Generally, direct taxes are considered as fair and equitable way of raising revenues for the governments. Direct taxes make the system more progressive through balancing income distribution and narrowing down the inequality gap. In Pakistan, the use of such redistributive tools has remained under-utilized and the tax structure remained tilted towards the regressive indirect taxes, contributing around 60 percent of total taxes.

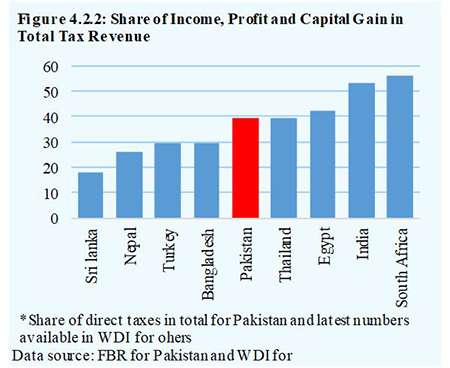

In terms of GDP, the revenue from direct taxes reached 4.3 percent in FY18 from an average of 2.9 percent during FY03- FY17. However, the growth in tax collection was low, when compared to growing income levels in the country (Figure4.2.1). In terms of its share in total taxes, Pakistan falls somewhere in middle, when compared with other emerging economies (Figure 4.2.2).

Within the direct taxes, around 70 percent comes from withholding taxes that sometimes becomes indirect when passed onto consumers. For example, around half of the WHT is collected through advance tax on imports and contracts that add to the final price of good and services.10 Excluding WHT, the share of direct taxes in total FBR Taxes falls to 12.5 percent form 40 percent.

Pakistan’s low collection from direct taxes is primarily due to weak tax compliance and large number of exemptions.

The main source of income tax is the personal and the corporate income tax, contributing about 92 percent in direct taxes. Though the number of active income tax payers increased to 1.46 million in FY18 from 0.98 million in FY14; it looks too small when compared to 57.4 million employed labor force. One of the reason is that out of the total employed labor force, 42.3 percent are dependent on the agriculture sector, which is either exempted from income tax or contributes very little.

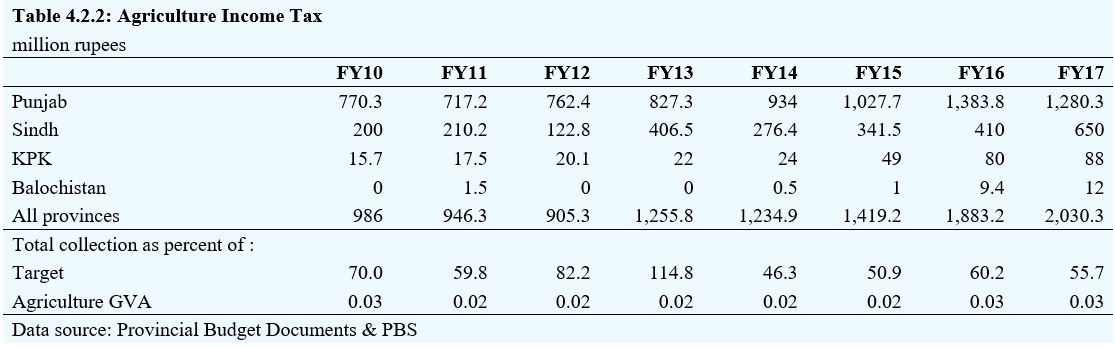

The agriculture sector contributes 19.2 percent to GDP, but its share in taxes is negligible (Table 4.2.1). After the 18th amendment, the provinces were authorized to collect taxes from the agriculture sector. During FY17, the consolidated revenue from the agriculture income tax from the provinces stood at 0.03 percent of gross value addition (Table 4.2.2). In case of Punjab, which accounts for 73 percent of the cultivated land, agriculture income tax is charged either on the basis of per acre cultivated or income declared under income tax ordinance. As per Punjab Agricultural Income Tax Act 1997, the income is exempt for tax if cultivated area is less than 12.5 acres, charged Rs150 per acre if area is between 12.5 and 25 acres, and Rs 250 per acre for the area exceeding 25 acres. In case of declared agriculture income, the exemption limits is Rs 80000, and the rate increases with rising income. The World Bank study on revenue mobilization in Punjab reveals that the province collected agriculture income tax of Rs 1.4 billion during FY16, only 10 percent of its revenue potential of Rs 14 billion.

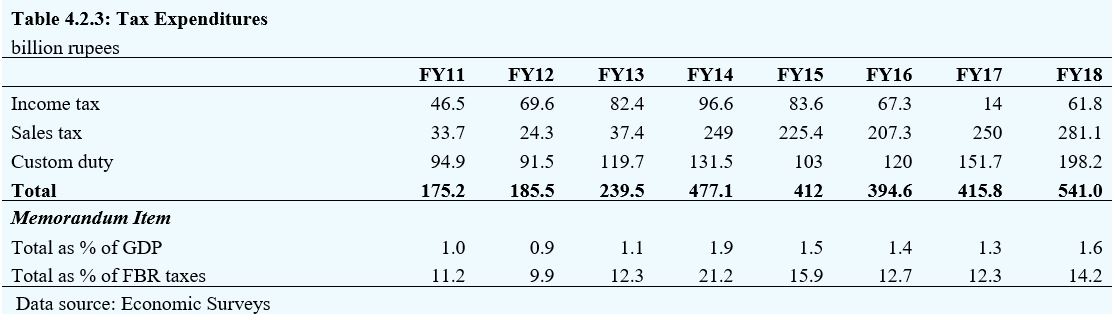

Moreover, the Income Tax Ordinance provides exemptions and preferential treatments to different segments of the society. These are called tax expenditures and their annual loss stood at 1.6 percent of GDP or around 14 percent of total FBR taxes in FY18 (Table 4.2.3). To the extent of income tax, the second schedule of the Income tax ordinance gives comprehensive list of exemption both for individuals and the corporates. Importantly, 56 percent of the total expenditure were made under section 56/B of the income tax ordinance 2002 during FY18, which provides the tax exemption on the payable tax by the companies on investment made for the purchase of plant and machinery, and the extension, expansion, balancing, modernization and replacement of the plant.

Recently, the minimum taxable income has been increased, leaving out a number of potential taxpayers

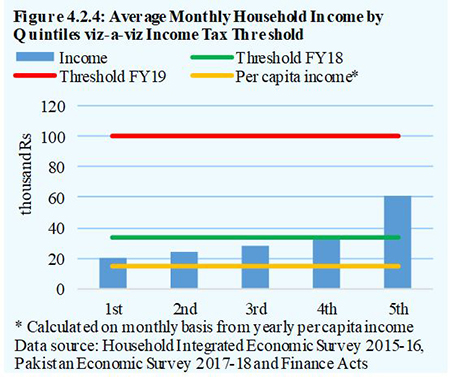

The Finance Act 2018 made substantial changes to taxes in Pakistan. The personal income tax rate was reduced for various tax brackets for the salaried class. The threshold level was raised from 0.4 million to 1.2 million for the salaried class and households having income from 14 to 70 hundred thousand (Figure 4.2.3).11 The Finance Supplementary (Amendment) Act, 2018 has maintained the threshold but partially reversed this benefit for the upper slabs.

Now, the threshold level stands six times of the GDP per capita and three times that of FY18. These changes have resulted in exempting sizeable population relative to FY18 threshold that was hardly touching top two quantile average monthly income in FY18 (Figure 4.2.4). As per IMF estimates, the average tax rate for a number of economies was 15 percent at per capita income level and becomes flat at 25 percent, when income reaches three to four times of GDP per capita. In addition, the government also cut corporate income tax (other than banks) to 30 percent from 35 percent five years ago, while remained same at 35 percent for the banking sector. Again this trend is in contrast to the emerging economies, where average corporate income tax stood 22.3 percent for 2015.

In Pakistan, the tax reform must be aimed at increasing tax bases, rather than imposing taxes on existing tax payers. The recent reduction in tax rates is a welcome development that may encourage voluntary tax payments, however, this might exclude a large number of potential tax payers. On the flip side, the reduction in rates would help increase savings or consumption that would, in turn, support higher economic activity. Given the large tax gap, provinces must enhance their efforts to bring untapped sources into tax net in order to reduce reliance on federal transfers. Moreover, Pakistan income tax system is based on universal self-assessment schemes and revenue capacity is limited due to the large informal sector. In FY13, 73.3 percent of employment was generated by informal sector, which means only a part of the remaining quarter would be paying taxes. A well thought policy aiming to improve tax compliance across existing sectors and bringing the informal sector into tax net can make the system more progressive.

The World Bank, 2017, Pakistan Development Update: A Shared Responsibility.

International Monetary Fund, 2016, Pakistan, Selected Issues Paper.

The World Bank, 2014, Study on Tax Expenditures in Pakistan.

International Monetary Fund, 2017, Fiscal Monitor: Tackling Inequality.

Ilzetzki, Ethan, and David Lagakos (2017). The Macroeconomic Benefits of Tax Enforcement in Pakistan. MPRA Paper No. id: 12130.