While the East Asian Crisis, at the terminal of the last millennium, reinforced the importance of holding adequate level of foreign exchange reserves, there is little consensus on what constitutes this ‘adequate level’. Traditionally, level of reserves necessary to finance a certain number of months, say three months, of imports was viewed as adequate. More recently, the short-term payment obligations that in fact triggered the East Asian Crisis become an important constituent of the reserve’s adequacy benchmark in addition to the import coverage.

However, reserve adequacy accounting only for the import cover, say for three months, and short-term debt, say by 100 percent, are narrowly based and may often fail to provide necessary cover in case of external sector shock.

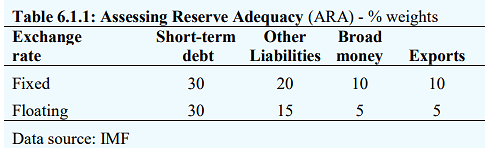

Consequently, IMF (2011), proposed an alternate approach for assessing the adequate level of FX reserves based on ARA (Assessing Reserve Adequacy) metric. Their composite model benefits from the regulatory requirement approach on the bank capital, in which potential source of risk is assigned weights to attain risk-weighted reserves. Therefore, these weights do not need to add to one.

Moreover, they have identified the four potential risky asset classes that could have a toll on foreign exchange reserves. These asset classes are, (a) potential loss of export income, (b) stock of liquid domestic asset that could be sold and transferred as a foreign asset, (c) rollover risks of short-term debt, and (d) risk of portfolio and long-term debt outflows.

Based on the historical experience of the external sector crisis, weights are assigned as per the exchange rate regime followed in a particular country (Table 6.1.1). Precisely, ARA metric for a country with fixed exchange rate regime will be calculated as follows: ARA metric = short-term debt (0.3) + other liabilities (0.2) + broad money (0.1) + exports of goods and services (0.1)

The IMF (2017) reported that Pakistan’s reserves were only 73.0 percent of ARA metric in Dec 2016, below a minimum adequate level of 100. Pakistan’s foreign exchange reserves were at comfortable levels until FY16. Since then, the pressure on country’s reserves magnified with growing demand for imports, slowdown in workers’ remittance inflows and lower export receipts. Consequently, the import cover dropped from over 5 months in end-June 2016 to below 3- months in end March 2018. At the same time, reserves to ARA metric dropped from 78.0 percent in end-June 2016 to only 51.0 percent in end-March 2018.

Interestingly, calculation of ARA number is critically dependent on the assumption of exchange rate regime. IMF assumes Pakistan’s exchange rate regime as ‘fixed’ for calculation of ARA metric. However, assuming the country’s exchange rate regime as floating, the FX reserves as percent of ARA metric fell within the adequacy range in end-March 2018 (Figure 6.1.1 b).

IMF (2011), Assessing Reserve Adequacy; Policy Paper, Washington D.C IMF, [imf.org/external]

IMF (2017), Pakistan: Article IV Consultation Country Report No. 17/212, Washington D.C IMF.