State Bank of Pakistan and Federal Board of Revenue have jointly introduced the online collection of Government taxes and duties through one-link facility.5 This would be applicable for the payment of income tax, sales tax, excise, and custom duties. Such a scheme is aimed at improving payment systems especially in the context of revenue collection besides facilitating tax payers and minimizing incidence of leakages.

This move is also expected to contribute positively towards revenue generation by lowering the chances of inefficiencies in the tax collecting machinery. Empirical studies show a strong correlation between electronic tax collection and revenue growth. Therefore, advancements in tax collecting mechanism in terms of digitization is expected to facilitate tax payers and enhance revenue collection.

More importantly, the initiative would be helpful in minimizing the time involved in tax payments through traditional methods. For instance, many small and medium businessmen argue that there is a cost incurred on visiting banks and tax offices for the payment of various taxes hence exacerbating their overall tax compliance costs. Thus, it will reduce cost for the tax payers as well.

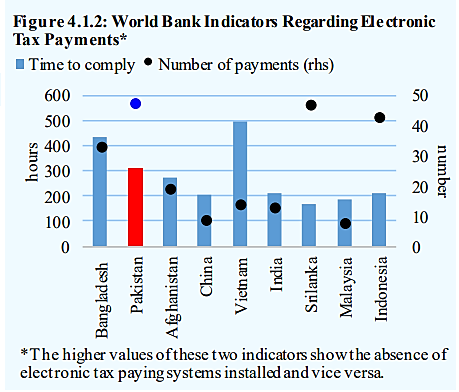

According to World Bank’s Paying Taxes report, the sub-indicators of the overall paying taxes’ measure such as number of payments6 and time to comply7 particularly assess the progress regarding online filing and tax payments. The lower the extent of these indicators, the higher the IT enabled procedures installed in the tax system. For instance, Estonian tax payers spend only 81 hours per year in preparing, filing, and paying their taxes such as VAT and labor taxes including mandatory contributions.

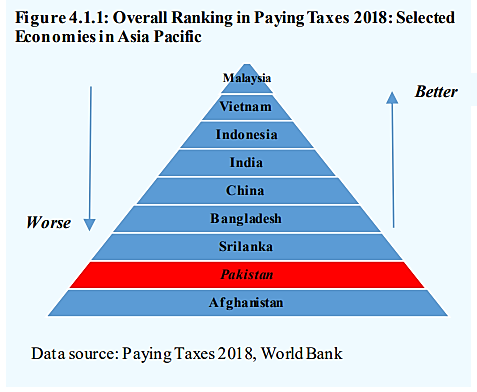

As per this report, Pakistan falls lower in the ranking among the Asian pacific countries in the overall tax paying category (Figure 4.1.1). In other words, absence of efficient IT based systems in tax collection mechanisms is reflected in higher magnitude of ‘number of payments’ and ‘time to comply’ indicators as in case of Pakistan (Figure 4.1.2). Therefore, the initiative holds the potential to improve Pakistan’s ranking in paying taxes and reflect better in terms of ease of doing business.

However, some concerns need to be taken care of to ensure the effective implementation of the system. From the tax payers’ side, “computer literacy” can be achieved by making every actor (tax payers and tax officials) capable of using the digitized processes through trainings. Whereas, digitization processes such as electronic payment and filing should be further simplified by the tax collecting authorities.

Furthermore, digital risks emanating from this system also need to be addressed carefully. Cyber security and privacy issues should be prudently tackled for developing taxpayers’ trust and making digitization more progressive.

Bett, B.K., Yudah, O.A. (2017). Contribution of i-Tax System as a Strategy for Revenue Collection at Kenya Revenue Authority, Rift Valley Region, Kenya. International Journal of Scientific and Research Publication, 7(9), 389-396

Gitaru, K. (2017). The Impact of System Automation on Revenue Collection in Kenya Revenue Authority (A Case Study of SIMBA).

Ndayisenga, E., Shukla, J. (2016). Effect of Electronic Tax Management System of Tax Collection in Rwanda: A Case Study of Rwanda Revenue Authority. International Journal of Business and Management, 4(5), 38-49