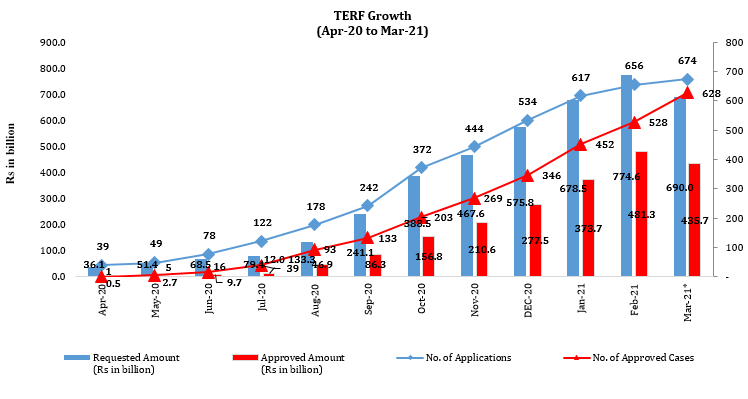

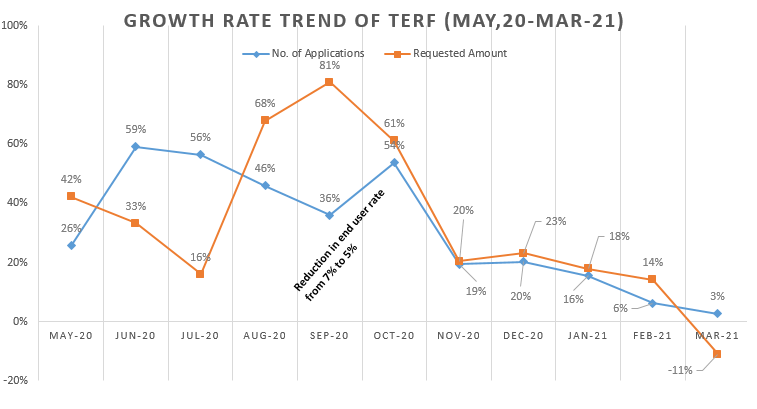

SBP reduces markup rate to 5% on Temporary Economic Refinance Facility (TERF) and introduces other enhancements under this Facility

On July 08, 2020, SBP reduced the end user mark-up rates on TERF from 7% to 5% to further improve the incentive under the scheme. SBP will now be providing refinance to banks at 1% with banks' maximum margin of 4%. Further, SBP has also allowed the TERF facility in cases where LCs/Inland LCs were opened prior but retiring after the introduction of the scheme on March 17, 2020.

Circular:

http://www.sbp.org.pk/smefd/circulars/2020/CL20.htm

SHARE THIS PAGE!