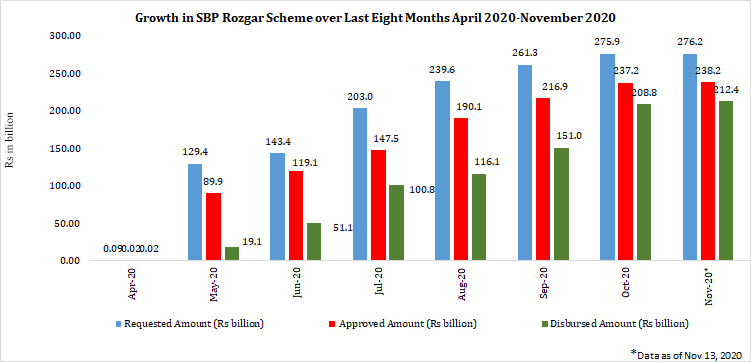

SBP's facilitates businesses availing financing under Rozgar Scheme to disburse salaries before Eid-ul-Azha

On July 24, 2020, SBP allowed disbursement of wages/ salaries for the month of July to be made before Eid-ul-Azha under its Rozgar Scheme. Further, SBP has also provided flexibility to the businesses by allowing them to avail financing from more than one bank. However, businesses cannot avail financing for a specific month from more than one bank.

Circular:

http://www.sbp.org.pk/smefd/circulars/2020/CL24.htm

SHARE THIS PAGE!