Financial Stability Review 2018

Governor’s Message

The year 2018 remained quite eventful from both global

and domestic perspectives. The global economic momentum softened, amid increasing

trade tensions and tightening financial conditions. The domestic economy faced

various idiosyncratic challenges. The country had to go through uncertainties

associated with the political transition in the first half. Afterwards, the

widening twin deficits and elevated inflationary pressures necessitated policy

measures for stabilization, which, as expected, slowed down the economic momentum.

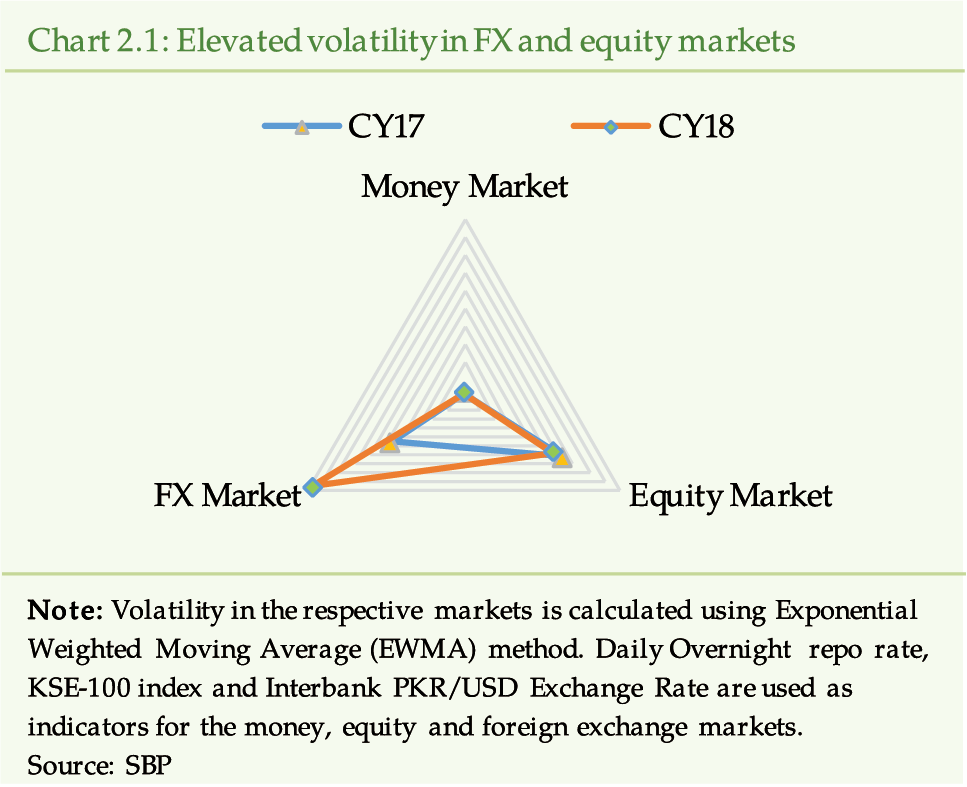

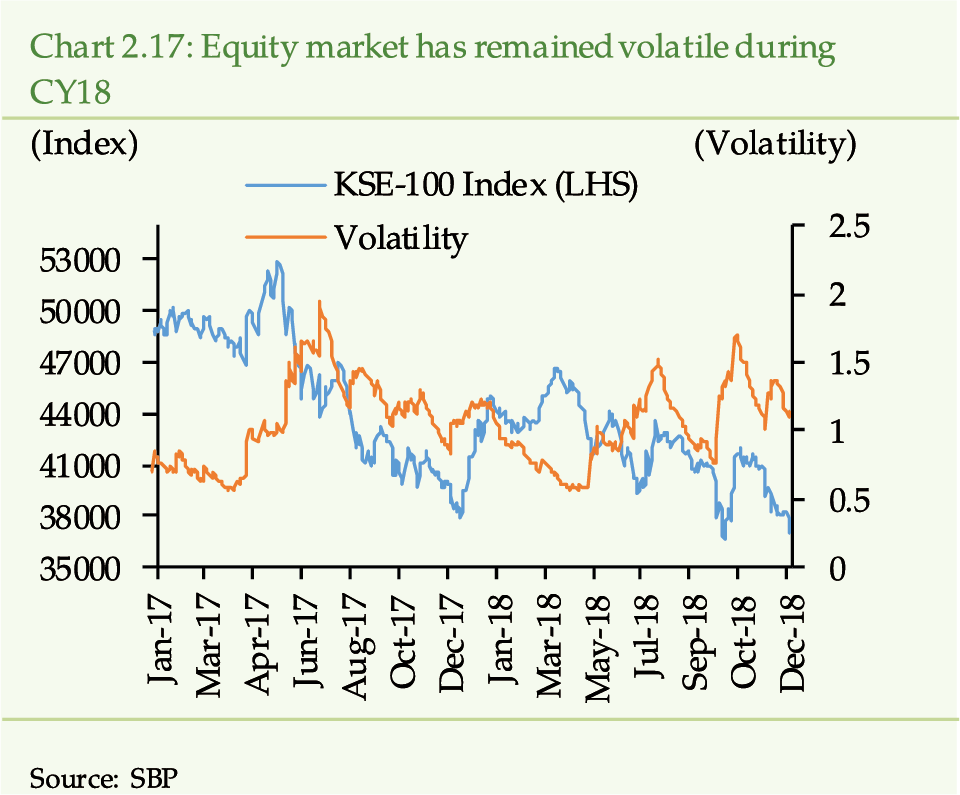

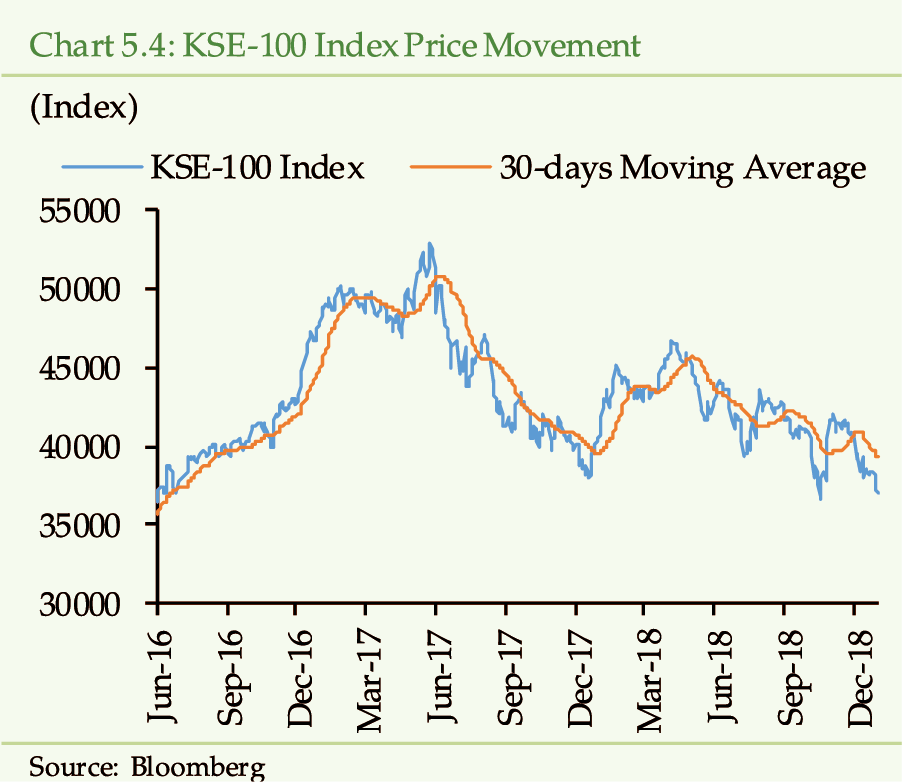

Resultantly, the investors’ sentiments remained subdued and financial markets,

particularly the foreign exchange and equity markets, observed increased volatility.

In response to the market dynamics, the local currency depreciated and the

KSE-100 index dipped. The money market, however, operated smoothly by virtue

of the interest rate corridor mechanism and improved liquidity conditions.

Amid these challenges, the financial institutions,

however, remained sound and facilitated the improvement in financial intermediation.

Banks, the key player in the financial sector, carried forward the rising

momentum in total loans with 22 percent growth, while maintaining strong solvency

and liquidity profiles. Their capital adequacy ratio at 16.2 percent stood

well above the international benchmark and the non- performing loans ratio

decreased to 8 percent, despite some increase in NPLs during 2018. Moreover,

the financial inclusion broadened due to joint efforts of the SBP and its

regulated financial institutions. Particularly, to pursue the National Financial

Inclusion Strategy, SBP introduced policy measures to enhance financial access

to priority areas of SME, Housing and Agriculture, and to promote cross cutting

themes of Islamic Banking and Digital Financial Services.

State Bank, in line with its strategic objective

of ensuring financial system stability, under “Vision 2020”, is closely monitoring

global and domestic developments and responding appropriately where necessary.

The current Financial Stability Review provides a detailed assessment of the

emerging risks and highlights measures taken to beef up the financial sector

stability. Among the emerging challenges, SBP stepped up its efforts to strengthen

the overall AML/CFT regime and fortified the cyber resilience. In addition,

SBP progressed towards Macro-Prudential Policy Framework by introducing regulatory

guidelines for the designation of Domestic Systemically Important Banks (DSIBs),

improving coordination among financial sector regulators and stepping up efforts

for the establishment of an overarching National Financial Stability Council

(NFSC).

I hope that the stakeholders would find this report

helpful and informative. Any suggestions, comments and feedback are welcome.

Dr. Reza Baqir

The Financial Stability Review (FSR) team is highly

indebted to Mr. Tariq Bajwa, Ex-Governor and Dr. Reza Baqir, Governor, State

Bank of Pakistan (SBP) for their encouragement and guidance. The team is also

grateful to members of Publications Review Committee (PRC) of the Management

for providing invaluable feedback on the report. We are also thankful to Mr.

Jameel Ahmad, Deputy Governor (Banking and FMRM) and Dr. Inayat Hussain, Executive

Director, Banking Supervision Group, for their continuous support and supervision

in the preparation of this report.

The team would also like to thank various departments

of SBP, especially Research Department (RD), Banking Policy and Regulations

Department (BPRD), Offsite Supervision & Enforcement Department (OSED),

Exchange Policy Department (EPD), Agricultural Credit & Microfinance Department

(AC&MFD), Domestic Markets and Monetary Management Department (DMMD),

Islamic Banking Department (IBD), Monetary Policy Department (MPD), Payment

Systems Department (PSD) and Statistics and Data Warehouse Department (S&DWHD)

for their valuable support and feedback.

We are also grateful to the Securities & Exchange

Commission of Pakistan (SECP), National Clearing Company of Pakistan (NCCPL),

Mutual Funds Association of Pakistan (MUFAP) and Pakistan Stock Exchange (PSX)

for providing relevant data, technical information and comments on the relevant

chapters/sections of the report.

Dr. Saeed Ahmed (Chairman)

Dr. Inayat Hussain

Syed Irfan Ali

Syed Samar Hasnain

Mr. Muhammad Ali Malik

Mr. Ali Choudhary

Dr. M. Farooq Arby

Dr. Omar Farooq Saqib

Dr. Azizullah Khattak

Mr. Muhammad Javaid Ismail

Team Leaders

Muhammad Javaid Ismail, Director – Financial Stability

Department

Dr. Asif Ali, Additional Director – Financial Stability

Department

Team Members

Amer Hassan

Anum Naeem

Aqeel Ahmed

Dr. Jameel Ahmed

Faraz Karim

Farzand Ali

Haris Ali

Hassaan Zafar

Mariam Abbas

Mohammad Abdul Rehman Ansari

Muhammad Sadiq Ansari

Qaisar Mehmood

Shahzad Ahmad

Waseem Abbas

Wasif Hussain

Feedback and Queries: [email protected]

The FSR 2018 uses CY for the Calendar Year, FY for

the Fiscal Year (starting in July of a CY and ending in June of the following

CY), Q1-Q4 for the four quarters of the corresponding CY or FY and H1-H2 for

the two halves of a CY or FY, as the case may be.

The review is, generally, based on the data reported

in the unaudited or audited accounts (where available) of financial institutions

for different components as follows:

-

Banks (conventional and Islamic), Development Finance Institutions (DFIs), Microfinance Banks (MFBs) and Payment System are based on un-audited financial statements reported to SBP through Quarterly Reporting Chart of Accounts (RCOA) and various other returns.

-

Data on Non-Bank Financial Institutions (NBFIs) is based on monthly reports submitted to SECP through Specialized Companies Return System (SCRS).

-

Insurance is based on audited and un-audited financial statements for the year ending December 31, 2018.

The data pertaining to corporate sector has been obtained

from the financial statements of companies, SECP, SBP, PSX and Bloomberg.

Introduction:

CY18 has been challenging for the financial sector

of Pakistan. The rise in macroeconomic vulnerabilities on external and fiscal

fronts necessitated stabilization measures that led to a slowdown in the pace

of domestic economic growth. The financial markets have remained volatile

and have, generally, trended downwards. However, financial institutions and

market infrastructure have largely remained resilient and performed steadily

during the year.

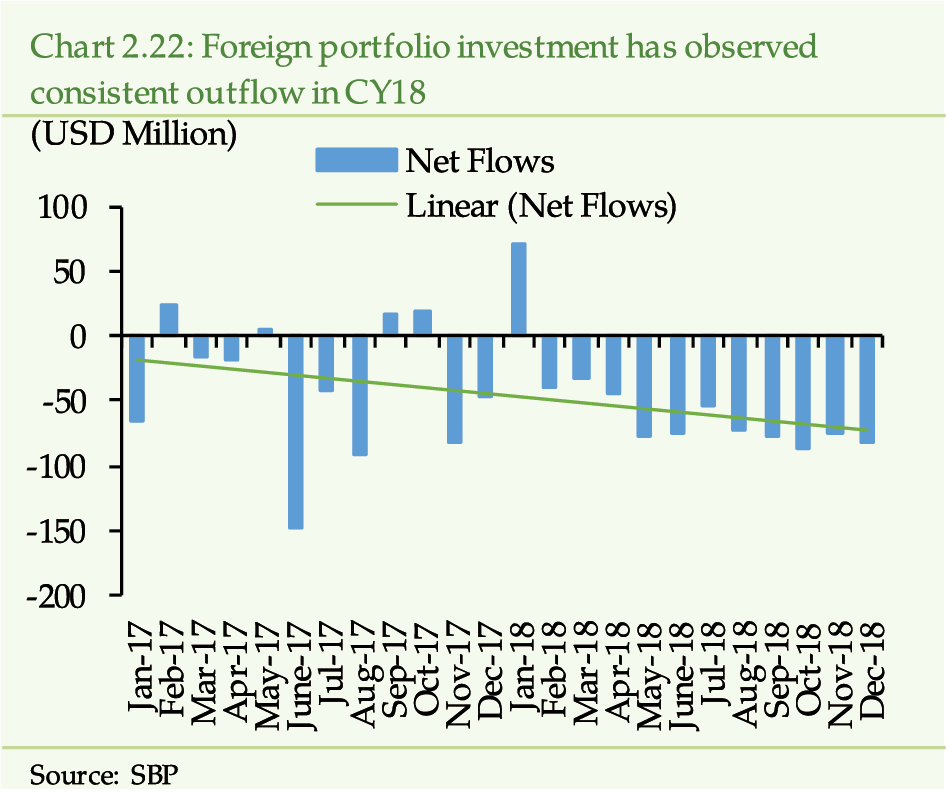

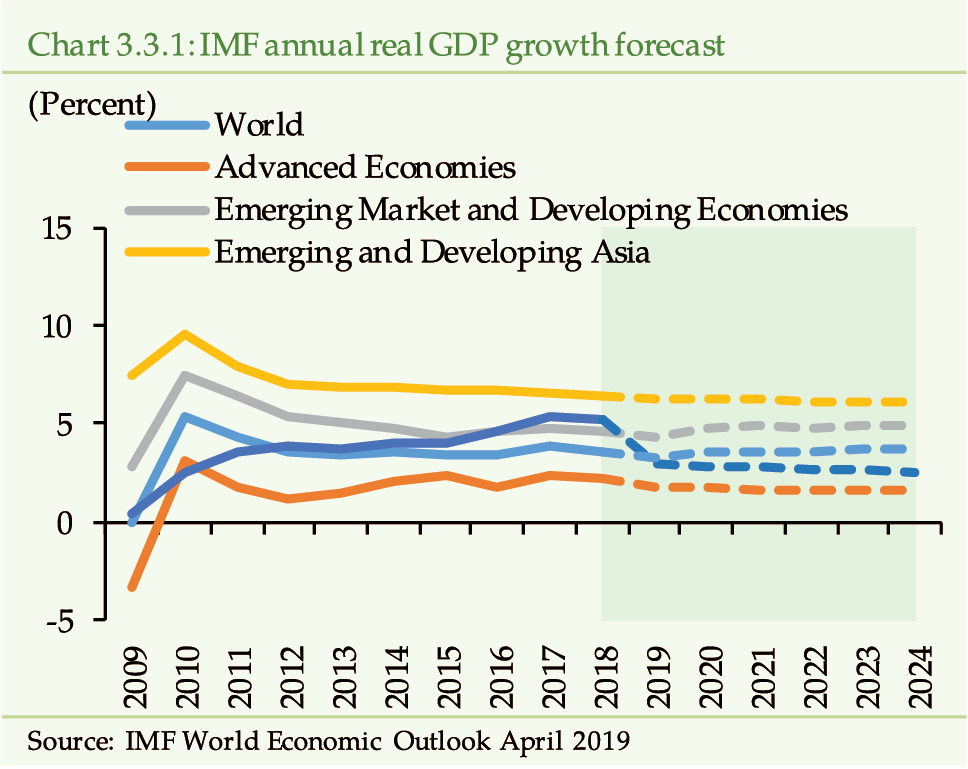

On the global front, the economic growth has moderated

to 3.6 percent in CY18, after peaking at 3.8 percent a year earlier. This

growth is also not broad based as 52 percent of the economies posted growth

in CY18 as against 57 percent of the economies a year earlier. The limitations

of fiscal and monetary policies to respond to growing challenges, especially

the rising trade tensions and geopolitical risks, increased the uncertainty

in the global economy. These uncertainties coupled with Fed rate hikes affected

the investors’ sentiments, which led to capital outflows from EMDEs, including

Pakistan. The policy measures adopted by EMDEs in response to these challenges

have constrained the economic growth. Though the Fed’s announcement to adopt

more accommodative monetary policy has allayed some of the concerns, global

economic prospects in the short term have been less than favorable and the

global economy is expected to further slowdown in 2019 (See Chapter 1).

[1]

The domestic economic developments during CY18, though

idiosyncratic in nature, influenced the performance and risk profile of the

financial system. The macroeconomic vulnerabilities, which started to emerge

in CY17, have further intensified in CY18. The rising twin deficits and elevated

inflationary pressures have necessitated the adoption of economic stabilization

agenda. The consequent measures like monetary tightening, exchange rate adjustments,

and fiscal consolidation have affected the economic momentum. After posting

a decade high growth of 5.53 percent during FY18, the economic growth has

tapered off to 3.29 percent in FY19.

[2]

The Large Scale Manufacturing (LSM) has also contracted by 3.64

percent during FY19,

[3]

while the annual average inflation has also jumped

to 7.3 percent during FY19.

[4]

Shrinking current account deficit remains the key improvement that

has come at the back of various regulatory measures and an increase in the

level of workers’ remittances (See Chapter 1).

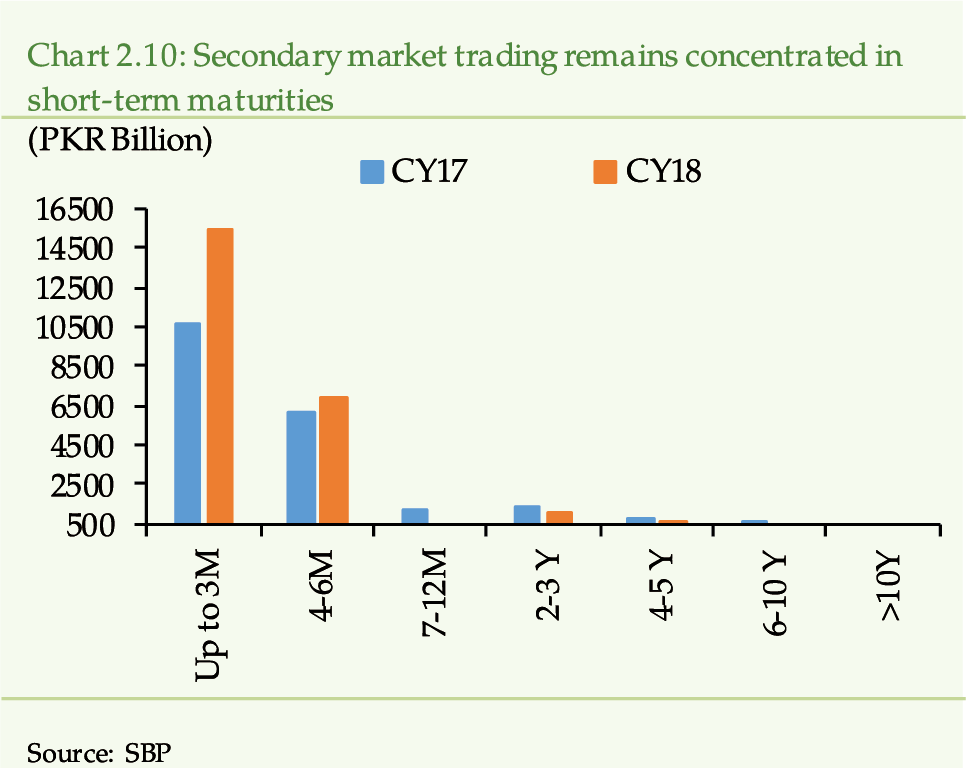

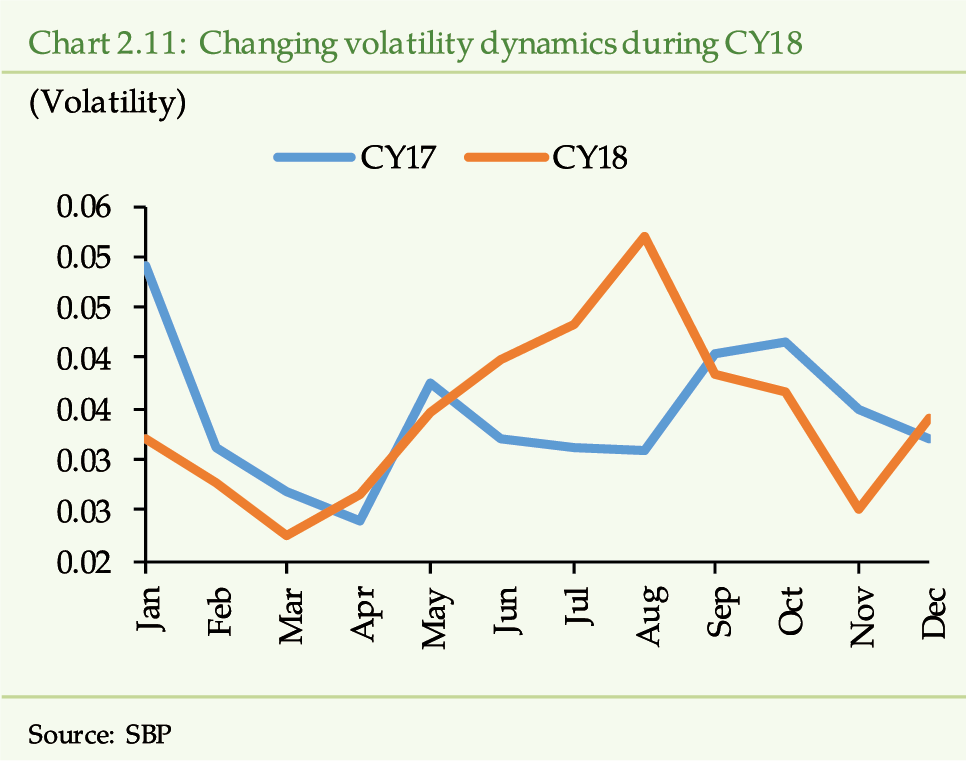

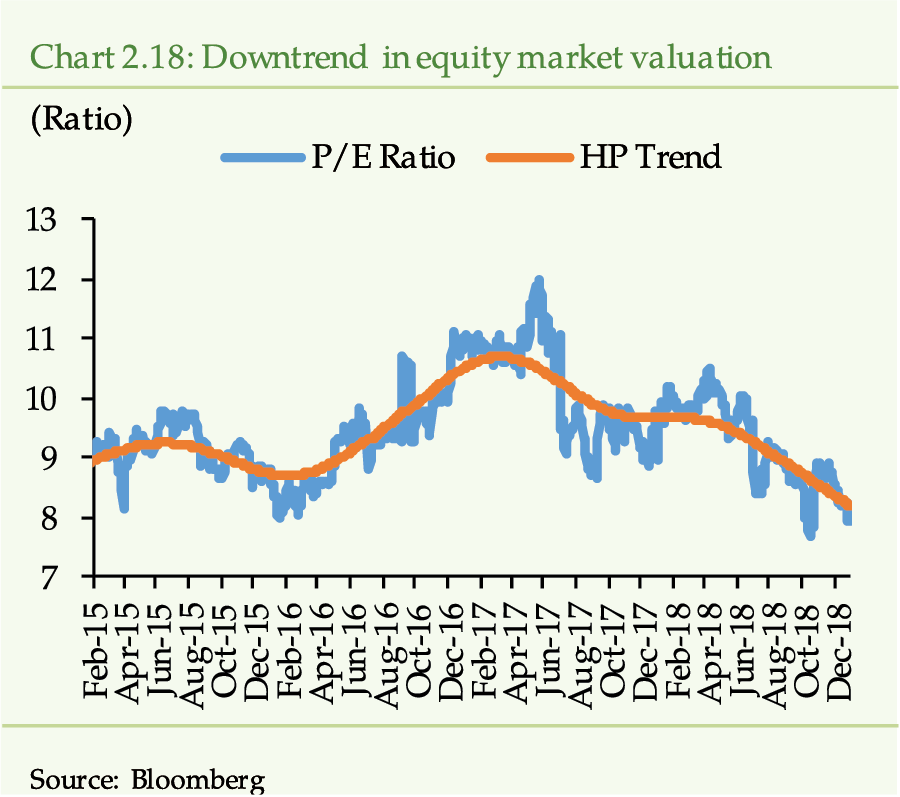

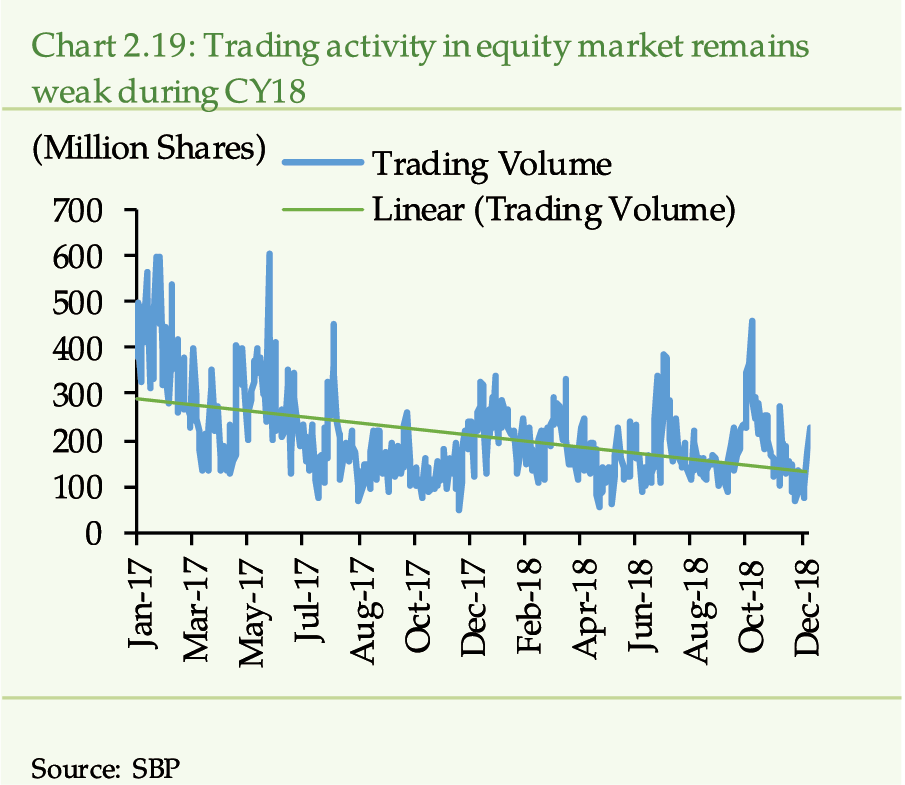

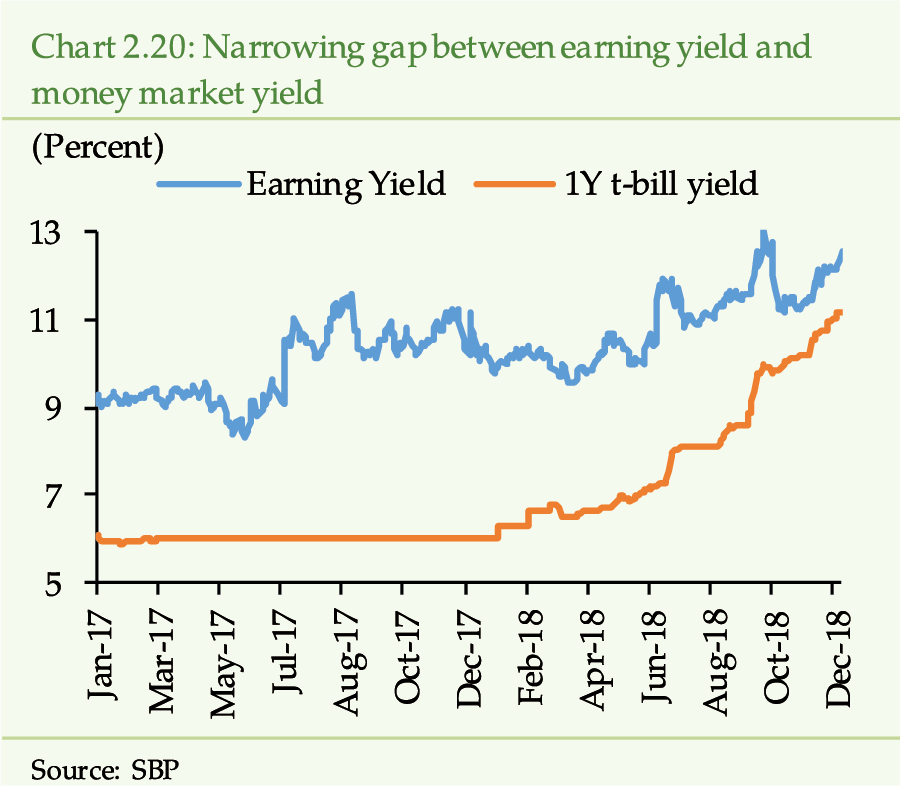

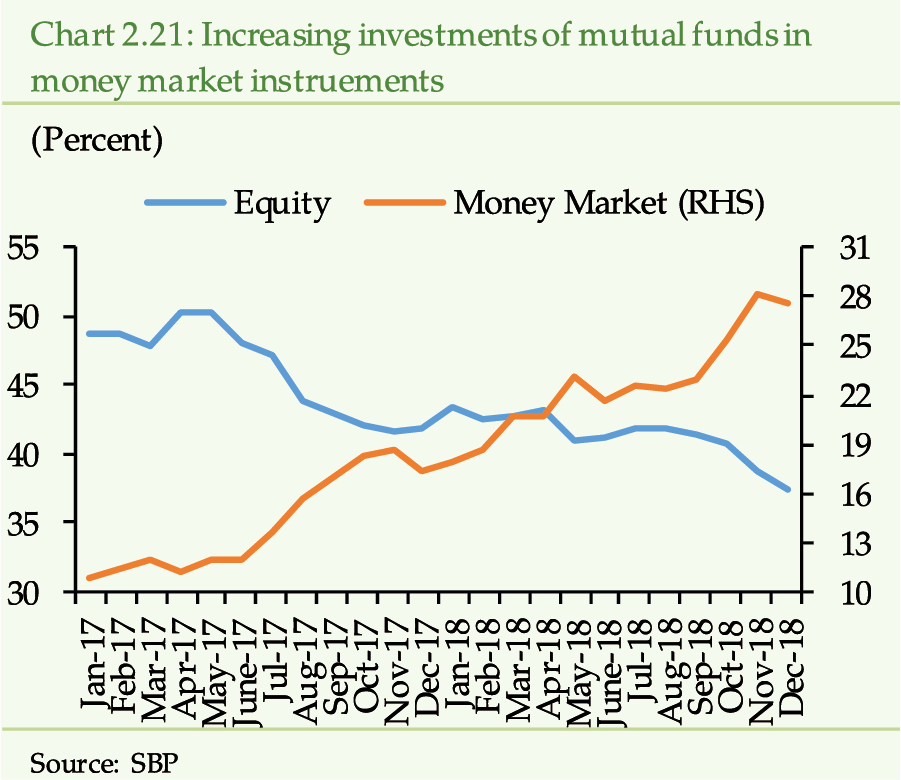

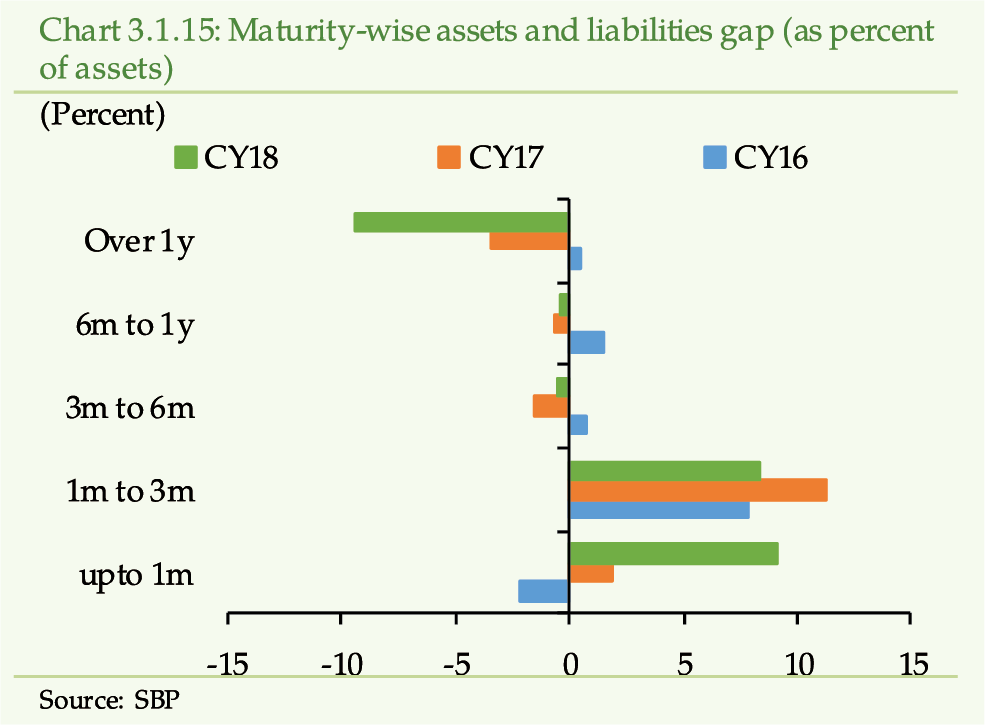

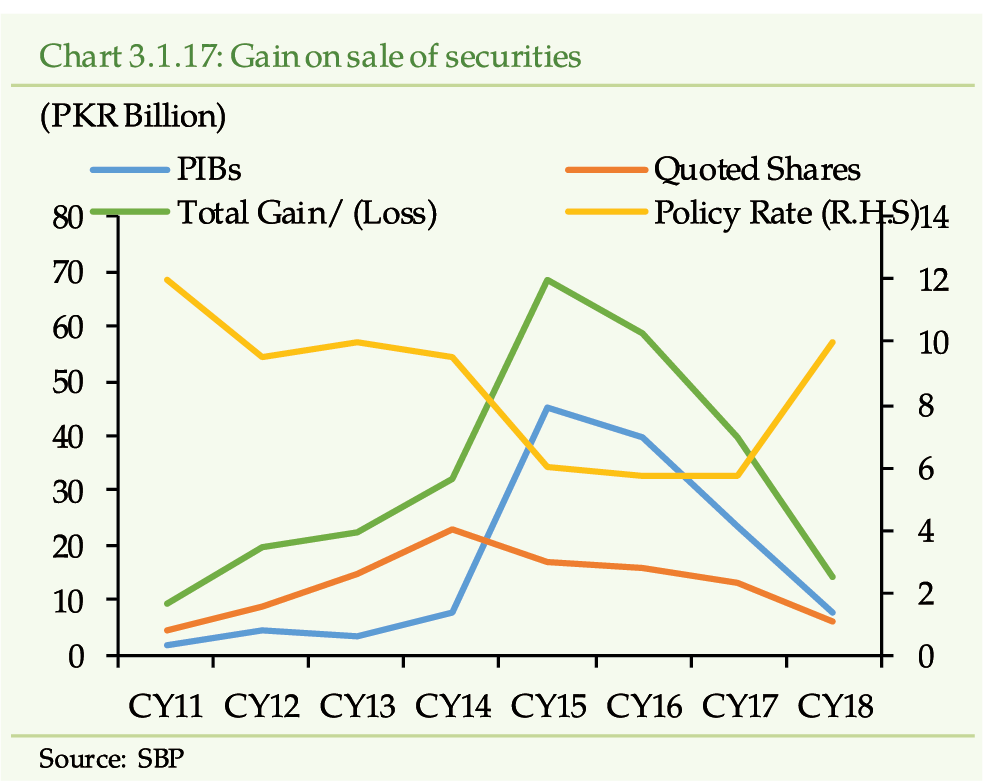

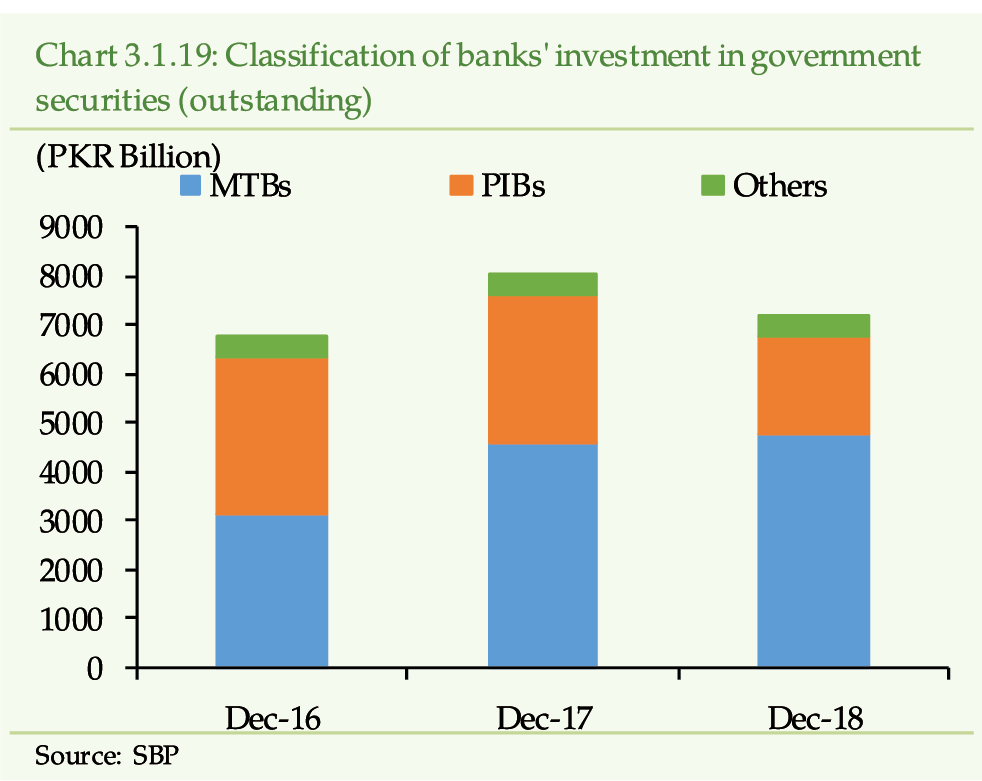

The tightening domestic financial conditions along

with rising uncertainty among the market participants have put the financial

markets under stress.

[5]

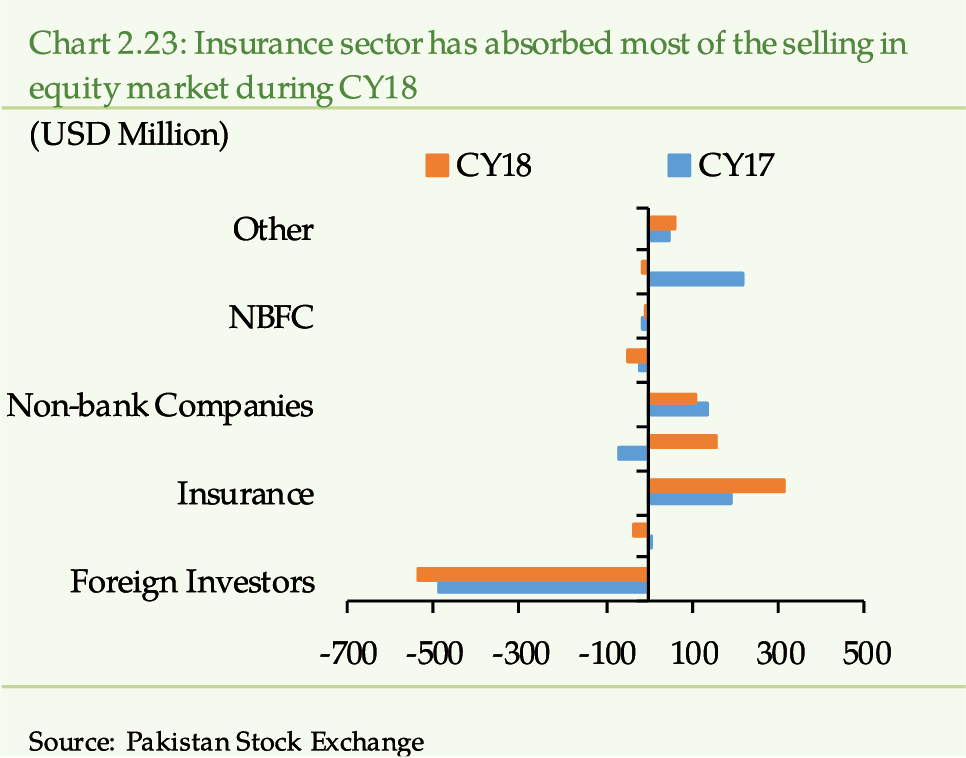

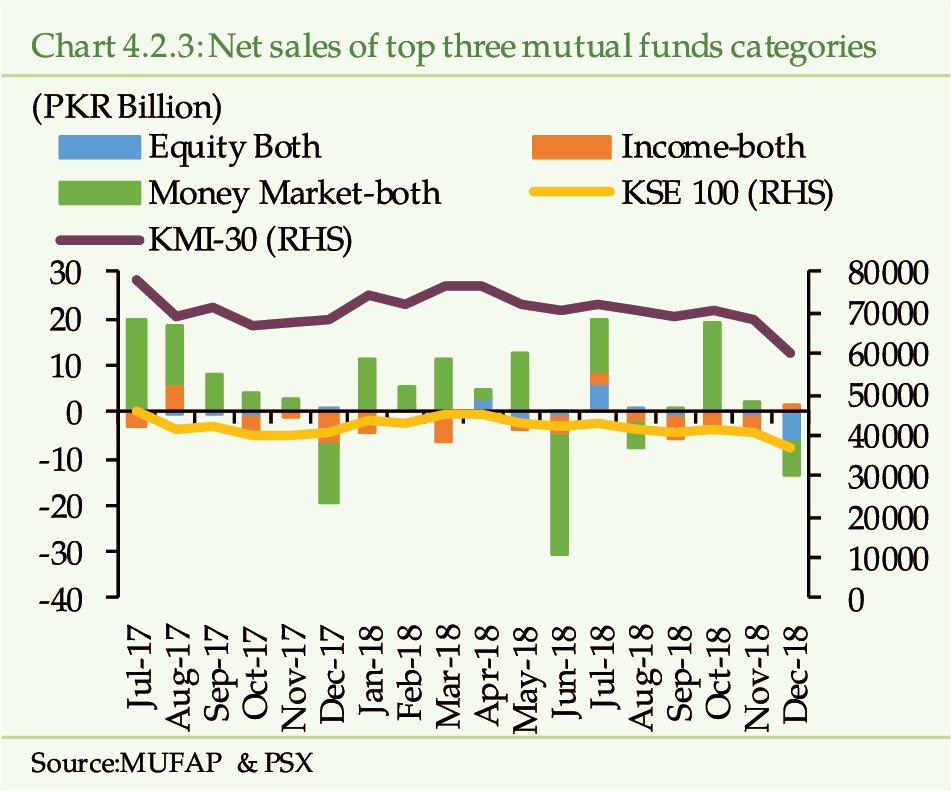

The bearish trend in the equity markets has accentuated risk-averse

sentiments and flight to safety as the investors have preferred money market

and fixed income funds over stocks. In addition, the financial institutions

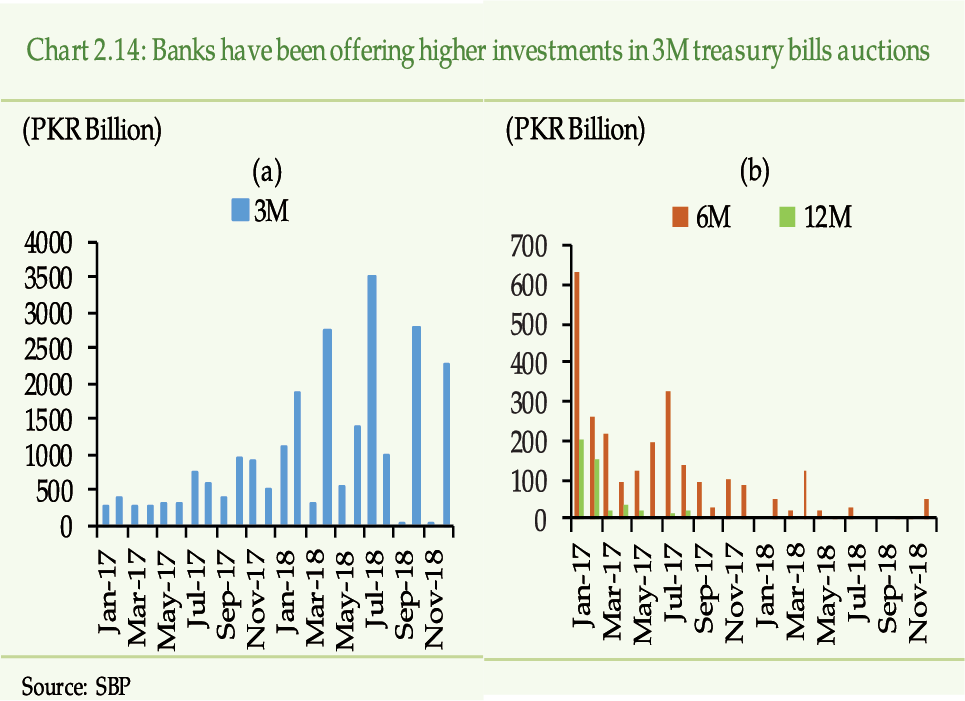

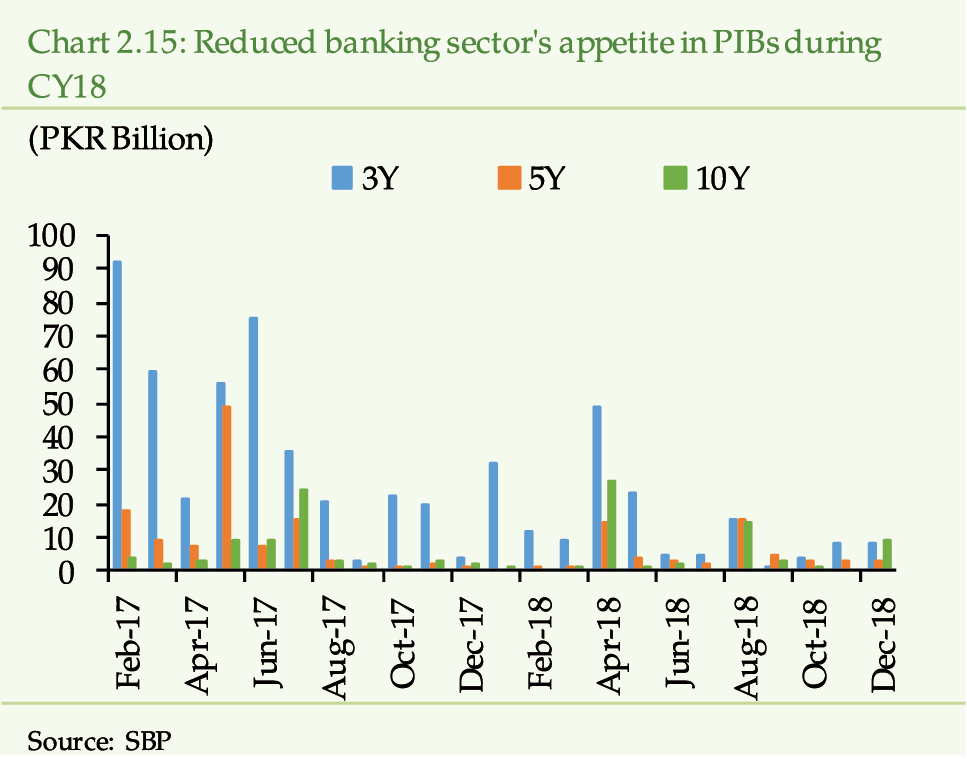

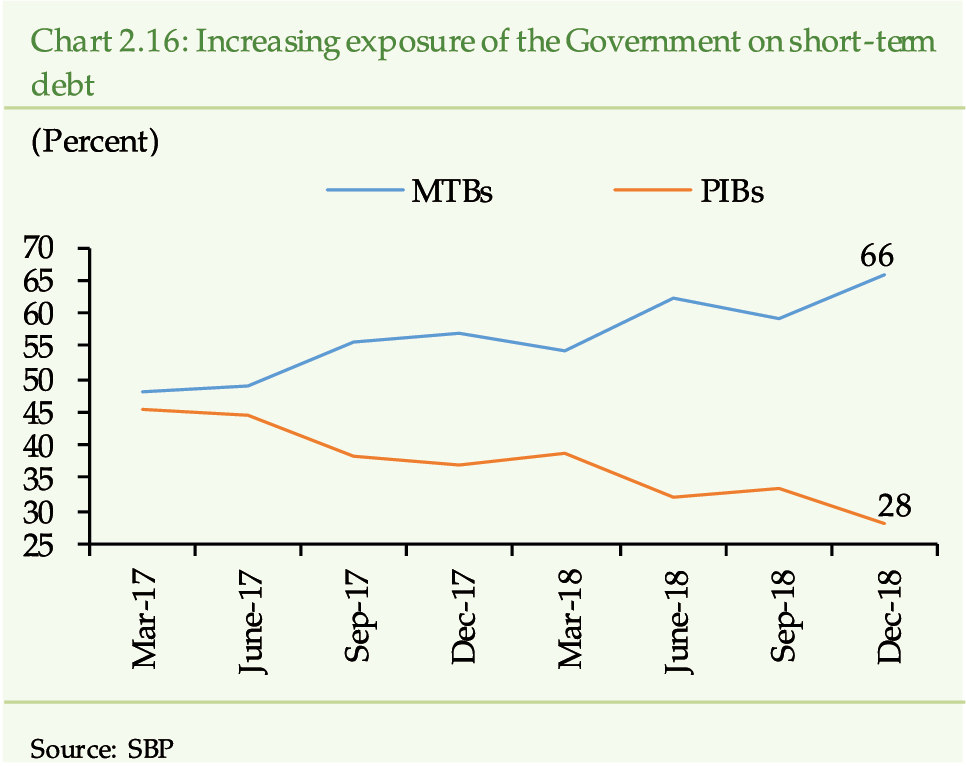

have tilted their investments in government securities towards short-end of

the maturity structure i.e. MTBs and retired long-term PIBs on net basis to

avoid any mark-to-market losses. This strategy has led to a decline in the level

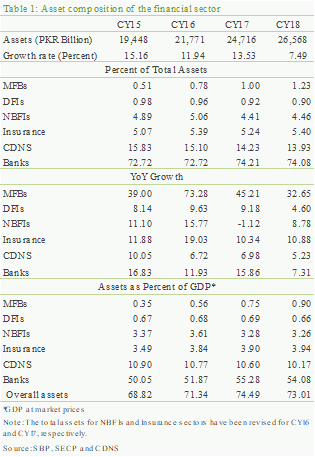

of outstanding investments during CY18. Accordingly, the growth of the financial

sector has moderated to 7.49 percent in CY18, and the financial depth, as

measured by financial assets to GDP ratio, has moderated to 73.01 percent (Table

1).

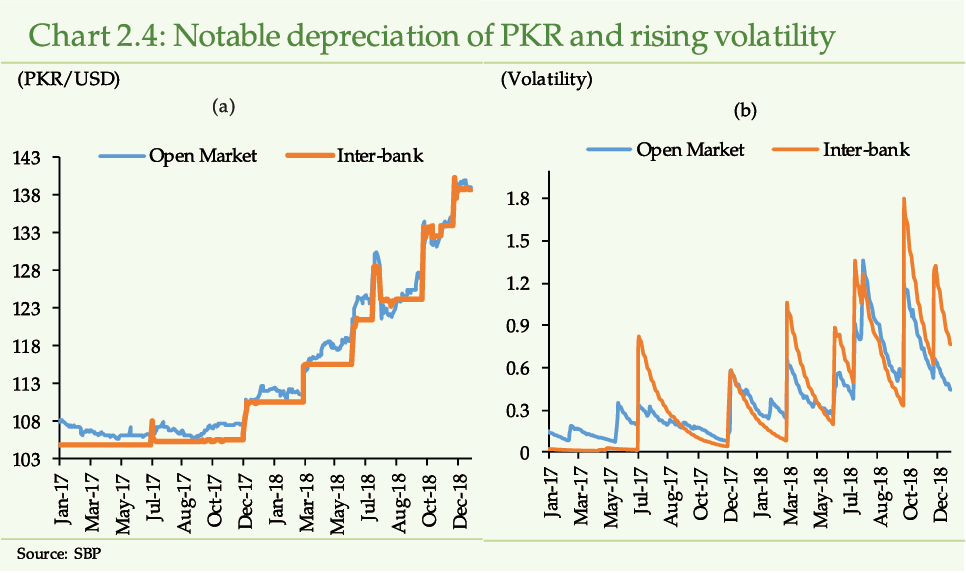

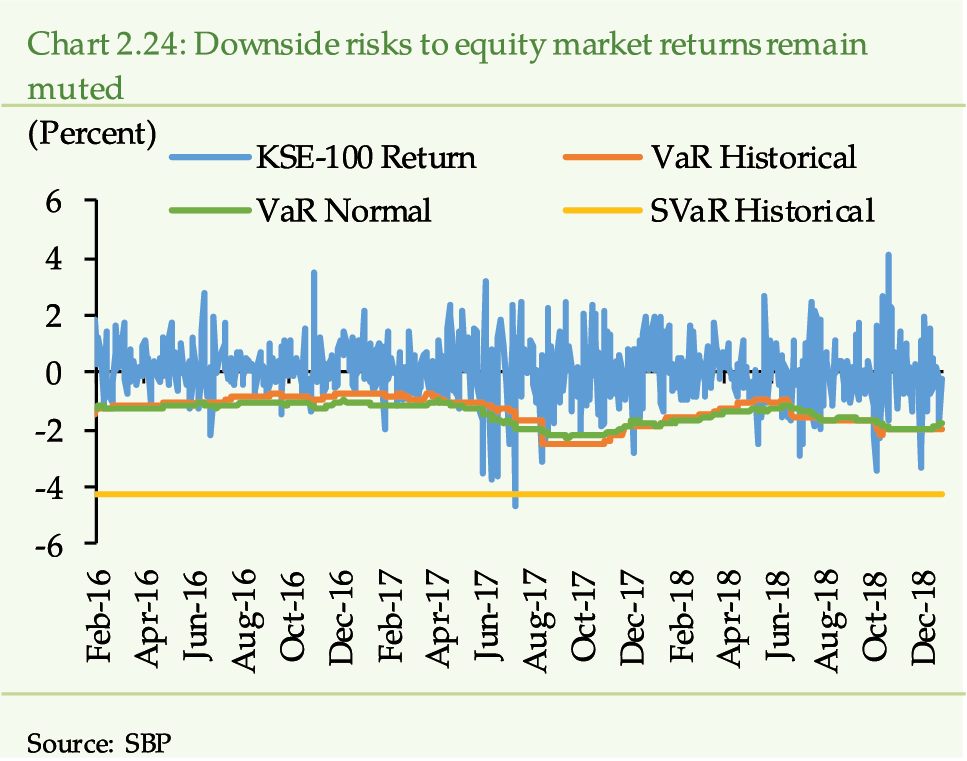

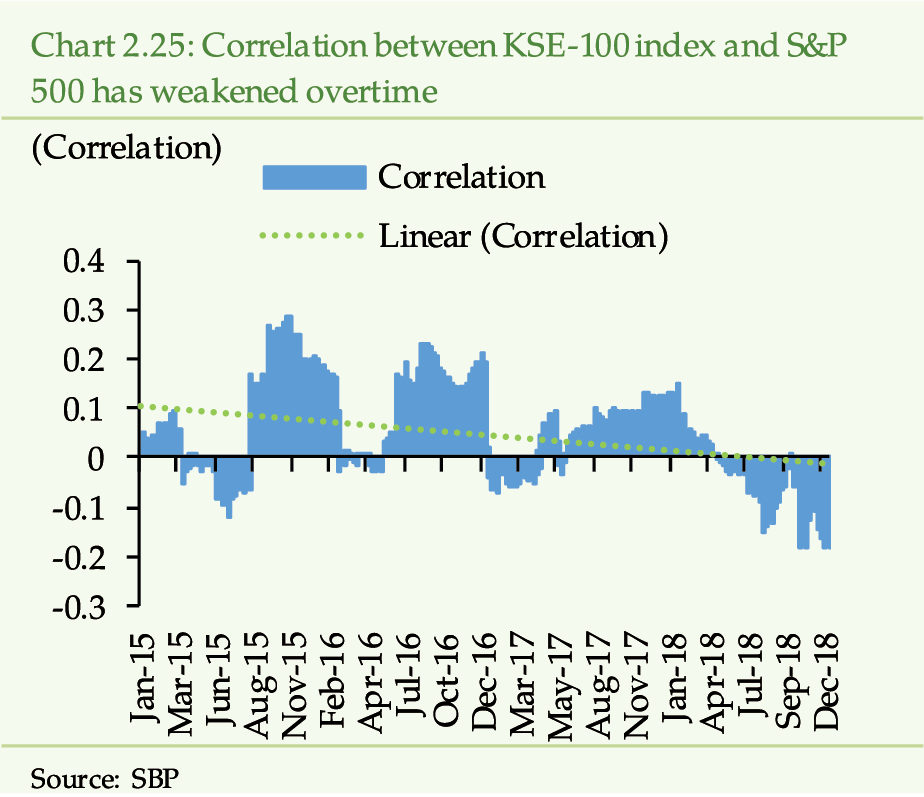

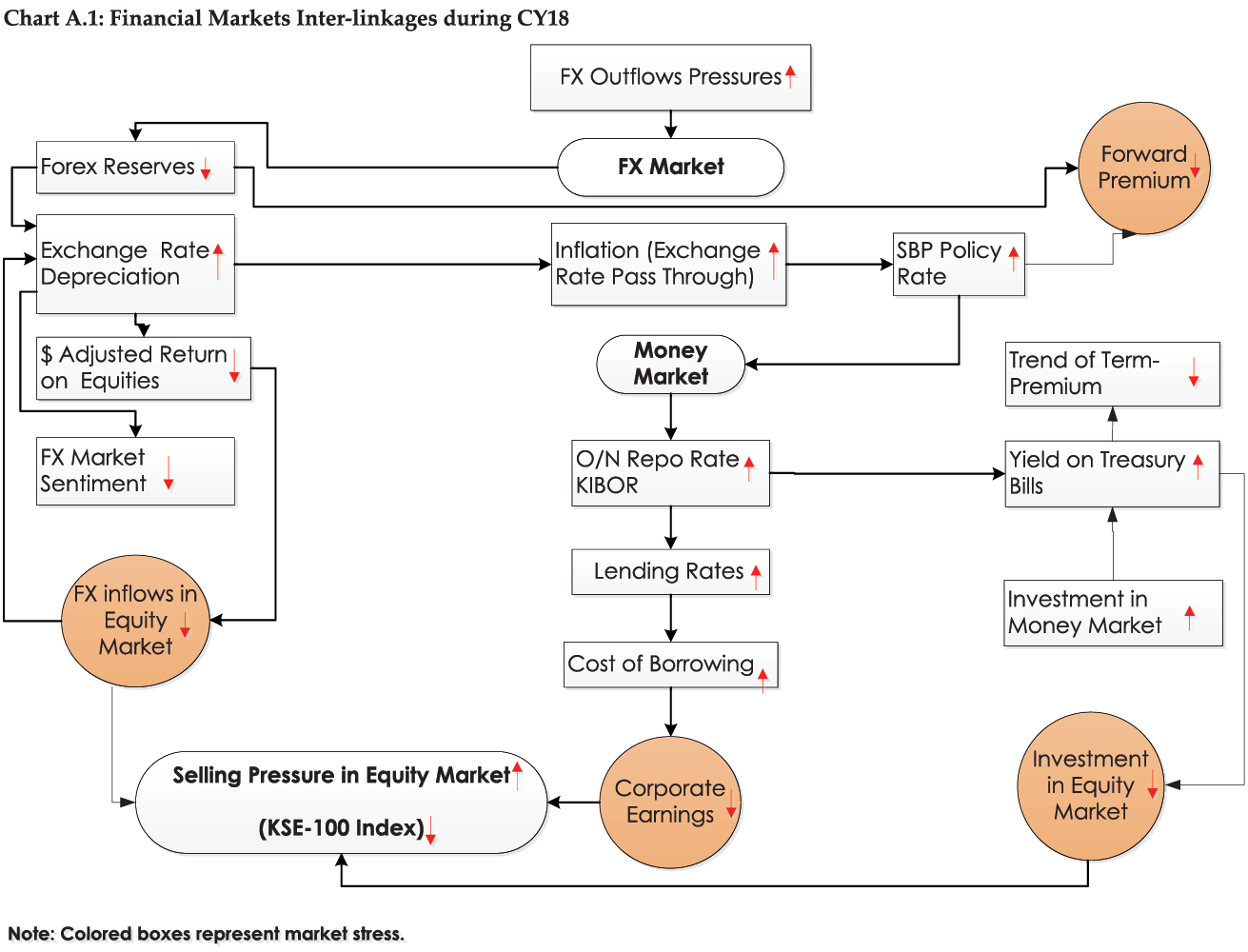

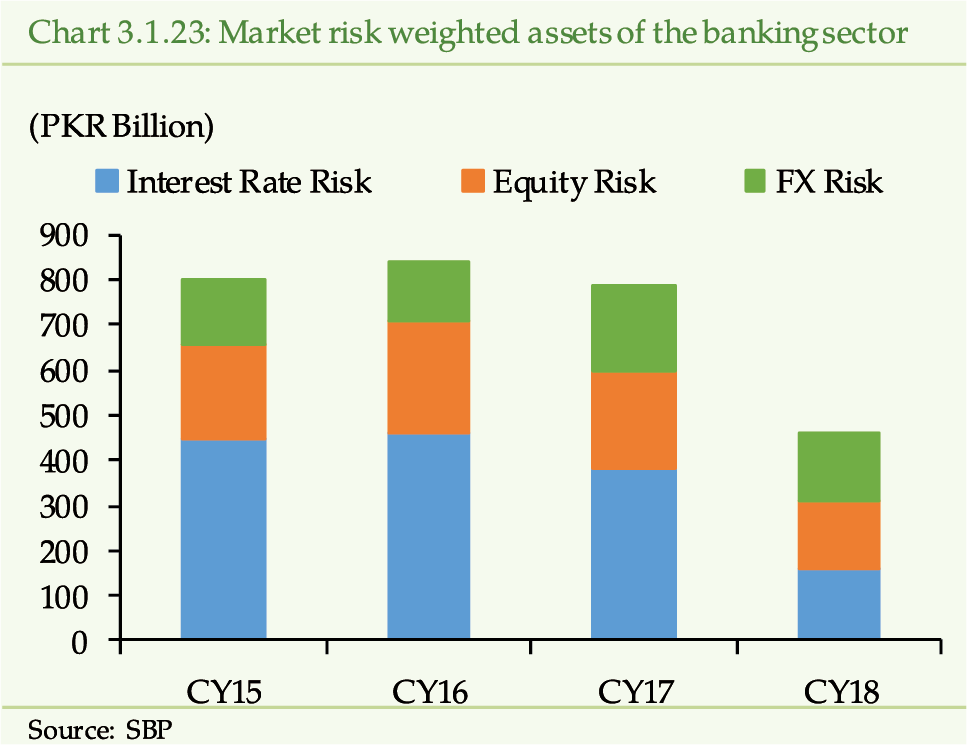

In CY18, the operations and risk profile

of the domestic financial markets have been largely influenced by the

growing external account vulnerabilities, tighter monetary policy response,

and uncertainty among the market participants. While Government has succeeded

in raising sizeable bilateral financial support, these flows could partially

finance the high current account deficit. As a result, the SBP FX reserves depleted

by around USD 7 billion and the PKR, cumulatively, depreciated by 23.61 percent

against US dollar, leading to higher volatility in the FX market. Besides, uncertainties

associated with the political transition and future economic direction led to

bearish sentiments in equity market that pulled down the KSE-100 index by 7.58

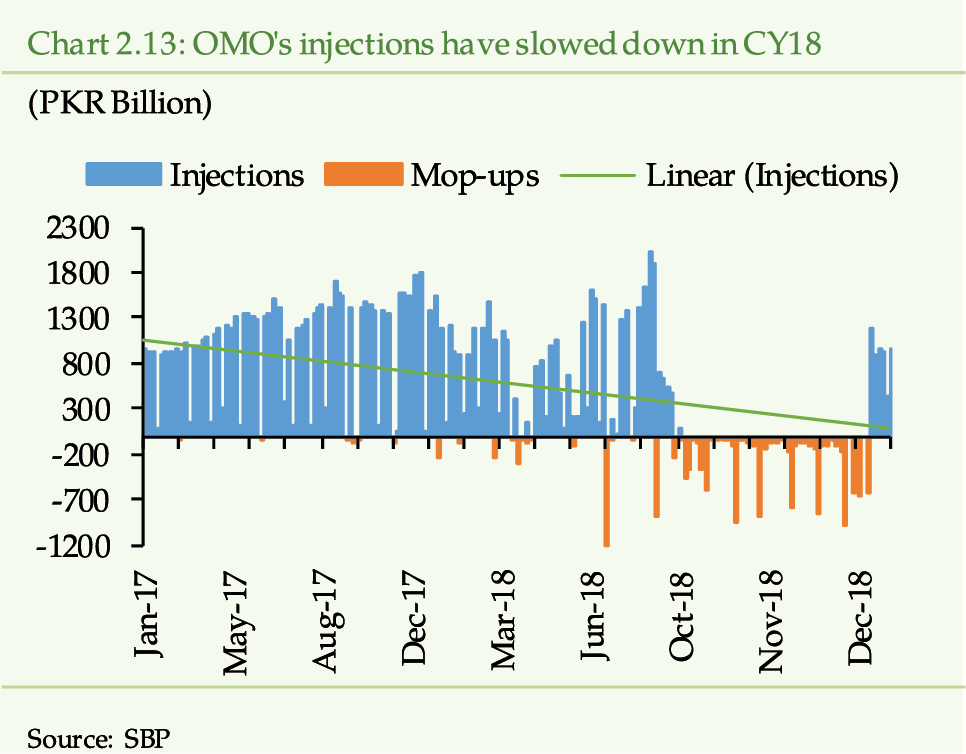

percent (on average) during the year. However, volatility in the money market

has remained contained due to interest rate corridor mechanism in place and

prudent management of market liquidity by SBP (See

Chapter 2).

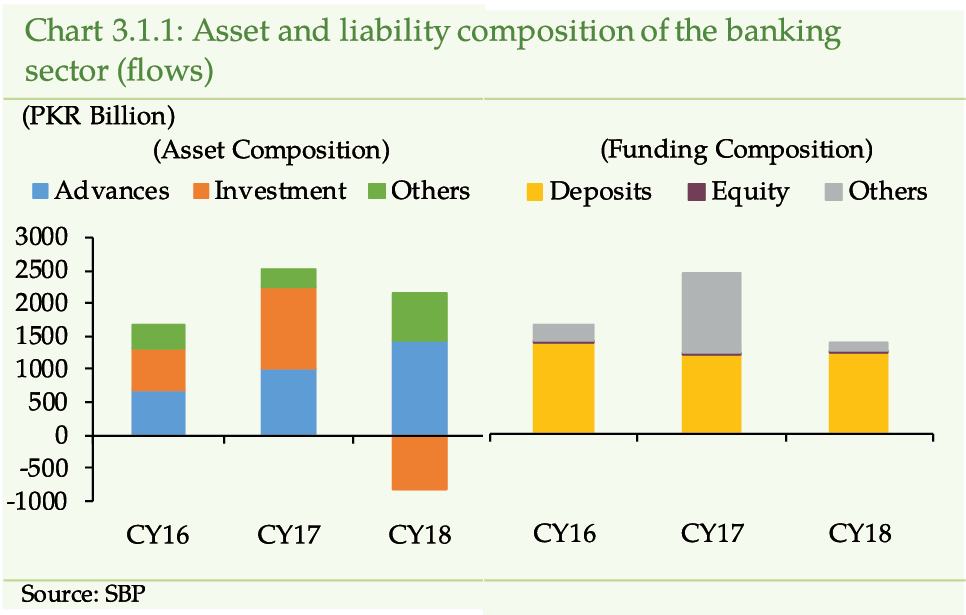

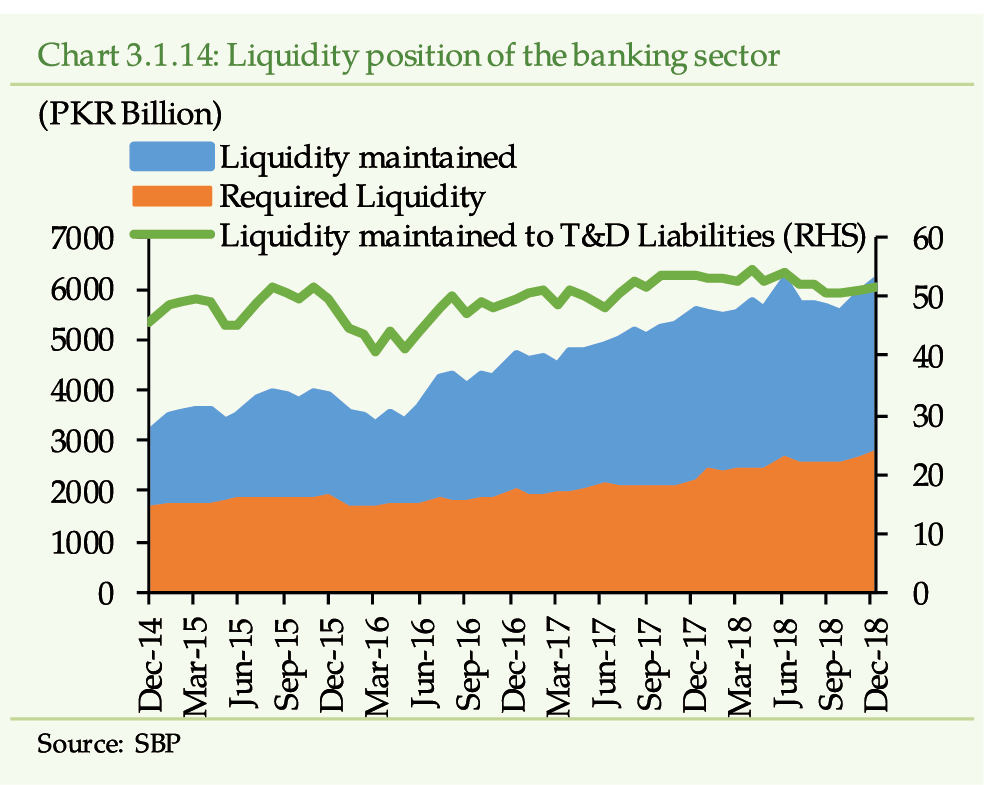

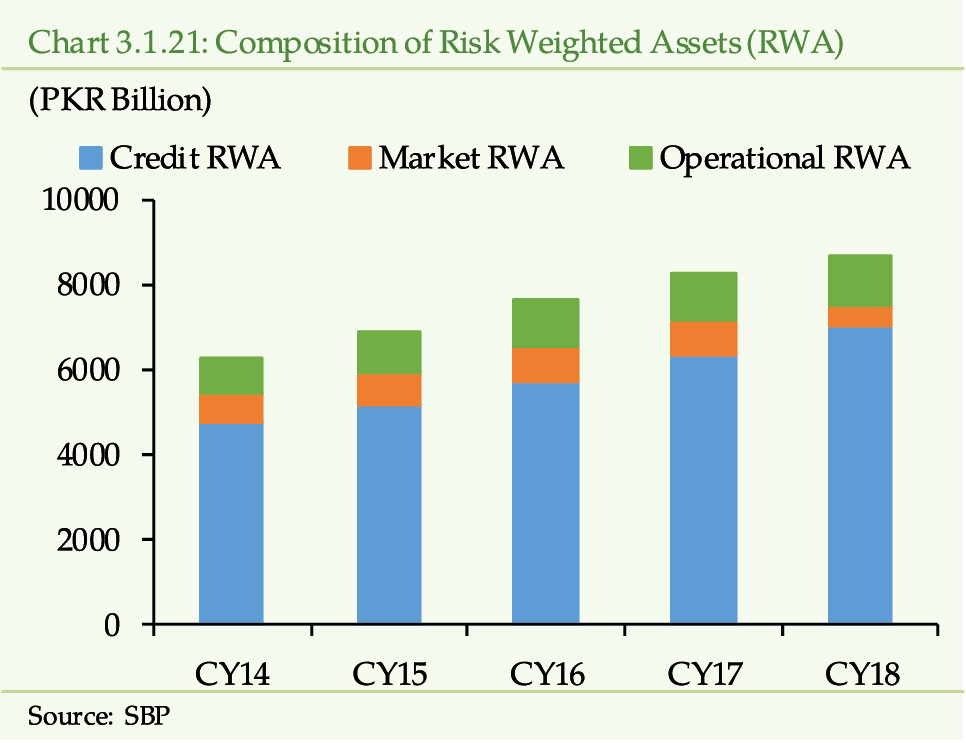

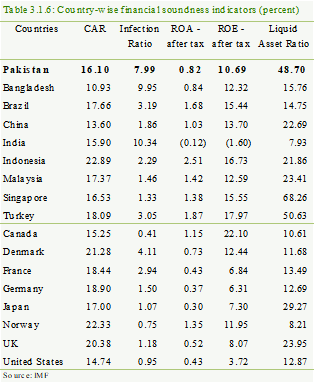

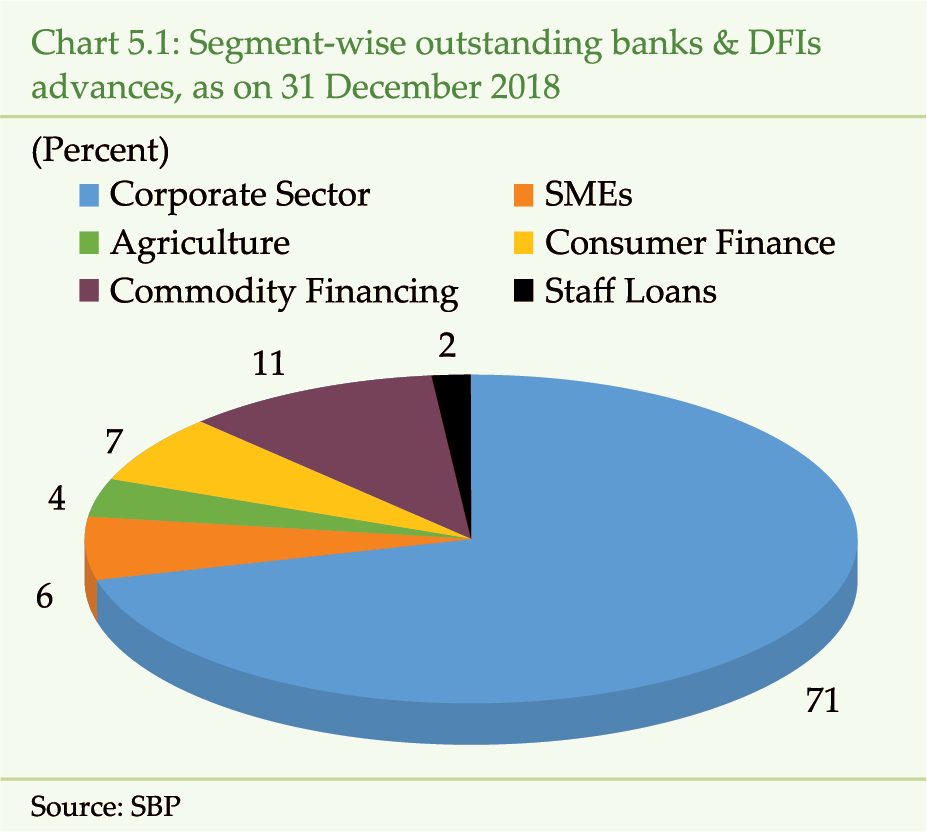

Banking sector, the backbone of the financial

sector, has generally weathered the challenging macro-financial conditions

and performed steadily. The financing growth has increased, profitability

remains reasonable, liquidity buffers stayed high, and solvency of the banking

sector has remained adequate (See Chapter 3.1).

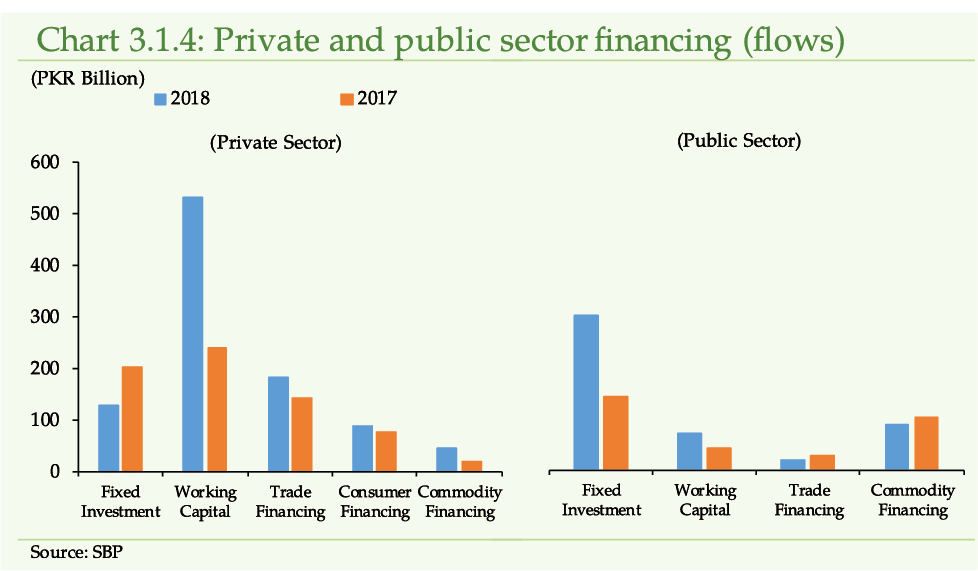

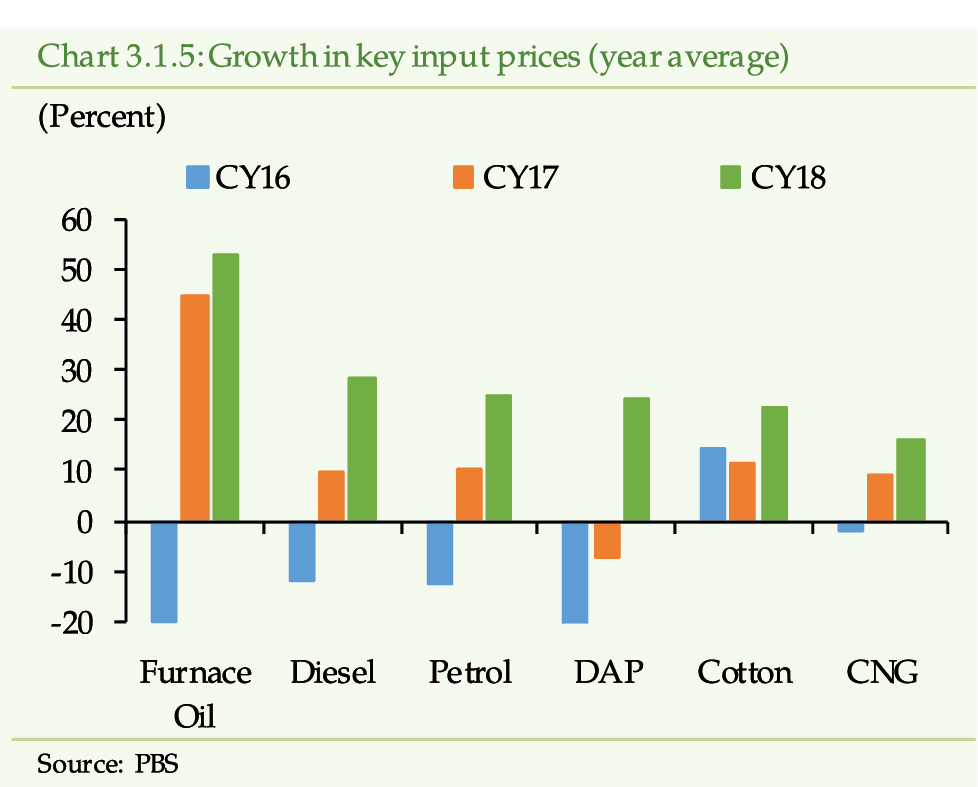

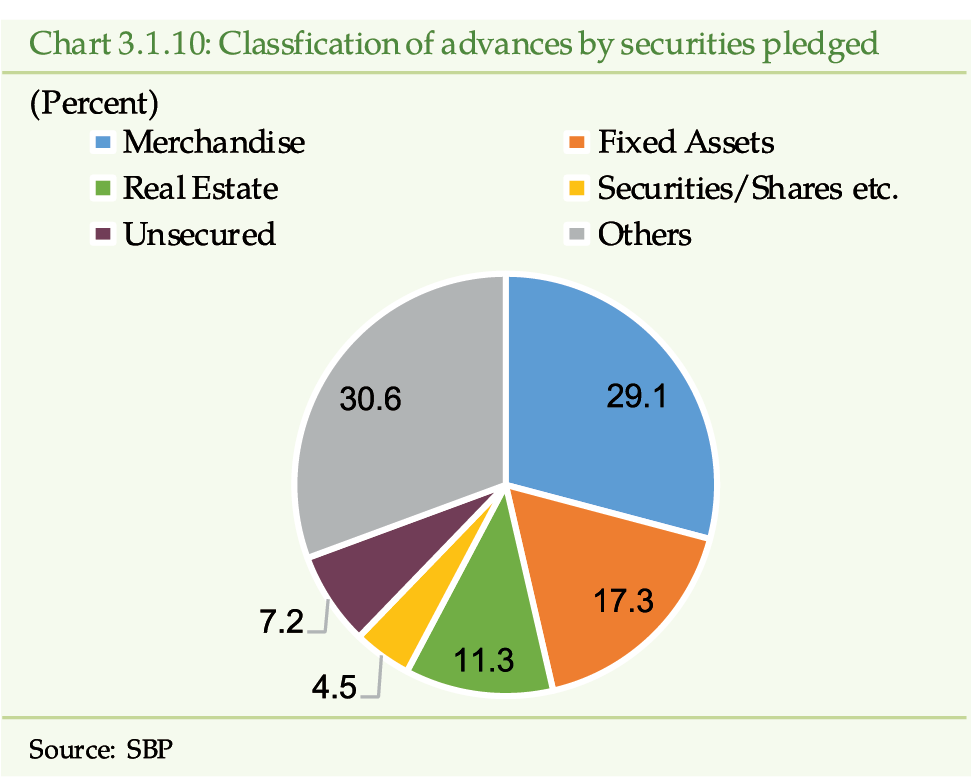

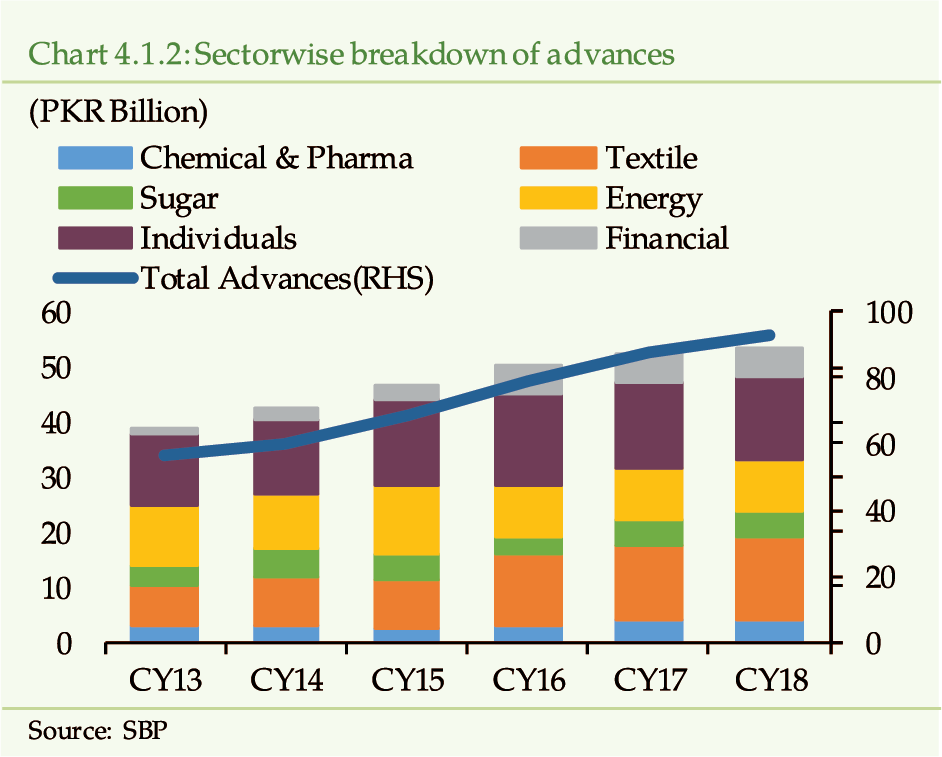

The financial intermediation has improved with advances

to deposit ratio attaining its highest level of 55.81 percent in the last

eight years. The high financing growth in the private sector has mainly supported

this improvement in intermediation. The demand for financing has mainly come

from textile, food and beverage, cement, energy, chemical and real estate

sectors. The rise in input costs, as reflected in almost 33.29 percent growth

in the working capital loans, is partially responsible for the surge in demand.

The funds generated through deposit mobilization coupled with net-retirement

of investment in government securities enabled the banks to meet the increase

in credit requirements.

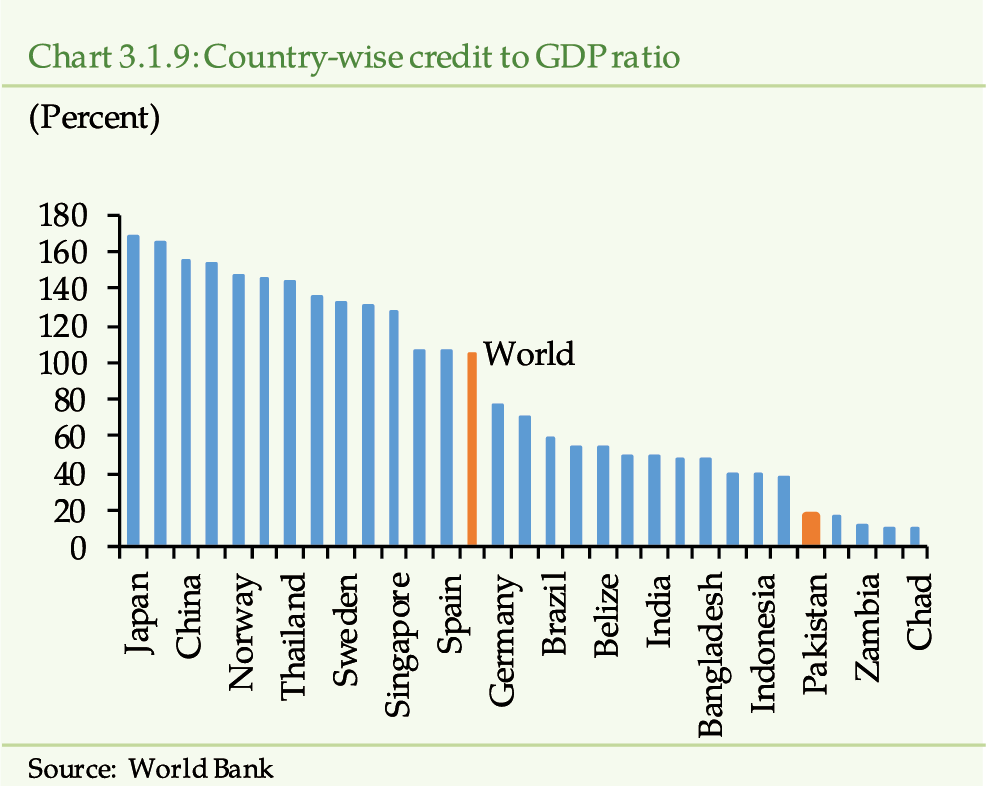

The credit to private sector can get further thrust

if the banking sector’s exposure to government could be reduced.

[6]

Though, it is encouraging to note that the trend of rising credit

to government has reversed in CY18, the exposure still remains high at 48.15

percent of the assets, with one-sixth of it lent to the public sector power

entities and commodity finance operations. As the share of financing to these

sectors is continuously growing, it is imperative to resolve the underlying

structural issues related to energy sector circular debt and otherwise self-liquidating

commodity operations.

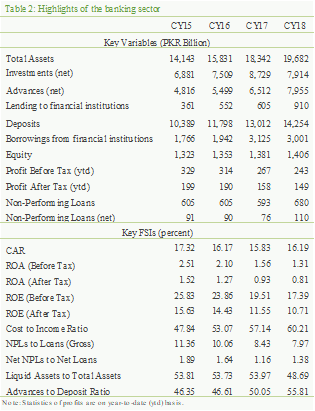

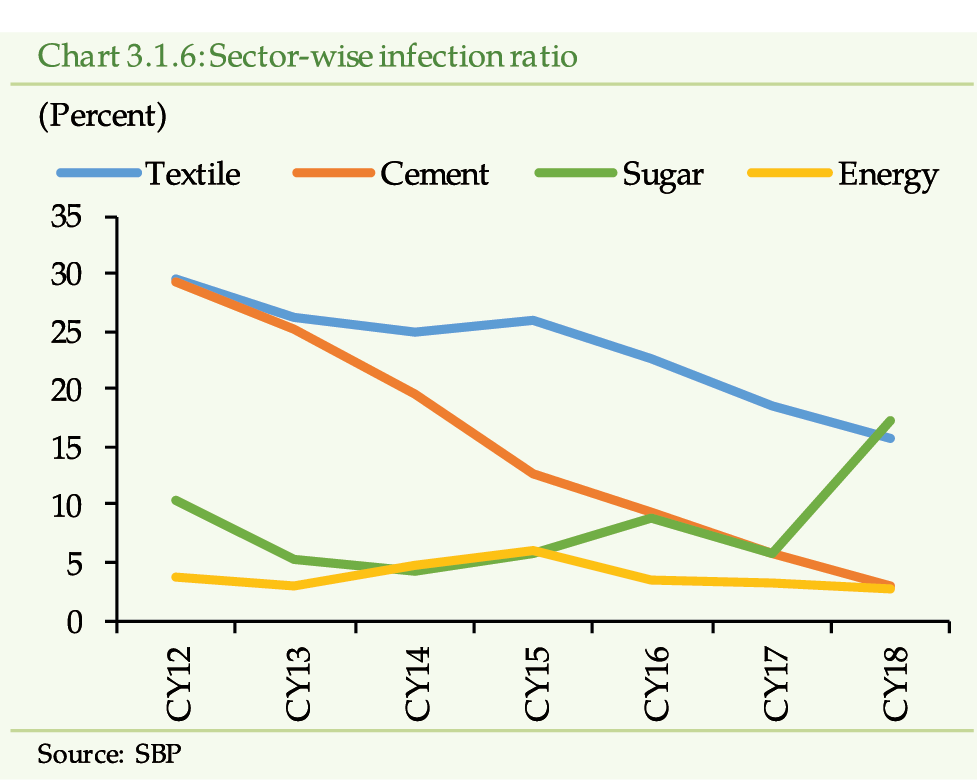

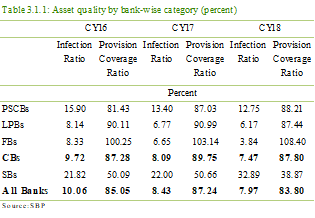

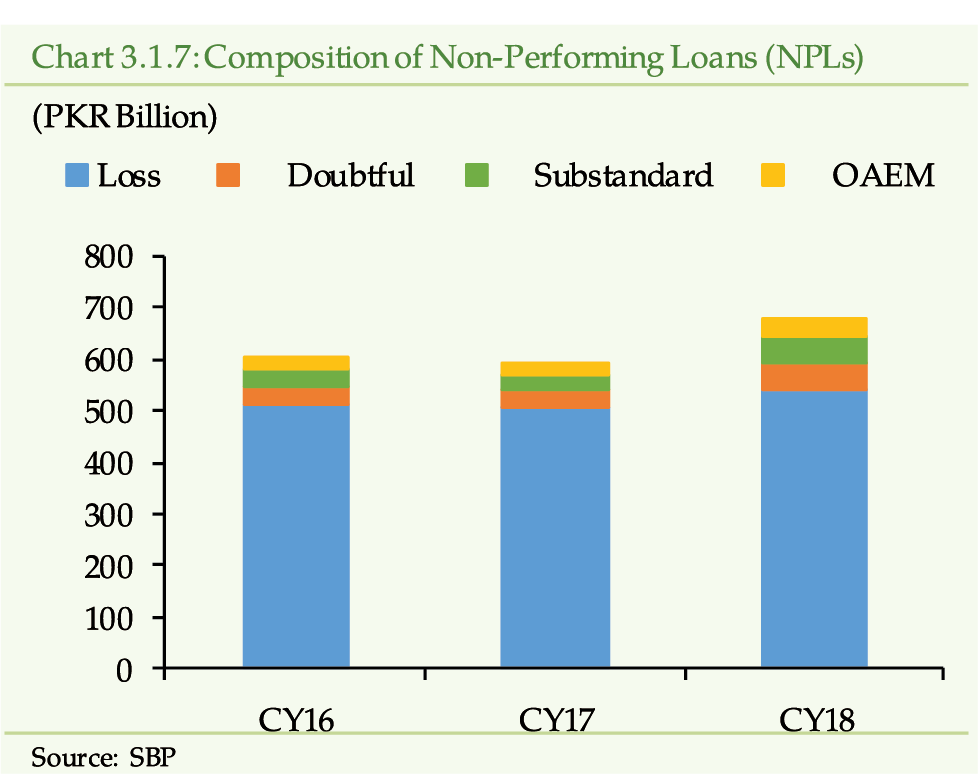

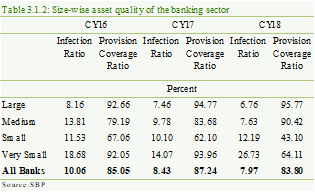

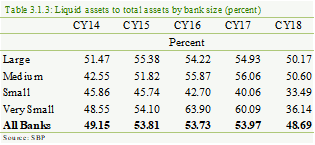

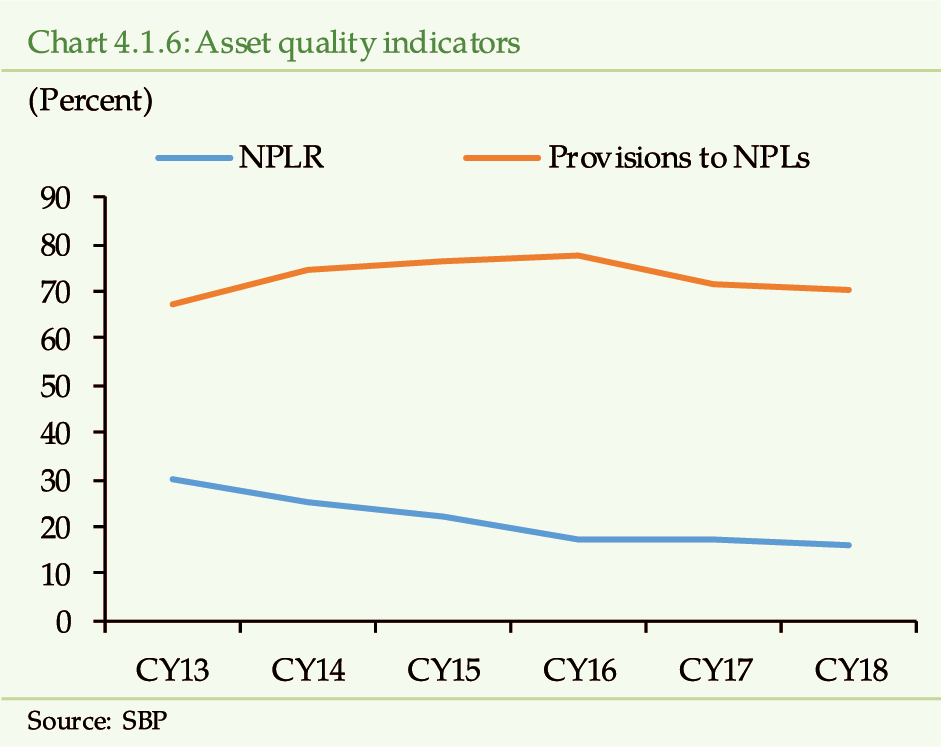

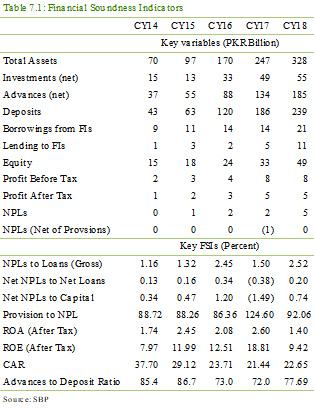

Asset quality of the banking sector presents a mixed picture. A higher growth in advances has led to a decline in infection ratio, though the quantum of NPLs has increased during the year. The flow of fresh NPLs is mainly observed in sugar, energy and agriculture sectors domestically along with some impairment in the overseas portfolio in the Middle East region. Accordingly, Net NPLs and capital impairment ratios have observed some rise during the year. [7] (Table 2)

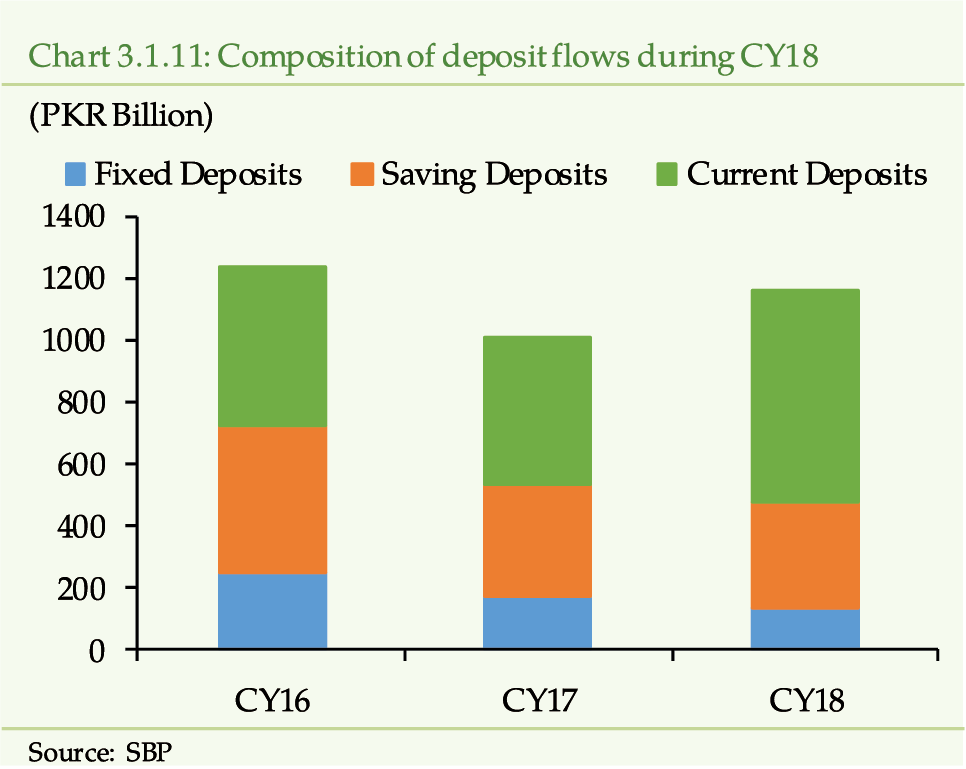

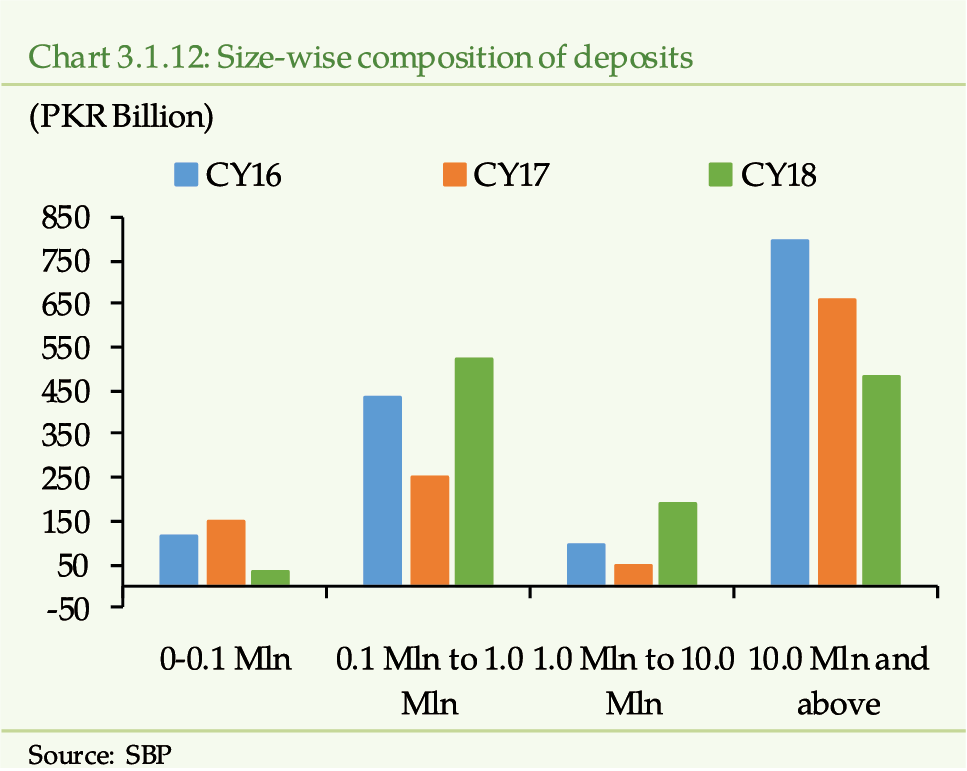

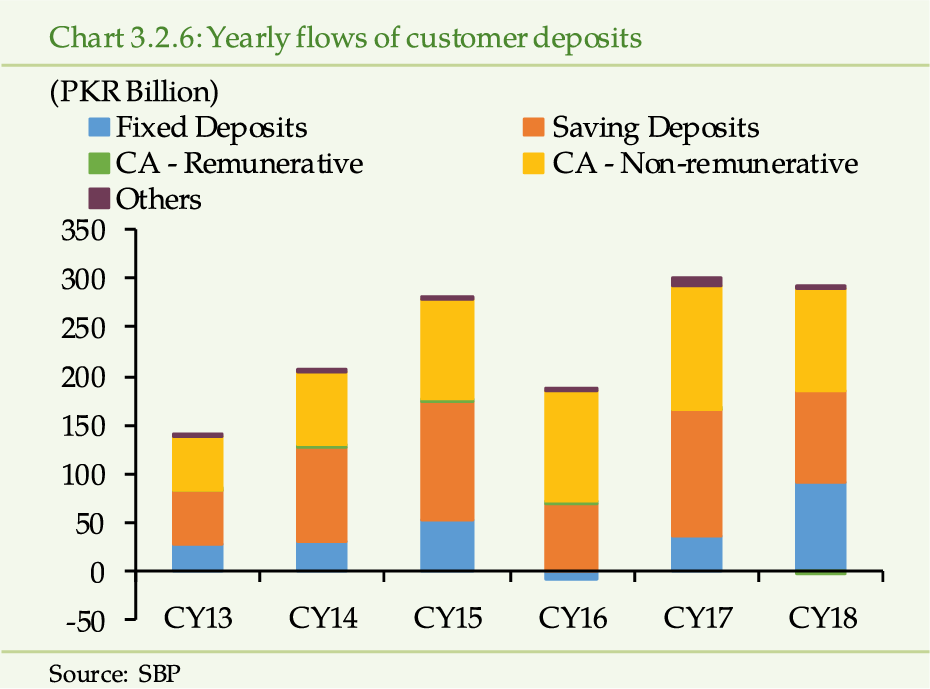

The deceleration in deposits, observed over the last

couple of years, continues during CY18. Deposits have witnessed a growth of

9.55 percent compared to last five years’ average of 12.26 percent. The slowdown

is mainly driven by: a) strategy of the banks to focus on low cost deposits

in a rising interest rate environment; b) scaling back of operations by few

banks in the overseas markets; c) probable effect of withholding tax on banking

transactions; d) enhanced KYC requirements for depositors; e) increasing placement

of retail deposits in government securities through non-competitive bids;

and f) liquidity generated through net retirement of investments. Among these

factors, compliance with enhanced KYC is necessary to avoid ML/FT risks, while

others like imposition of withholding tax needs appropriate policy tweaking

for effectively pursuing the financial inclusion agenda and enhancing the

banks’ ability to improve intermediation.

[8]

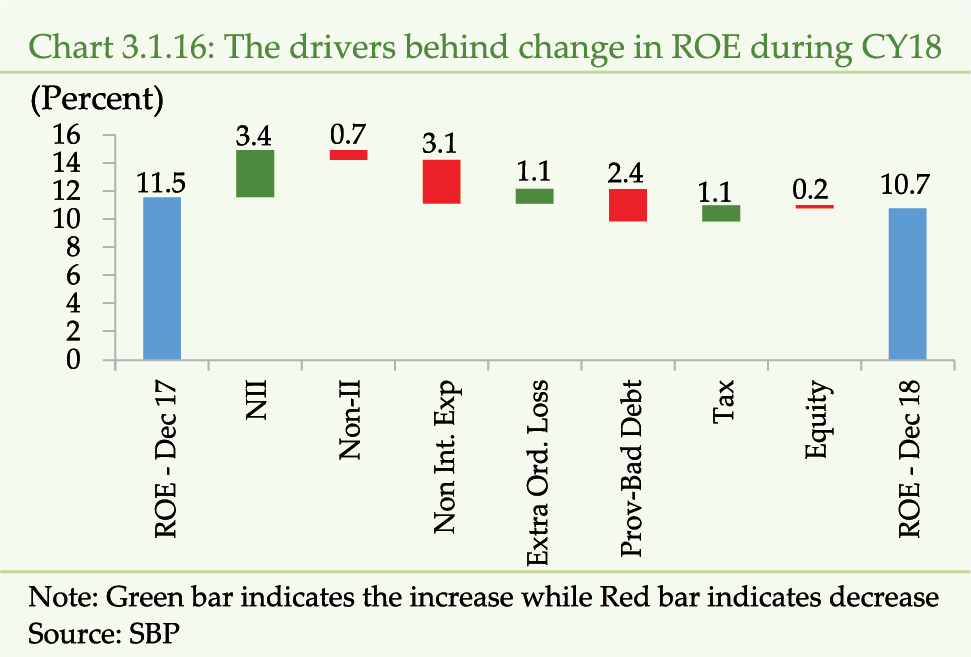

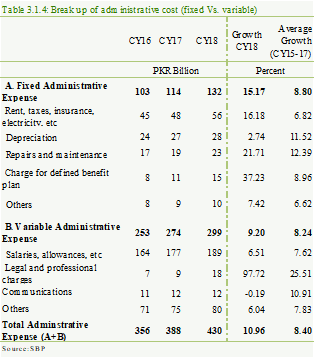

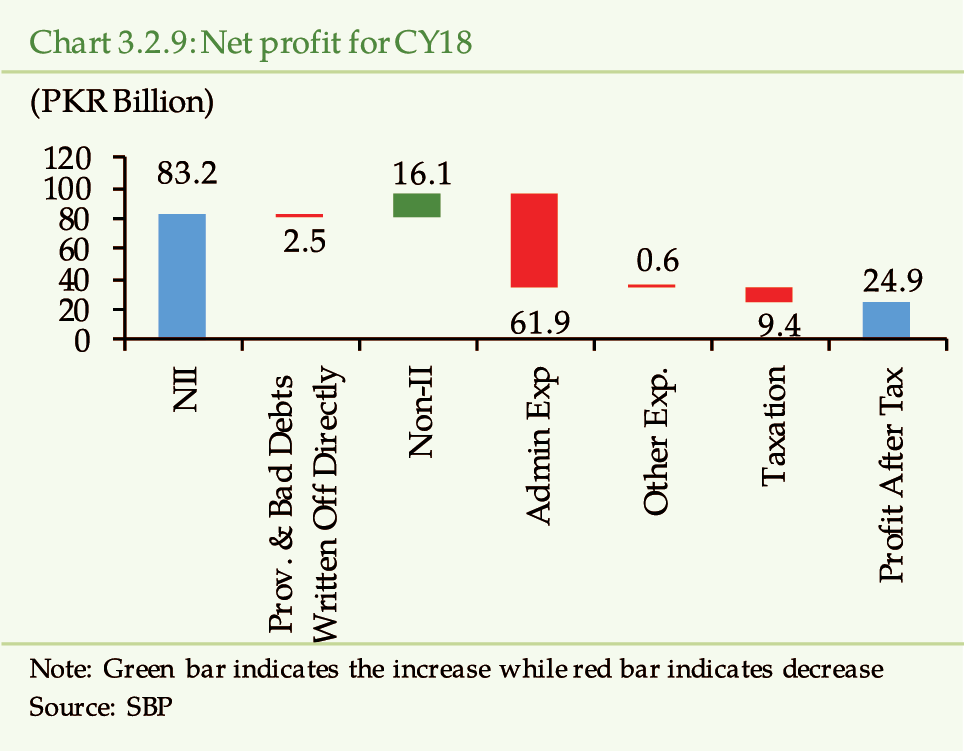

The banks have posted reasonable profit during CY18,

though increase in provisioning charges against NPLs coupled with a rise in

administrative expenses and one-off extraordinary pension expense have kept

the profitability below the last year’s level. Encouragingly, a healthy growth

in advances has increased the share of interest income from core financing

activity. Consequently, the net interest margin (NIM) has improved that has

been falling for the last 3 years.

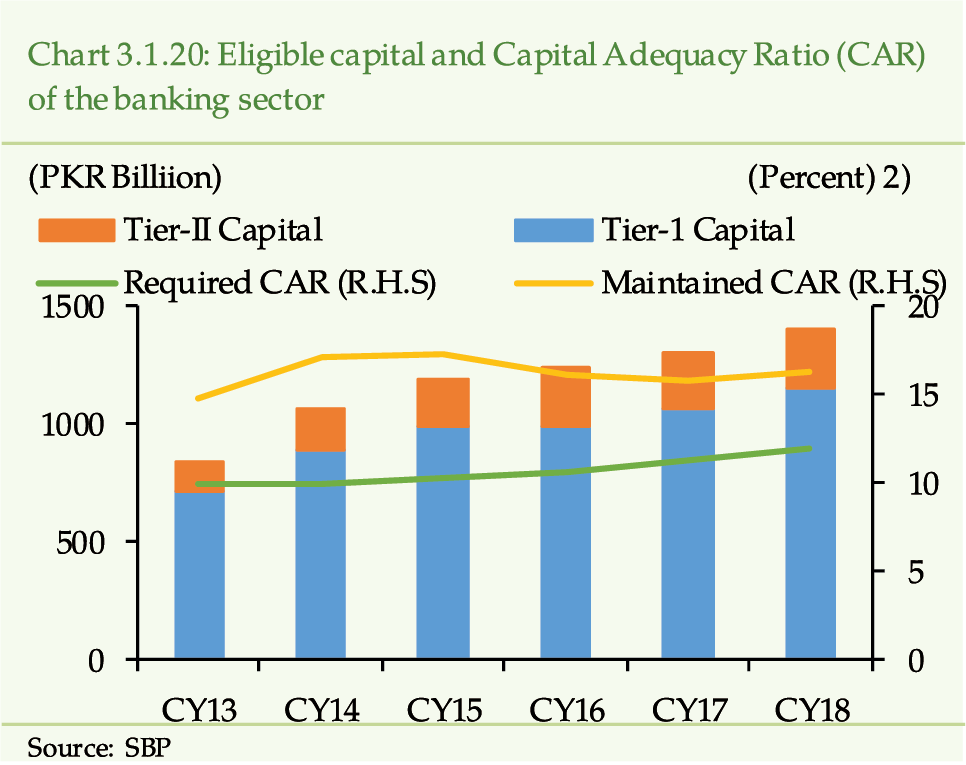

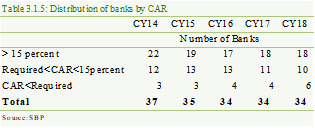

The solvency of the banking sector remains strong

with capital adequacy ratio (CAR) at 16.2 percent – well above the minimum

regulatory requirement of 11.9 percent.

[9]

(Table 2). Further, to address the possible systemic risk

posed by the large institutions, SBP has issued a framework for designation

of Domestic Systemically Important Banks (D-SIBs).

[10]

Under the framework, three banks have been designated

as D-SIBs that are subject to enhanced supervision; including the Higher Loss

Absorbency Capital surcharge in the form of additional common equity tier-1

capital (CET1).

[11]

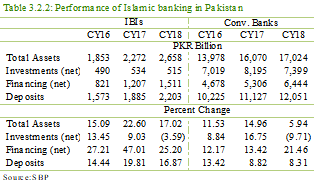

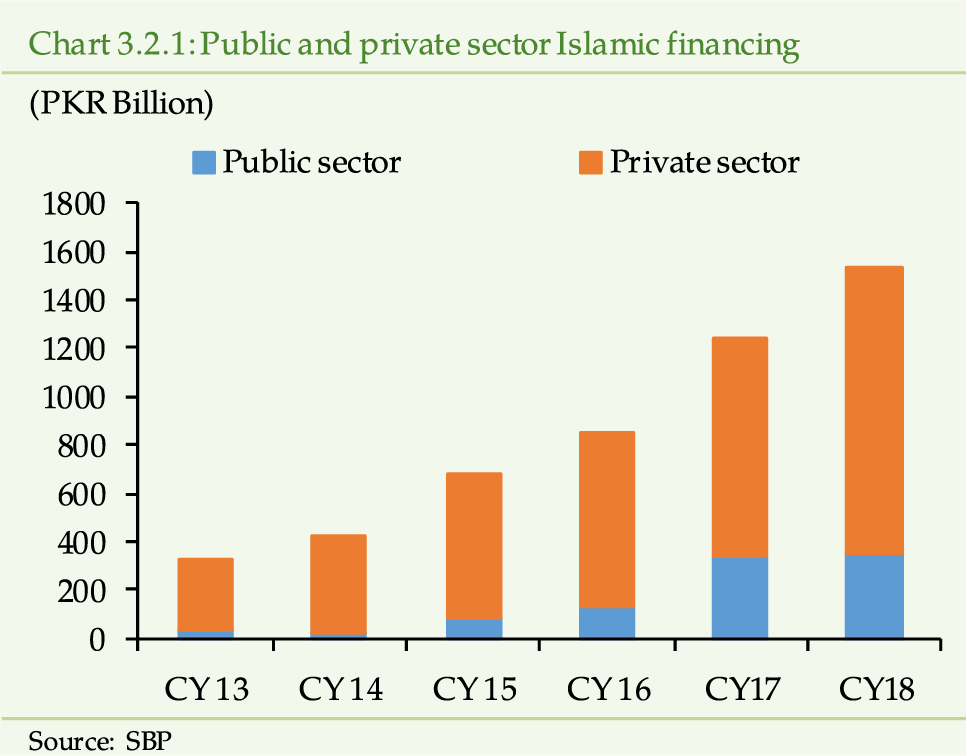

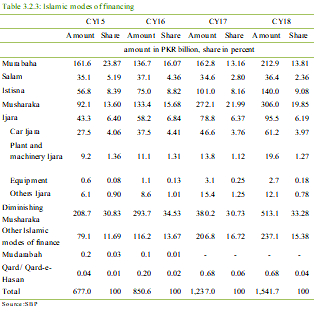

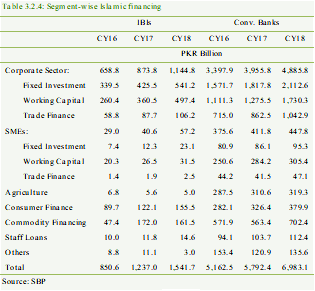

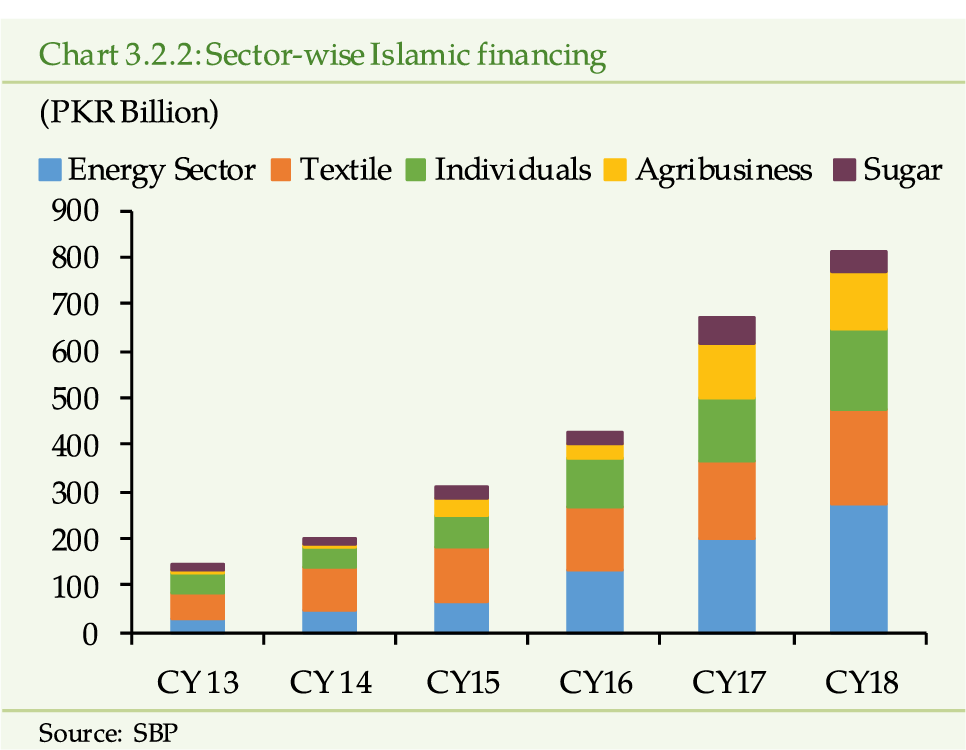

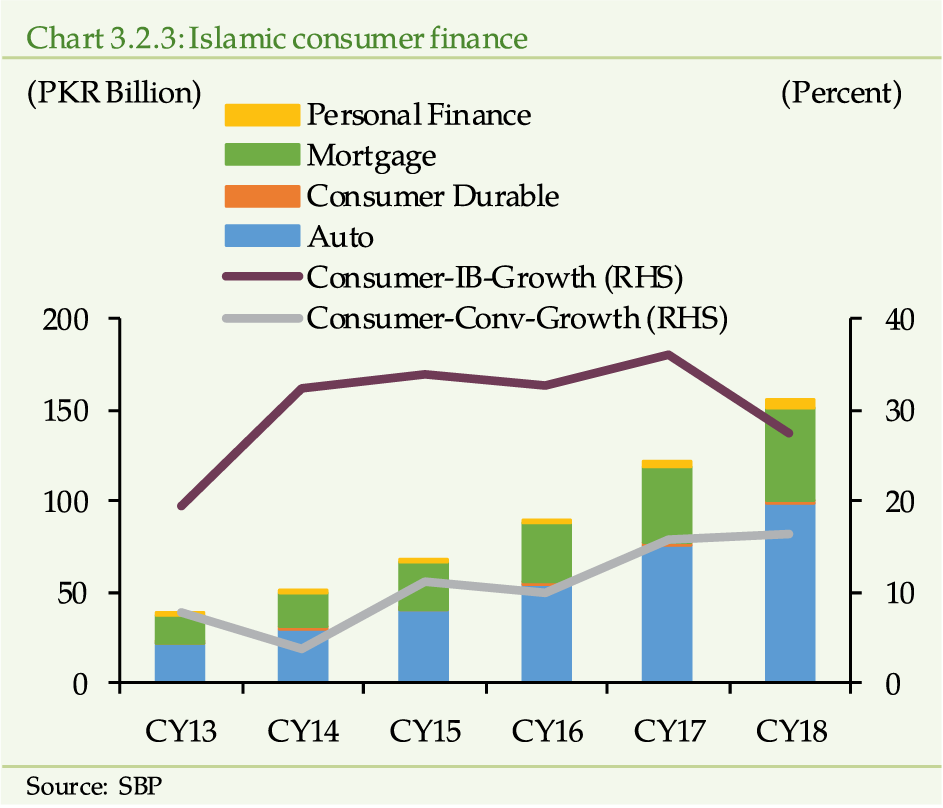

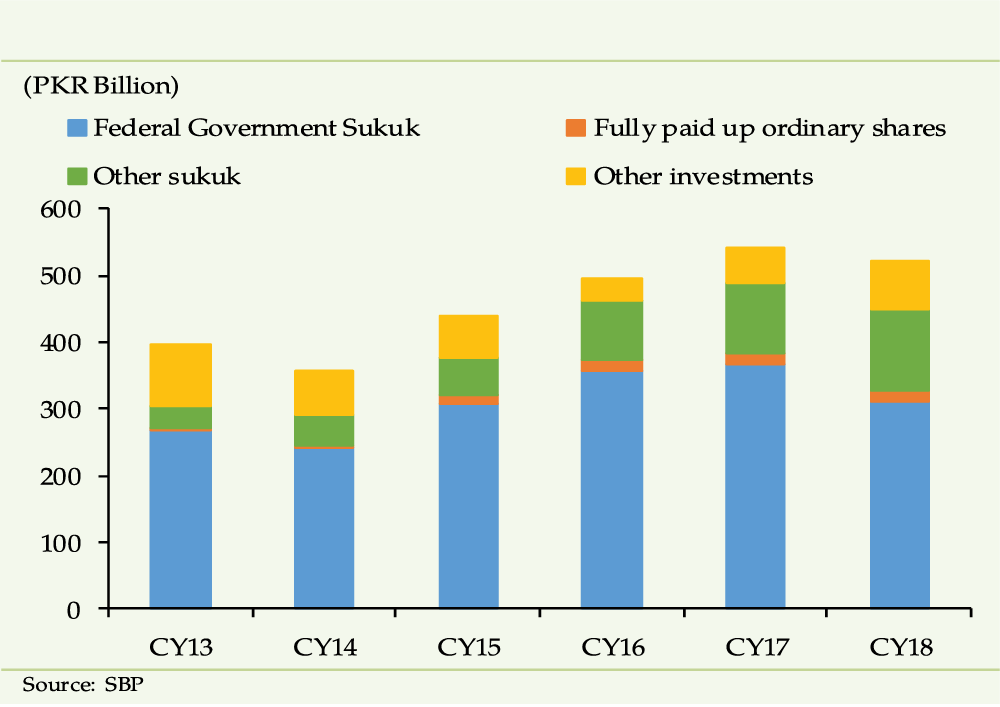

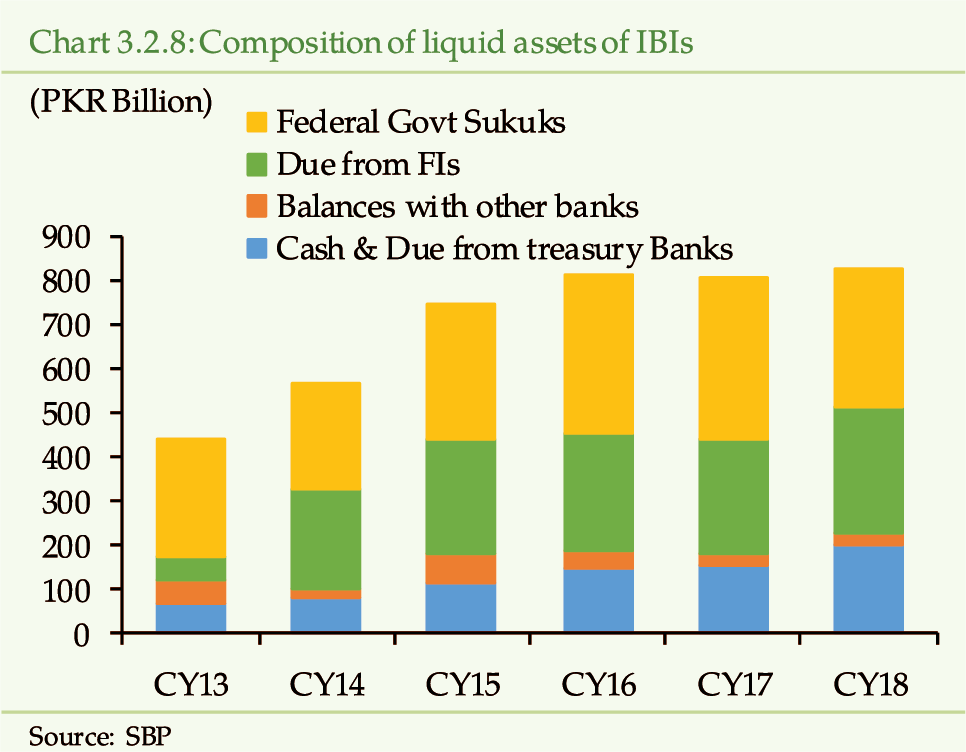

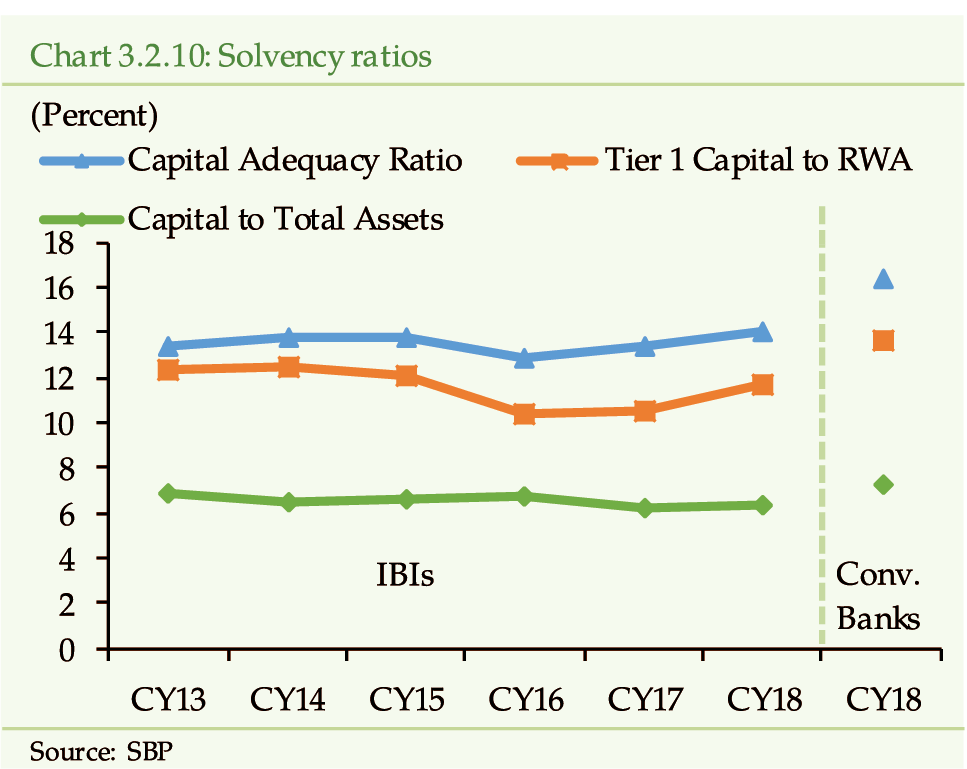

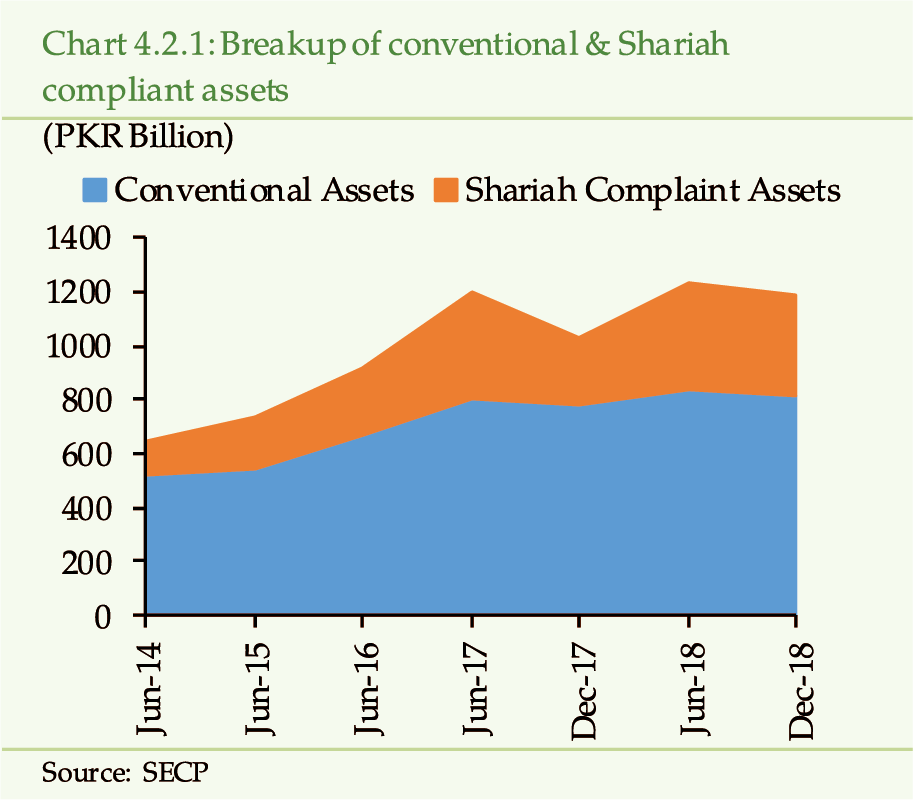

Islamic Banking Institutions have maintained

the fast growth over the years, and, as of end CY18, constitute almost 13.51

percent of the total banking sector assets. The growth in IBIs is mainly driven

by financing activity, while healthy increase in Mudarabah based deposits

provided the required funding. Among the Islamic financing categories, profit

and loss sharing modes of Musharaka and Diminishing Musharaka have gained

prominence with 53 percent share in financing. While IBIs have lent to diverse

economic sectors, their share in financing to SMEs and Agriculture sector

still remains small. As such, IBIs needs to make efforts to explore these

potential financing avenues (See Chapter 3.2).

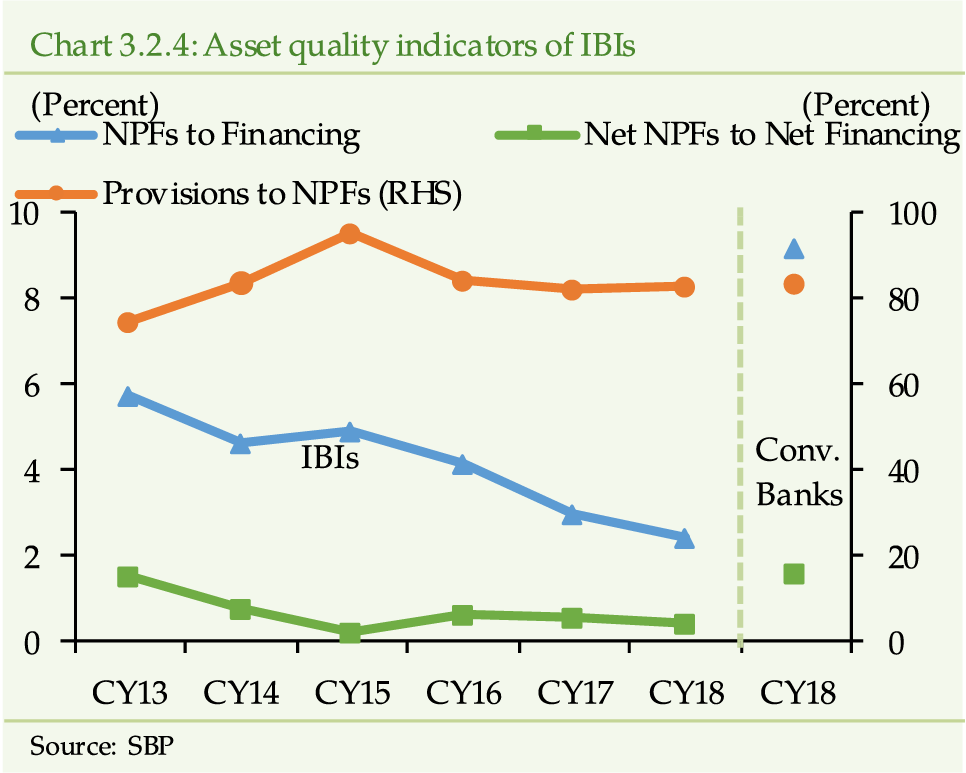

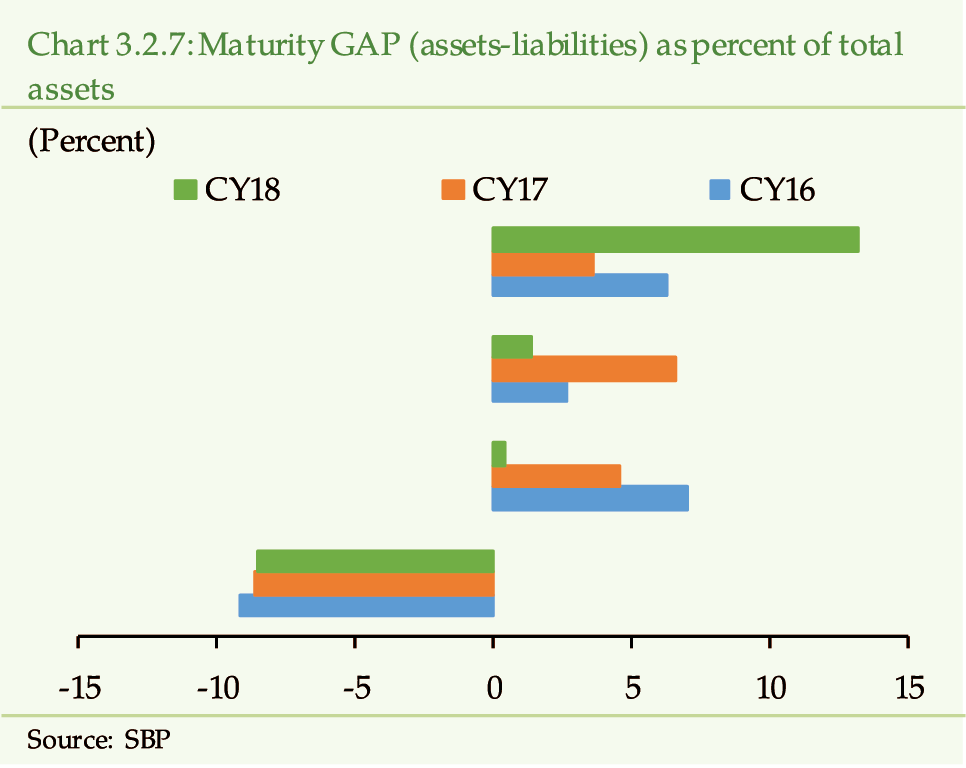

IBIs have remained sound, with improved asset quality,

higher profitability and CAR well above the minimum requirement. However,

the sector continues to face the dearth of long-term Shariah compliant investment

avenues that limits IBIs ability to effectively manage their liquidity. It

is also affecting the deposit mobilization efforts of IBIs necessary for maintaining

growth trajectory.

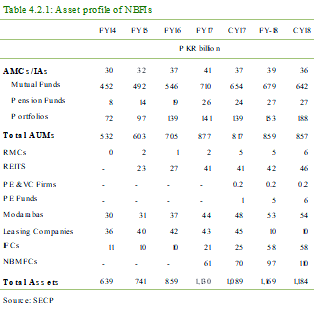

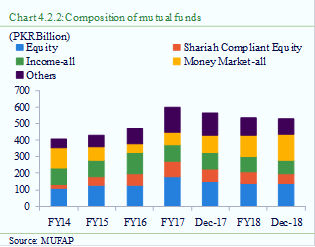

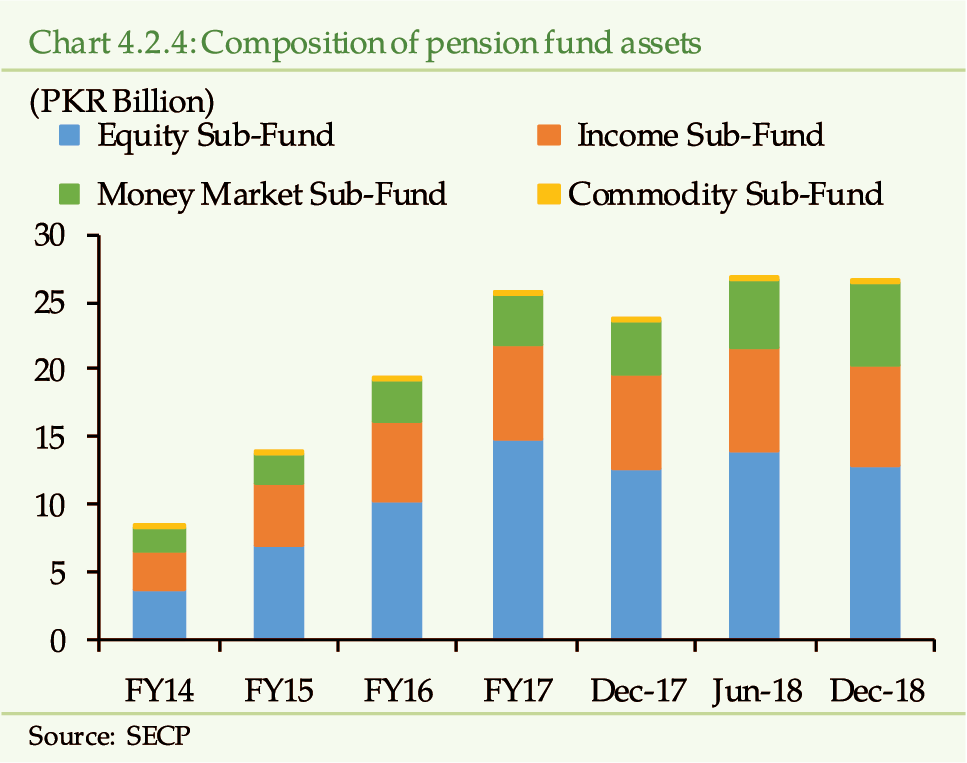

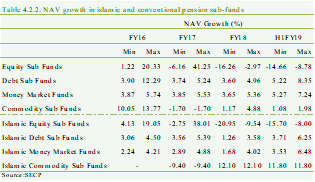

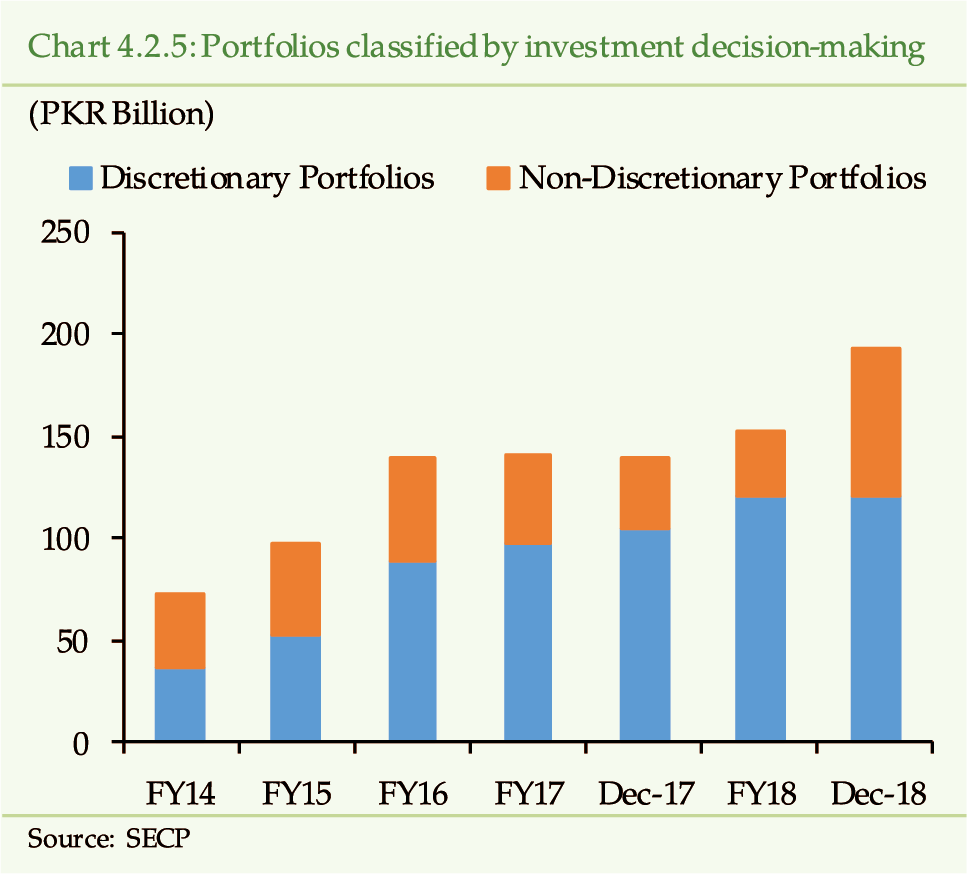

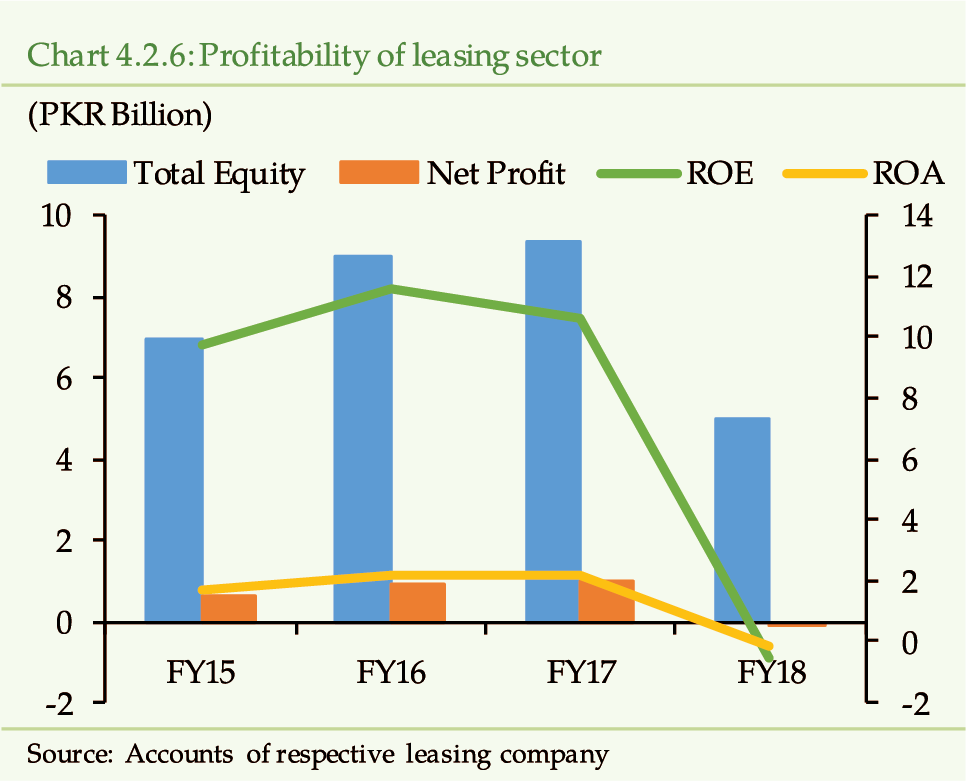

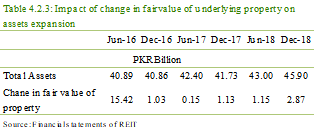

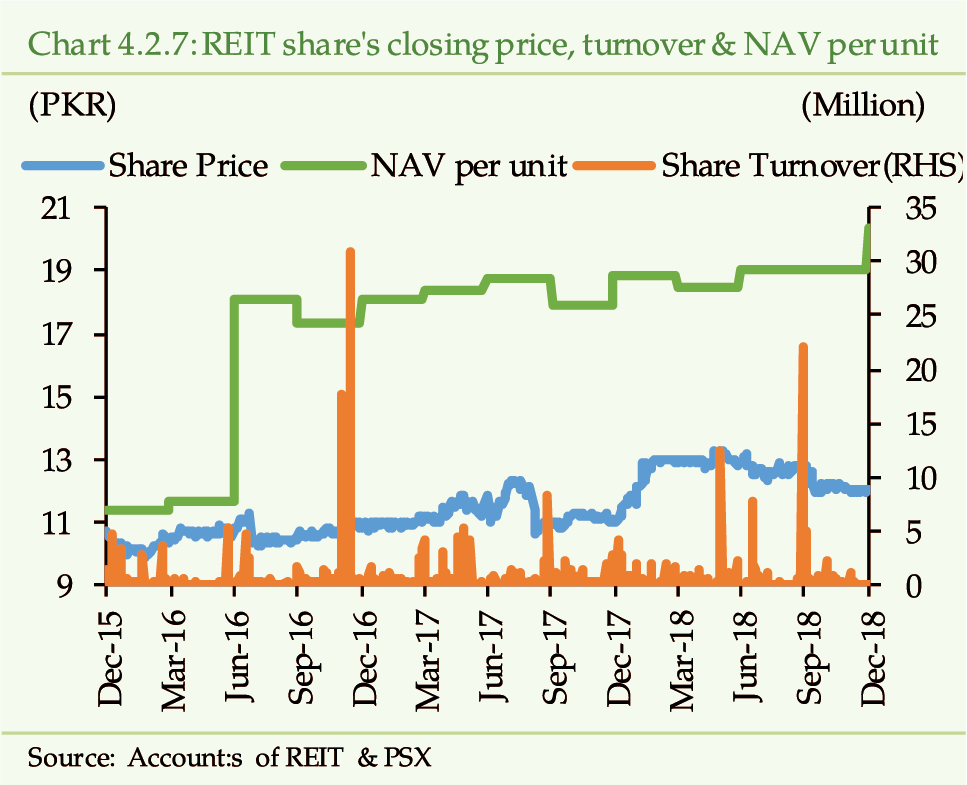

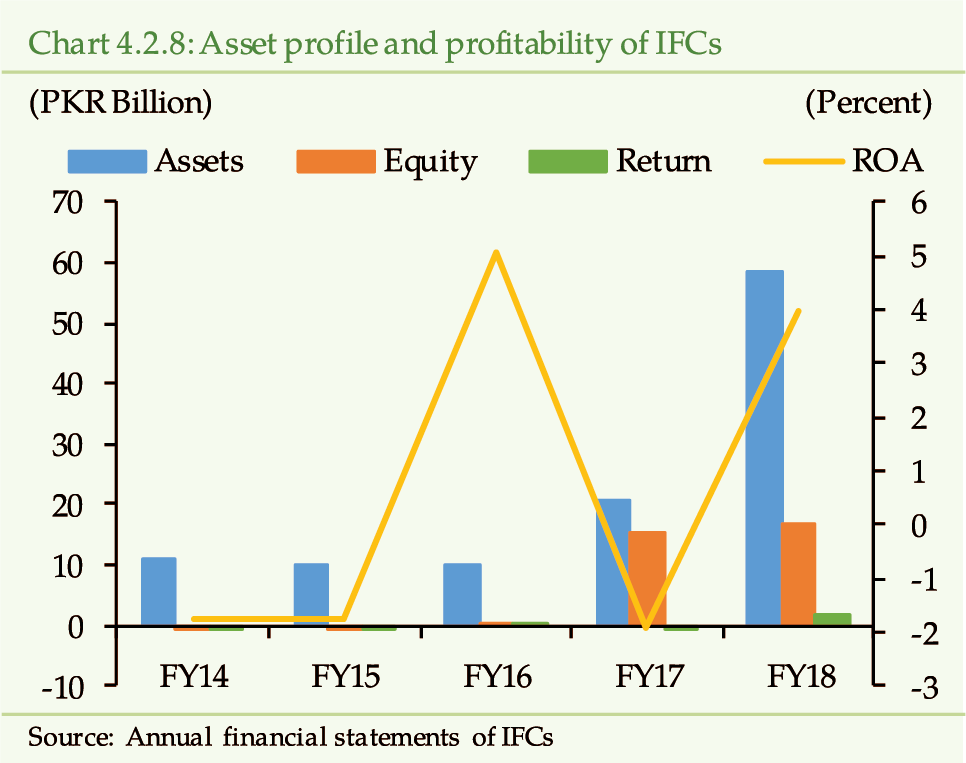

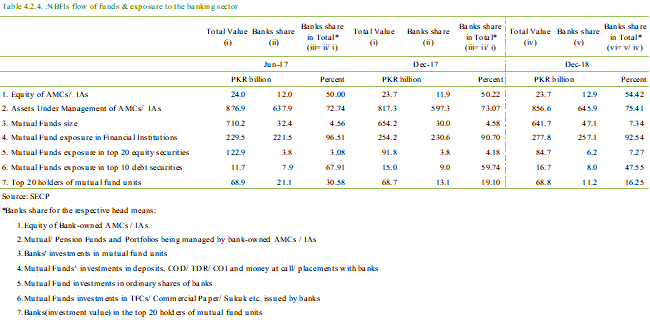

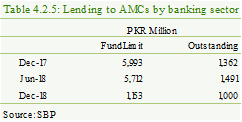

Challenging macro environment coupled with increased

volatility in financial markets have particularly increased the risk aversion

in Non-Bank Financial Institutions (NBFIs) directly linked with equity

market. The mutual funds—the dominant segment of NBFI—have witnessed

both contraction in assets under management as well as a flight to safety

i.e. movement from equity stocks to money market funds. On the other hand,

Investment Finance Companies (IFCs) and Non-Bank Microfinance Companies

(NBMFCs) that are engaged in intermediation function have observed asset

growth and exhibited relatively better performance. The improved availability

of market-based funding has also facilitated the growth of NBMFCs during the

year under review (See Chapter 4.2). Nevertheless, NBFIs continue to

face various challenges that are hindering their growth. Particularly, the

stiff competition from banks is limiting their ability to mobilize low cost

funds and attract quality human resources. Development of an industry level

strategy is needed to address the issues in order to enable the NBFIs to play

an effective role in financial deepening.

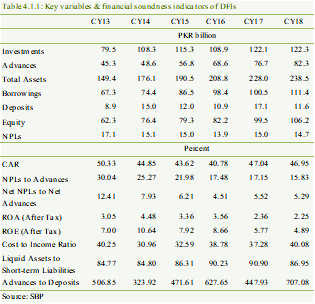

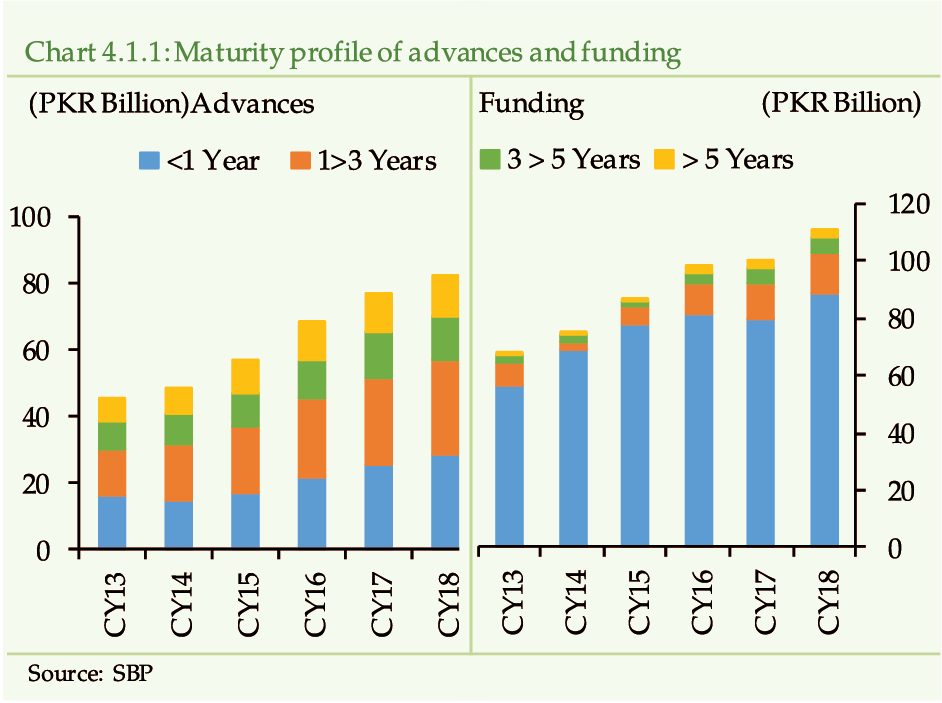

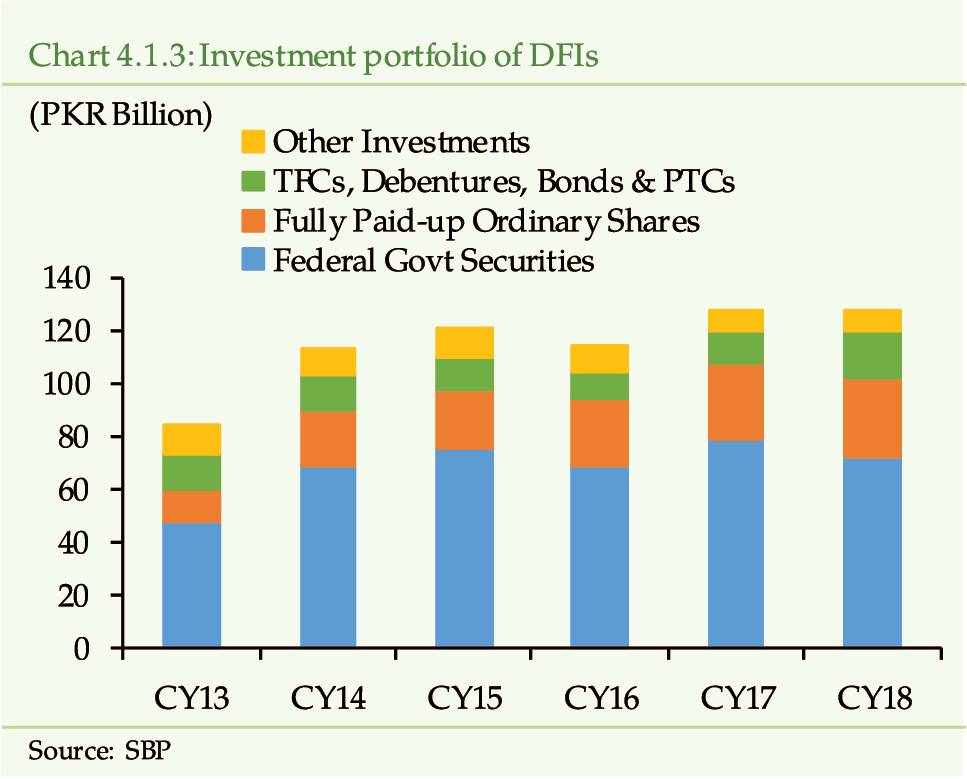

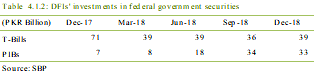

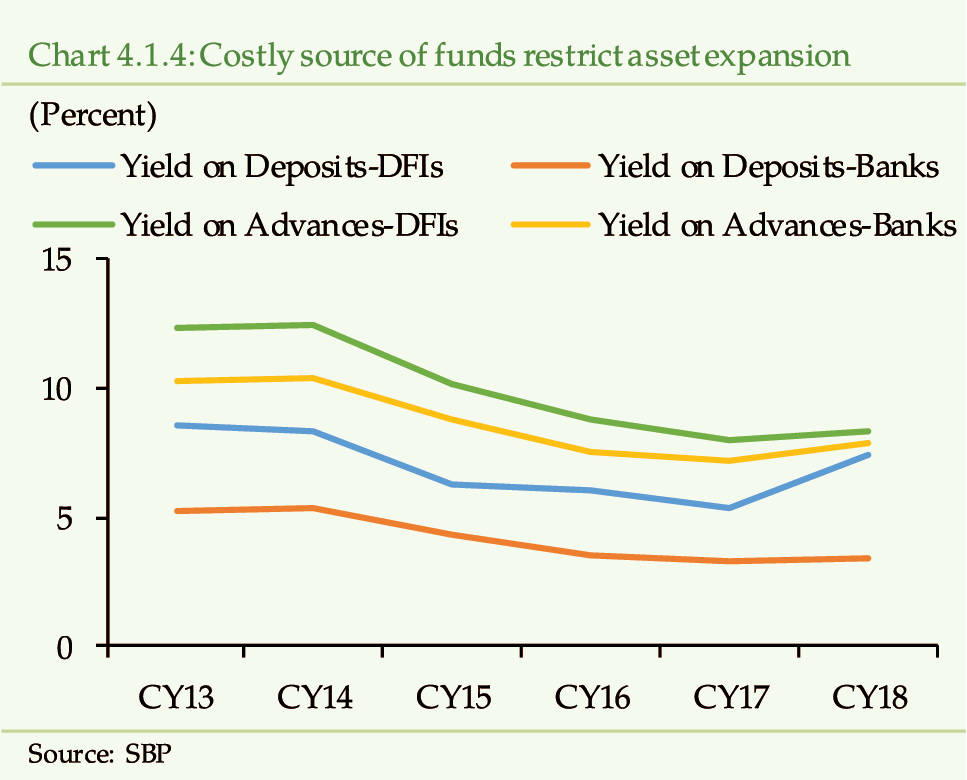

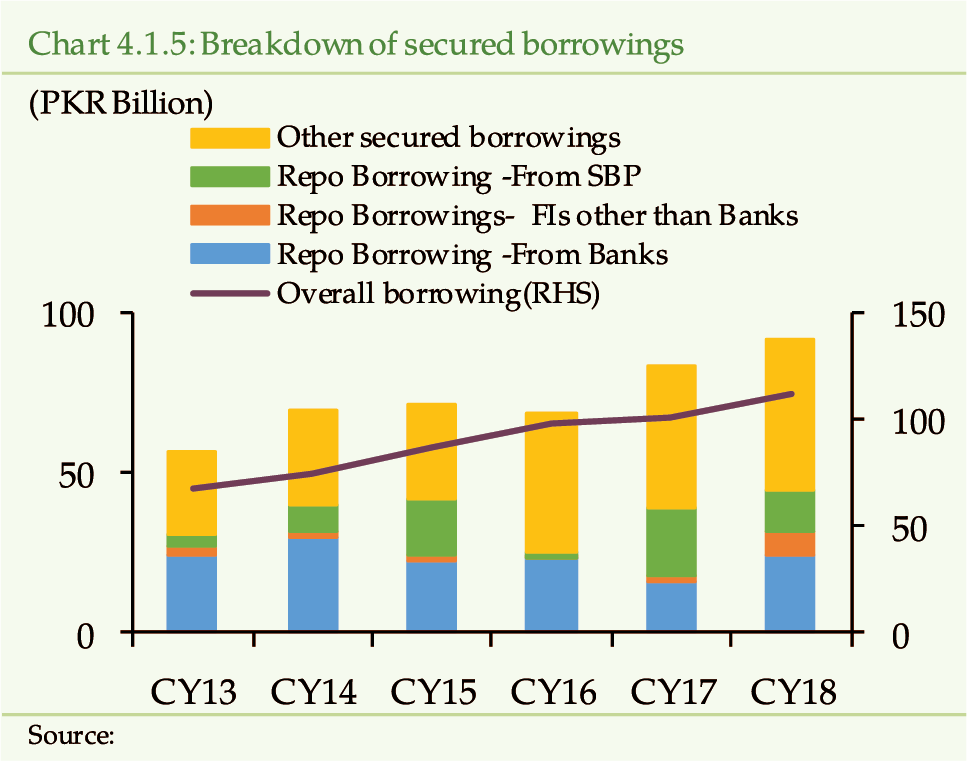

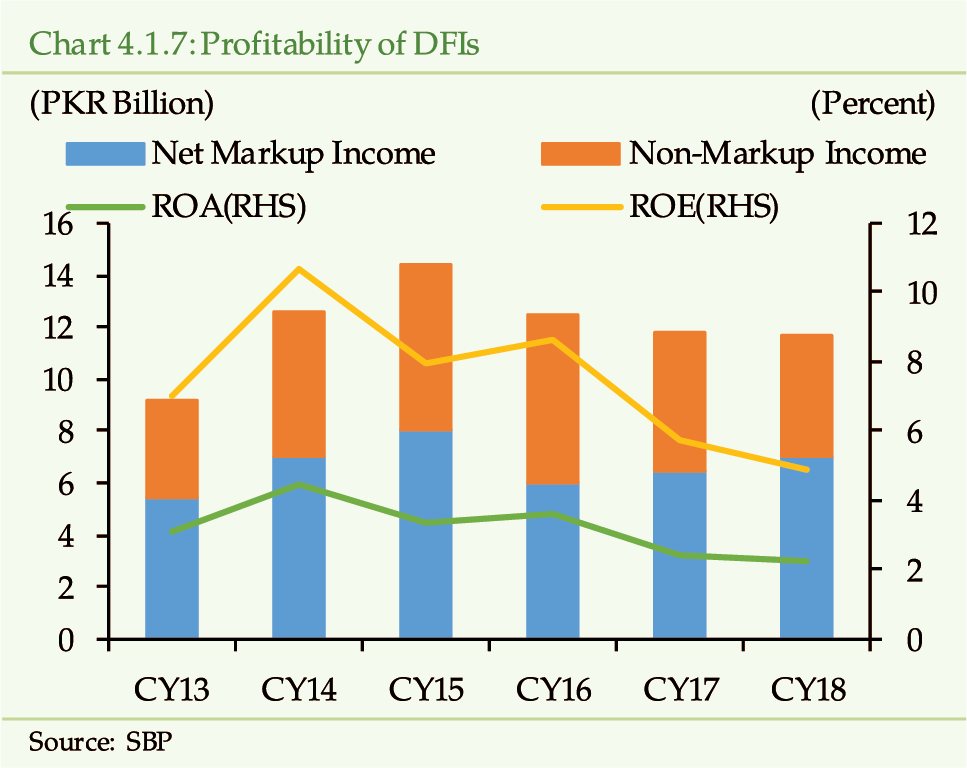

The Development Finance Institutions remains

well capitalized; though, they continue to operate with limited suite of financing

products. Particularly, the role of the DFIs in their key area of project

financing remains less than encouraging due to lack of affordable long term

funds. However, the renewed interest in SME financing during CY18 is a positive

development. The DFIs need to make concerted efforts to raise long-term funding

by exploring alternate resource mobilization avenues such as capital market

(See Chapter 4.1).

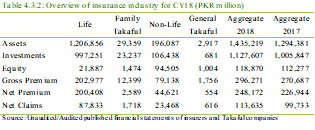

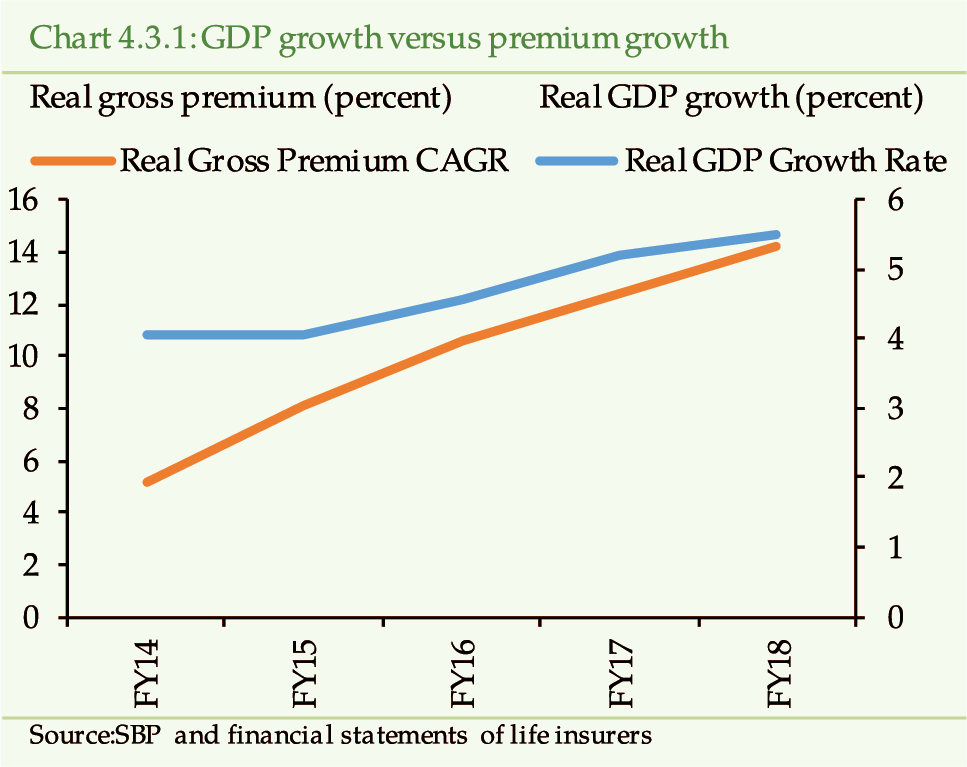

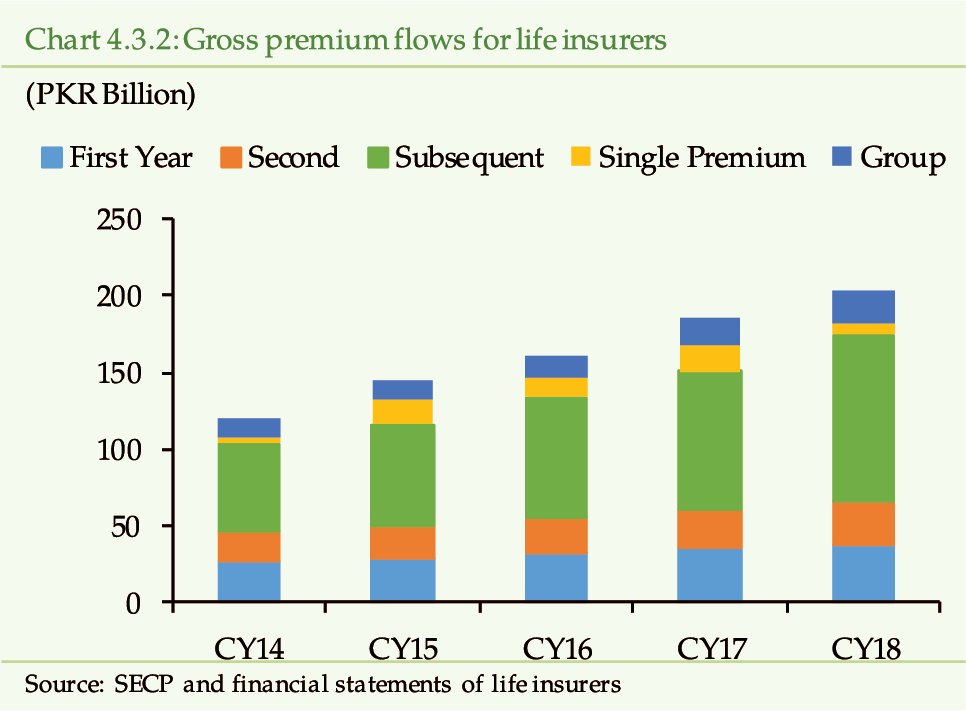

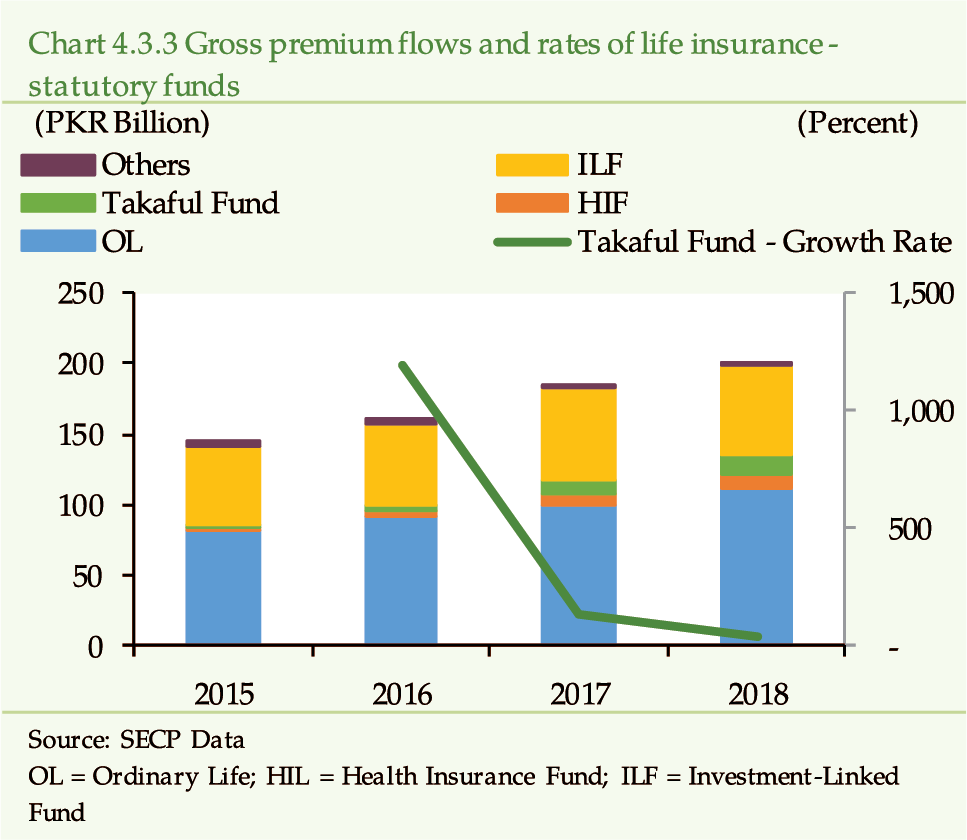

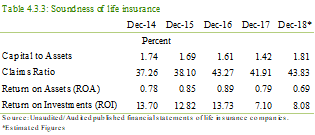

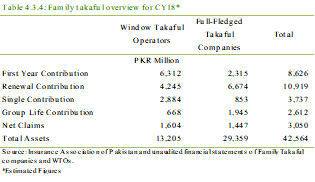

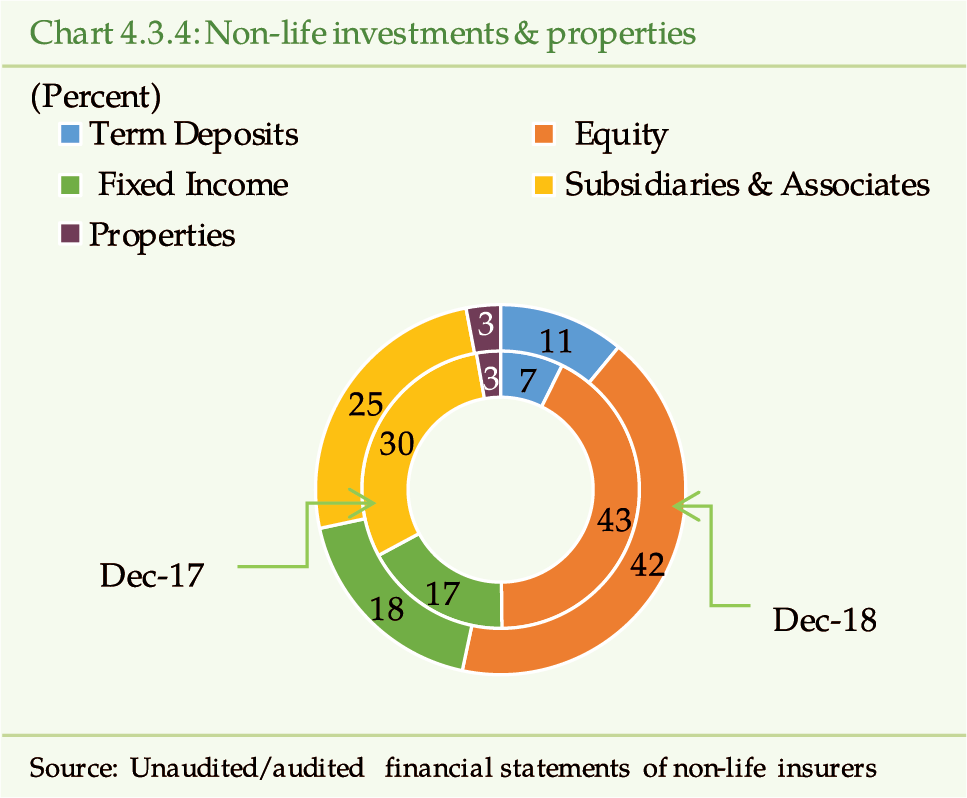

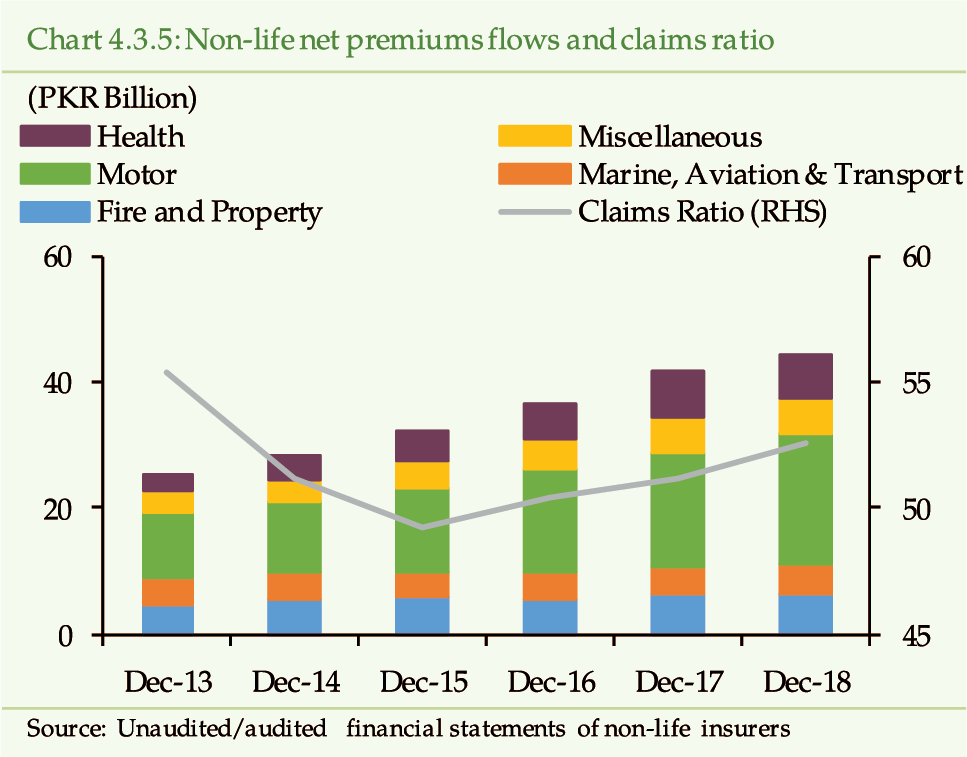

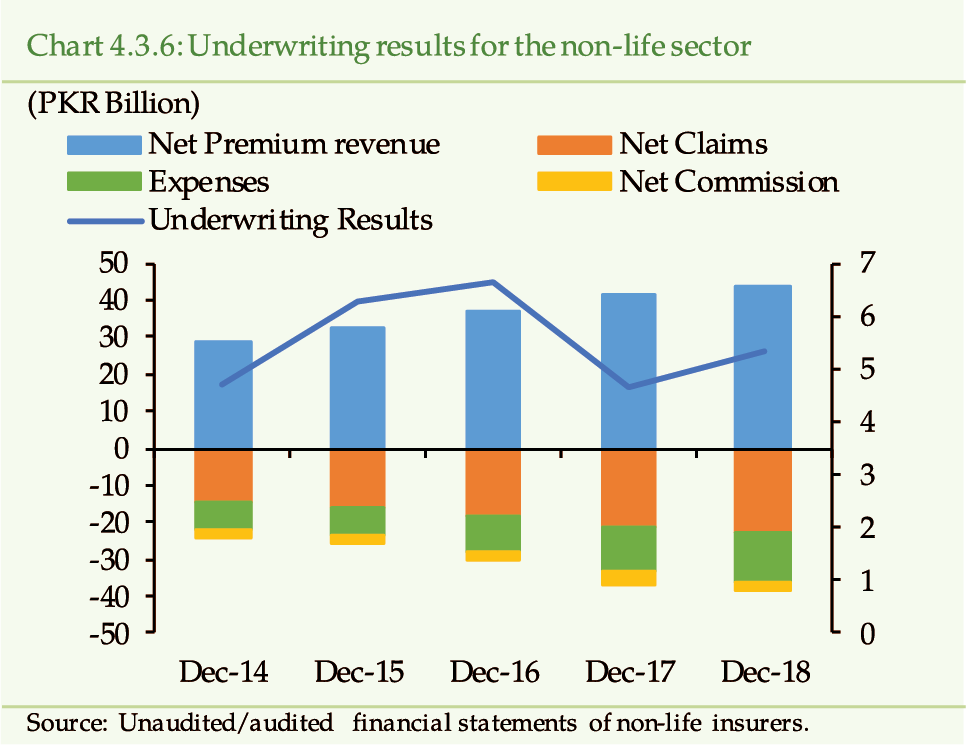

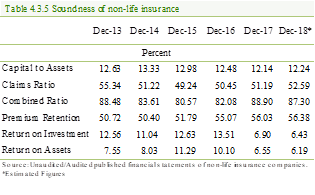

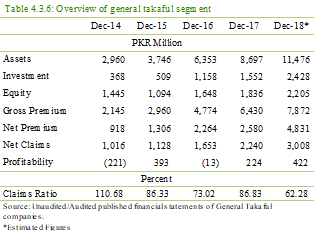

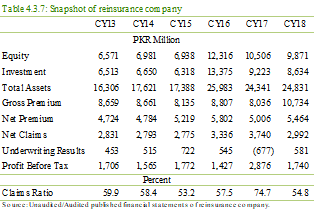

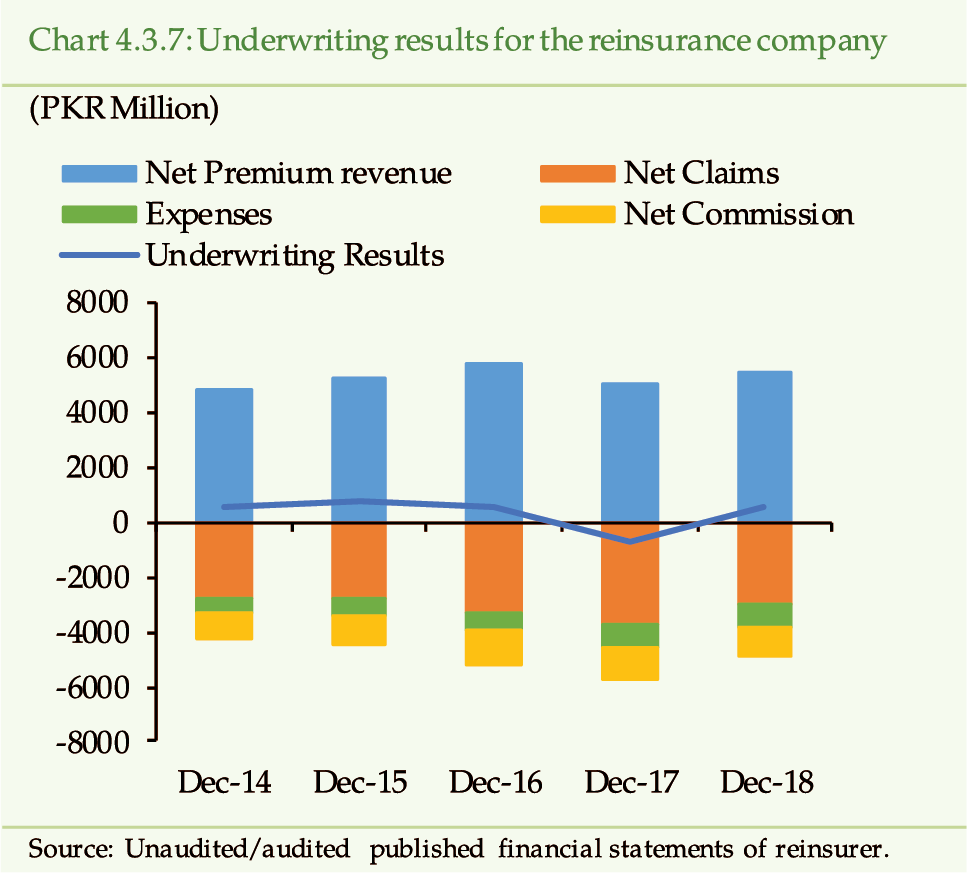

The asset base of the Insurance sector has

expanded by 10.88 percent in CY18, funded in part by 9.45 percent increase

in gross premiums. However, the profitability indictors for the sector have

slid down slightly owing to increase in net claims. Further, the concentration

remains a concern as the public sector insurers dominate the insurance industry.

Some non-life insurers are also facing solvency issues. These insurers need

to work on viable recovery plans or pursue possible consolidation avenues.

Nevertheless, the low insurance penetration in the country provides an opportunity

for the sector to grow (See Chapter 4.3).

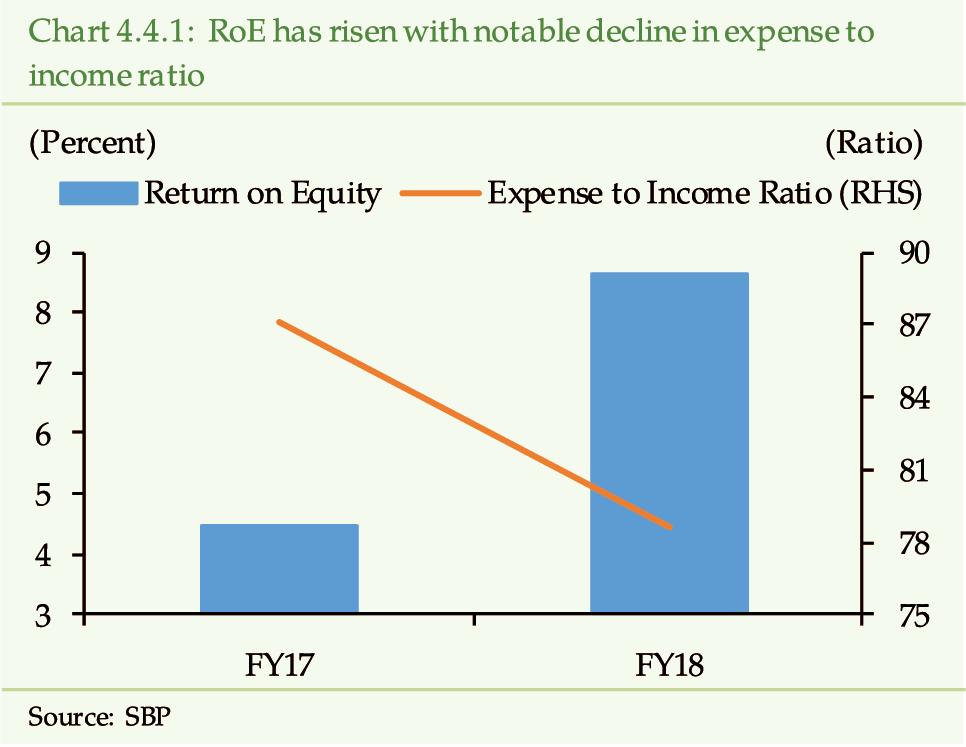

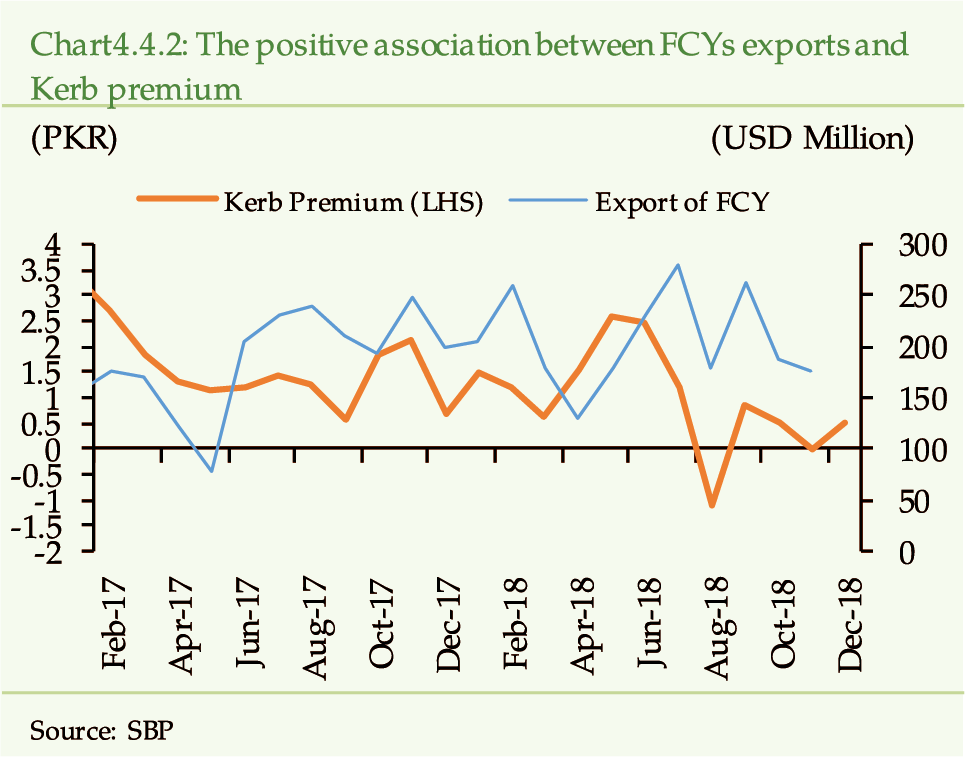

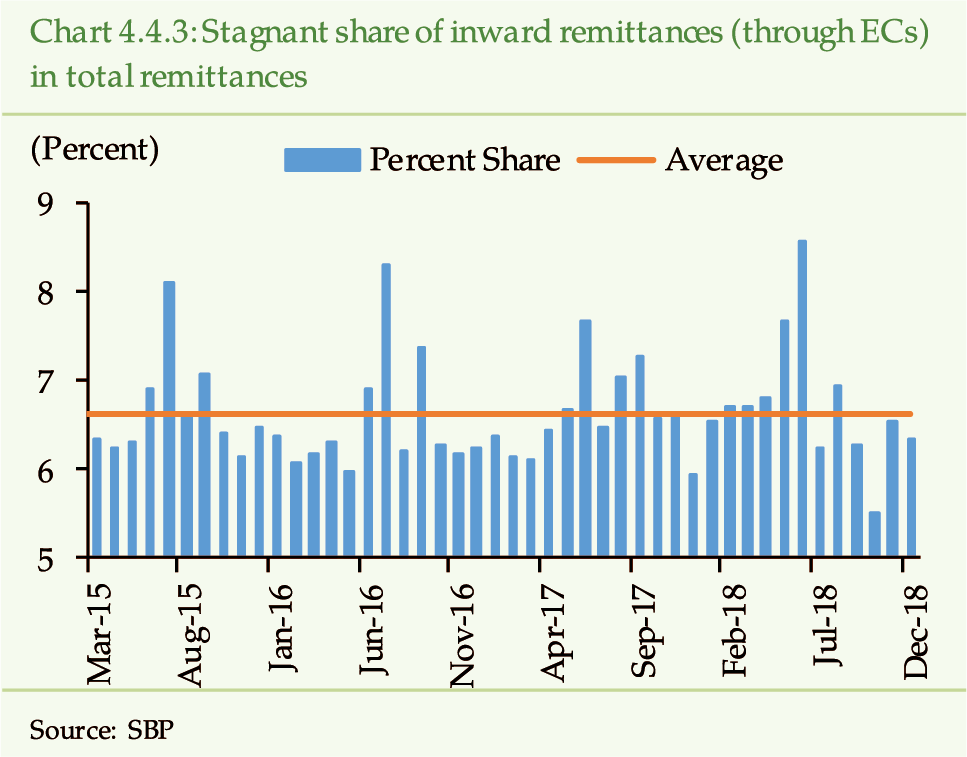

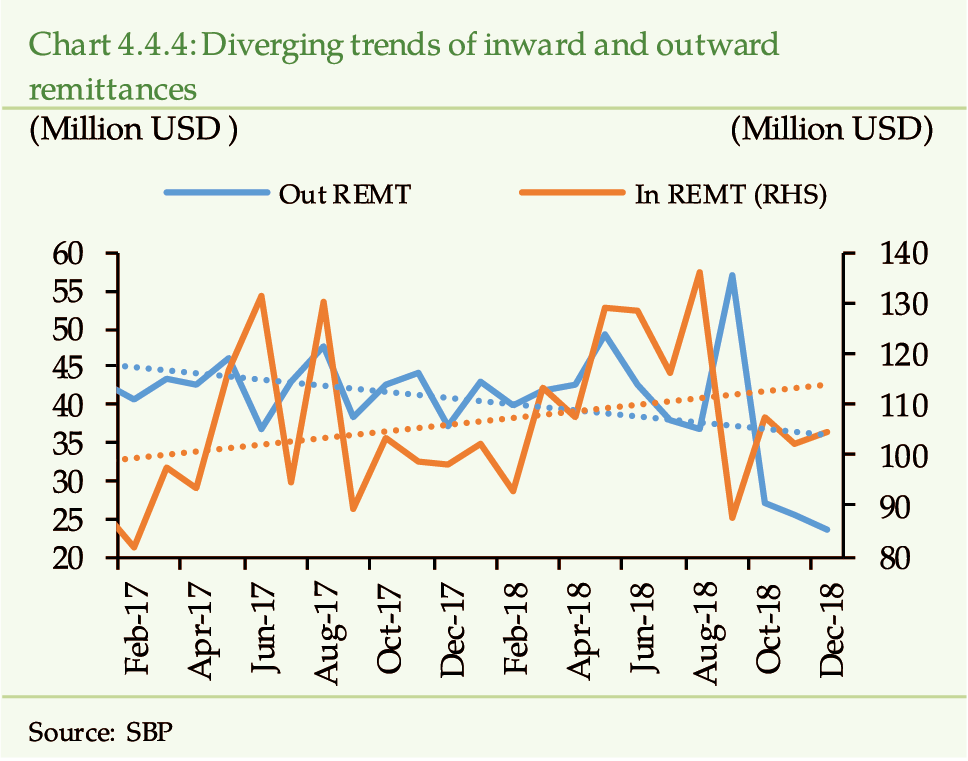

Due to their peculiar business model of dealing in

foreign currencies, the Exchange Companies (ECs) have benefited from

the exchange rate dynamics. However, the operational risk, especially relating

to AML/CFT, remains tangible for these companies. To address these concerns,

SBP has further strengthened the regulatory regime for ECs during the year

under review (See Chapter 4.4).

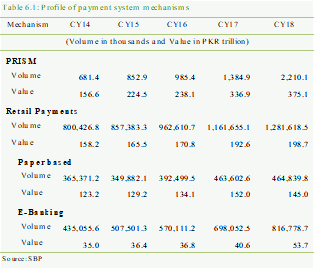

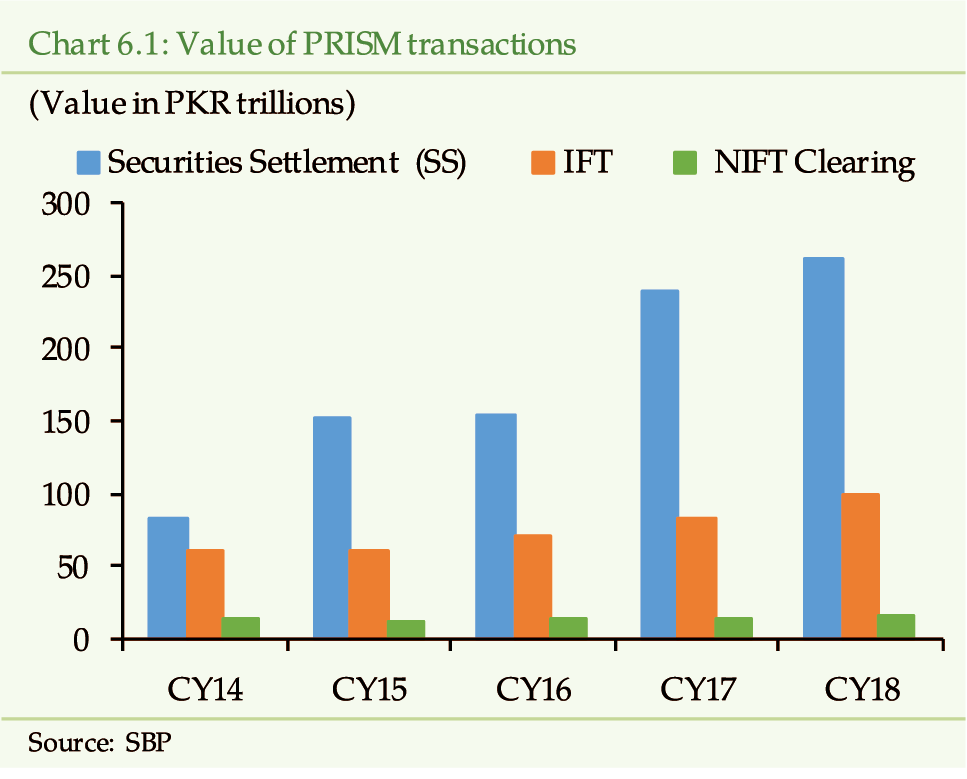

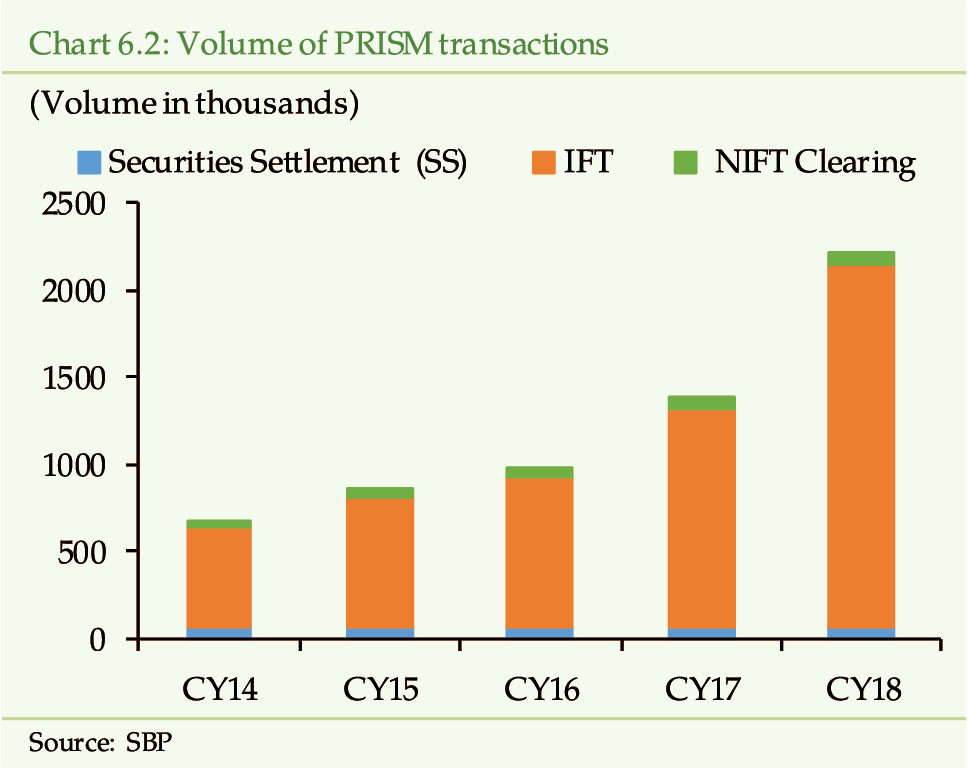

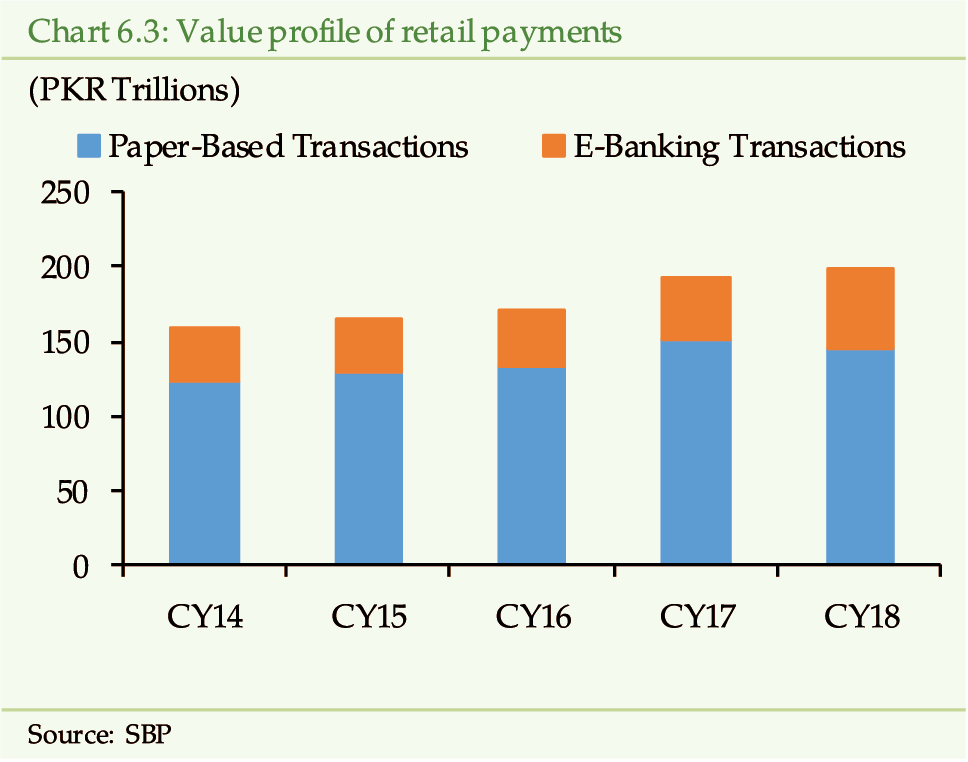

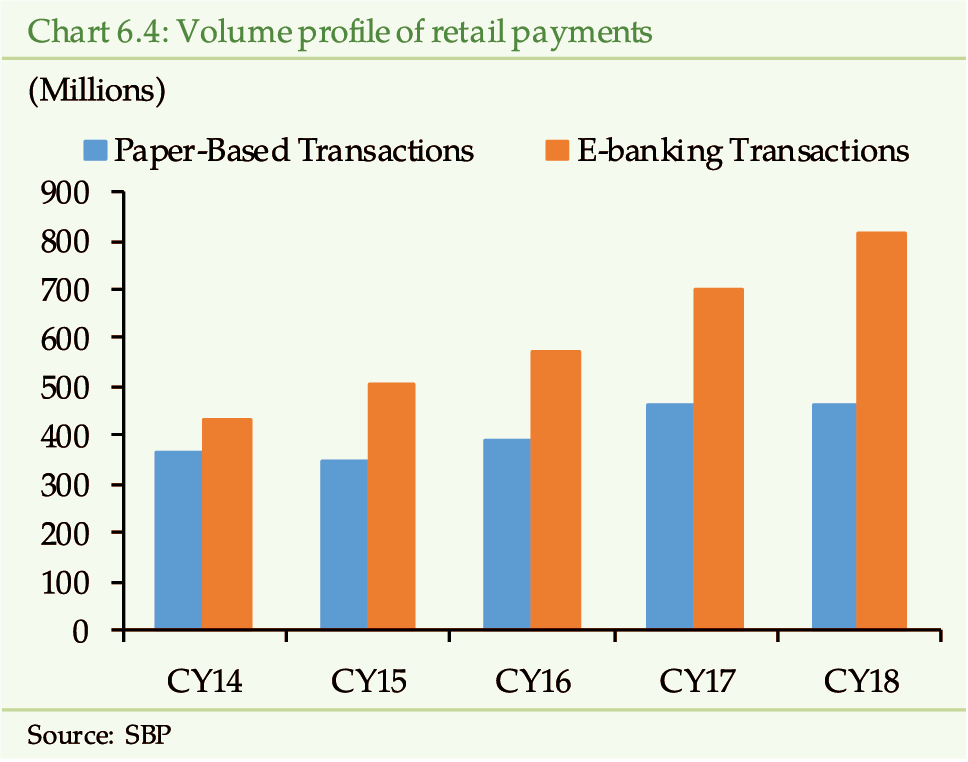

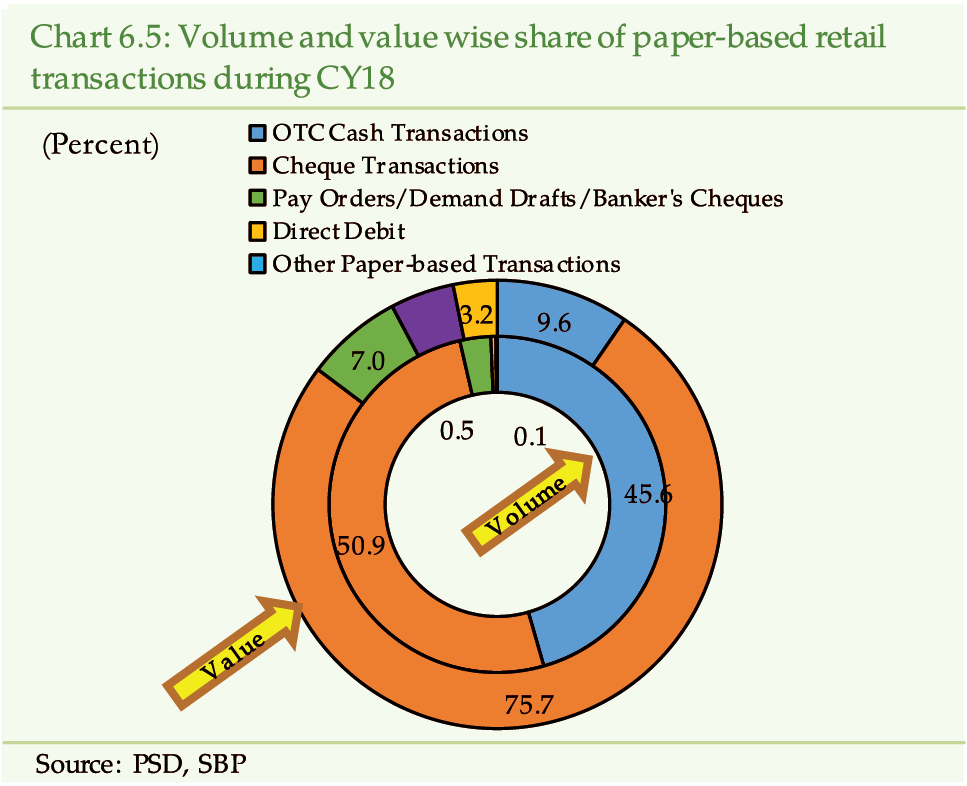

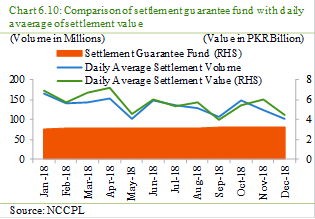

Financial Market Infrastructure (FMI) remains

resilient and continues to perform efficiently without any major disruption.

Pakistan Real-time Inter-bank Settlement Mechanism (PRISM) has settled a higher

volume and value of large-value transactions, whereas the retail-value segment

has also registered an uptrend. The increasing adoption of electronic modes

for payment indicates growing consumers trust in use of digital financial

services. Furthermore, access of the PRISM allowed to retail customers and

corporate securities settlement institutions

[12]

has infused efficiency in high-value retail settlements and operations

of the markets (See Chapter 6).

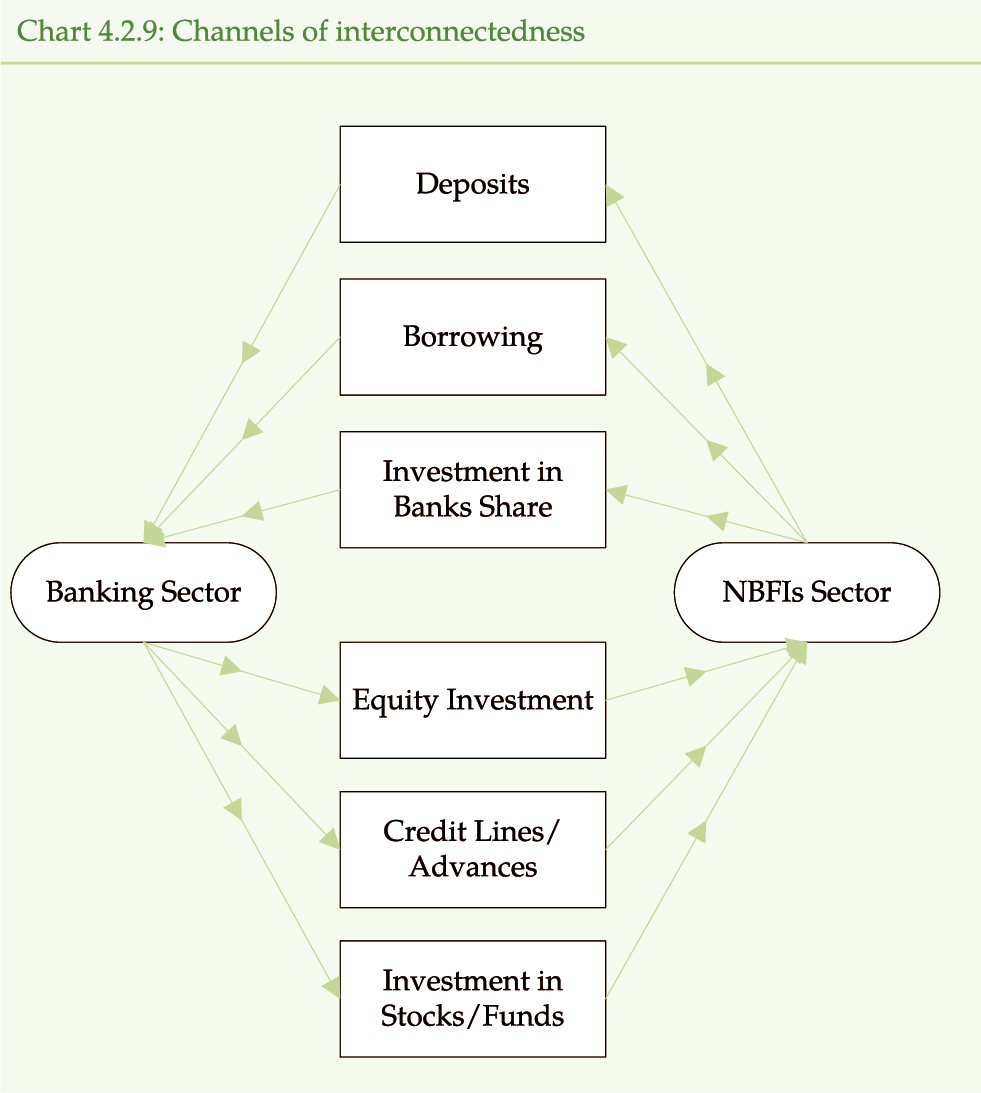

The integration between FMIs has also increased the

level of interconnectedness, which involves the element of contagion risk.

Coupled with this, the cyber-security risk poses additional challenges to

these FMIs, with retail payment segment being more vulnerable to the latter

risk category. To safeguard against these emerging threats, SBP has taken

various measures to protect the integrity of the FMIs. Particularly, a comprehensive

set of instructions has been issued to ensure security of digital payments.

Moreover, the National Clearing Company Limited (NCCPL) and Central Depository

Company (CDC), which constitute the corporate securities settlement infrastructure,

have also strengthened their risk management practices.

To guard against the cyber security risk, banks have

also fortified mitigation measures. Most of the banks have implemented multifactor

authentication to strengthen the security of internet banking transactions,

whereas they continue to work on strengthening their intrusion detection and

prevention systems to protect their IT infrastructure from cyber-attacks.

Furthermore, in compliance with SBP’s regulations, banks have been issuing

payment cards with Euro-MasterCard-Visa (EMV) anti-skimming standards.

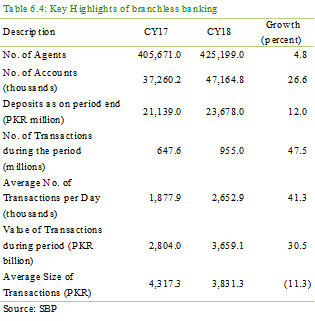

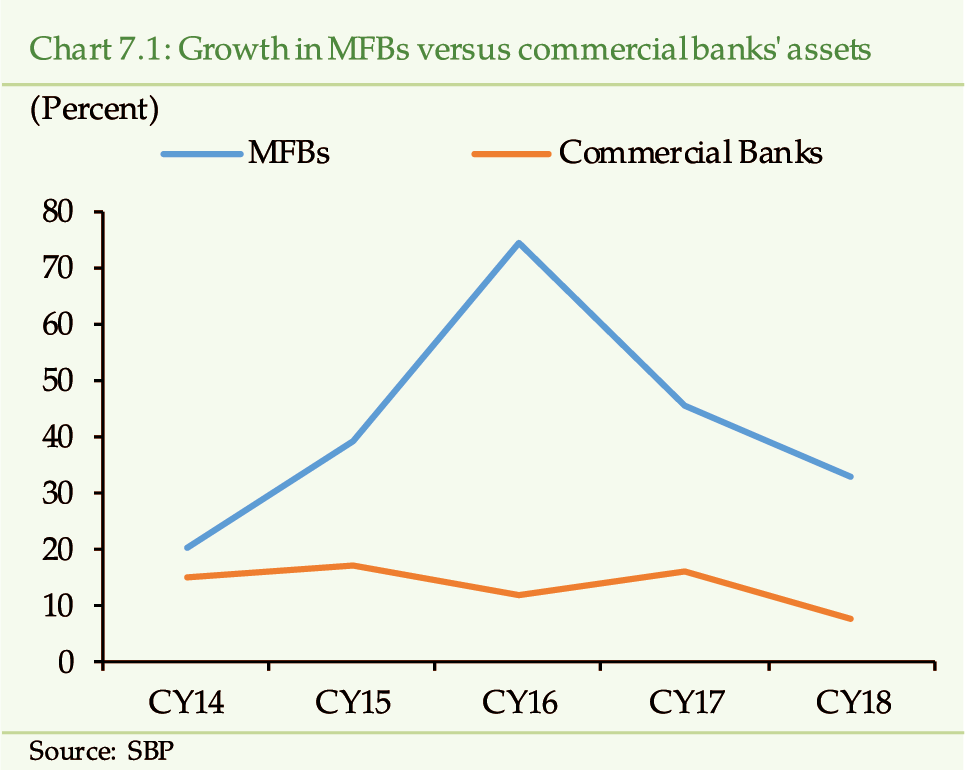

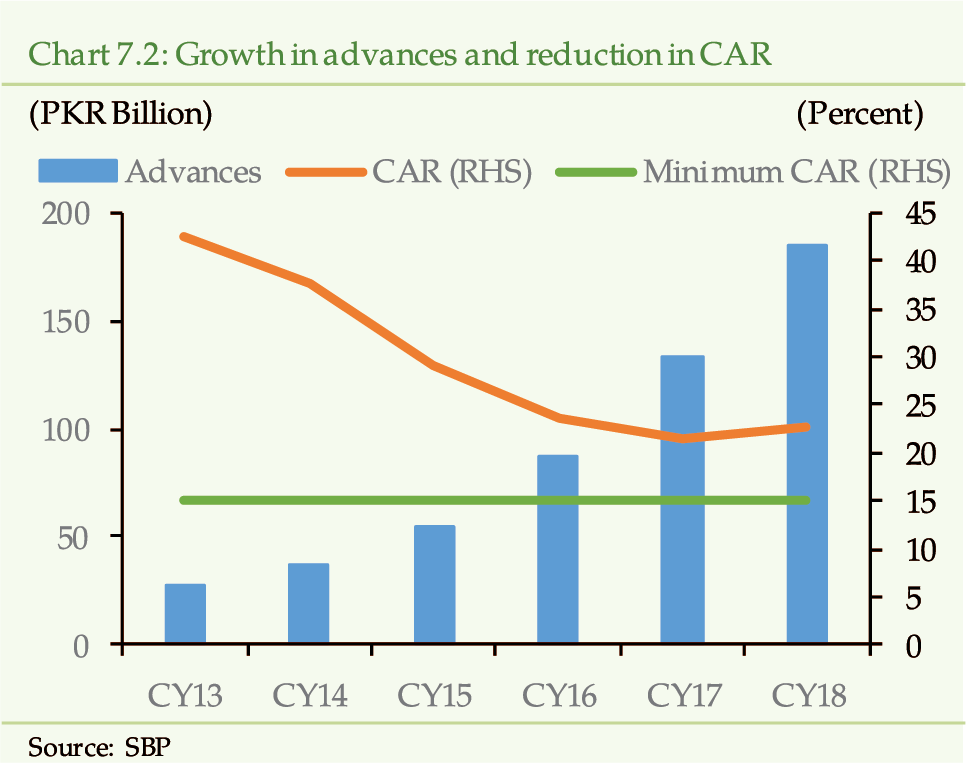

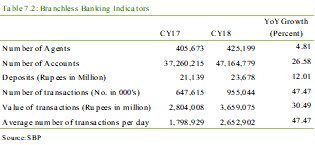

Financial inclusion in the country is accelerating

due to increased access to quality financial services to a wider stratum of

the population. Especially, the branchless banking and m-wallet accounts have

remained the key drivers in enabling the financial access to the underserved

areas of the country. Microfinance banks, an important element of National

Financial Inclusion Strategy (NFIS), continue to perform well with improved

resilience. At present, growing financial inclusion poses minimal concerns

to financial stability due to lower inclusion base, risk based due diligence

of customers, and comprehensive regulatory and supervisory framework in place

(See Chapter 7).

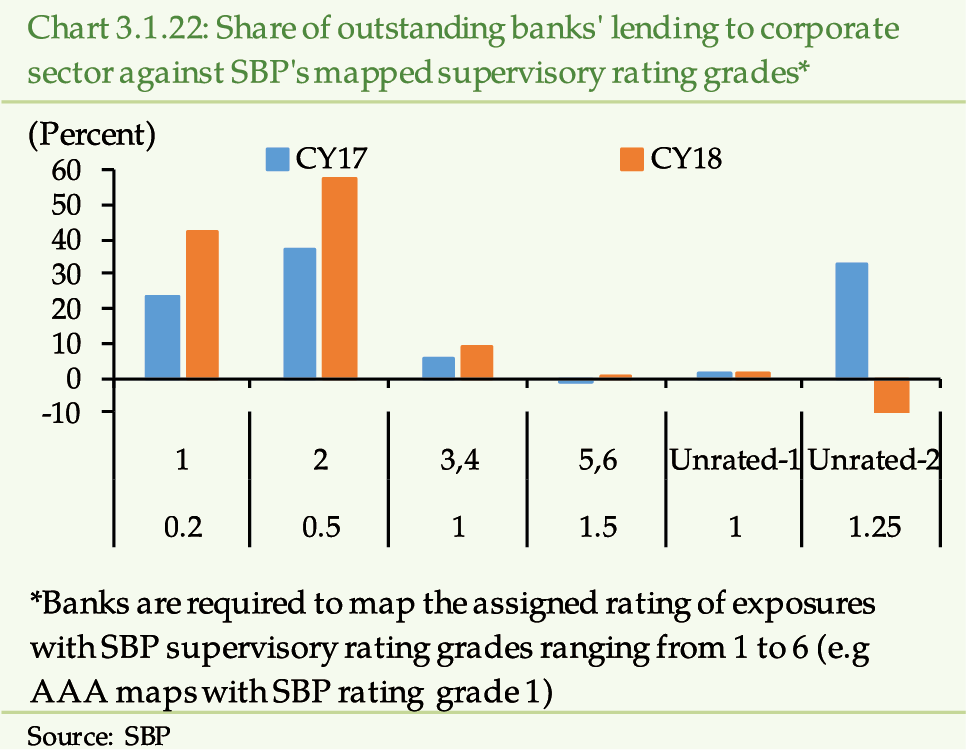

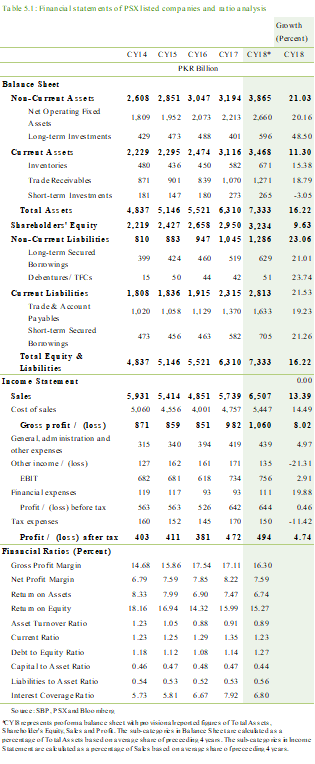

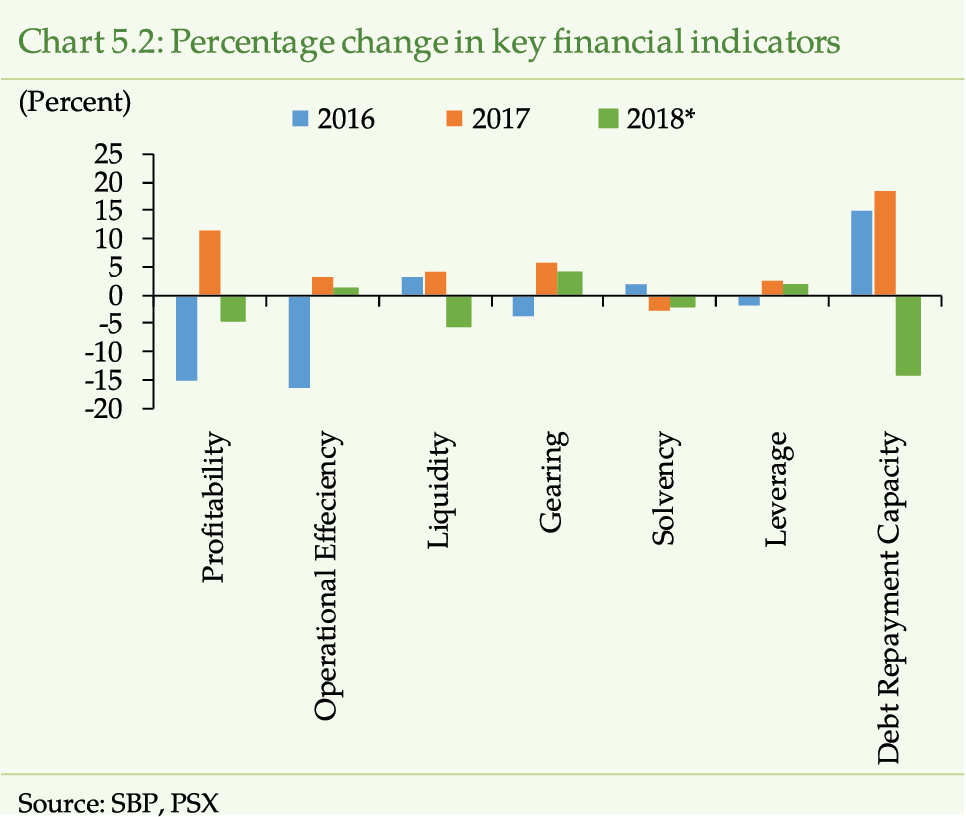

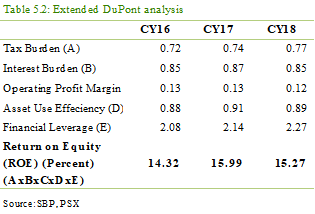

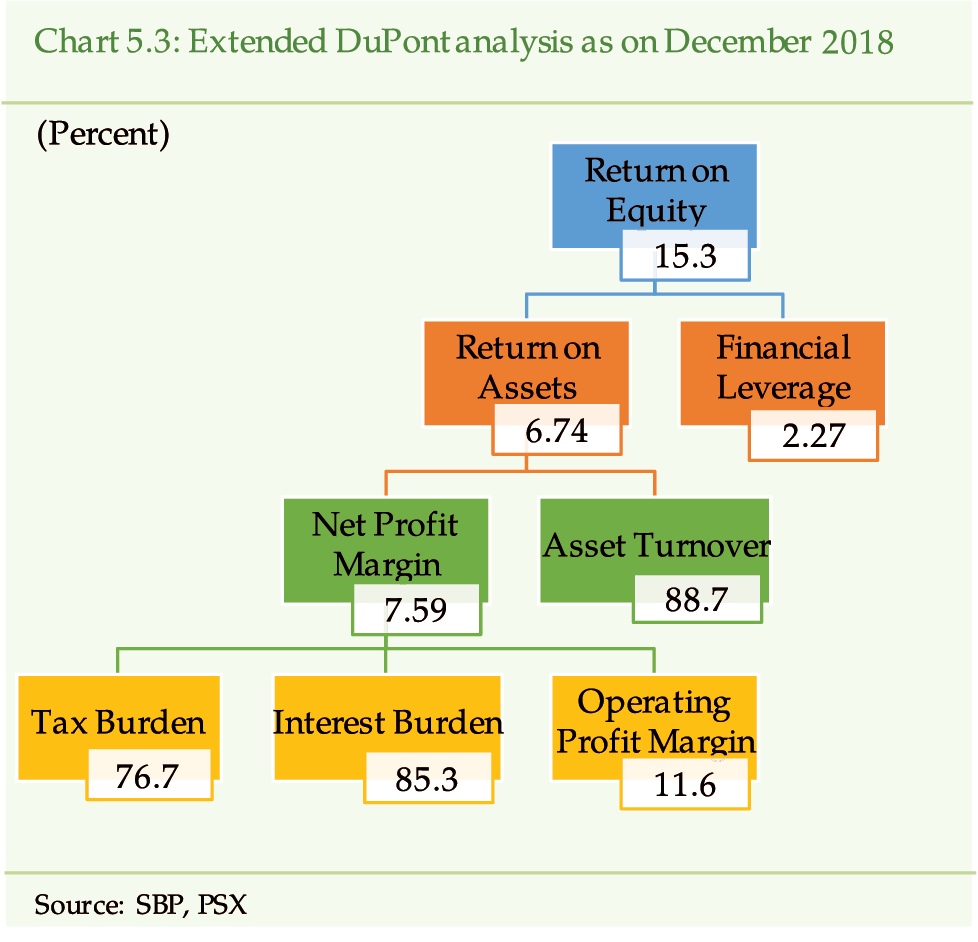

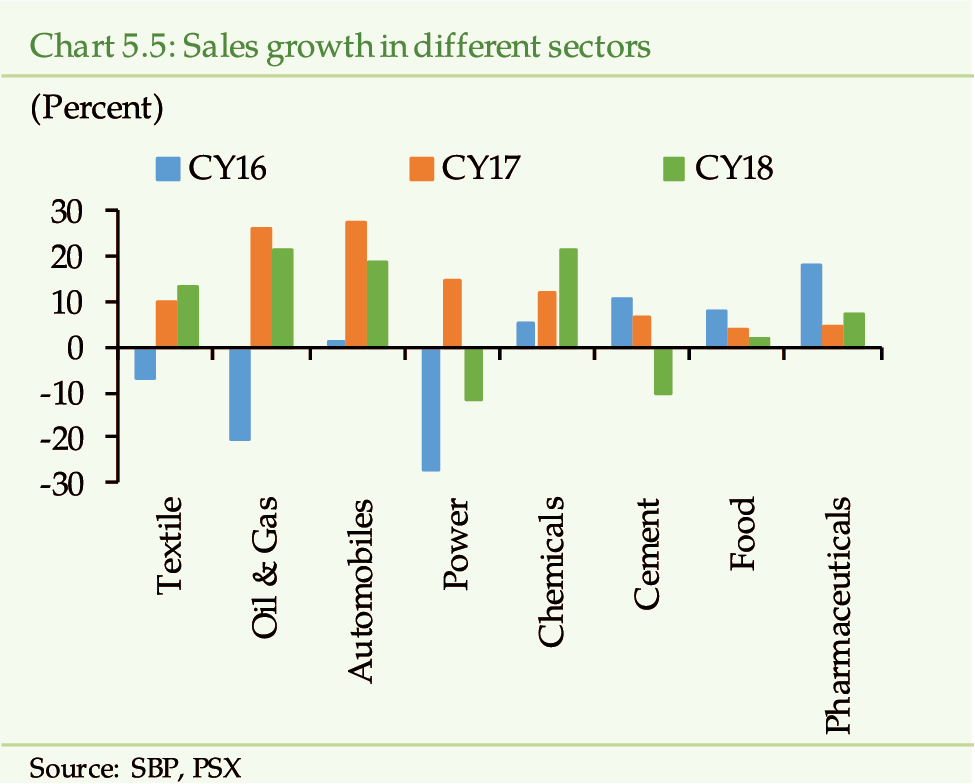

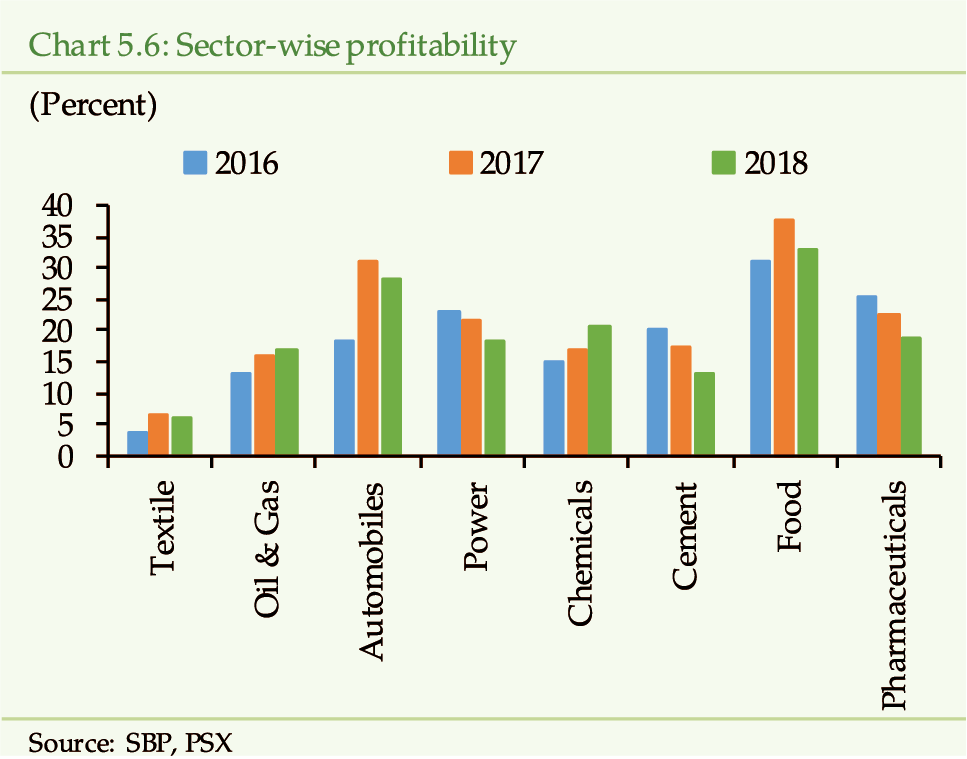

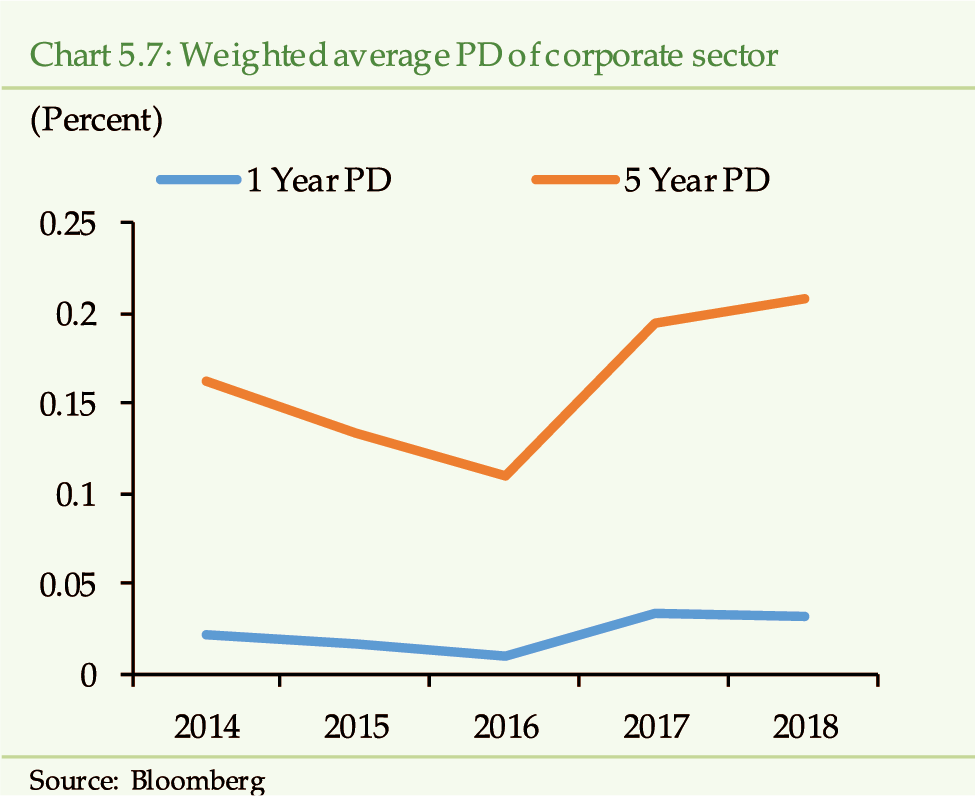

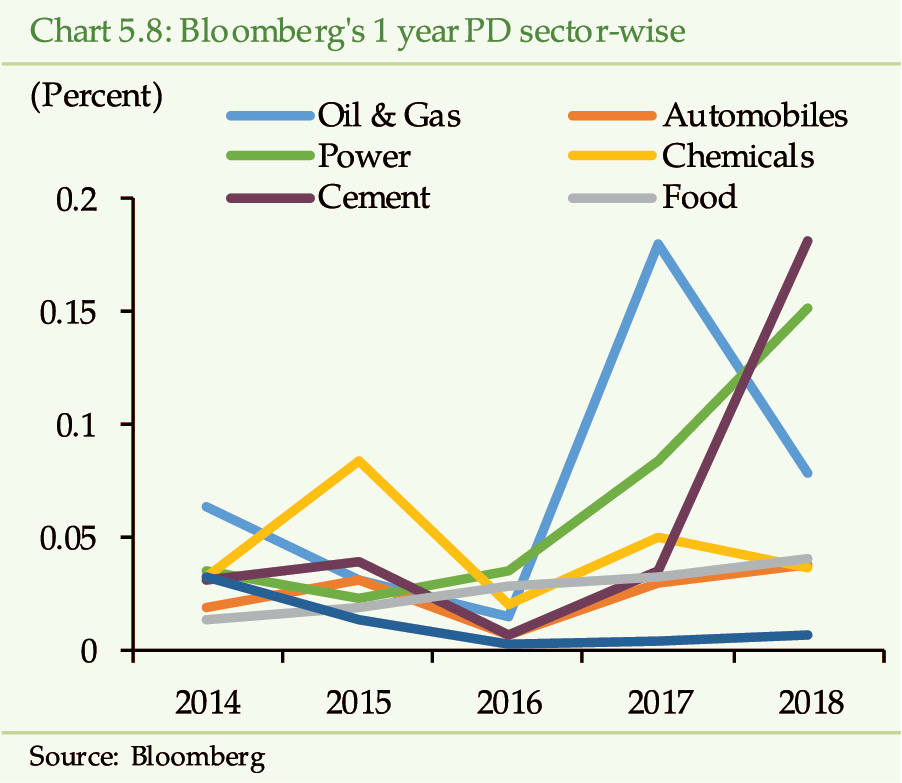

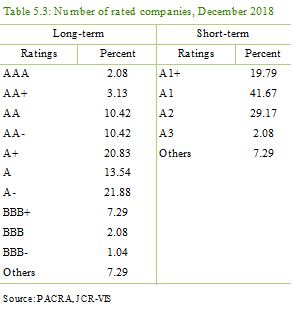

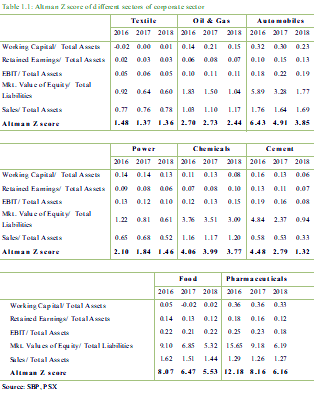

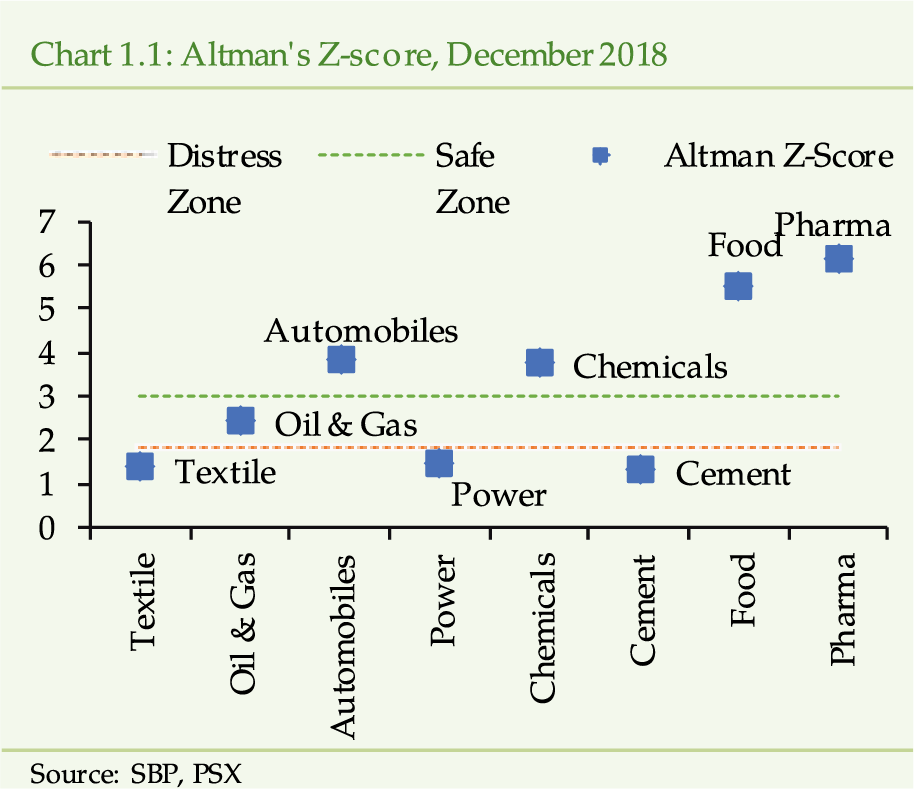

The performance of non-financial corporate sector

has moderated as reflected in the slackness of its operational

efficiency and financial standing in CY18. The leverage of the sector has

inched up, whereas liquidity, debt repayment capacity and profitability have

slightly declined. The investors’ perception about the corporate sector has

also weakened as illustrated by a drop in stock prices and other leading market

indicators. Positively, the rating culture in the corporate sector is on the

rise. The phased decline in corporate tax rate as proposed in the interim

fiscal budget is likely to augment profitability of the corporate sector (See

Chapter 5).

Anti Money Laundering/Countering Financing of Terrorism

(AML/CFT) is another key area where local regulatory bodies are making continuous

efforts to safeguard the financial system against ML/FT risk. Though Pakistan

has recently been identified as a jurisdiction with strategic AML/ CFT deficiencies,

it has made a high-level political commitment to implement the action plan

for overcoming the identified gaps. To this end, a number of measures have

been introduced that demonstrates the seriousness of the country to ensure

a robust AML/CFT regime. Key regulatory initiatives include a)- establishment

of dedicated CFT desk in banks, b)- ensuring biometric verification of 100

percent portfolio, c)- issuance of guidance to bring more clarity on the regulatory

expectations in the areas of consumer due diligence, corresponding banking,

wire transfer, compliance with UNSC sanctions, definitions of beneficial owner

and legal entity, counter measures for high-risk countries, etc., d) strengthening

of regulations for NBFCs including adoption of risk-based approach, e) extension

of regulatory regime to cover Designated Non-Financial Business & Professions,

NGOs, Pakistan Post, etc. and f) amendment in the Protection of Economic Reform

Act to strengthen the regime around foreign currency accounts and movement

of foreign currency (See Box-4).

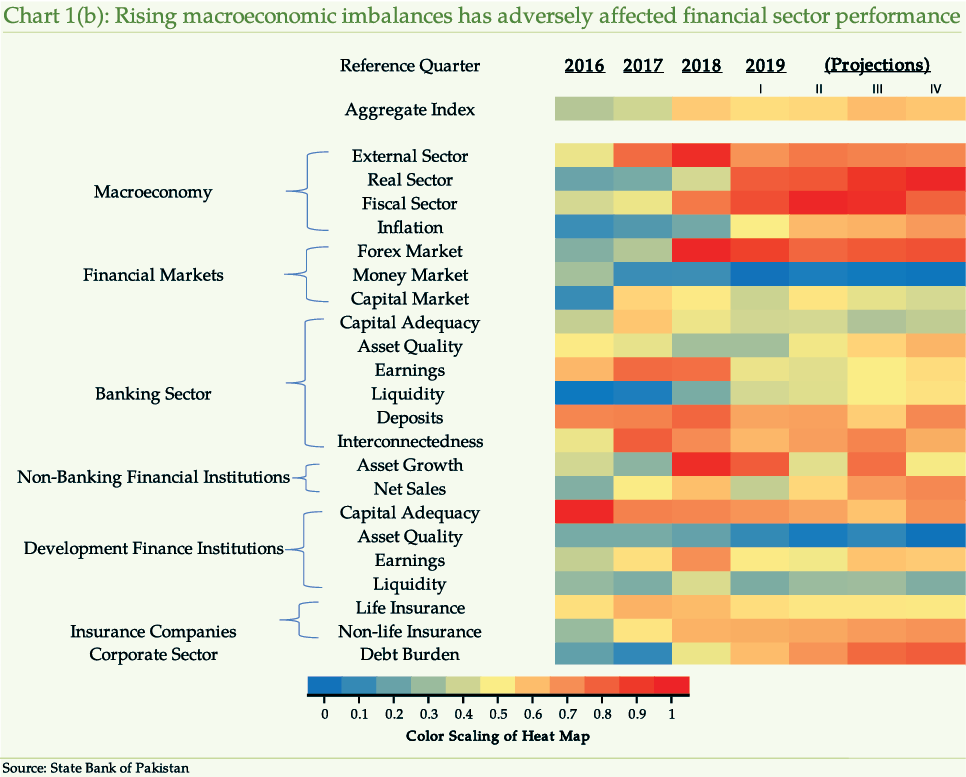

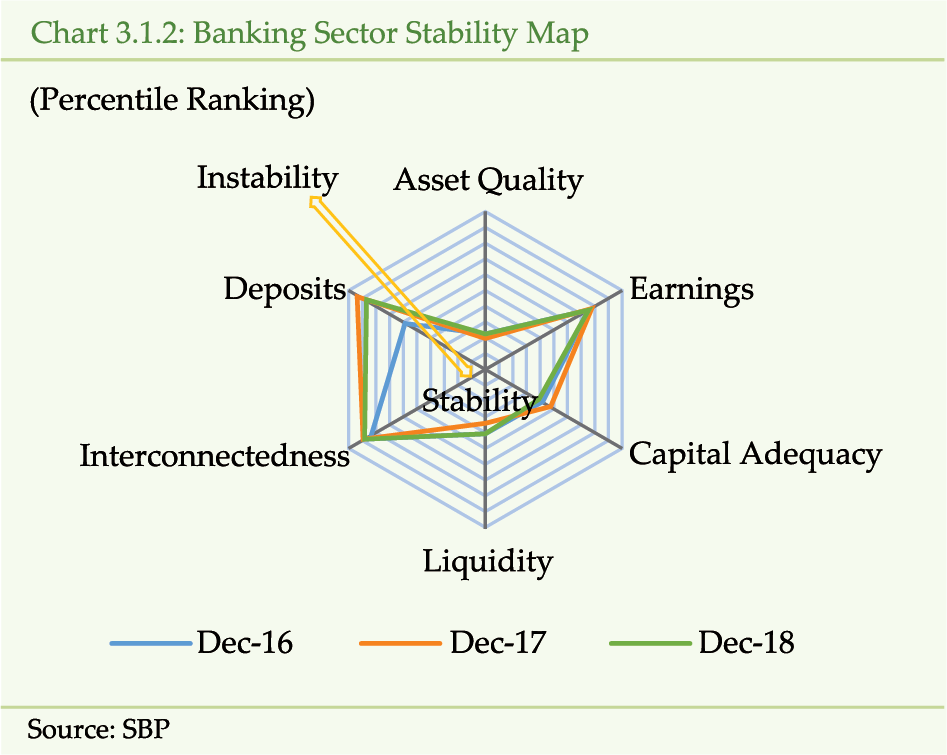

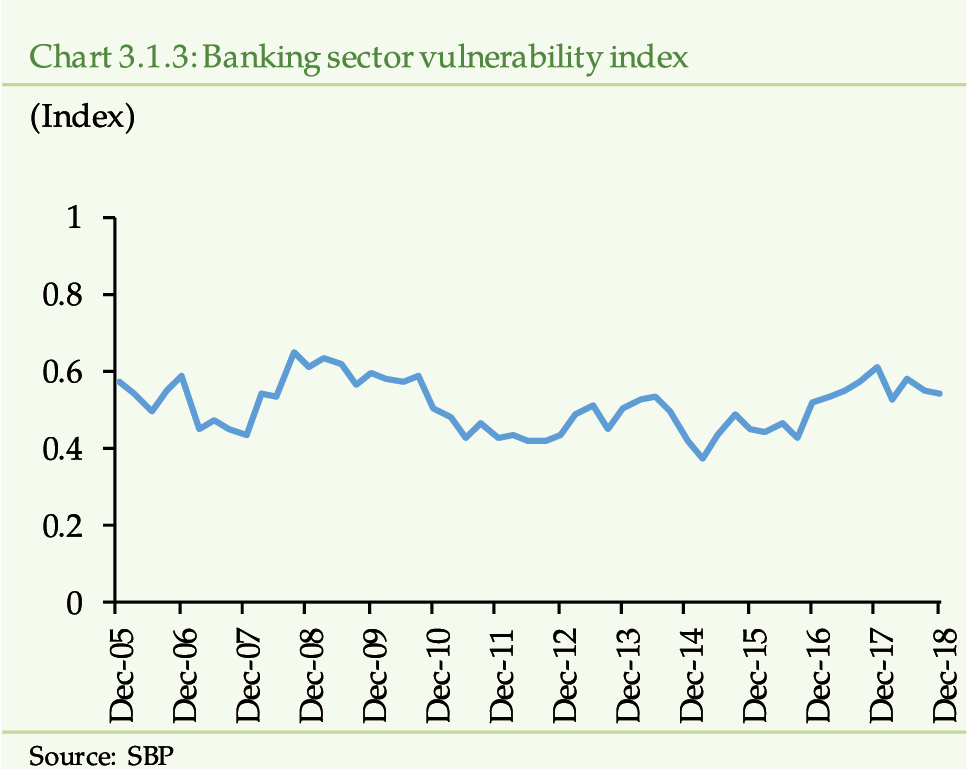

The consolidated picture thus reveals that, amid rising

macro-financial challenges, risks to financial stability have somewhat increased

during CY18 (Chart 1a) (Chart 1b).

.png)

Financial Sector Outlook…

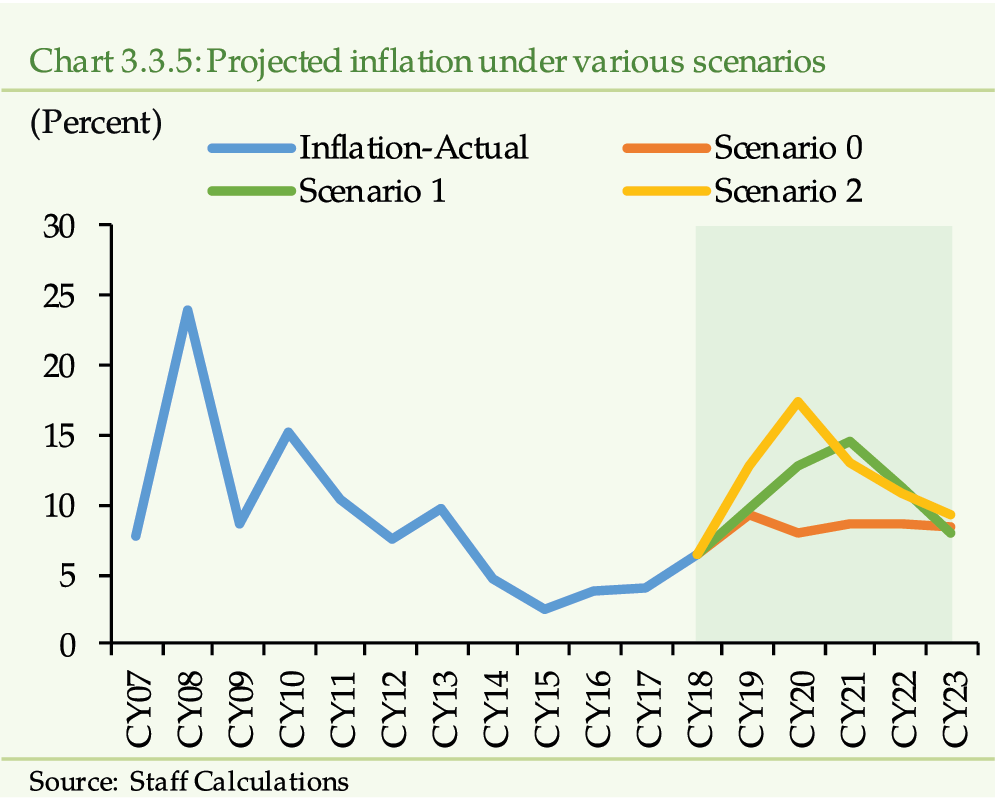

Post CY18, the macroeconomic imbalances, particularly

the fiscal deficit, have widened. The current account deficit, though narrowing

gradually, remains at elevated level putting pressure on foreign exchange

reserves. SBP has raised the policy rate by 325 bps post CY18 (until July

2019) to address these macroeconomic challenges. In the near future, the necessary

policy measures for the stabilization of the economy such as rationalization

of taxes in the budget FY19-20 and adjustment in utility prices may further

slowdown the pace of economic wheel. The real GDP is expected to rise modestly

in FY20. The average CPI Inflation has remained within the range of 6.5-7.5

percent in FY19 but is anticipated to be considerably higher in FY20.

[13]

There are considerable uncertainties around the projected

path of the financial vulnerability index (Chart 1b).

[14]

External account imbalances may have strong repercussions for the

financial markets. The uncertainty surrounding the equity market may continue

to strain the performance of mutual funds and insurance sector, which are

more dependent upon the capital market. The monetary tightening may affect

the debt repayment capacity of the borrowers with some lag. In the backdrop

of this challenging economic outlook, the corporate sector could perform below

its full potential. Therefore, improvement in macroeconomic conditions and

successful implementation of the IMF program will be the key drivers in ensuring

stability of the financial sector.

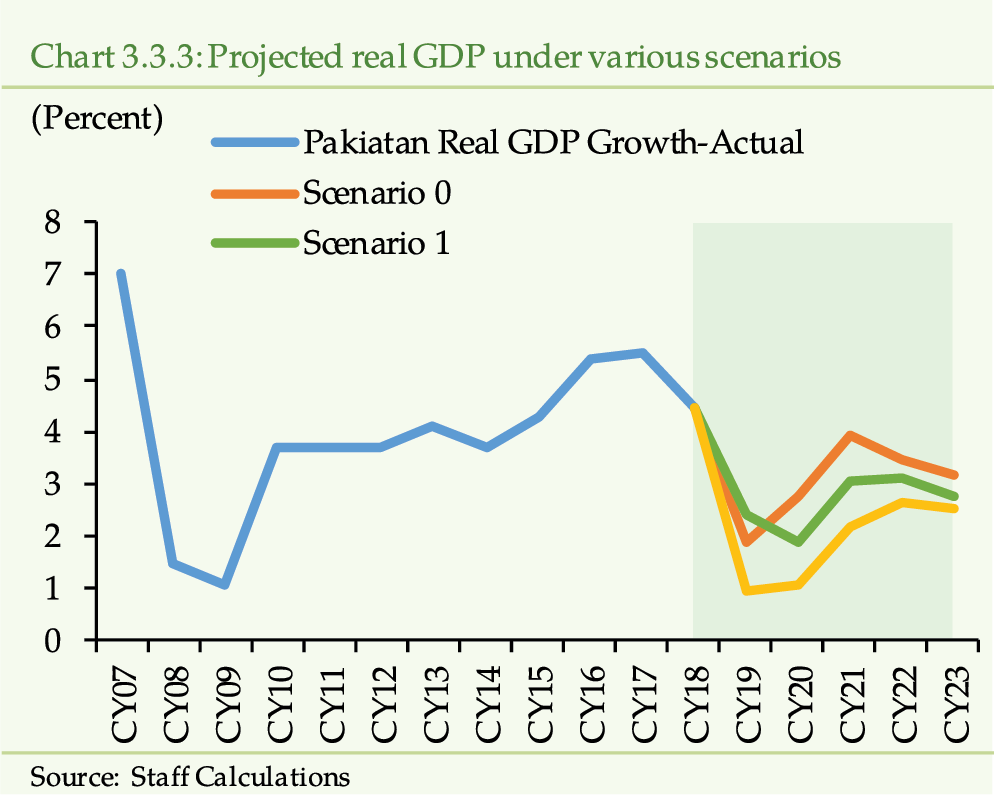

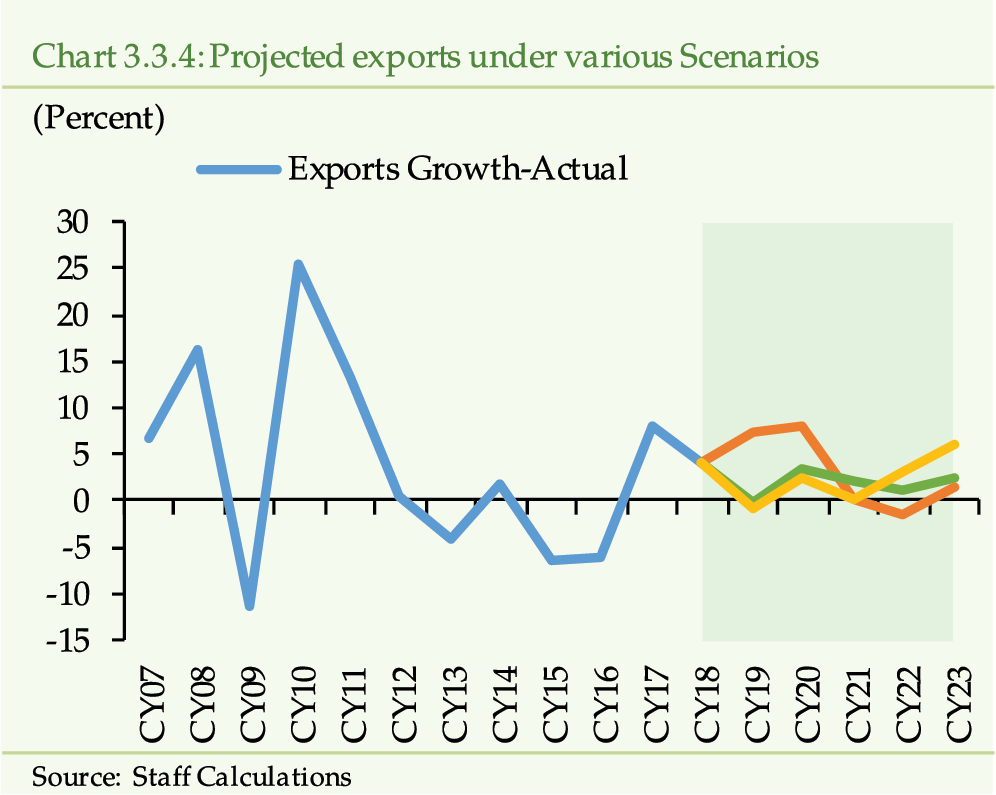

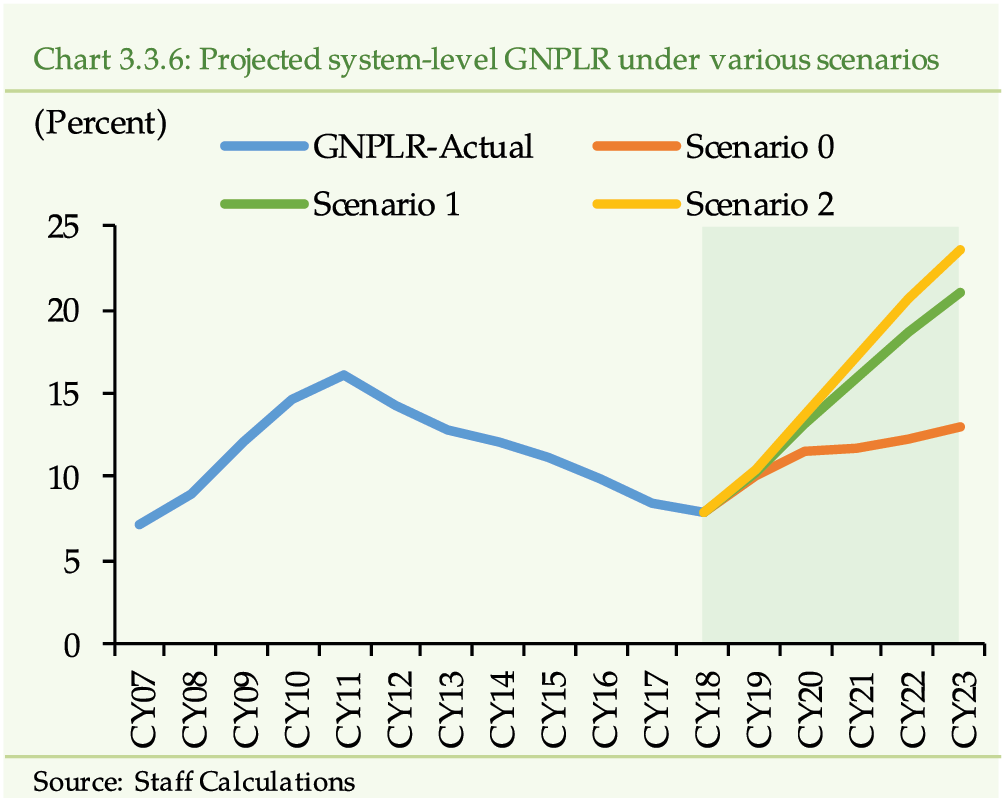

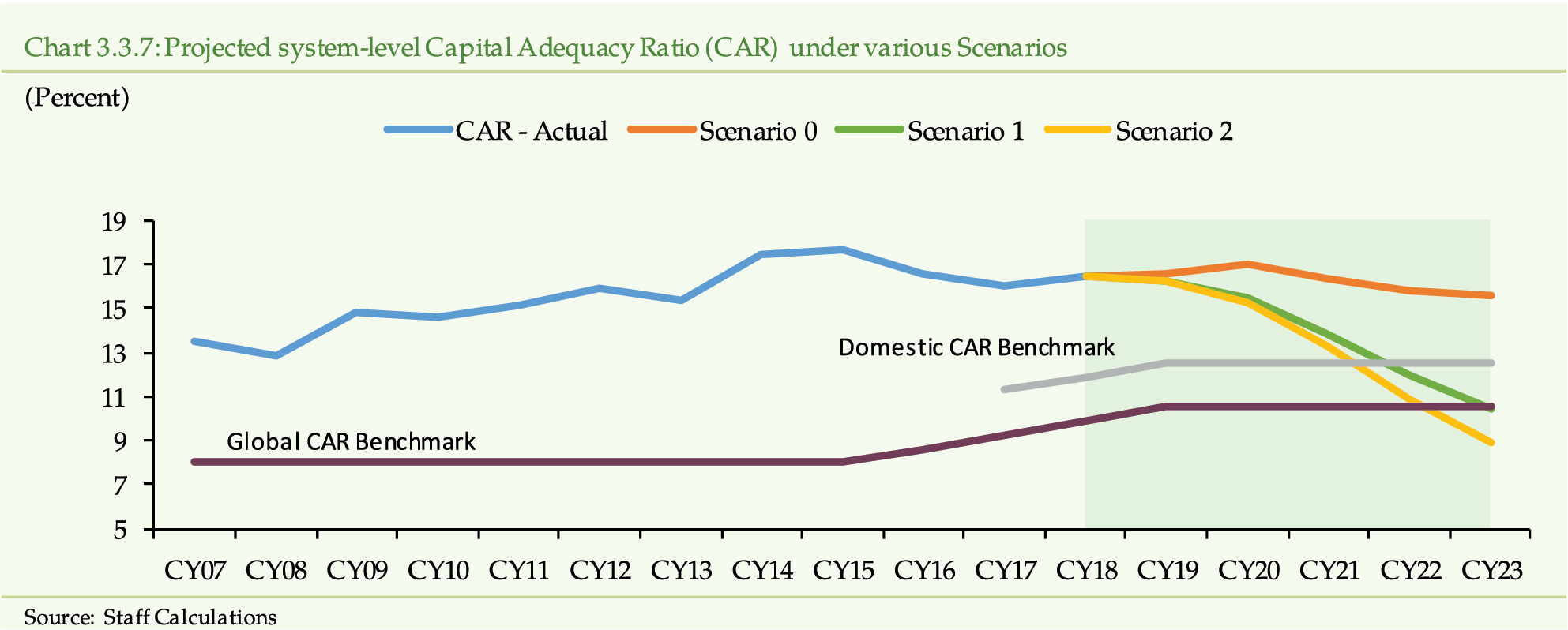

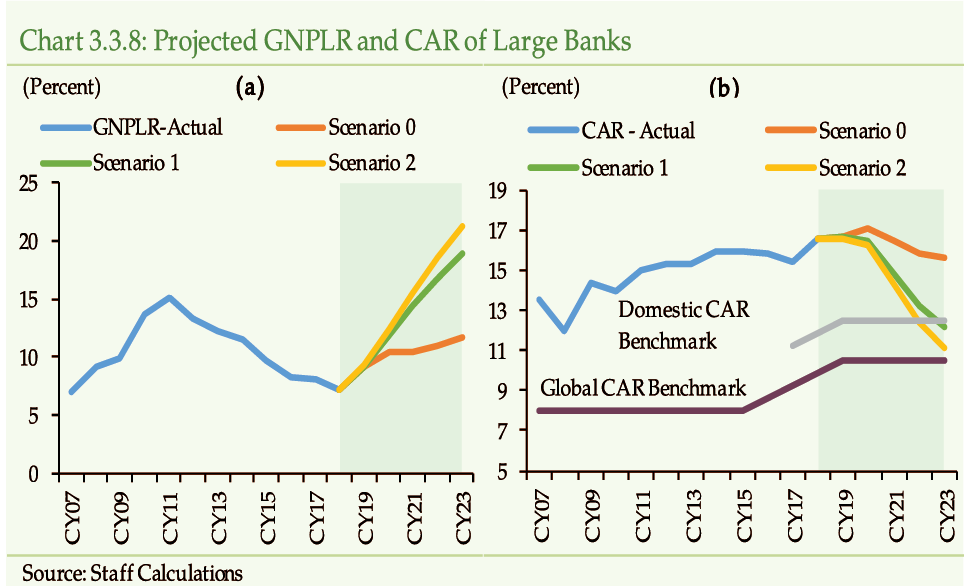

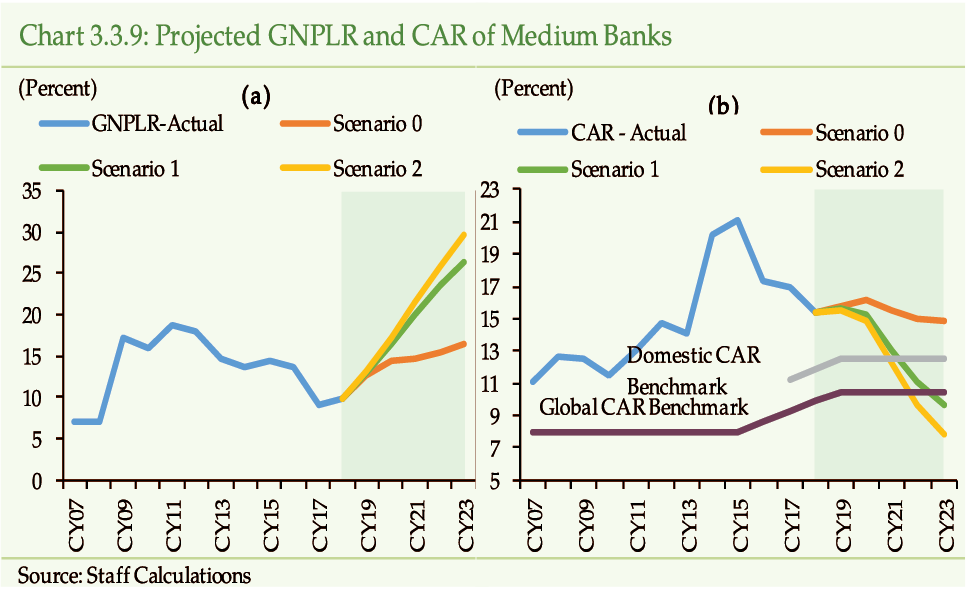

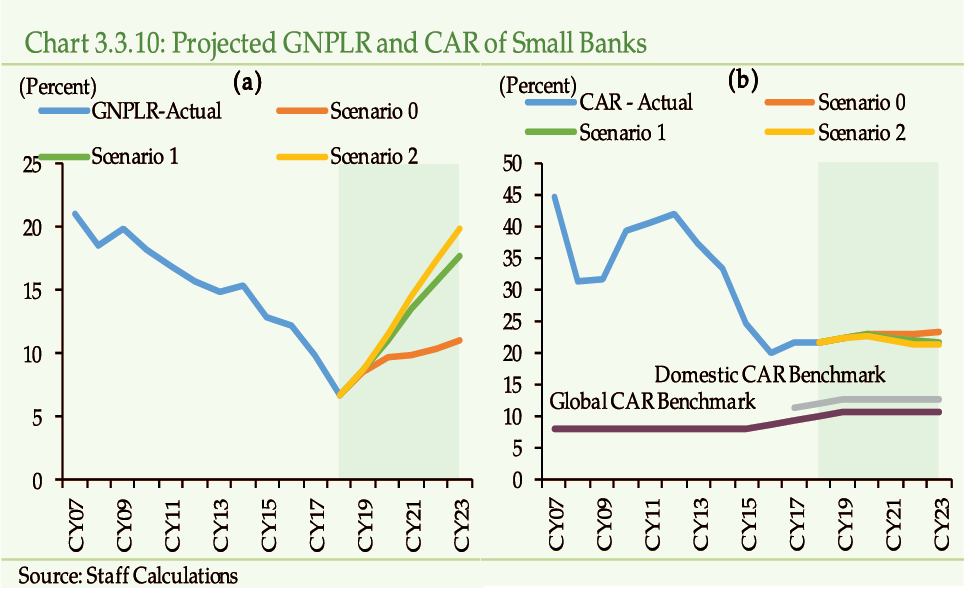

The assessment of resilience of the banking sector

to probable future domestic or global stress event in the medium term is of

paramount importance. This year’s stress testing results indicate that the

banking sector can withstand for three years the severe and protracted downturn

induced by hypothetical adverse global macroeconomic conditions. The large

banks, however, carry sufficiently higher capital buffers and are able to

sustain the impact of hypothesized shocks for around four years (See Chapter

3.3).

The 3rd wave of SBP Systemic Risk Survey (conducted

in Jan-2019), reveals that foreign exchange rate risk, balance of payment

pressures, widening fiscal deficit and increase in domestic inflation would

remain the key risks to financial system stability for the next six months

(See Box 1).

SBP is aware of these emerging challenges to the financial

sector and has taken steps to foster risk management practices and enhance transparency

in its regulated sectors, which constitute 76.21 percent of the total financial

sector’s assets. SBP is also working in collaboration with other stakeholders

for formulating and implementing a comprehensive and well-stru ctured Macroprudential

Policy Framework to ensure stability of the financial sector (See Box 2).

Box 1: SBP’s Systemic Risk Survey-3rd Wave (January, 2019)

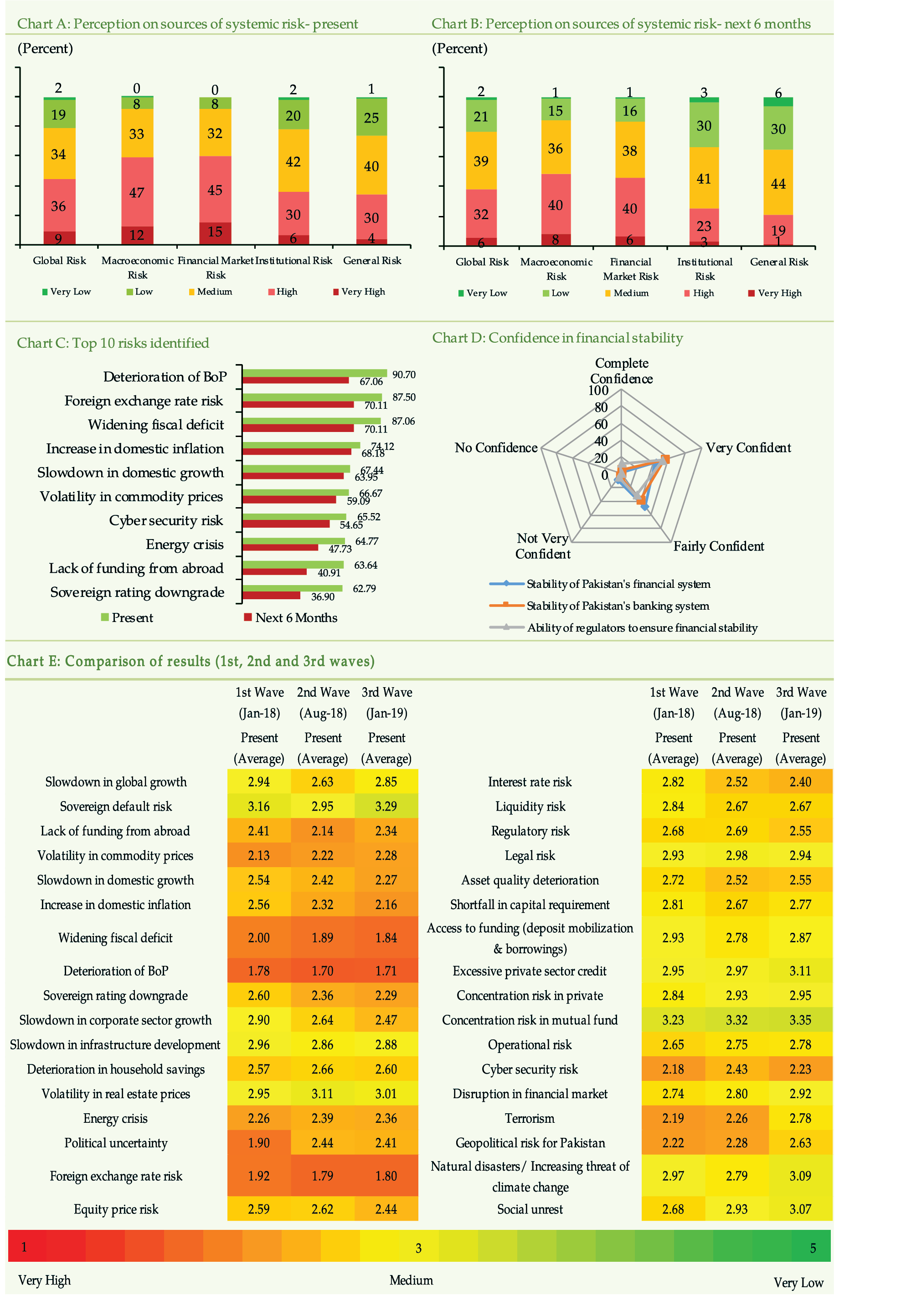

SBP launched the 3nd wave of its biannual Systemic Risk Survey in January, 2019 to capture the risk perceptions of market participants and evaluate their confidence in the stability of the financial system. The respondents of the survey included senior executives of financial institutions, financial journalists and academia. [15]

The survey intends to gauge

the present and future (over the next six months) risk perceptions of the respondents

related to five broad categories i.e. global, macroeconomic, financial markets,

institutional and general risks. The overall response rate to the survey stands

at 40 percent.

[16]

Summary of Results

[17]

:

1. At aggregate level, financial market and macroeconomic

risks are perceived to be critical for financial stability both in current

scenario as well as over the next six months (Chart A & B).

2. Among all the risks, the highest cited risks at

present are deterioration in balance of payment, foreign exchange rate risk

and the widening fiscal deficit. In addition, increase in domestic inflation,

slowdown in domestic growth, volatility in commodity prices and cyber security

risks are other high risk

[18]

sources having the potential to undermine financial

stability (Chart C).

3. Over the next six months foreign exchange rate

risk, balance of payment pressures, widening fiscal deficit and increase in

domestic inflation were reported as key risks (Chart C).

4. The likelihood of occurrence of a high risk event

in Pakistan’s financial system over the short term is slightly higher than

medium term according to survey results.

5. A higher proportion of respondents show confidence

in the ability of regulators to ensure financial stability and felt confident

about the stability of the overall financial system (Chart D).

6. A comparison of the results of the past three

waves of the survey depict that risk perceptions of the respondents relating

to external sector, rising domestic inflation and slowdown in growth have

firmed up. On the other hand, risk of political uncertainty has subsided after

the conduct of general elections (Chart E).

Box 2: SBP’s Initiatives

to Strengthen the Stability of the Financial Sector

Post Global Financial Crises (GFC) of 2008, ensuring

the stability of the financial system as a whole or, in other words, the containment

of systemic risk, has emerged as one of the key priority areas of the policy

makers.

[19]

Accordingly, various jurisdictions have established a well-defined

and formal Macro Prudential Policy Framework (MPPF). Though diversity prevails

across jurisdictions in terms of MPPF structure, the IMF-FSB-BIS, in a joint

policy paper in August 2016, have taken stock of such structures existing around

the globe. According to them, the key elements for an effective MPPF include

(a) defining the objective and scope of MPP, (b) establishing an elaborate institutional

structure, (c) assessing the systemic risk and identifying the policy toolkit,

and (d) collaborating to contain the cross-border spillovers.

[20]

Financial Stability—A Macro Perspective

The economies where banks are the key providers of

financial services, the MPPF largely revolves around the banking sector (IMF-FSB-BIS,

2016). Since in Pakistan the financial sector is bank centric with 73 percent

share in total assets, the primary responsibility for MPP lies with SBP.

[21]

This is the reason that SBP has been instrumental in making progress

towards formation of a well-structured MPPF.

SBP’s strategic plan “Vision 2020” envisages “Strengthening

of Financial Stability Regime” as one of the key goals. Under this goal, SBP

vowed to establish a comprehensive systemic stability framework consistent with

FSB principles.

To formalize an institutional structure for an MPPF,

SBP has made several arrangements that include formation of Financial Stability

Executive Committee (FSEC) within SBP, Council of Regulators (COR) comprising

SBP and SECP, and working towards establishing an overarching National Financial

Stability Council (NFSC) involving SBP, SECP, and Ministry of Finance.

[22]

Using these forums, SBP has initiated deliberations

to assess the macro-financial risks, their probable repercussions for the stability

of the financial sector and any needed remedial measures. The main themes of

discussions included macroeconomic developments that may impact the financial

sector, risks arising from Financial Action Task Force (FATF) evaluation of

Pakistan, designing a large exposure framework to contain concentration risk,

streamlining exchange of data/information between SBP and SECP etc.

In-house, SBP has strengthened the process of assessment and communication of systemic risk. To enhance its assessment of pro-cyclical systemic risk capabilities, SBP has brought in substantial improvements in its macro stress-testing regime to capture the macro-financial interlinkages. [23]

Further, a suit of variables has been identified, which serve as

Early Warning Indicators (EWIs) for build-up of systemic risk. These EWIs hint

at possible risks emanating from external and financial sectors and their interaction

with the real sector.

[24]

SBP has launched its Systemic Risk Survey (SRS) that

helps to gauge the risk perceptions and confidence of the respondents in the

stability of the financial system. The survey provides useful insights into

the current and emerging risks (over the next six months) to guide policy actions.

[25]

SBP has conducted regular waves of SRS to closely monitor the industry’s

risk perceptions about the macroeconomy and the financial sector.

To contain structural risk, SBP has developed a framework

for designation and supervision of Domestic Systemically Important Banks (D-SIBs).

Under this framework, SBP has designated three large banks as D-SIBs with enhanced

supervisory and regulatory requirements. Additional supervisory measures for

D-SIBs include preparing comprehensive risk appetite framework, conducting macro

stress tests/scenario analysis, preparing recovery plans and enhanced supervisory

engagement with the top management and Board of the designated banks. Additional

regulatory measures include higher loss absorbency requirement in the form of

CET1 over and above the standard capital requirements.

To monitor up and down stream risks emerging from financial

conglomerates (including non-financial entities), SBP is conducting Consolidated

Supervision (CS) through continuous coordination with SECP. SBP has been in

touch with the IMF to further strengthen its CS framework.

Regarding communication of financial risk assessment,

SBP has been regularly publishing the yearly “Financial Stability Review”, half-yearly

“Performance Review of the Banking Sector”, and quarterly ”Compendium: Statistics

of the Banking System”. All these publications enhance transparency by providing

detailed data including financial soundness indicators, discussion about various

emerging risks and mitigating actions taken there against.

In terms of introduction and calibration of MPP tools,

SBP has implemented Net Stable Funding Ratio (NSFR) and Liquidity Coverage Ratio

(LCR), as prescribed under Basel III capital standards, at 100 percent for both

NSFR and LCR. Further, in CY18, CAR has been increased from 11.275 percent to

11.90 percent, which is to be further raised to 12.5 percent by end of CY19.

This will help in building up of the liquidity and capital buffers in the wake

of recent credit expansion in the banking sector (See Chapter 3.1).

One of the key elements of MPPF is the international

coordination to limit the cross-border spillovers of policy actions. Though

the probability of cross-border spillovers is limited, SBP has active presence

on various international forums and coordinates with multilateral agencies,

national level stakeholders, and cross-border supervisory institutions.

An efficient ex-post resolution framework, including existence

of credible financial safety nets, limits the spread of a system-wide contagion

in a crisis. Such a framework helps maintain confidence in the system. In this

regard, with the objective of compensating the small and financially unsophisticated

depositors (to the extent of protected deposits), Deposit Protection Corporation

(DPC) has been established as a wholly owned subsidiary of SBP (under the Deposit

Protection Corporation Act-2016). The Corporation commenced its business with

effect from June 01, 2018

[26]

. Accordingly, DPC has taken following initiatives in order to initiate

and implement an effective deposit protection mechanism/ framework; (a) all

scheduled banks operating in Pakistan were notified as members of the Corporation,

thus included in the protection framework

[27]

, (b) DPC has rolled out deposit protection mechanism for banking

companies including Islamic banks effective from July 01, 2

018, in line with its statute and Core Principles for Effective Deposit

Insurance Systems issued by International Association of Deposit Insurers (IADI)

[28]

, (c) a separate deposit protection arrangement has been made for

the Shariah based deposits under Shariah Compliant Deposit Protection Mechanism

for depositors of Islamic Banking Institutions (IBIs)

[29]

and (d) all member banks have started paying the required premium

contributions on quarterly basis. [30]

Financial Stability—A Micro Perspective

The presence of sound financial institutions and efficient

markets is essential to ensure financial stability enabling the country to cope

with the emerging risks, adapt the changing market dynamics, and ensure smooth

flow of financial services. As per BIS-FSB-IMF (2016), micro prudential regulation

and supervision complements the macro prudential framework. SBP—in its regulatory

and supervisory domains—has taken various measures to address the emerging risks.

The key focus areas include:

Foreign Exchange Policy & Operations: SBP is well

cognizant of the vulnerable external sector, which has jittered the foreign

exchange market (See chapter 2). It is monitoring the FX flows and taking

measures to limit speculative activities. It is also strengthening the operating

procedures to contain the likelihood of ML/FT activities. The following SBP

initiatives are worth mentioning:

To facilitate enhanced monitoring, SBP has introduced

amendments in Protection of Economic Reforms Act (PERA), 1992 through Finance

Act, 2018, which has allowed SBP to bind all carriers of foreign currencies

of Exchange Companies (ECs) to declare cash currencies to Custom authorities

(Chapter 4.4). Further, another amendment in PERA, has also restricted

deposit of cash foreign currency in foreign currency account to income tax returns

filers only and allowed the federal government to make rules governing deposits

in and withdrawals from the foreign currency accounts.

[31]

In order to keep abreast with the fast changing market

dynamics, SBP has made revisions in its Foreign Exchange Manual related to authorized

dealers, foreign currency loans, overdrafts and guarantees, forward exchange

facilities etc.

[32]

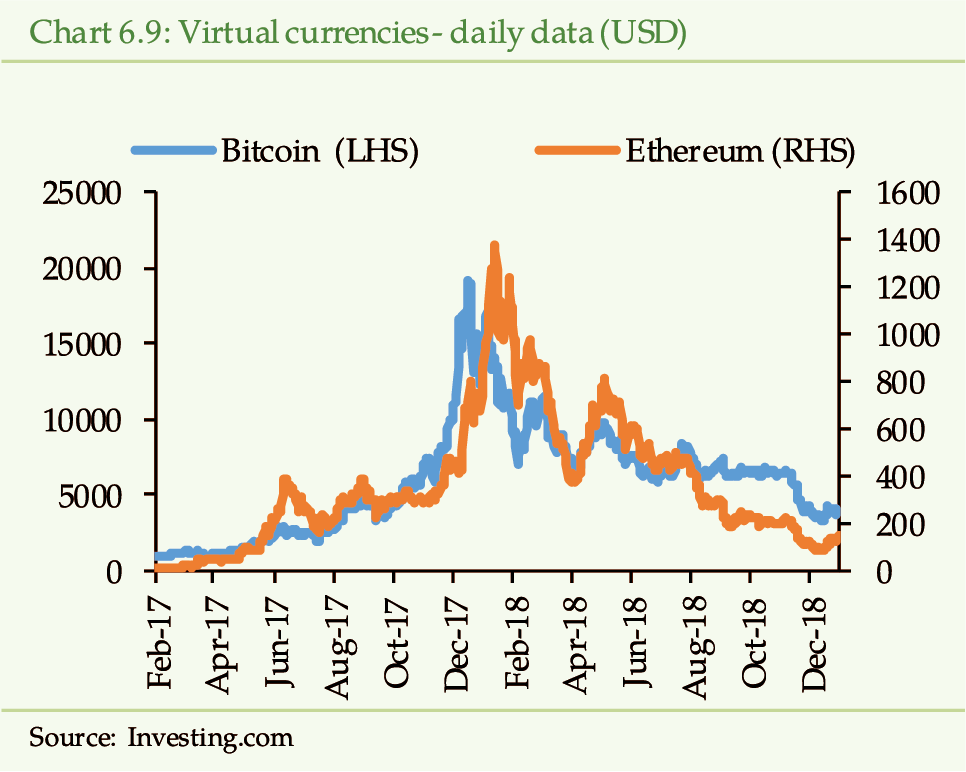

Weighing the risk associated with the virtual currency

(e.g. bitcoin, Litecoin, Pakcoin, OneCoin etc.) including volatility in the

price and use of such currencies in illegal activities such as money laundering

and the trade in illegal goods, SBP has barred ECs and ECs of ‘B’ category from

processing, using, trading, holding, transferring value, promoting and investing

in Virtual Currencies/Tokens. Further, ECs and ECs of ‘B’ Category have also

been restricted from facilitating their customers to transact in VCs/ICO tokens.

(See Chapter 6). AML/CFT: SBP has taken several initiatives to strengthen AML/CFT regime. These

include a) amendments in AML/CFT regulations to bring about clarity on various

terminologies, b) guidance on compliance of SROs and notifications issued by GoP

under UNSC resolutions, and c) enhancement in scope of KYC requirements.

Overseas Operations: The overseas operations

contribute around 5 percent share in the assets of the banking sector. In response

to challenges emerging for the banking sector in the overseas markets, SBP has

issued a comprehensive Governance Framework for banks’ overseas operations in

2018. The framework is aimed at strengthening banks’ capacity to understand,

identify and manage various risks posed by its foreign operations. Banks are

required to strengthen their governance, risk management & compliance practices

for their overseas branch & subsidiary operations.

[34]

Quality of Disclosures: SBP has revised the

financial statement format/disclosures of banks/DFIs to align them with the

regulatory changes and international best practices. The objective is to bring

consistency in financial reporting among the banking industry while enhancing

the transparency and quality of their disclosures.

[35]

[36]

Dynamic Provisioning: IFRS 9, the new accounting

standard has presented a major overhaul of financial instruments accounting

by introducing an expected credit loss approach based on probability of default.

SBP has advised the banking industry in 2018 to carry out a ‘Quantitative Impact

Assessment’ of IFRS 9 implementation on their balance sheets. The purpose of

this exercise was to determine the banking sector’s readiness and identification

of the challenges expected during its implementation. This step is expected

to complement the MPPF later as IFRS 9 encourages dynamic provisioning.

Risk Based Supervision: SBP has made major strides

in the development of Risk Based Supervision (RBS) framework by entering into

a Long Term Country Engagement (LTCE) program with Toronto Centre (TC) for capacity

building of SBP officials. LTCE program spreads over two and a half years (July

2018 – Dec 2020). During this time, the RBS framework will be developed, tested

and refined.

IT Inspection: For comprehensive assessment

of IT systems of the supervised financial institutions, Information Systems’

Inspection Framework (ISIF) has been developed. ISIF would form part of overall

RBS framework, which is presently in development phase. ISIF assess the risk

in core IT functions i.e. IT operations, IT value delivery, Alternate delivery

channels, Project management and IT procurement & Service Level Agreement

(SLA) management, while controls and governance aspects are also assessed.

Banking Conduct and Consumer Protection: SBP considers

Financial Consumer Protection or Responsible Banking Conduct crucial for stability

and inclusive growth of the sector. In this connection, some of the most eminent

conduct milestones achieved by SBP in CY18 include:

·

SBP has issued guidelines on ‘Prohibited Banking Conduct. These guidelines will

enable banks to exhibit responsible conduct by ensuring the inclusion of adequate

and preemptive controls in their Fair Treatment of Consumers (FTC) frameworks.

[37]

·

In order to strengthen the FTC regime, SBP has embraced effective conduct monitoring

tools to collect market data, highlight malpractices, analyze the root causes

and recommend corrective actions. Accordingly, SBP has recently conducted off-site

thematic examination on “Marketing Disclosures for Individual Lending Products”

by banks.

·

In view of digital transformation, the functional importance and allied conduct

risks of call centers, SBP undertook a diagnostic review of “Call Center Management

at banks”. Based on the thematic review, detail guidelines on the Call Center

management, eliciting the related bare minimums, have been issued for the banks

and MFBs.

[38]

·

SBP has granted the certificate of commencement of business to Aequitas Information Service Limited, first private credit bureau in Pakistan, and license to another credit bureau viz. Data Check Limited in the year 2018.

Financial Market Infrastructure (See Chapter 5): Pakistan Real Time Interbank Settlement Mechanism (PRISM) is the payment system of systemic importance facilitating large scale transactions. Keeping in view that significant developments have taken placed in terms of scope and operational efficiency of PRISM, SBP has updated PRISM Operating Rules (PORs) which are in line with international standards and offer directions related to PRISM (RTGS) business operations. [39]

Electronic Fund Transfers

(EFTs) enable customers to access their bank accounts electronically for fund

transfers and account management using different channels like ATMs, internet

and mobile banking etc. SBP has issued Regulations for EFTs with the purpose

to promote, ensure consumer protection and payments transparency by standardizing

EFTs as broadly outlined in Payment System & Electronic Fund Transfer (PS&EFT)

Act 2007

[40]

. These regulations identify the minimum information of originator

and beneficiary required to initiate/process an EFT, highlight the responsibilities

of originator, Payment System Operators (PSOs) /Payment Service Providers (PSPs)

and beneficiary compensation policy for unauthorized and / or delayed EFTs,

disclosure requirements and dispute resolution process etc.

To safeguard banks/MFBs and

their customers from potential losses due to cyber-crimes and online banking

frauds, SBP has issued a comprehensive set of instructions – advising banks

to take pre-emptive measures and ensure security of card data.

[41]

A vast literature has established

that, besides supporting poverty reduction and economic growth, the financial

inclusion also promotes financial stability.

[46]

In fact, providing greater access and better uses of financial services

to a vast under-privileged section of the society strengthens the financial

stability, given the country has already implemented financial infrastructure

and skilled supervision (Okpara 2011; Prasad 2010; Cull et al. 2012). Morgan

and Pontines (2014) highlighted that increased share of lending to small and

medium-sized enterprises (SMEs) aids financial stability, mainly by reducing

non-performing loans (NPLs) and the probability of default by financial institutions.

Han and Melecky (2013) observed that financial inclusion, measured by wider

access to and use of deposits, can build the banks’ deposit base stronger in

period of financial trauma, which ultimately promotes financial stability of

countries, especially the middle income countries. On the other hand, greater

financial access may lead to financial risks if driven by rapid credit growth

or the expansion of relatively unregulated parts of the financial system (BIS

Quarterly Review, March 2015).

SBP has long been promoting

the development finance including microfinance, SME finance, Agriculture finance,

Infrastructure and Housing finance and Islamic Banking. Increasing financial

inclusion is one of the key strategic goals of SBP Vision 2020. The developments

in this regard are as under:

National Financial Inclusion

Strategy (NFIS): To promote financial inclusion, government launched NFIS in

2015. With the ultimate objective of enhancing inclusion, the federal government

has published new policy directions for its implementation during the next five

years.

[47]

,

[48]

The policy offers a national framework, definite action plan and

targets for achieving universal financial inclusion. The updated policy contributes

headline targets and specific tasks for their accomplishment, assigned to the

relevant institutions, with given timeline and Key Performance Indicators (KPIs)

for implementation until 2023.

[49]

These targets focus on broad areas, such as;

-

Enhancing usage of digital payments (65 million transaction accounts including 20 million share of women)

-

Increasing deposit base to 55.0 percent of GDP [50]

-

Promoting SME finance (achieve 17 percent of private sector credit and increase borrowers to 700,000) [51]

-

Increasing agricultural finance (target annual disbursement of PKR 1.8 trillion and cater to 6 million farmers digitally), enhancing low-cost housing, increasing share of Islamic banking (to 25 percent of banking industry and attain 30 percent share in overall branch network)

Microfinance: In order to address

funding constraints of the microfinance sector, SBP has established a Line of

Credit (LoC) Fund for Microfinance Banks (MFBs) and Non-Bank Microfinance Companies

(NBMFCs) for onward lending to microfinance borrowers. This has been carried

out with the funding support of GoP under WB’s Financial Inclusion and Infrastructure

project.

[52]

SME Financing:

To promote SMEs, SBP’s following initiatives are noteworthy:

-

The scope of current Credit Guarantee Scheme (CGS) has been extended through inclusion of low-end medium enterprises under this scheme.

-

To enable un-incorporated SMEs to use moveable assets as collateral, SBP is facilitating establishment of an electronic registry under Financial Institutions (Secured Transaction) Act, 2016.

-

In consideration of the fact that majority of the SMEs lack expertise to professionally manage financial, technological, marketing and human resource aspects of their businesses, banks have been advised to adopt Non-Financial Advisory Services (NFAS) in their SME banking to better serve their existing and potential SME clients. [54]

-

SBP introduced the modus operandi for the Refinance Scheme for Working Capital Financing of Small and Low-End Medium Enterprises in selected economic sectors. [55] Similarly, in an effort to improve financing access for women entrepreneurs, the coverage under ‘Refinance and Credit Guarantee Scheme for Women Entrepreneurs in Underserved Areas’ has been extended by increasing the number of eligible districts. [56]

Housing Finance: The housing finance

has a meager share in Pakistan (0.5 percent of GDP). In order to promote housing

finance, Pakistan Mortgage Refinance Company (PMRC), established with the equity

contributions from Financial Institutions (FIs) and the Government of Pakistan

(GoP), has been granted permission to commence business. PMRC is mandated to

provide long term funding to Primary Mortgage Lenders (PMLs) and will also contribute

to the development of bond market.

Islamic Finance: In order to provide

Shariah compliant alternative of conventional Long Term Financing Facility (LTFF),

SBP has issued Mudarabah based Islamic Long Term Financing Facility (ILTFF)

to facilitate export industries for purchase of imported or locally manufactured

new plant and machinery.

[57]

SBP has revised ‘Shariah Governance Framework for Islamic Banking Institutions’. The framework covers the roles of various organs of Islamic. Also, IBIs have been advised to undertake enhanced measures for training and capacity building of their staff.

[1]

IMF, World Economic Outlook Update, July 2019. As per IMF estimates,

the global economy is expected to grow by 3.2 percent during 2019.

[2] Pakistan Bureau of Statistics (PBS).

http://www.pbs.gov.pk/sites/default/files//

[3] Source: PBS

http://www.pbs.gov.pk/sites/default/files//

industry_mining_and_energy/qim/

2019/web%20note%20June%2019.pdf

4] 12 months moving average inflation (Source: SBP Inflation Snapshot,

http://www.sbp.org.pk/ecodata/MPM.pdf)

5]

Overseas Investors Chamber of Commerce and Industry (OICCI) Survey,

Seventeenth Wave, January 2019

https://www.oicci.org/wp-content/uploads/2019/02/OICCI-BCI-

Survey-Wave-17-Highlights-December-20181.pdf

SBP’s Business Confidence Surveys, 2018-19.

http://www.sbp.org.pk/research/BCS-r.asp

[6]

Government exposure includes investments in government securities

and lending to public sector entities.

[7]

Fresh NPLs, generally, require lower provisions leading to rise in

net NPLs. As a result, the net NPLs to net Advances ratio and Capital impairment

(net NPLs to Capital) ratio increase.

[8]

The government has abolished the withholding tax on deposit withdrawals

for filers while it maintained 0.6 percent tax rate for the non-filers in the

interim budget 2019. (Finance Supplementary (Second Amendment) Act, 2019)

9]

This comprises minimum CAR requirement of 10 percent and capital

conservation buffer of 1.9 percent that will increase to 2.5 percent by the

end of CY19 (BPRD Circular No. 6 of 2013).

10]

The framework follows two steps approach; in first step, a sample

of banks based on quantitative and qualitative criteria is identified. In the

second step, among these sample banks, D-SIBs are designated based on Size,

Interconnectedness, Substitutability and Complexity.

11]

http://www.sbp.org.pk/press/2018/Pr-14-Jun-18.pdf

12]

CDC and NCCPL are corporate securities settlement systems which have

been allowed as special participants of PRISM for settlement of transactions

in the form of multilateral net settlement batches.

13] State Bank of Pakistan. (2019). Monetary Policy Statement. May 2019

http://www.sbp.org.pk/m_policy/2019/MPS-May-2019-Eng.pdf

[14]

Most of the underlying indicators of FSVI have been projected

using the exponential smoothing technique of Holt-Winters.

[5]

The respondents included executives from commercial banks, insurance

companies, exchange companies, MFBs, DFIs, major financial market infrastructures,

financial journalists, members of academia, SECP officials and think tanks.

6]

The 3rd wave of the survey was sent to 230 respondents

out of which 92 responded.

[17]

The results presented

here are based on responses to the survey and do not necessarily reflect the

State Bank of Pakistan views on risks to the financial system

[18]

High risk is identified by aggregating percentage of respondents

by clubbing together percentage of respondents choosing either high or very

high as response to a particular risk category or type in the survey questionnaire.

[19]

Systemic risk has two dimensions i.e. Pro-cyclical (or Time dimension)

and Structural (or Cross-sectional dimension).

[20]

Please see “Elements of Effective Macro Prudential Policies”, BIS,

August 2016.

[21]

Pakistan has shallow capital market (low market capitalization to

GDP ratio), non-complex thin volume trading in financial markets, limited cross

border exposures, almost negligible volume of mortgage financing (thus, expectedly,

limited role of real estate prices), and less reliance on wholesale funding

(thus, expectedly, low interconnectedness)

[22]

For further detail, please see FSR 2017 Overview Box 2

[23]

The macro stress testing model include univariate Auto Regressive

Moving Average (ARMA), Vector Auto Regressive (VAR) model, vector error correction

model (VECM) etc.

[24]

These EWIs incorporate spreads, market price indicators

and their volatility, deviation from trend, and growth rates of financial and

external variables.

[25]

SRS is a biannual survey and its respondents include executives from

commercial banks, insurance companies, exchange companies, MFBs, DFIs, , major

financial market infrastructures, financial journalists, members of academia

and SECP officials and think tanks.

[26]

DPC Circular No. 02 dated May 31, 2018

[27]

DPC Circular No. 03 dated June 22, 2018

[28]

DPC Circular No. 04 dated June 22, 2018

[29]

This mechanism has been developed in accordance with the requirements

of Section 7(3) of the Act, to comply with the Shariah requirements of such

protection arrangement

[30]

The protected amount has been determined by the Corporation to be

PKR 250,000 per depositor per bank, which is 1.46 times of GDP per capita.

[31]

EPD Circular Letter No. 05 of 2018

[32]

FE Circular No. 14 of 2018

[33]

FE Circular No. 03 of 2018

[34]

BPRD Circular No. 06 of 2018

[35]

BPRD Circular No. 02 0f 2018

[36]

Few changes include as (a) movement of revaluation surplus/deficit

under equity head, (b) separate line for intangible assets, (c) single line

presentation for provision against NPLs and investment, (d) addition of new

line for income from derivative, (e) addition of state of comprehensive income,

and (f) few changes in the notes of financial statements.

[37]

BC&CPD Circular No. 02 of 2018

[38]

BC&CPD Circular No. 01 of 2018

[39]

PSD Circular No. 02 of 2018

[40]

PSD Circular No. 03 of 2018

[41]

PSD Circular No. 09 of 2018

[42]

PSD Circular No. 05 of 2018

[43]

PSD Circular letter No. 02 of 2018

[44]

PSD Circular No. 04 of 2018

[45]

PSD Circular No. 01 of 2018

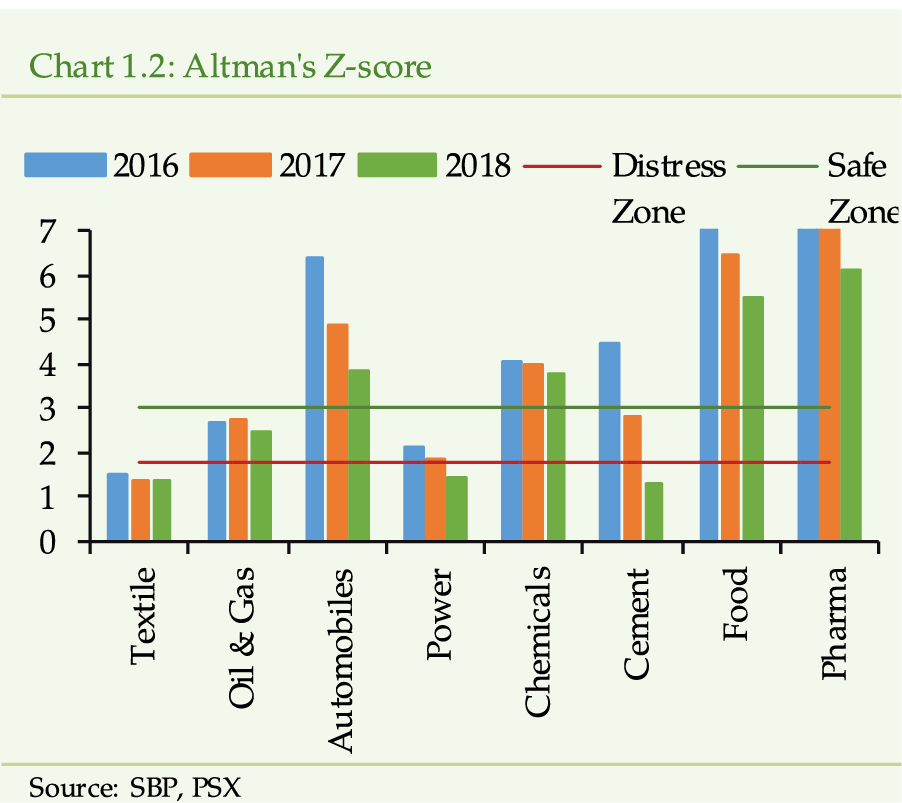

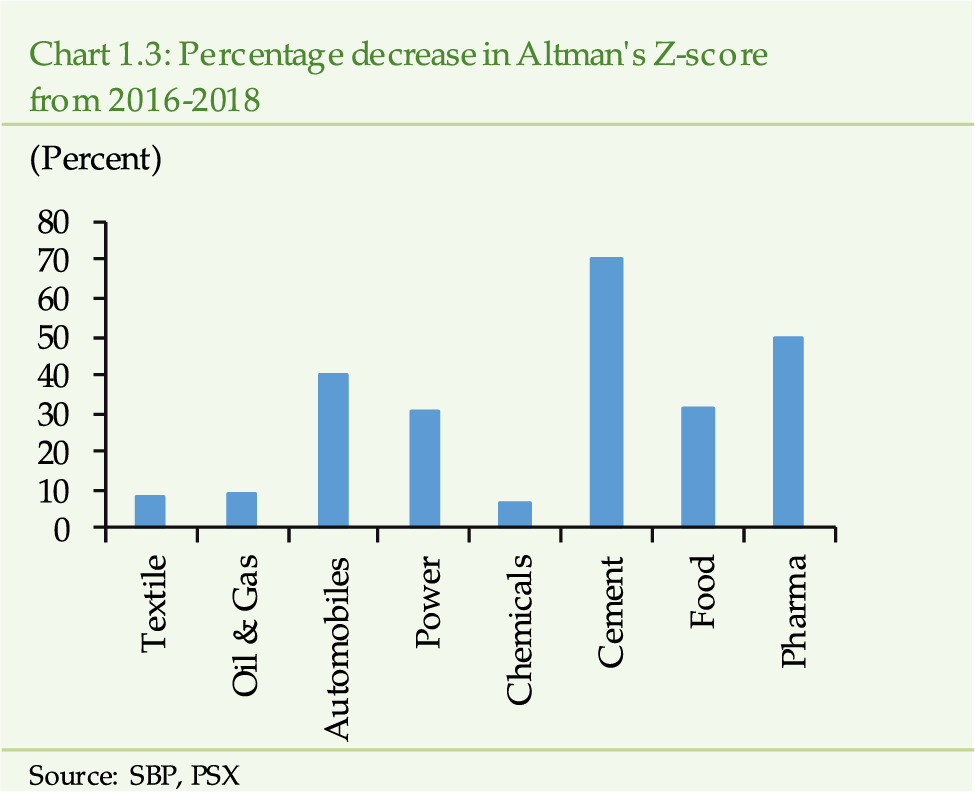

[46]

Indicators used to proxy financial inclusion (e.g. share of

credit provided to SMEs, number of bank branches per 1000 population, number

of ATMs per 1000 population, number of SME borrowers, number of accounts at

formal institutions, and financial inclusion index etc.)

Indicators used to proxy financial stability

(bank Altman’s Z-score, stock market volatility, provision for non-performing

loan, standard deviation of deposit, financial stability index etc.)

[47]

Publication “NFIS Government’s 100 day Agenda” (retrieved from http://www.finance.gov.pk/NFIS.pdf)

[48]

In 2015, Government of Pakistan (Ministry of Finance (MoF)) and SBP

introduced the National Financial Inclusion Strategy (NFIS) per implementation

plan until 2020.

[49]

With regard to the implementation framework, a central monitoring

and coordination system has been realized through the creation of “Transformation

Office” at PM office. The ultimate responsibility for the implementation rests

with the assigned institution.

[50] According to World Bank, the deposit to GDP ratio was 32.0 percent in 2016

(https://fred.stlouisfed.org/series/

[51] As of December 30 2018, the credit to SME sector as percent of Pvt. Sector financing was 8.46 percent and SME borrowers were 180,704. (Source: Annual SME Finance Review, 2018:

http://www.sbp.org.pk/sme/PDF/DFG/2018/

[52]

AC&MFD Circular No. 01 0f 2018

[53]

IH&SMEFD Circular Letter No. 01 of 2018

[54]

IH&SMEFD Circular No. 10 of 2017

[55]

This scheme was introduced in December 2017 (IH&SMEFD Circular

No. 11 of 2017)

[56]

IH&SMEFD Circular Letter No. 02 of 2018

[57]

IH&SMEFD Circular No. 01 of 2018

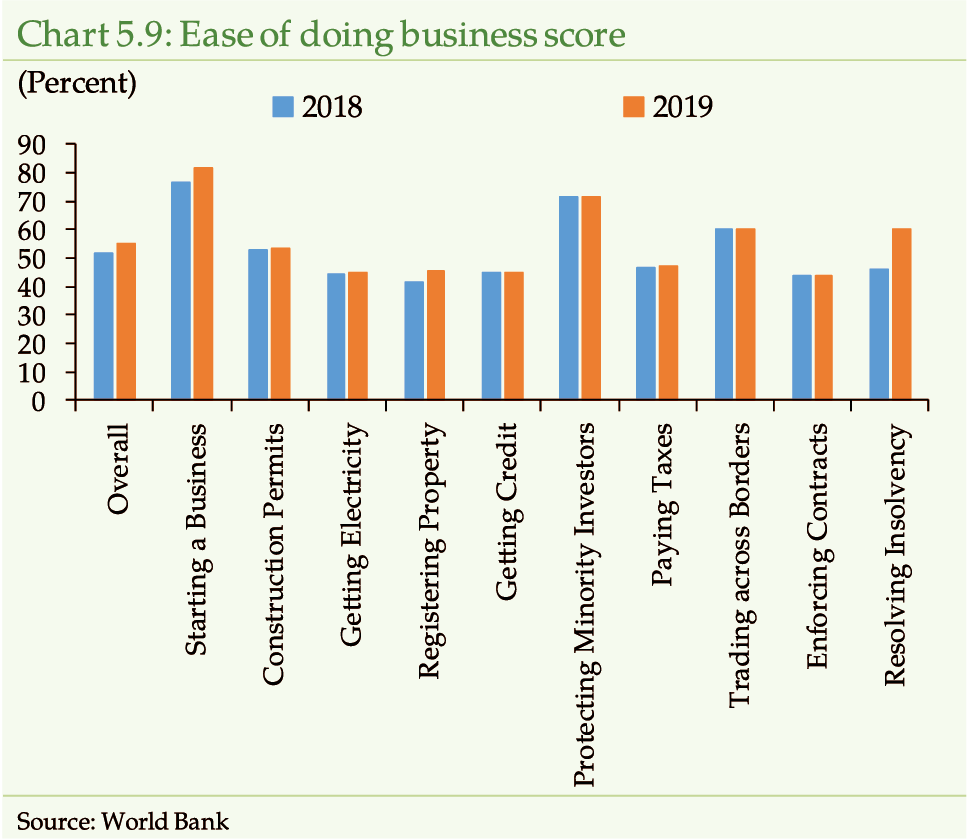

1 Global and Domestic

Macro-financial Environment

The global economic cycle has trended downwards

during 2018 amid rising trade tensions and tightening financial conditions.

Short-term risks to global financial stability have risen modestly, while

the medium-term risks remain elevated. Financial vulnerabilities in the

global financial system continue to build-up in the form of elevated leverage

and stretched asset prices. Likewise, the domestic economy has decelerated

owing to rising twin deficits, elevated inflationary pressures and the

stabilization measures taken to contain the macroeconomic imbalances.

A combination of monetary tightening and fading economic activity may

undermine the repayment capacity of the borrowers. The pace of economic

expansion is expected to remain weak in the short-term.

Pace

of global economic expansion has moderated during 2018…

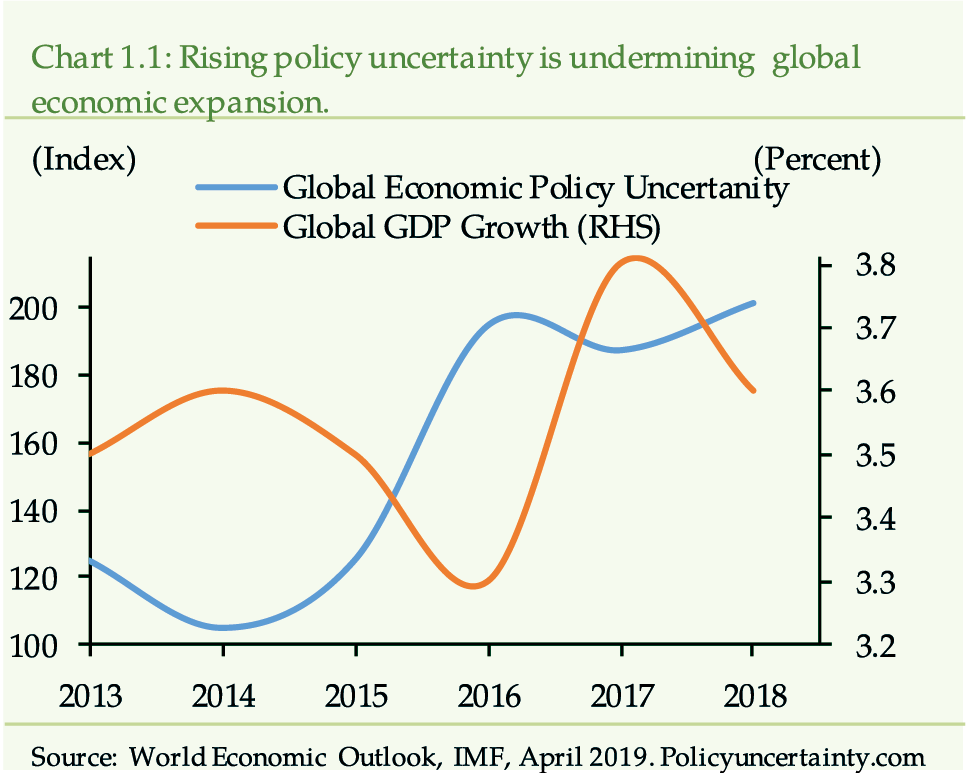

In 2018, the global growth momentum has softened

to 3.60 percent after peaking at 3.80 percent in 2017. Increased policy

uncertainty—driven by trade tensions—and tighter financial conditions,

particularly in the emerging markets and developing economies (EMDEs),

have primarily undermined the pace of global expansion (Chart 1.1).

[1]

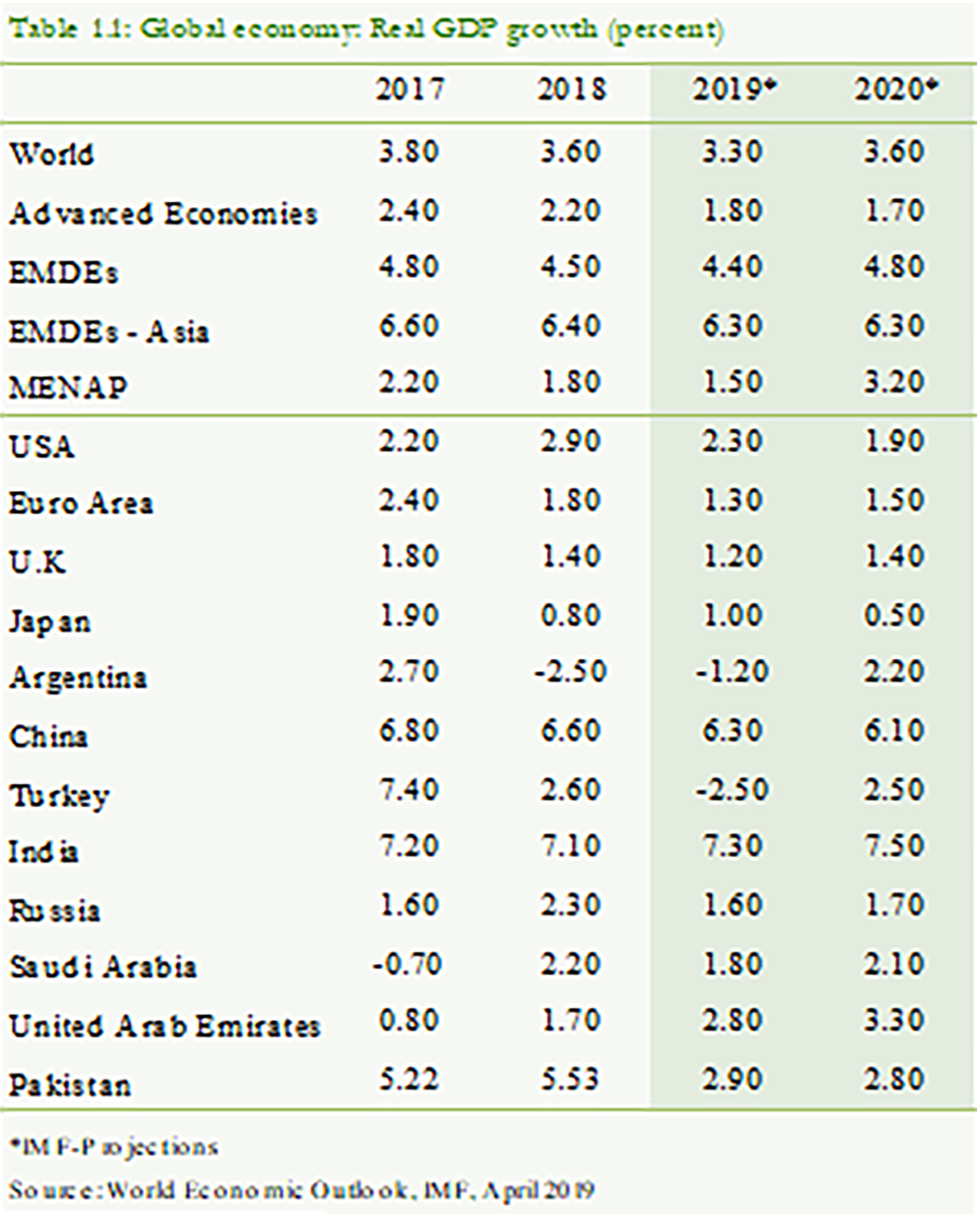

Among the advanced economies (AEs), weak economic

activity in the euro area, United Kingdom and Japan along with rising

vulnerabilities in certain EMDEs (i.e. Turkey and Argentina) have resisted

the world economy to maintain its growth momentum. Contrary to the global

economic slowdown, the growth in the US has accelerated (2.90 percent

in 2018 versus 2.20 percent in 2017), which has helped moderate the global

downturn. (Table 1.1).

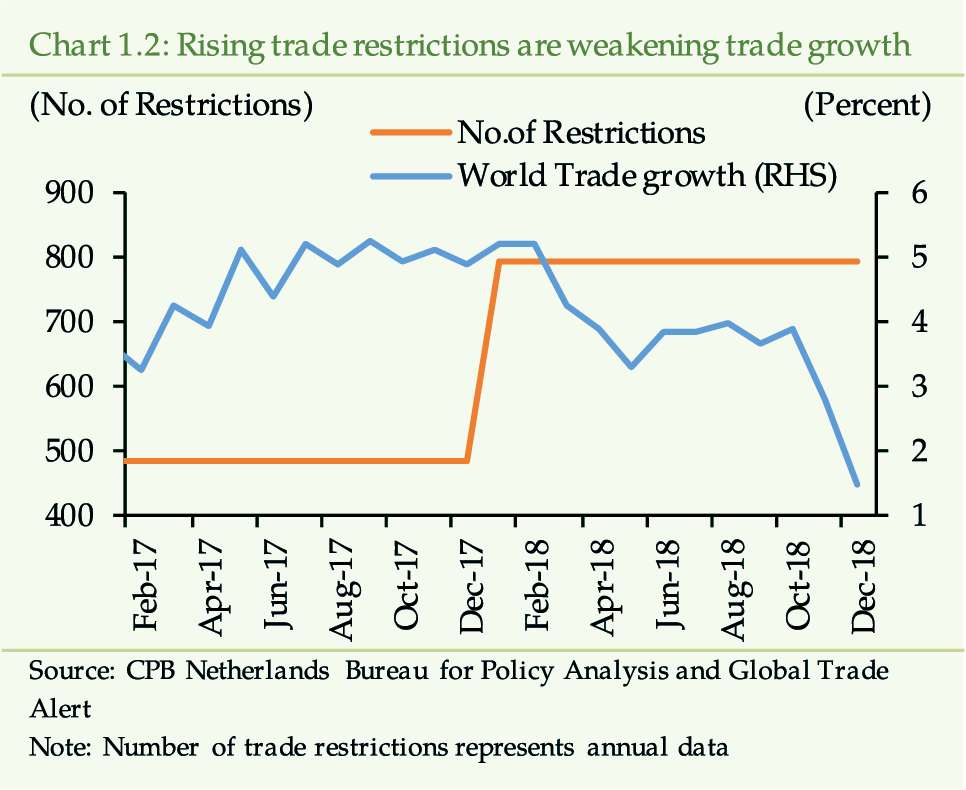

The mounting trade tensions have weakened the

business confidence and resultantly global trade has observed weaker growth

of 3.27 percent in 2018 against 4.68 percent in 2017 (Chart 1.2).

[2]

The trade restrictions, in turn, are hindering the overall

growth and investment.

[3]

The downward trend in global economy is, thus, likely

to continue if the trade tensions among major economies, particularly,

the US and China are not resolved.

…along

with receding growth synchronization

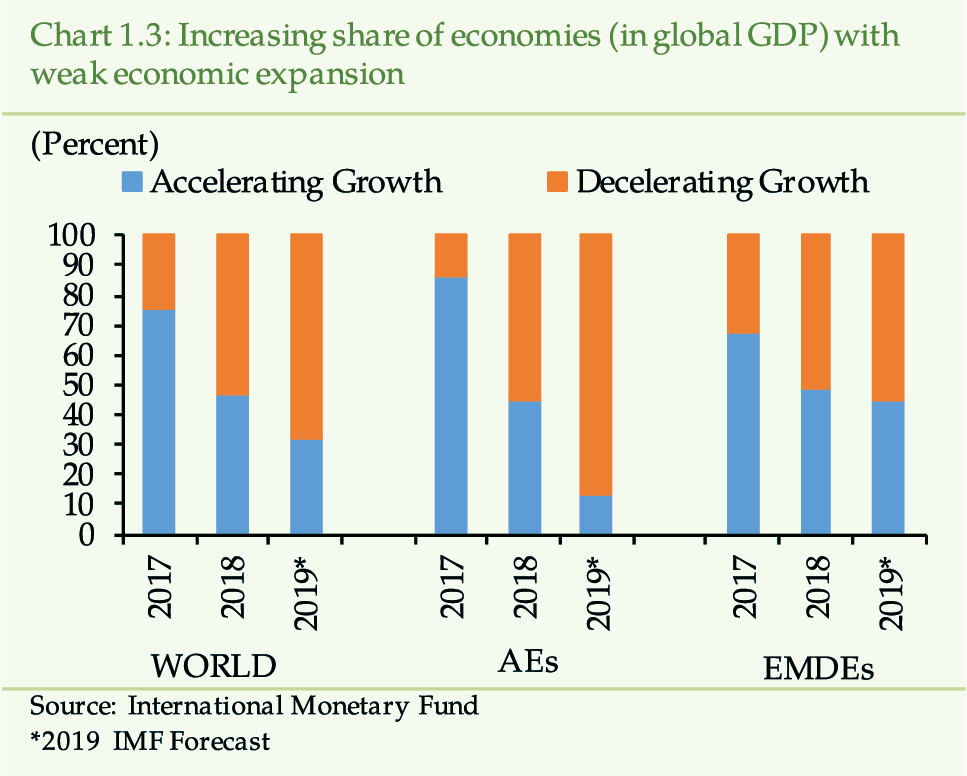

Besides moderating, the global economic growth

has remained less synchronized during 2018. In 2017, 58 percent of the

world’s economies (representing 75 percent of global GDP) had experienced

upturn in growth. However, in the reviewed year, the expansion has been

contained to 52 percent of the economies (representing 47 of global GDP),

indicating a possible tilt of the business cycle towards a trough (Chart

1.3).

[4]

A

number of factors have constrained euro area growth…

Euro area has struggled to grow as it recorded

1.80 percent growth in 2018—down from 2.40 percent in the year 2017. The

notable slowdown in the economic activity has come from: (i) waning consumer

and business confidence, (ii) weak industrial output in Germany and France

due to revision of auto emission standards and the street protests (yellow

vests movement), respectively, (iii) fiscal policy uncertainty; and (iv)

dent in the external demand for exports owing to appreciation of Euro.

[5]

Moreover, the growth outlook may further deteriorate to 1.30

percent in 2019, if the uncertainties arising from trade tensions and

a no deal-Brexit continue.

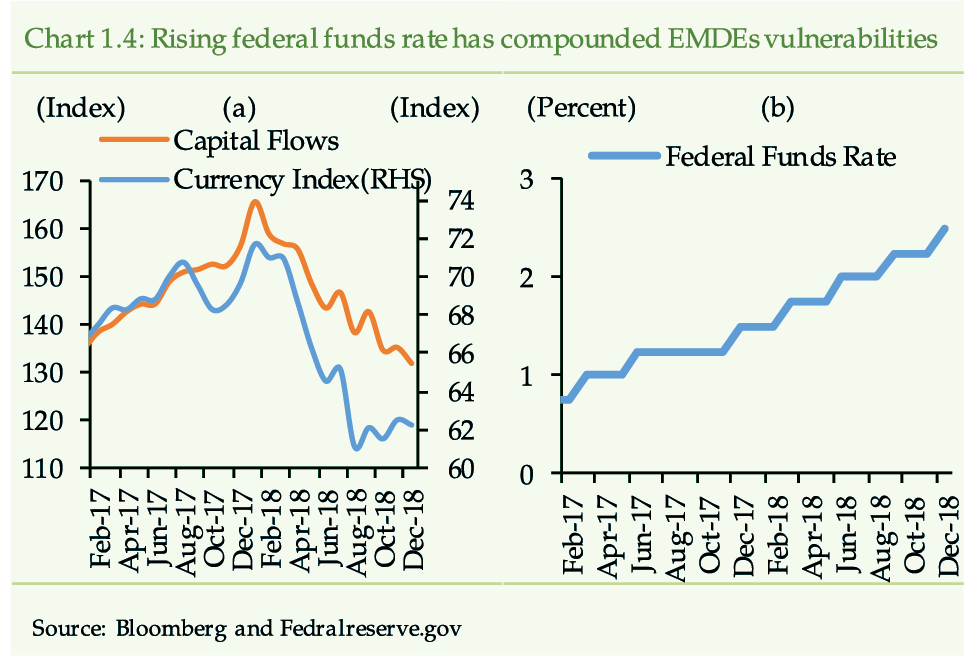

EMDEs

including China have followed slow growth trajectory…

The EMDEs have delivered 4.50 percent growth

in the year 2018—down from 4.80 percent achieved in the previous year.

Corrective policy measures in response to growing idiosyncratic vulnerabilities

(i.e. macroeconomic imbalances, external leverage etc.), coupled with

capital outflows in the backdrop of rise in federal funds rate and escalating

trade tensions, have constrained their economic activity and triggered

risk aversion (Chart 1.4).

[6]

,

[7]

However, jittery sentiments in such markets have not spread

to other EMDEs because the country-specific factors seem to be instrumental

in investors’ decisions.

[8]

Among the EMDEs, Chinese economy has slightly

moderated to 6.60 percent in 2018 as compared to 6.80 percent in the previous

year. This deceleration has largely resulted from regulatory measures

taken during 2017 to limit high indebtedness

[9]

, partly brought about by growing shadow banking

intermediation, and softening of export demand due to on-going trade conflict

with the US.

Anticipating further deceleration in economic

activity, the People’s Bank of China has provided liquidity support and

reduced reserve requirements in early 2019. Moreover, there has been targeted

fiscal policy loosening as well.

[10]

The uncertainties surrounding trade tensions

with the US are likely to critically determine future economic course

of the Chinese economy. Unless the aforementioned dynamics play out positively,

[11]

the growth is expected to further moderate to 6.18

percent in CY19.

While

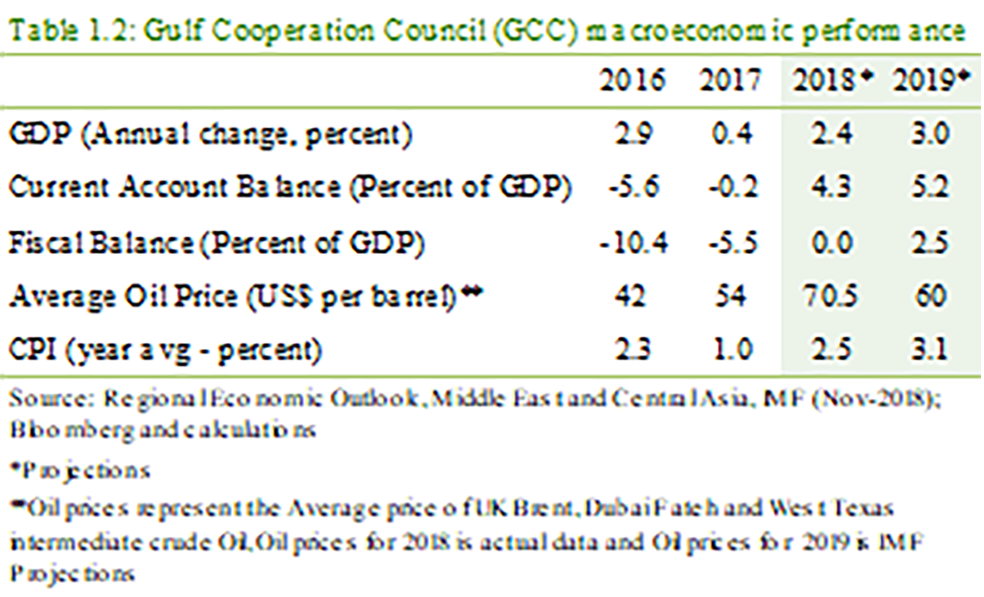

GCC economies have performed well…

The pattern of economic activity in the Gulf

Cooperation Council (GCC) economies is tied to the oil price dynamics.

In 2017, as the oil prices dropped so did their growth (0.40 percent).

With increase in oil prices, GCC economies are expected to bounce back

with 2.40 percent growth in 2018 (Table 1.2). The economic recovery

has allowed some fiscal space to UAE, Qatar and Kuwait to invest in public

projects.

The growth outlook though encouraging, remains

uncertain as it is mainly contingent upon the future path of oil prices.

Rising trade concerns, geo-political tensions in the gulf region, as well

as global growth slowdown could dampen the demand for oil. This may jeopardize

GCC economies growth prospects.

…and

so has the US economy…

The US economy—given its considerable weight

in the global output—has uniquely performed by growing at 2.90 percent

in 2018, higher than 2.20 percent observed in the previous year. The continued

growth momentum—despite Fed’s monetary tightening during 2018—is due to

strong labor market conditions and robust consumption spending.

In the near term, nonetheless, the restrictions

on bilateral trade may dent exports and investments. Therefore, the economic

activity is expected to slow down to 2.30 percent in 2019.

[12]

The growth momentum may further stall as the fiscal

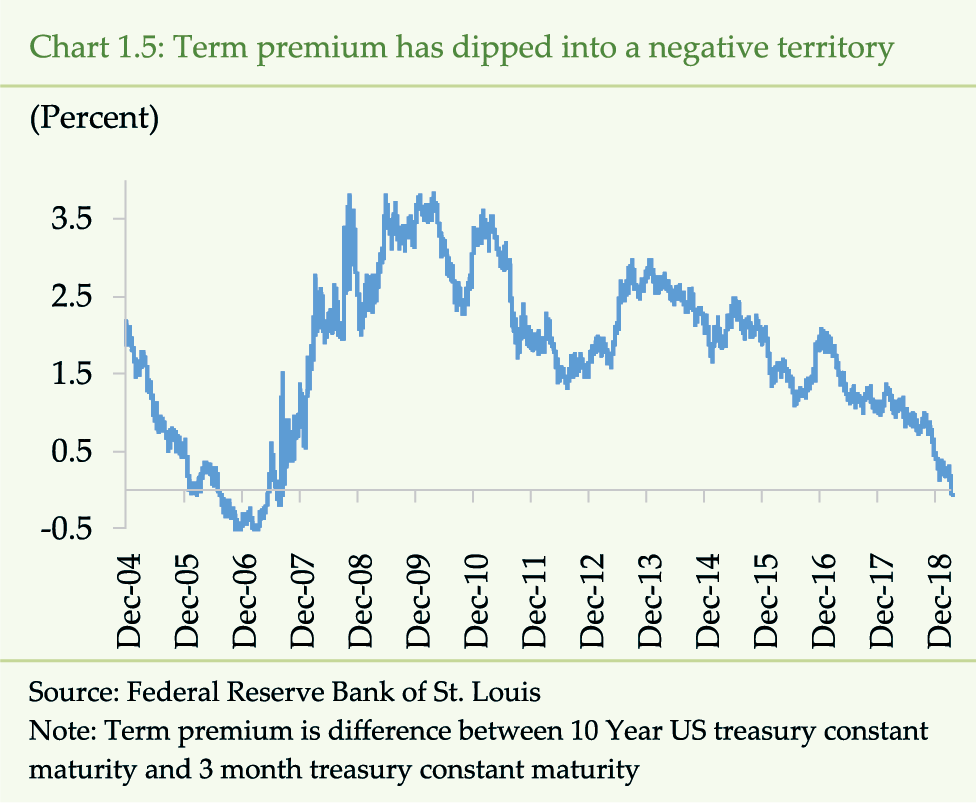

expansion fades down. More recently, the term-premium

[13]

in the US has dipped into negative territory indicating

increased risk perceptions of the investors about US growth outlook (Chart

1.5).

Inflationary

concerns, due to softening global growth, remains benign…

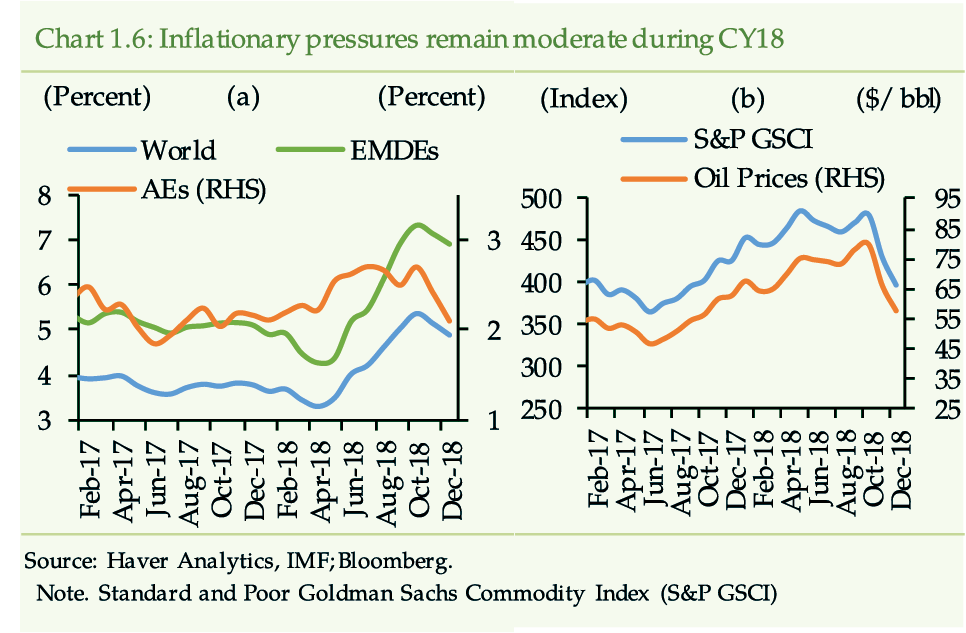

Globally, inflationary pressures have remained

moderate during CY18 (Chart 1.6a). In AEs, inflation has hovered

around 2.0 percent level during 2018—up from 1.70 percent in CY17.

[14]

In EMDEs, it has inched-up to 4.80 percent compared

to 4.30 percent in 2017. Marginal uptick in the headline inflation is

due to rising oil prices

[15]

(Chart 1.6b) and the pass through impact of currency

depreciation in EMDEs. It is important to note that the core inflation

across AEs and EMDEs has remained subdued reflecting softening of economic

momentum.

Risks

to global financial stability have somewhat risen…

Near-term risks to global financial stability

have risen modestly during CY18 amid tightening in financial conditions.

Short-term risks to global financial stability could sharply elevate in

response to sudden tightening of financial conditions, unexpected growth

slowdown, further increase in trade tensions, and geopolitical risks.

…and

the financial vulnerabilities continue to build-up

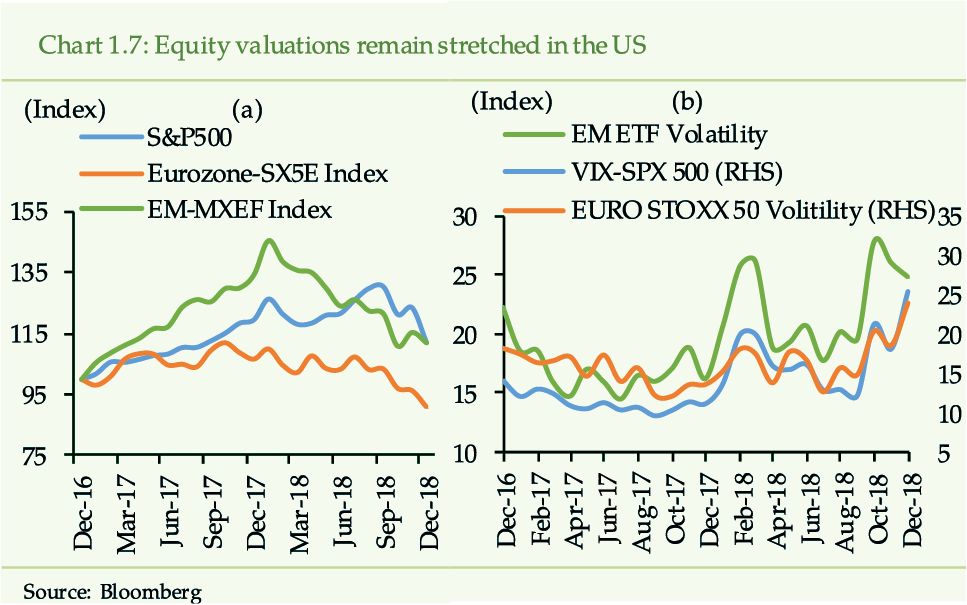

A prolonged period of easy financial conditions

has been feeding vulnerabilities into the global financial system; hence,

the medium-term risks to global financial stability remain elevated. The

stretched equity valuations in the US along with lower volatility

[16]

, amid accommodative monetary policy, represent

vulnerabilities in the form of possible asset price corrections.

[17]

(Chart 1.7a-b)

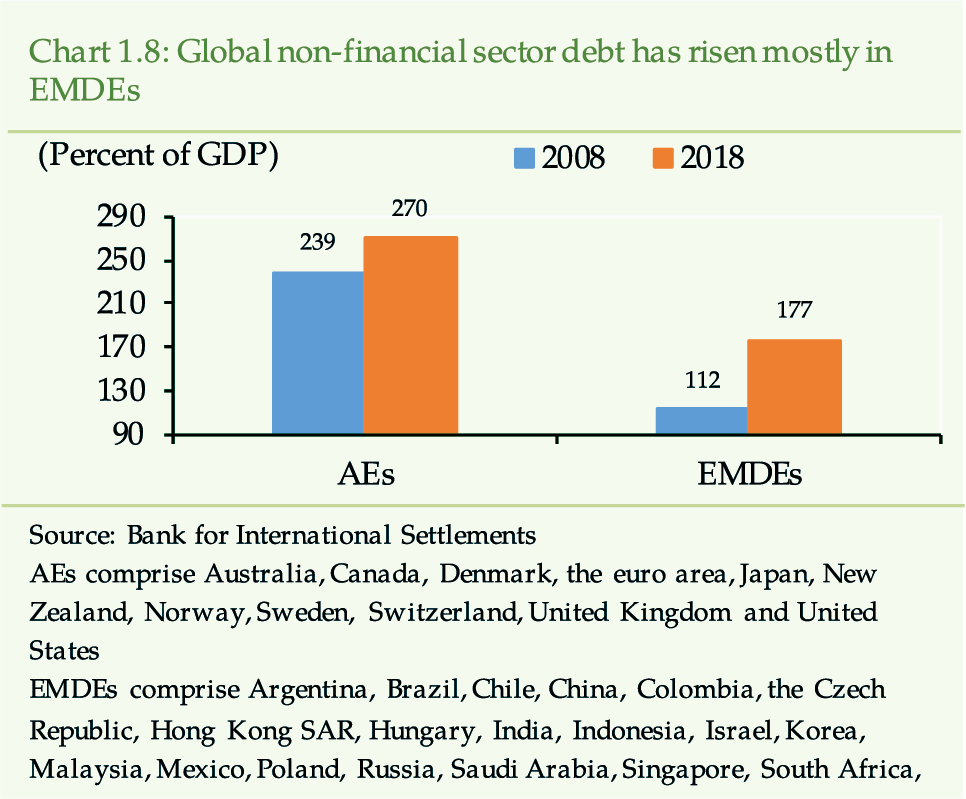

Besides, low interest rates in AEs are triggering

leverage. Total non-financial sector debt stands at USD 183 trillion (217.80

percent of world GDP)—up from USD 119 trillion (178.90 percent of world

GDP) a decade earlier.

[18]

Most of the global debt pertains to AEs (69.41 percent share

in the global debt). However, EMDEs have increased accumulation of the

global non-financial debt as a percentage of GDP during the last decade

(Chart 1.8).

It deserves emphasis that in AEs, financial risk

taking has increased and resultantly the stock of lower-rated investment

grade bonds (BBB) has quadrupled since the global financial crisis.

[19]

A reversal in financial conditions or negative growth shock

could hamper repayment capacity of the weaker firms and may trigger defaults.

EMDEs

near-term outlook is less than encouraging…

The growth in EMDEs is likely to dip to 4.4 percent

in the year 2019—slightly down from 4.5 percent in 2018. Slowing pace

of economic activity reflects the impact of deceleration in China’s growth,

recession in Turkey, the lagged impact of weaker activity in 2018, and

downturn in Iran.

Moreover, the interplay between the idiosyncratic

challenges and the external environment marked by softening growth momentum

in AEs and elevated trade concerns would continue to determine the near-term

prospects for the EMDEs.

[20]

Domestic Developments

After

robust economic expansion during FY18, economic prospects are fading…

The domestic economy has managed to grow by 5.53

percent during FY18—up from the 5.22 percent in FY17. The momentum was

backed by robust consumption and relatively low inflationary environment.

[21]

However, in FY19, economic prospects are fading

[22]

amid rising twin deficits, elevated inflationary pressures,

and corrective policy measures taken by the authorities to rein in macroeconomic

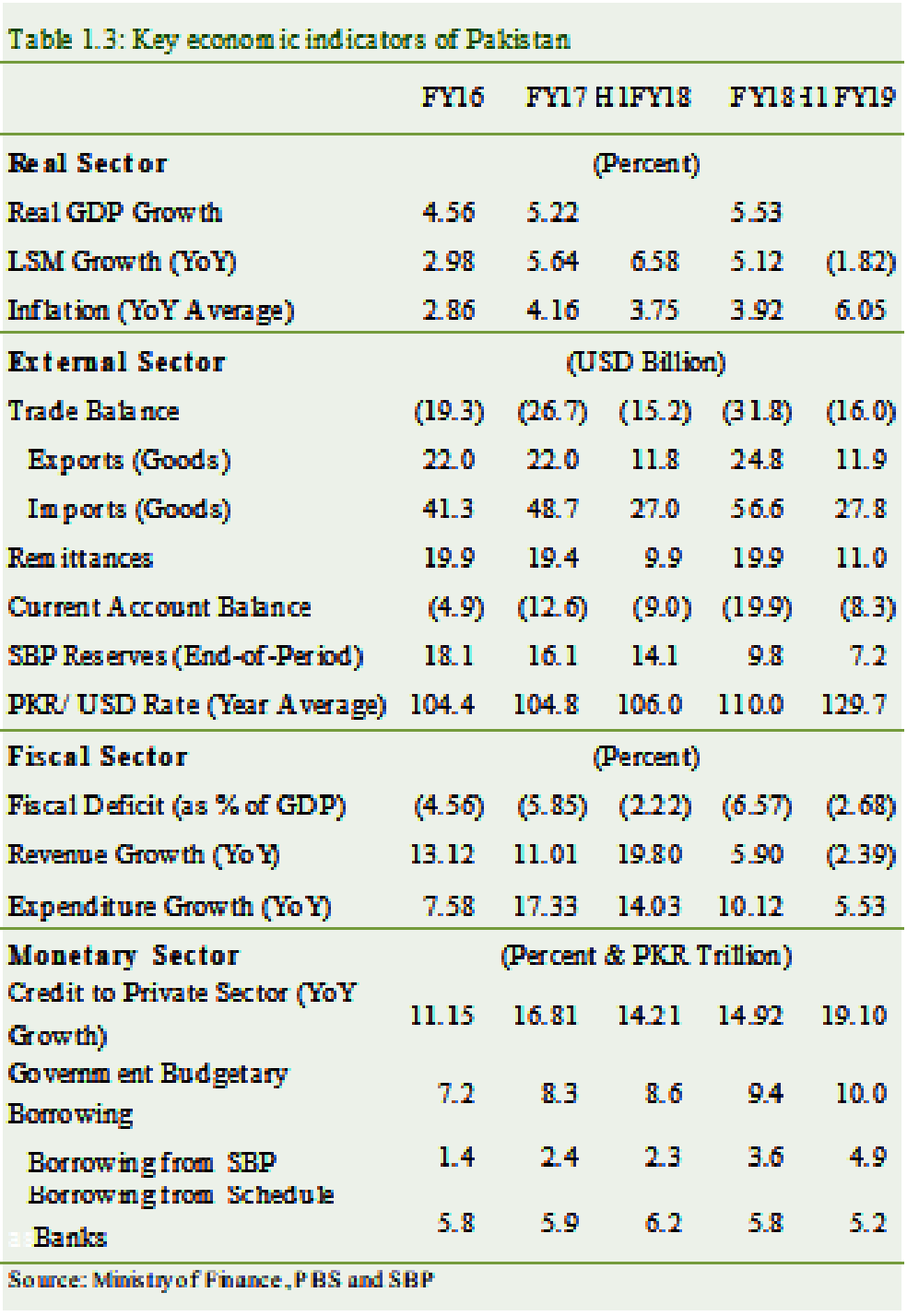

imbalances (Table 1.3)

External

account pressures remain instrumental risk to the growth…

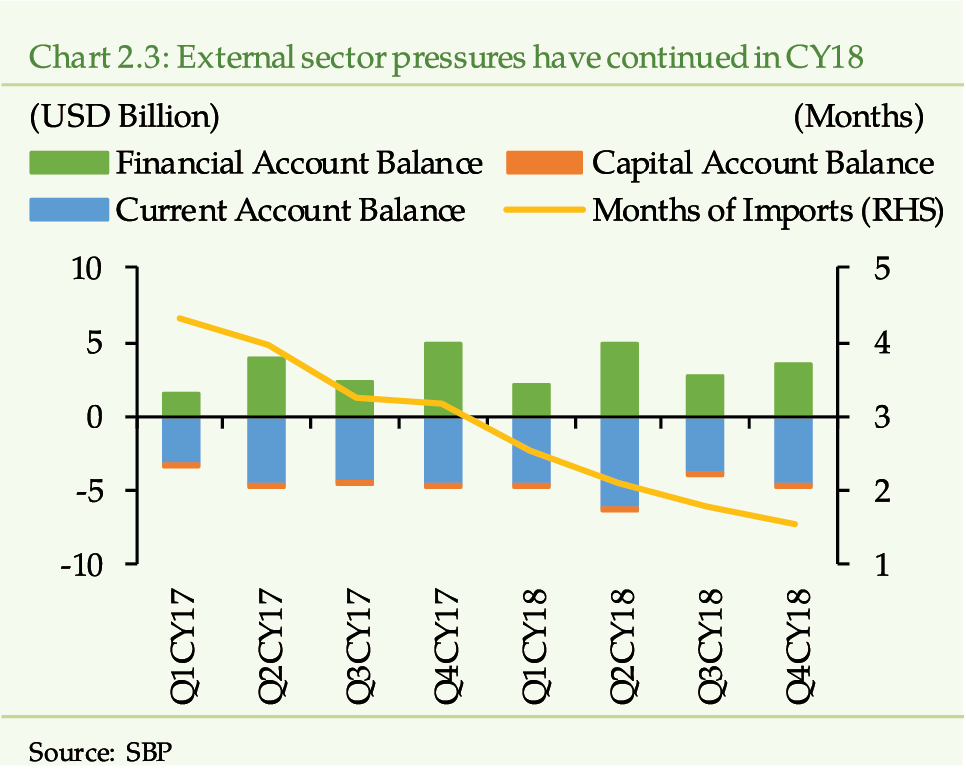

In FY18, current account deficit has been 57.65

percent higher than FY17. Resultantly—absent matching inflows—SBP forex

reserves declined by USD 6.4 billion to reach USD 9.8 billion by Jun-2018.

The external account vulnerabilities have continued

into H1-FY19, despite marginal improvement in current account deficit.

Though pickup in worker’s remittances has provided some support, surge

in trade deficit has overshadowed this improvement. Particularly, increase

in international oil prices has led to rise in dollar value of imported

petroleum products and overall imports. This coupled with a meager increase

in exports has further worsened the trade deficit and curtailed the improvement

in current account deficit (Table 1.3).

[23]

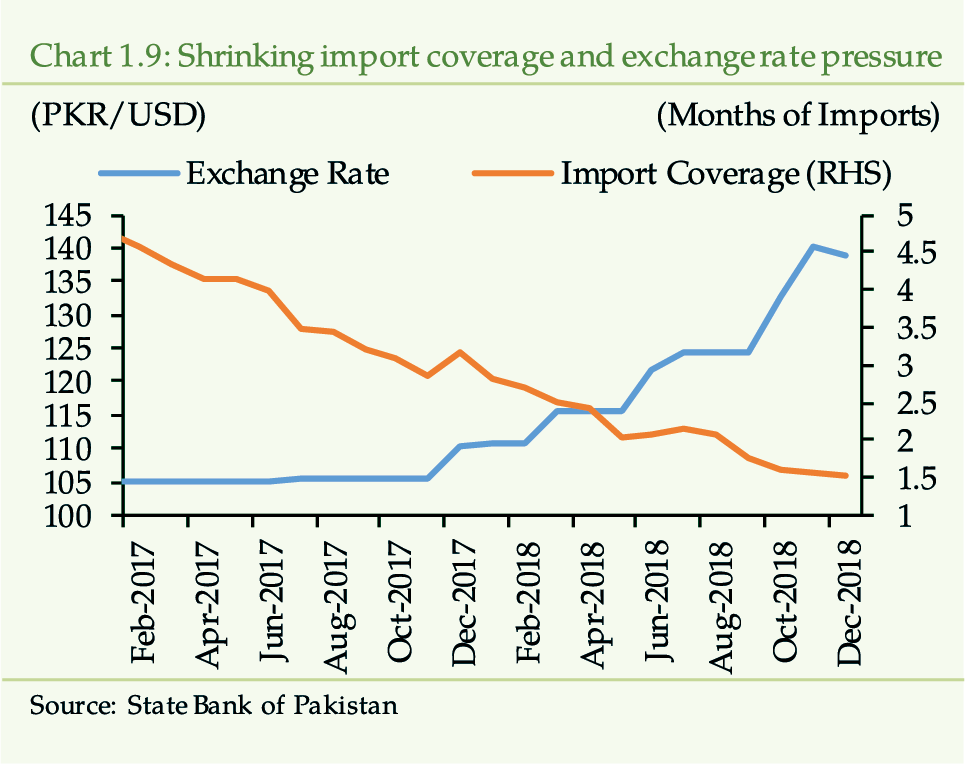

Consequently, SBP’s forex reserves have further declined to

USD 7 billion by end Dec-2018; weakening the capacity to finance imports

and leading to depreciation of domestic currency (Chart 1.9).

During FY18 the fiscal deficit widened to 6.57

percent from 5.85 percent in FY17. The upswing in deficit has sustained

in H1FY19 despite cut in developmental spending. This increase has come

from significant rise in overall expenditures and contraction in revenue

collection. Resultantly, the revenue expenditure gap has widened leading

to higher fiscal deficit in the first half of the current fiscal year.

Consequently,

debt accumulates…

The widening twin deficits have been financed

through increased borrowing from both the domestic and external sources.

As of end CY18, Pakistan’s gross public debt has reached to PKR 27 trillion

(equivalent to 71.21 percent of GDP).

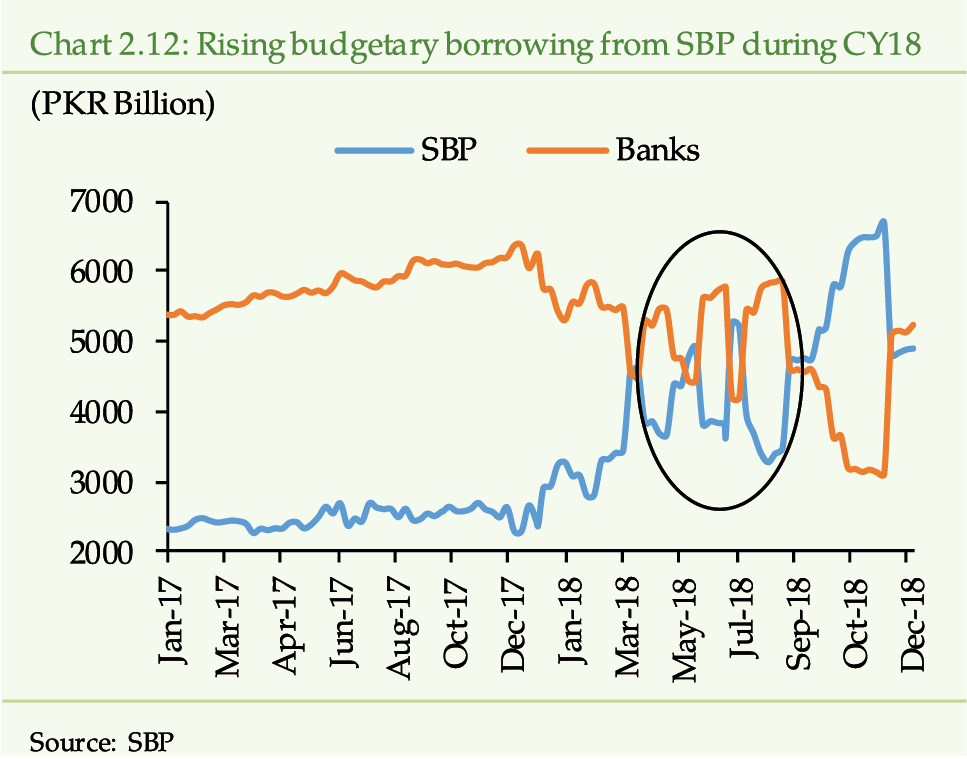

The domestic government debt has risen by 6.82

percent during H1FY19—up from 3.96 percent in H1FY18. The dynamics of

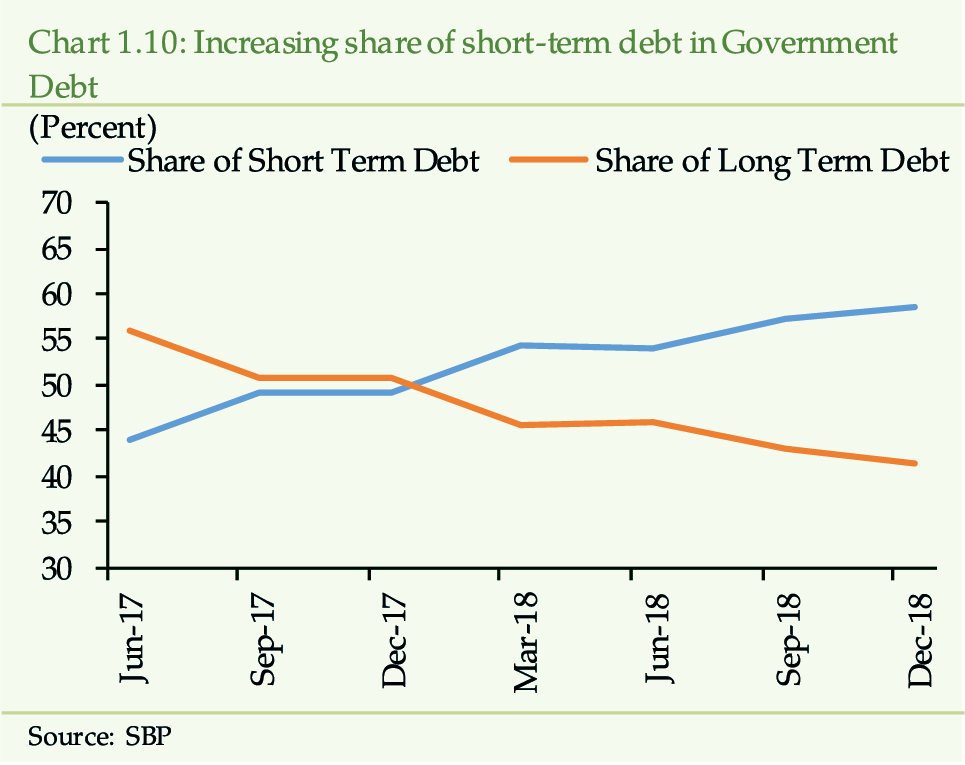

domestic debt reveal that the debt structure has tilted towards short-term

maturity (Chart 1.10).

[24]

This concentration of debt at the lower end of the maturity

spectrum has exposed the government to rollover risk.

Besides, the government has heavily relied on

bilateral and commercial loans leading to higher accumulation of external

debt during H1FY19.

[25]

If the external account vulnerabilities persist, the foreign

debt is likely to accumulate to bridge the financing gap leading to weakening

in repayment capacity.

Besides

twin deficits, growing inflationary pressures remain a concern….

Inflation began to rise since late FY18—largely

due to demand pressures—and increased further during H1FY19. Average headline

inflation has risen to 6.05 percent in H1FY19—up from 3.75 percent in

the comparable period of the previous year. More importantly, core inflation

(non-food non-energy) has increased to 8.0 percent in H1FY19 against 5.5

percent in H1FY18.

While demand pressures eased during H1FY19, rising

price level is driven by a number of factors encompassing; (1) PKR depreciation

(2) pass through of higher international oil prices to domestic consumers

(3) upward adjustment in gas and electricity tariffs (4) higher regulatory

duties on imports; and (5) increase in government borrowing from SBP.

[26]

The

Corrective policy measures are likely to contain domestic demand…

Notable adjustment in the exchange rate (cumulative

depreciation of 23.61 percent in PKR), monetary tightening (425 bps rise

in policy rate), cut in PSDP expenditures

[27]

, asnd increased regulatory duties

[28]

on imports during CY18, indicate a combination of

policy measures taken to address the rising macroeconomic vulnerabilities.

The stabilization measures have had an impact on economic activity but

their full translation into moderation in aggregate demand may take some

more time.

Despite

monetary tightening, lending rates have been slow to respond…

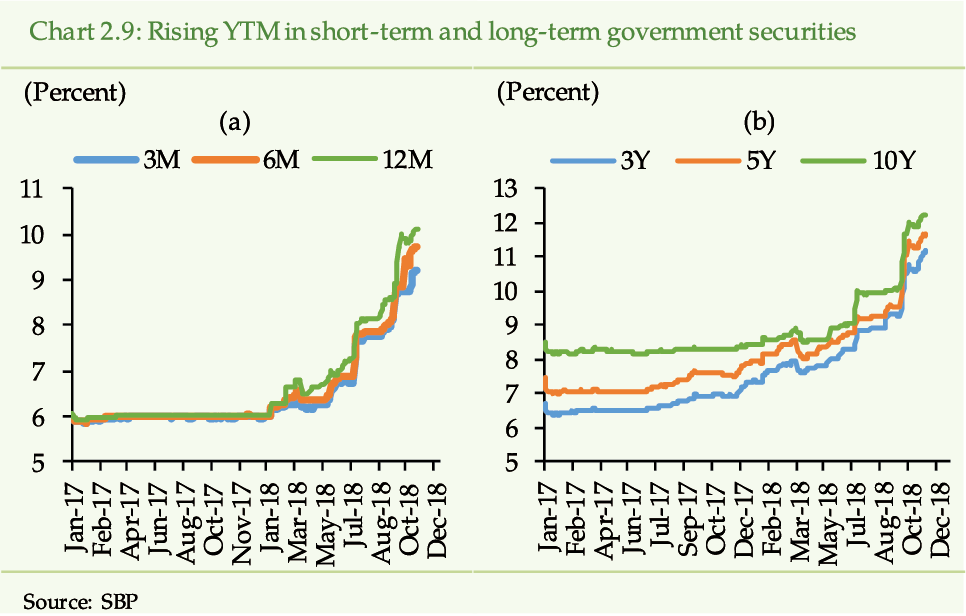

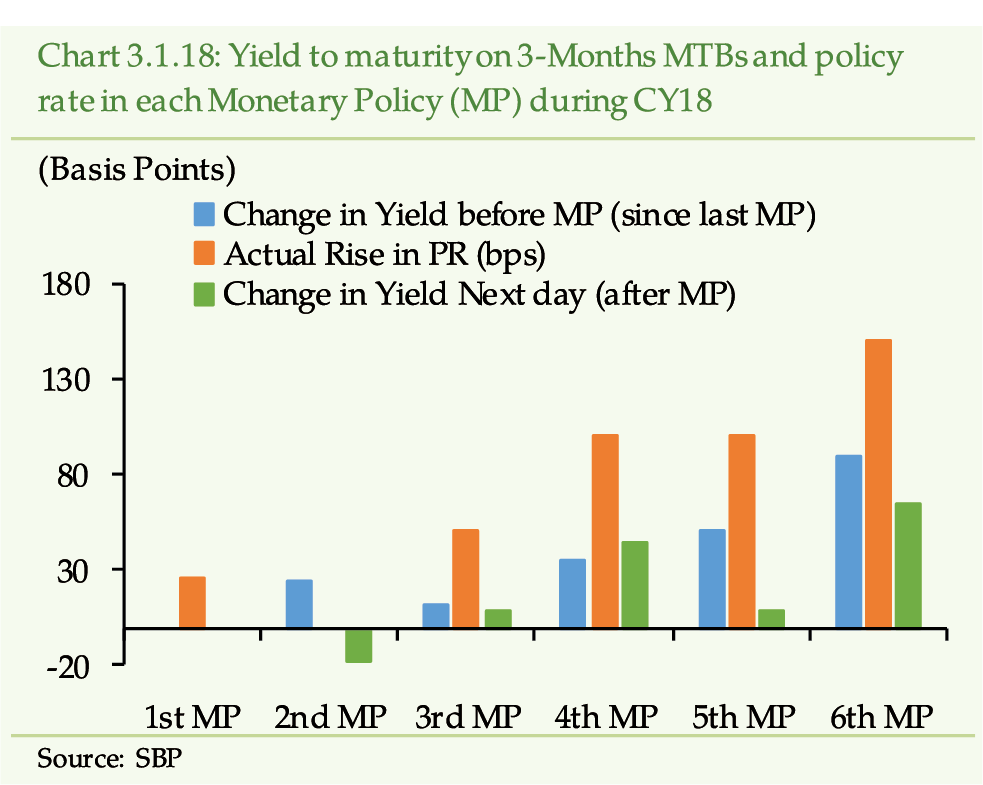

In CY18, the rise of 268 bps in weighted average

lending rates (WALR) despite

425 bps increase in policy rates indicate availability of ample liquidity

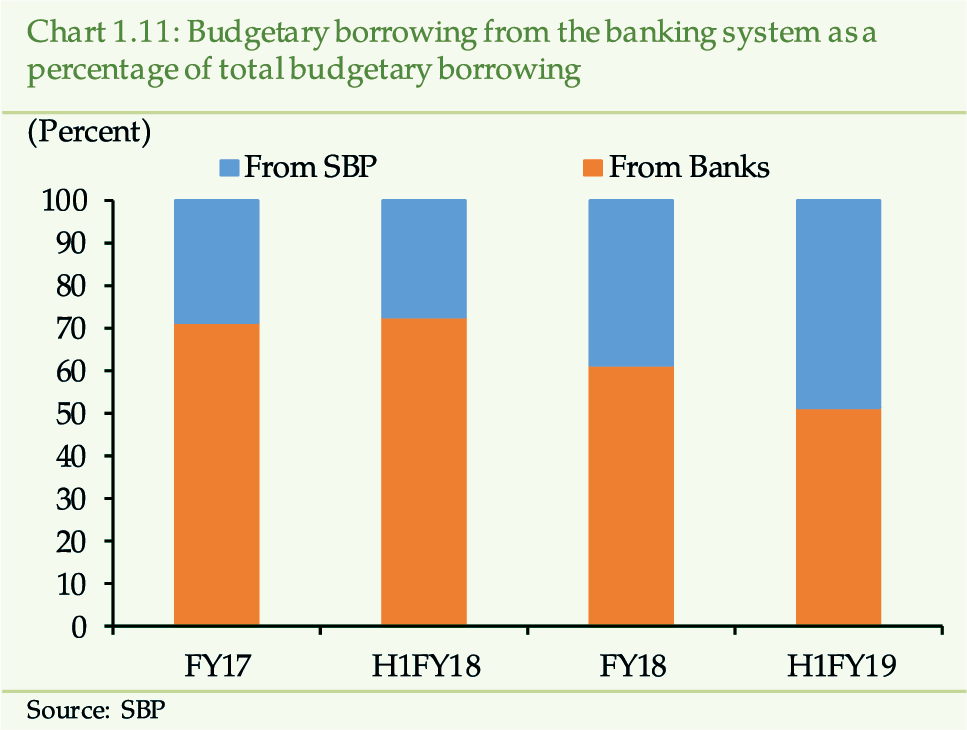

with the banks. The shifting pattern of the government budgetary borrowing

from banks

[29]

to SBP has improved banks’ liquidity which led lower increase

in WALR (Chart 1.11).

…and

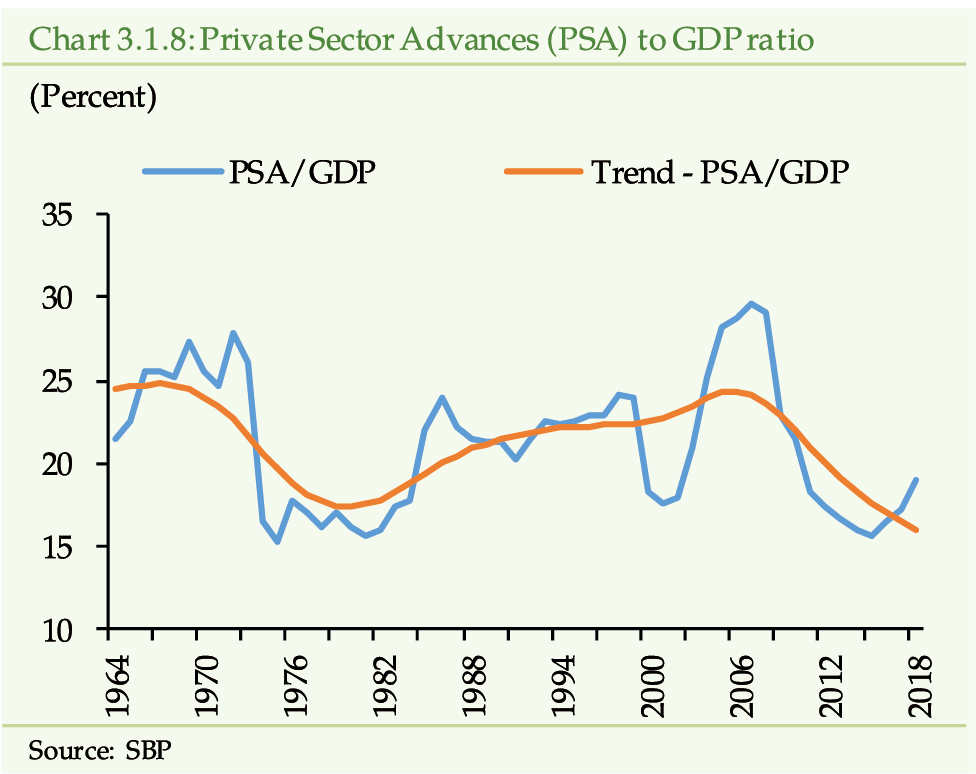

the private sector advances have continued to surge

In the wake of ample liquidity, the banking sector

has increased its lending to the private sector. The domestic private

sector advances have surged by 20.03 percent (YoY) during CY18 as compared

to 16.40 percent in the previous year. The robust increase in advances

has resulted from higher working capital needs. However, fixed investment

advances have decelerated to 8.25 percent during CY18 down from 14.97

percent in CY17. Moreover, the growth in private sector advances has been

broad-based as textile, energy, chemicals, cement sectors along with individuals

have availed advances (See Chapter 3.1).

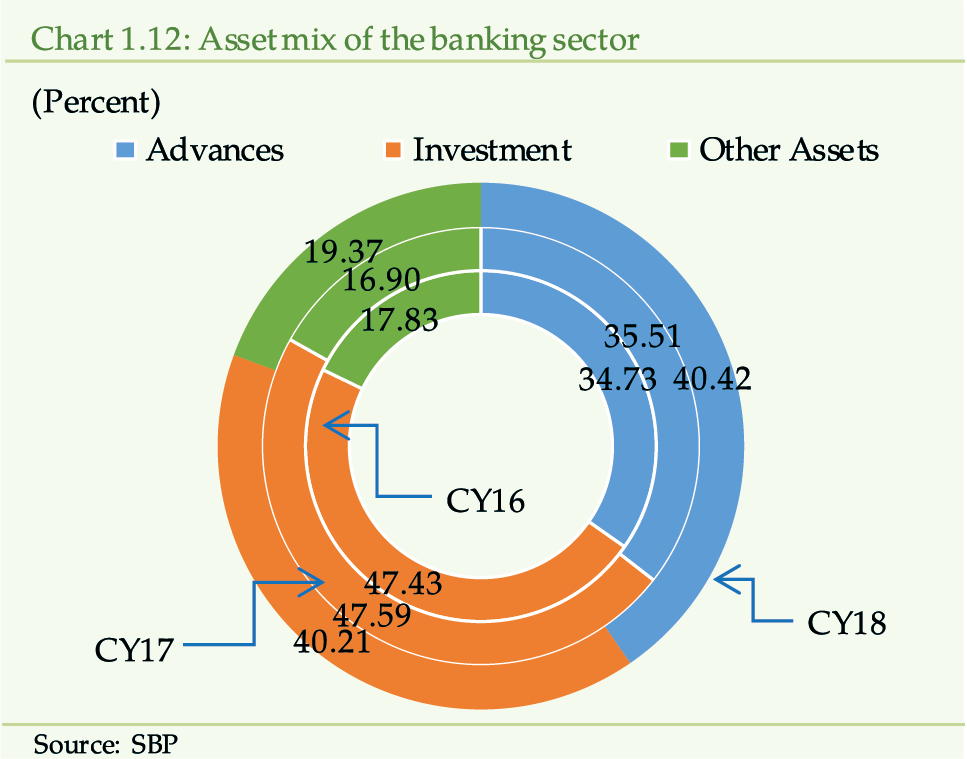

Resultantly, the advances share—in total assets—has

risen to 40.42 percent in CY18 against 35.51 percent in CY17, while banking

sector exposure to the government securities has declined (Chart 1.12).

A

combination of higher interest rates and lower economic activity may undermine

the repayment capacity…

The asset quality of the banking sector may come

under stress due to continued monetary tightening and receding economic

activity. With higher interest rates, re-pricing of existing loans could

increase the financial costs for the borrowers. This may weigh on repayment

capacity and earnings of the corporates, while hurting the profitability

of the banks due to higher provisioning expense (See Chapter 3.1 and

5).

The

domestic economy is likely to follow slow growth trajectory in the short-term…

The much needed stabilization measures are expected

to further rein in aggregate demand and higher inflation. The resultant

slackness in economic activity would help abate the intensity of macroeconomic

imbalances in the external and fiscal sectors. Reaching an adequate level

of forex reserves seems to be the upfront challenge for favorable investor

sentiments and lower risk perceptions.

[1]

International Monetary Fund. (2019). World Economic Outlook.

Washington, April.

[2]

In the wake of trade restrictions imposed since the start of

2018, the import of goods in the US and Chinese economies has declined

by about 12 percent and 6.5 percent, respectively. World Bank. (2019).

Global Economic Prospects. Washington, January.

[3]

Organization for Economic Co-operation and Development (2019).

Interim Economic Outlook. France, March.

[4]

International Monetary Fund. (2018). World Economic

Outlook. Washington, October.

[5]

International Monetary Fund. (2019). World Economic Outlook.

Washington, April.

World Bank. (2019). Global Economic Prospects.

Washington, January.

[6]

Yield on EMDEs sovereign bonds has risen by 140

bps in 2018.

[7]

International Monetary Fund. (2019). World Economic Outlook.

Washington, April.

[8]

IMF. (2018). Global Financial Stability Report. Washington,

October.

[9] Debt levels have reached to its historically highest level of USD 34 trillion (over 253.40 percent of GDP) as of Q1CY18, compared to USD 6 trillion (145.80 percent of GDP) in Q1CY08 (Source: BIS.

https://stats.bis.org/statx/srs/table/f1.2)

[10]

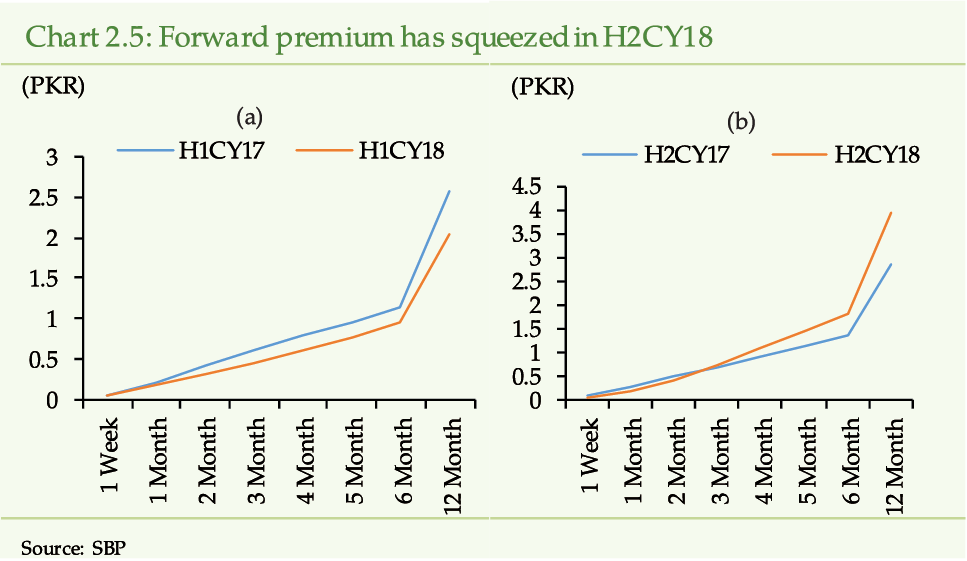

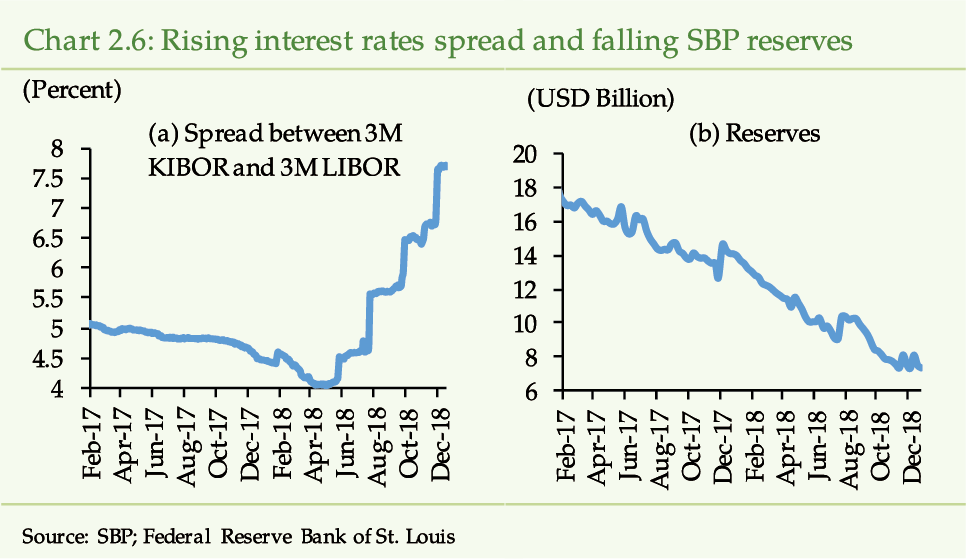

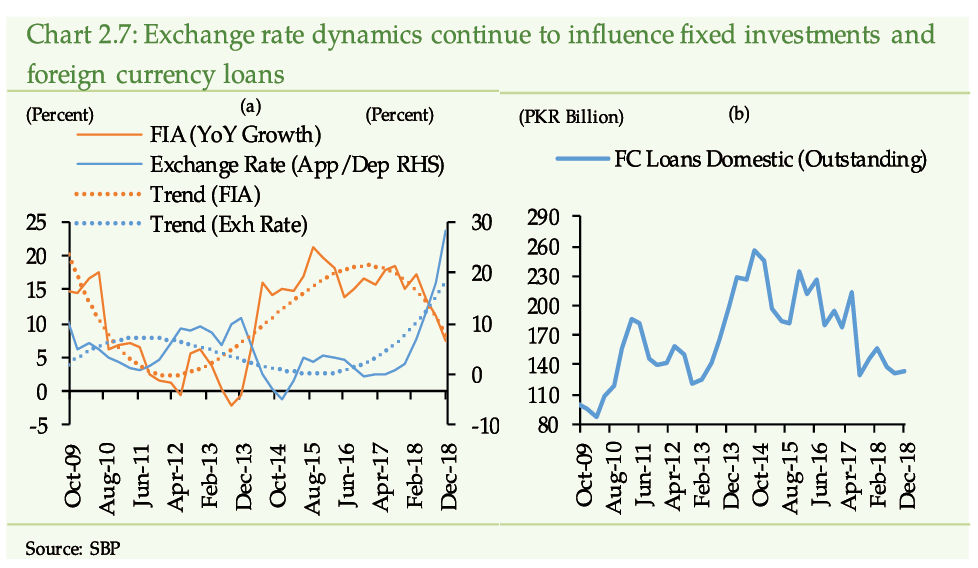

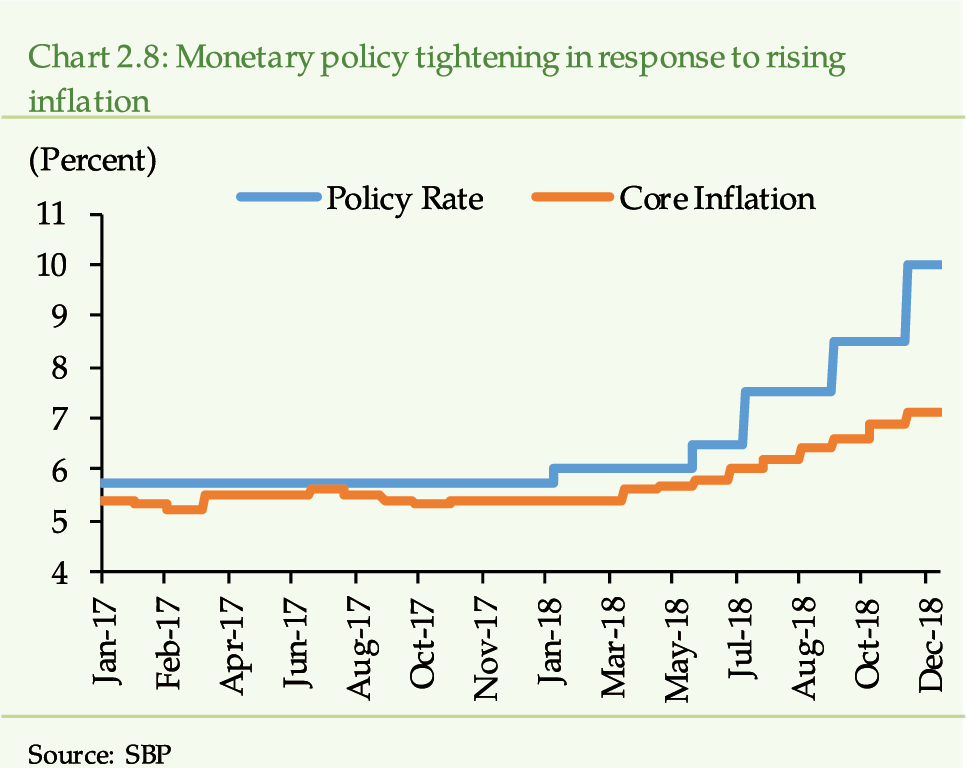

Reserve Bank of Australia. (2018). Financial Stability