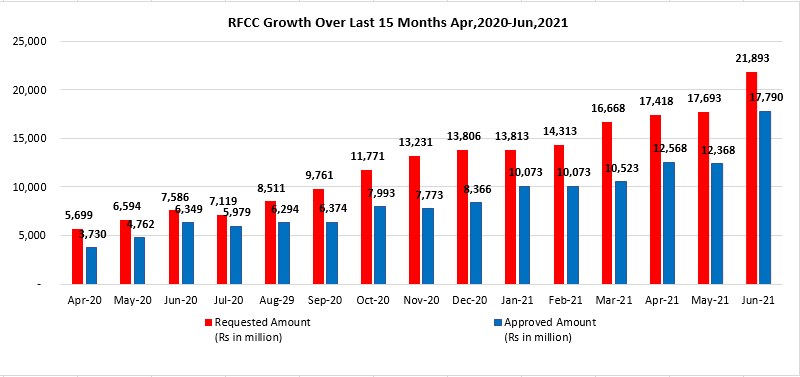

SBP clarifies status of approved cases and enhances loan limit for setting up of new hospitals

Regarding validity of the scheme (Sep 30,2020), SBP on September 29, 2020 issued instructions that all applications approved by Banks/DFIs up till September 30, 2020 will be eligible for refinance under Refinance Facility for Combating COVID-19/Islamic Refinance Facility for Combating COVID-19. Hence, LCs established under these approved applications will be eligible for refinance even if these LCs are established after September 30, 2020.

Further, to meet financing needs for setting up of new hospitals, SBP enhanced the loan size from Rs. 500 million to Rs. 1 billion per hospital.

Circular:

https://www.sbp.org.pk/smefd/circulars/2020/CL26.htm

SHARE THIS PAGE!