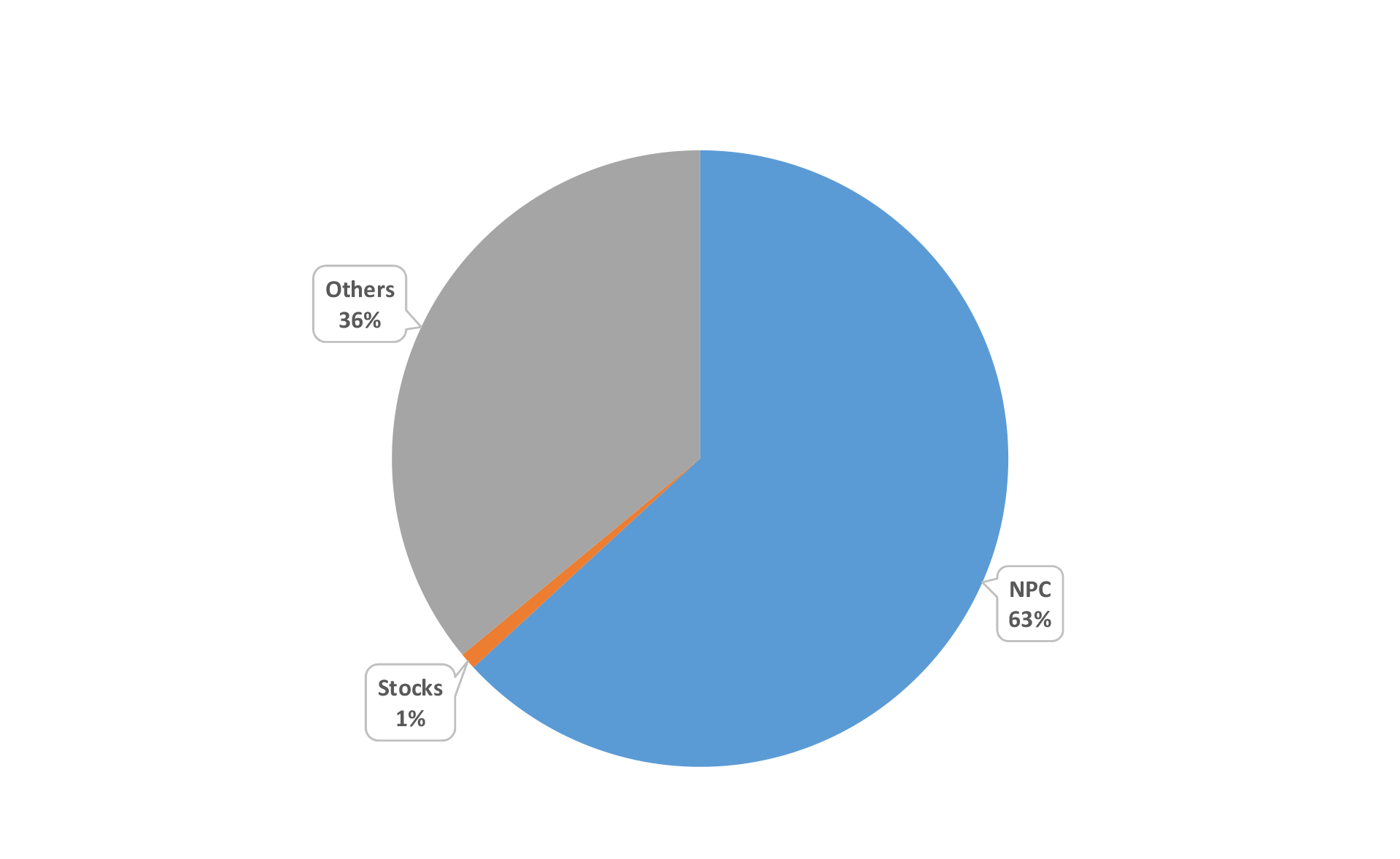

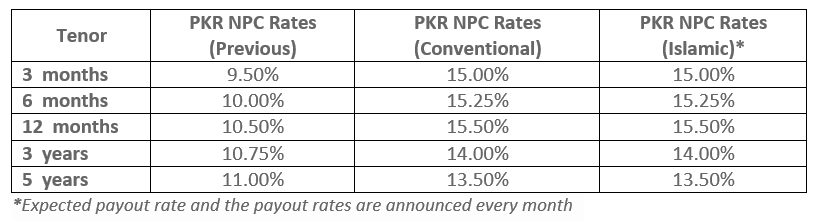

Since the inception of the NPCs, the returns in PKR denominated NPCs provided adequate premium that surpassed the returns provided in other government securities at that time. The basic objective behind this move was to compensate the NRPs who have stood by Pakistan through every thick and thin. However, during the last few months, SBP had to increase the policy rate in order to curb inflation in the country. Due to this increase in the policy rate, the returns on different lending and deposits rates had also seen an increase, rendering the returns on NPCs less attractive for the RDA holders.

In order to keep NPC a valuable investment proposition, SBP pursued the case with the Ministry of Finance (NPC being a sovereign debt instrument issued by the Government of Pakistan) to revise the rates of return on the PKR denominated NPCs that would meet the expectations of the diaspora. Also, SBP requested the Ministry to decrease the minimum investment amount as majority of the NRPs are from the blue-collar segment of the society and it is very difficult for them to save the amount to avail the benefits of the NPCs. After detailed and thorough deliberations, Ministry of Finance in September 2021 notified an increase in the NPC returns on PKR denominated NPCs. The following table depicts this increase:

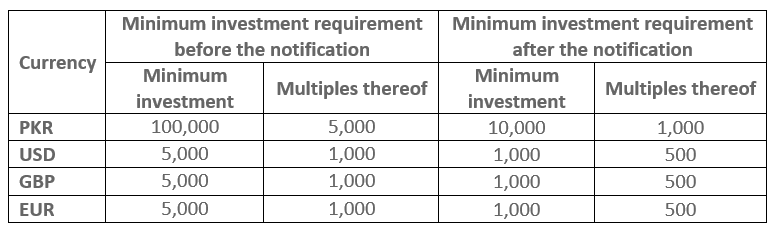

In addition to the increase in the rates, Ministry of Finance keeping in view the requirements and to cater to the needs of blue collar individuals have also decreased the minimum investment amount in all currencies. The details of the change in minimum investments can be found in the below table:

The revision of NPC rates and minimum investment amount in all currencies shows SBP’s resolve to continue to own the RDA scheme. SBP will continue to vigilantly monitor different aspects of RDA and come up with new products and services meeting RDA customers’ needs.