Four factors have played a dominant role in the recent digitization spurt of the domestic services sector:

(i) A decent ICT base

From humble beginnings in early 1990s, Pakistan’s ICT sector has steadily held its ground over the past three decades. In fact, the last decade has been a period of mushroom growth; the number of IT firms registered with the SECP has increased from less than 2,000 in 2007, to 4,600 firms at end 2017 (10 percent CAGR). Presently, the industry is providing various associated services in the domestic market, including software development, business analytics, gaming and animation, mobile applications, consulting, etc. The high potential of the domestic IT market is reflected by the presence of a large number of global enterprises. Also, big IT companies in Pakistan have recently begun to nurture and support new enterprises in the digital space, which bodes well for future prospects.

(ii) Connectivity and affordability

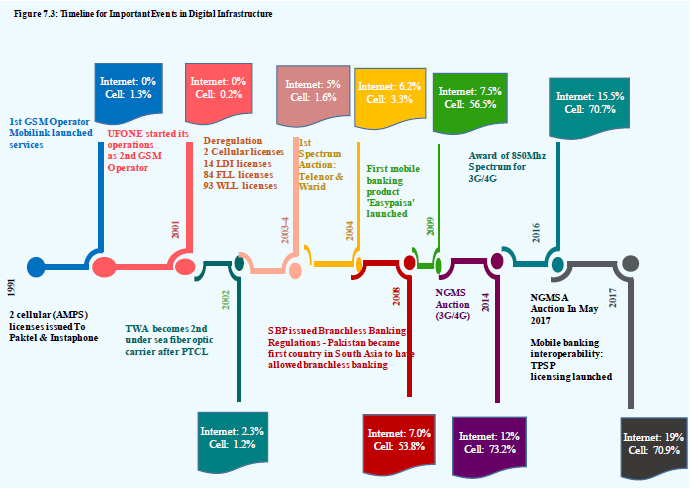

Regarding connectivity, while a steady improvement in telecom infrastructure was underway in Pakistan since 1991, the auction of NGMS in 2014 proved to be the most important trigger behind the recent wave of digital innovation (Figure 7.3). According to PTA, 3G cellular mobile signal covered more than 70 percent of the population as of end-March 2017; similarly, 4G LTE services were accessible to over 30 percent of the population. In addition, the affordability of smartphones and their operating systems in the country has been a boon. Presently, a large number of device manufacturers are eyeing the high growth potential in low-end smartphone space, especially in developing countries like Pakistan. As for operating systems, the launch of the Android One platform by Google in 2013 was a big game changer, which made smartphones easier and cheaper to produce. In Pakistan, nearly 85 percent of all cellular imports come from China17, with Android dominating the operating systems space.

(iii) Favorable demographics

Around 64 percent of Pakistan’s population is under the age of 29, and the country will continue to enjoy the youth bulge for another thirty years or so, according to the United Nations’ National Human Development Report 2017. The fact that this young population is more open to embrace technology and smart-phones compared to the older generation represents optimism regarding the demand for ITeS and digital transformation. The supply side is equally supportive: according to the Digital Pakistan Policy 2018, the country produces more than 20,000 IT graduates and engineers every year and is home to more than 300,000 English-speaking IT and BPO professionals with expertise in current and emerging IT products and technologies.

(iv) Support from the diaspora

A sizable contingent of Pakistani-Americans reside in Silicon Valley, working in established high-tech companies and startups alike. This large diaspora is helping in at least three ways:

• First impact comes from those IT professionals who have had exposure of working in Silicon Valley, but have chosen to return to Pakistan. Familiar with successful startup ecosystems, these individuals are at the forefront of new support initiatives. In addition to formalizing advocacy for policy change, they themselves are reinforcing the angel investor activity in Pakistan, and are also launching institutional vehicles to deploy their capital.

• Second impact comes from CEOs and tech innovators who are still working in the US, but their presence and networking is a major source of encouragement for global companies to invest in Pakistan’s technology sector.

Finally, global business associations of Pakistani diaspora, like The Indus Entrepreneurs (TiE) and Organization of Pakistani Entrepreneurs (OPEN), have been active in encouraging Pakistan’s technology sector.