Since the eruption of Covid-19 Pandemic, Monetary Policy Committee (MPC) of SBP has reduced the policy rate in a short span of time reducing the burden of forthcoming interest payments on businesses and households considerably.

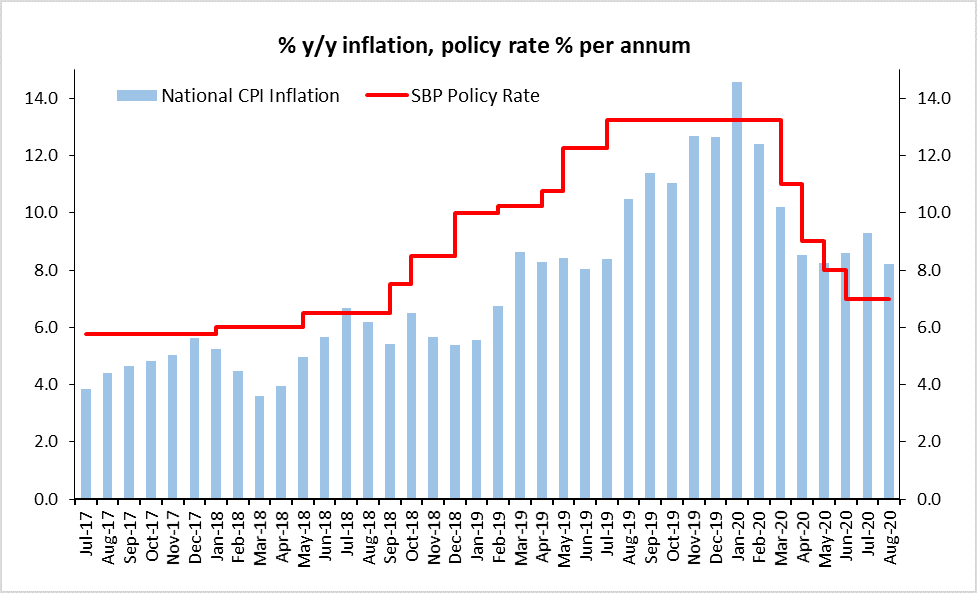

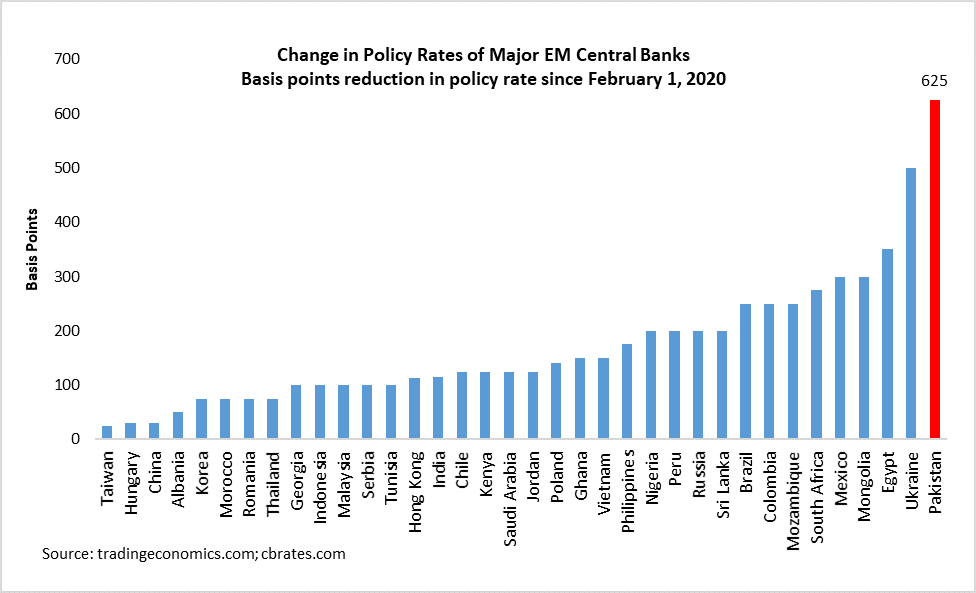

The MPC reduced the policy rate by a cumulative 625 basis points from 13.25 percent to 7 percent in a short span of time from mid-March to June 2020. This is one of the largest reduction in the policy rate among the emerging economies during Pandemic. The major factors prompting aggressive reduction in the policy rate was a sharp fall in inflation and continued economic slowdown. During the challenging times, the focus of monetary policy shifted toward supporting growth and employment. Recently, in its meeting held on 21st September 2020, the MPC decided to keep the policy rate unchanged at 7.0 percent. Taking note of the improved outlook for growth and rising inflation, MPC is of the view that current monetary policy stance is appropriate to support the emerging recovery, while keeping inflation expectations well-anchored and maintaining financial stability.

SHARE THIS PAGE!