers who can display their QR code at their business locations to receive money through the digital

channel. It is expected that this will play a pivotal role in enhancing the digital acceptance points in the country and will assist in moving towards SBP’s goal of reducing currency in

circulation.

Any account holder of a bank can generate QR code from the mobile banking app /internet banking. This is designed to be an interoperable QR code; which simply means that a QR code

generated by the mobile app of one bank can be scanned by the mobile apps of all other banks.

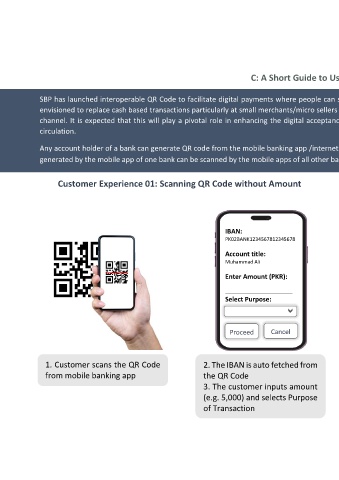

Customer Experience 01: Scanning QR Code without Amount

IBAN:

PK02BANK1234567812345678 Are you sure you want

Account title: to transfer PKR 5000 to

Muhammad Ali.

Muhammad Ali

Enter Amount (PKR): You have successfully

Click OK to continue transferred PKR 5000 to

________________________ Muhammad Ali.

Select Purpose:

Trx. Reference no:

23174635

Proceed Cancel OK Cancel

OK

1. Customer scans the QR Code 2. The IBAN is auto fetched from 4. Title Fetch screen is displayed 5. Confirmation screen is

from mobile banking app the QR Code to confirm whether the funds displayed once funds are

3. The customer inputs amount are being transferred to the transferred

(e.g. 5,000) and selects Purpose intended recipient

of Transaction

25