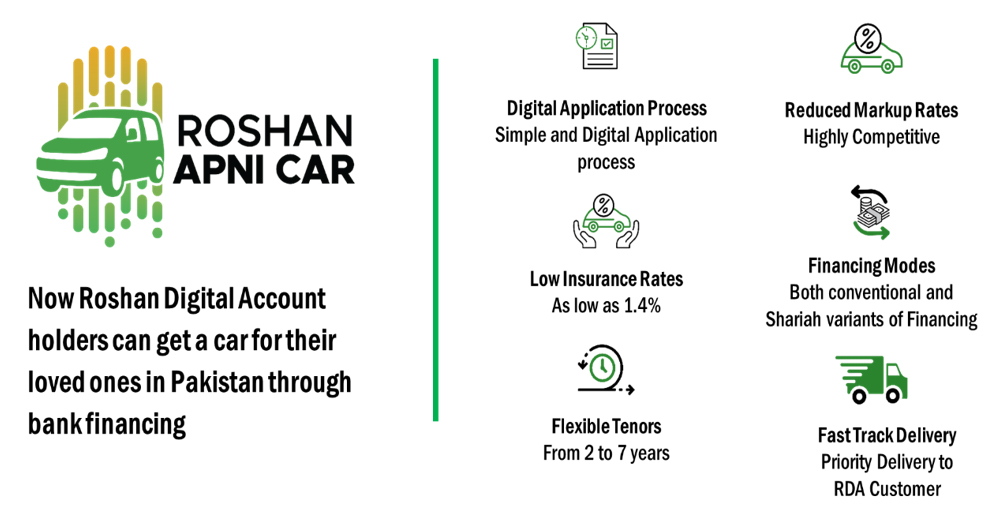

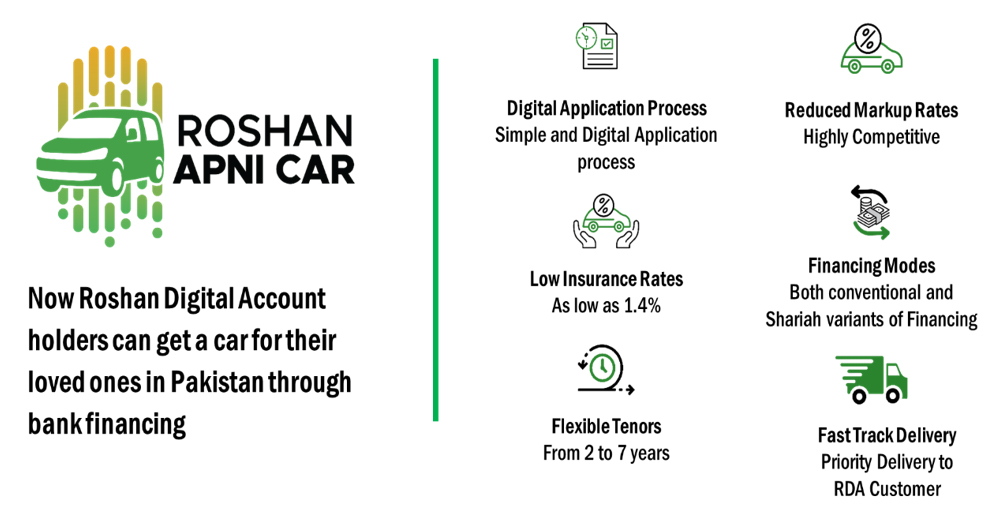

Realizing this, SBP embarked on a journey to provide a digital process for NRPs to request their RDA banks for car financing. This journey became a reality, when last year after detailed deliberations and collaboration with leading car manufacturers, banks and insurance companies, SBP launched the Roshan Apni Car (RAC) initiative under the RDA banner.

Features: Under the Roshan Apni Car, Overseas Pakistanis with a Roshan Digital Account are able to get financing at attractive rates to provide cars for their family members living in Pakistan. The product is available in both Conventional and Shariah compliant variants.

Faster processing: With digital loan application process, documentation needs have been streamlined and the loan approval time has been substantially reduced. If all the documents for car financing submitted to banks are complete, the processing and disbursement takes up to 4-5 days.

Cheaper: Financing rates for Roshan Apni Car are highly competitive and financing is available at both fixed or floating rate. The financing rates further decrease, if the customers can pledge their deposits and Naya Pakistan Certificates to get financing for their cars.

Multiple cars: In domestic market, it is typically very difficult to get a loan for more than one car. However for RDA holders, up to 3 cars are available under lien based financing and up to 2 cars under non-lien based financing.

Fast-track delivery: Car manufacturers have agreed to cut the delivery time of cars especially for RDA customers.

Insurance rates: This is not all, RDA customers can also avail highly lucrative insurance rates on their cars with rates as less as 1.4%.

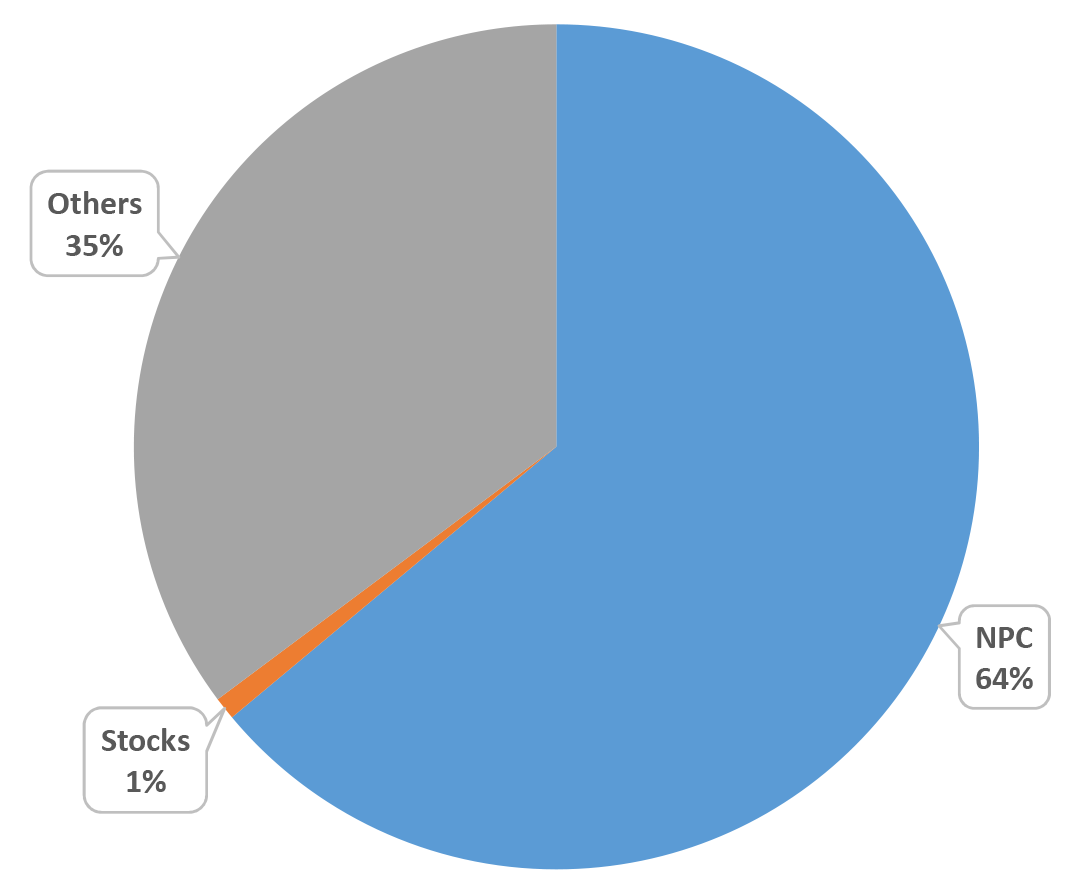

To date, NRPs have availed financing of more than PKR 8 billion worth of financing and approximately 1,700 cars have been delivered to their loved ones in Pakistan. In addition, more than 2,700 applications have been approved and 860 financing applications are under process under the RAC banner. This shows that the NRPs are highly receptive towards the product offering. RAC also provides value added features in the desired cars, for which the customers otherwise pay additional amount to the car manufacturers and vendors.

Roshan Apni Car, along with many other products in the RDA suite, shows State Bank of Pakistan’s commitment towards our valuable NRPs that have been serving their country through every thick and thin. This also shows that SBP is mindful of the needs of NRPs and is committed to serve them in the best possible way.